Download 5020 California Form

Common Questions

What is the purpose of the 5020 California form?

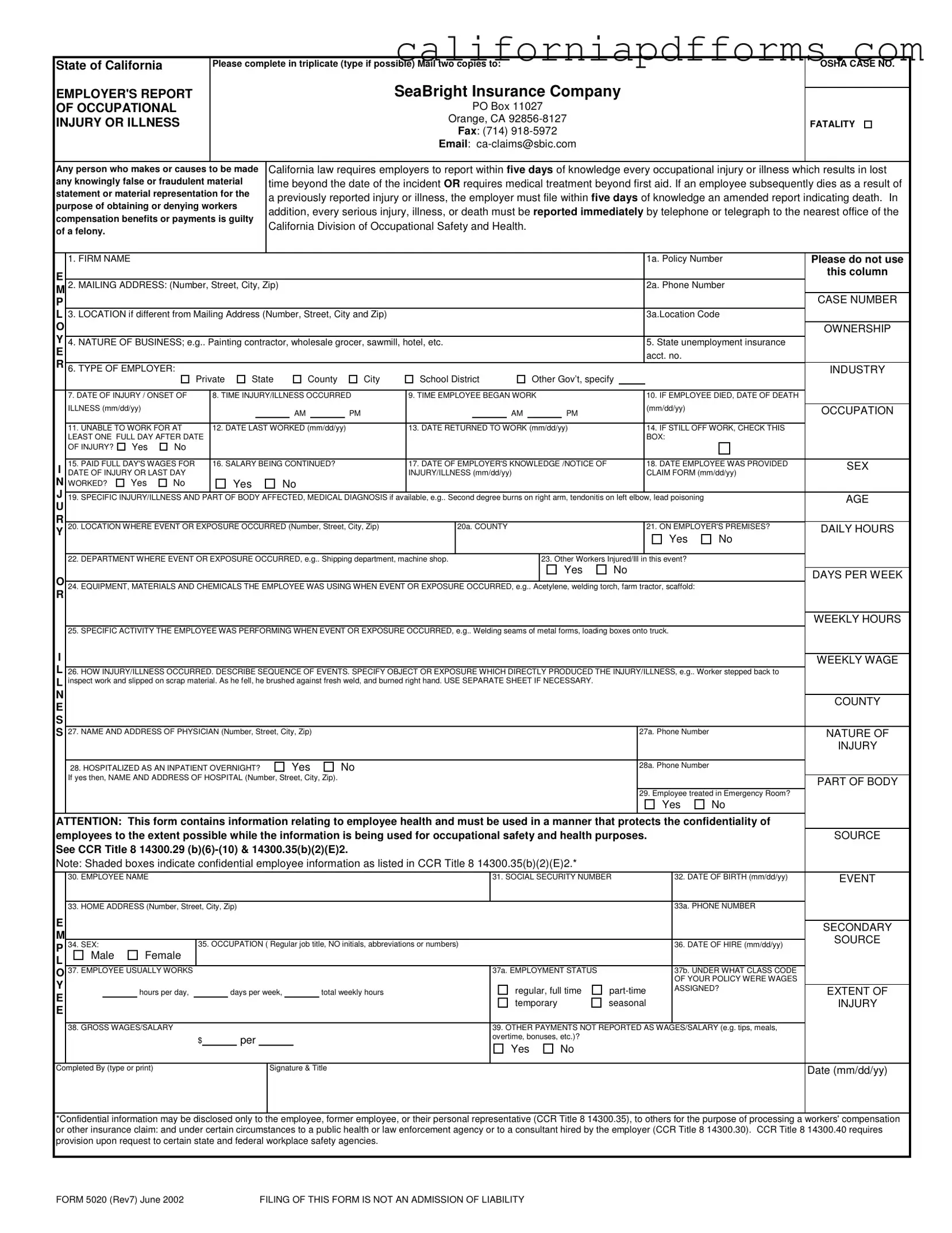

The 5020 California form, also known as the Employer's Report of Occupational Injury or Illness, is used by employers to report workplace injuries or illnesses. This form must be completed when an employee experiences an injury that results in lost work time or requires medical treatment beyond first aid. It ensures compliance with California law and helps in the proper handling of workers' compensation claims.

Who needs to fill out the 5020 form?

Employers in California are required to fill out the 5020 form whenever an employee suffers an occupational injury or illness. This includes private companies, state agencies, county offices, city governments, and school districts. The form must be submitted for any incident that leads to lost time or requires medical attention.

How quickly must the form be submitted?

The form must be submitted within five days of the employer's knowledge of the injury or illness. If an employee dies as a result of the reported incident, an amended report must be filed within five days of that knowledge. Immediate reporting is also required for serious injuries or fatalities to the California Division of Occupational Safety and Health.

What information is required on the 5020 form?

The form requires various details, including:

- Employer's name and address

- Policy number

- Date and time of the injury or illness

- Description of the injury or illness

- Employee's name, social security number, and contact information

- Details about medical treatment received

Completing all sections accurately is essential for effective processing of the claim.

What happens if the form is not submitted on time?

Failure to submit the 5020 form within the required timeframe can lead to penalties for the employer. It may also complicate the employee's ability to receive workers' compensation benefits. Timely reporting is crucial for both legal compliance and the welfare of the employee.

Can the form be submitted electronically?

While the form can be completed electronically, it must be printed and submitted in triplicate. Two copies should be mailed to SeaBright Insurance Company, while one copy is retained by the employer. Fax and email submissions are also accepted, but ensure that all required information is included to avoid delays.

Is the information on the 5020 form confidential?

Yes, the information on the 5020 form is considered confidential. It must be handled in a manner that protects employee privacy. Disclosure is limited to the employee, their personal representative, or for the purpose of processing workers' compensation claims. Certain state and federal agencies may also access the information under specific circumstances.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The 5020 California form is used to report occupational injuries or illnesses that occur in the workplace. |

| Filing Requirement | Employers must file the form within five days of becoming aware of an injury or illness that results in lost time or requires medical treatment beyond first aid. |

| Amendment for Death | If an employee dies from a reported injury, an amended report must be filed within five days of knowledge of the death. |

| Immediate Reporting | Serious injuries, illnesses, or deaths must be reported immediately by phone or telegraph to the California Division of Occupational Safety and Health. |

| Confidentiality | The form contains confidential employee information, which must be protected during use for occupational safety and health purposes. |

| Governing Law | This form is governed by California Code of Regulations, Title 8, Sections 14300.29 and 14300.35. |

| Fraud Warning | Providing false information on this form is considered a felony under California law. |

Dos and Don'ts

When filling out the 5020 California form, it is crucial to approach the task with care and attention to detail. Here is a list of important dos and don’ts to consider:

- Do complete the form in triplicate to ensure all necessary copies are available.

- Do provide accurate information regarding the employer's name and address.

- Do report the injury or illness within five days of becoming aware of it.

- Do include specific details about the injury, including the part of the body affected and the nature of the injury.

- Do ensure that the form is signed and dated by the appropriate individual.

- Don’t provide false or misleading information, as this can lead to serious legal consequences.

- Don’t neglect to report any serious injuries or fatalities immediately by phone or telegraph.

- Don’t forget to include the employee’s social security number and other identifying information.

- Don’t leave any shaded boxes blank, as these contain confidential employee information that must be handled carefully.

- Don’t assume that the filing of this form admits liability; it is merely a report of the incident.

By following these guidelines, you can ensure that the form is filled out correctly and complies with California regulations.

Misconceptions

Misconception 1: The 5020 form is only necessary for severe injuries.

This is not true. Any occupational injury or illness that results in lost time or requires medical treatment beyond first aid must be reported using this form.

Misconception 2: Employers can take their time submitting the form.

Actually, California law requires employers to report injuries within five days of learning about them. Delays can lead to penalties.

Misconception 3: The form must be filled out in person.

You can complete the 5020 form electronically. However, it’s recommended to type it if possible for clarity.

Misconception 4: Only the employer can file the 5020 form.

While the employer is responsible for filing, employees can assist in providing necessary information to ensure accuracy.

Misconception 5: Submitting the form means the employer admits liability.

Filing the 5020 form is not an admission of liability. It is simply a requirement for reporting injuries or illnesses.

Misconception 6: The form is only for physical injuries.

The 5020 form also covers occupational illnesses, which can be just as significant as physical injuries.

Misconception 7: Employers can ignore minor injuries.

Even minor injuries that lead to lost work time or require medical treatment must be reported. Ignoring them can lead to legal issues.

Misconception 8: The information on the form is not confidential.

The form contains sensitive employee information, and confidentiality must be maintained as per California regulations.

Misconception 9: You don’t need to report an injury if the employee returns to work the next day.

If an injury results in lost time or requires medical treatment beyond first aid, it must still be reported, regardless of when the employee returns.

Misconception 10: The form is only necessary for workers' compensation claims.

While it is crucial for workers' compensation, the 5020 form also serves other safety and health reporting purposes, making it important for overall workplace safety.

Documents used along the form

The 5020 California form, officially known as the Employer's Report of Occupational Injury or Illness, is a crucial document for employers reporting workplace injuries or illnesses. Alongside this form, several other documents are commonly used to ensure compliance with California's workers' compensation regulations. Each of these documents serves a specific purpose in the reporting and claims process.

- Form 300: This is the Log of Work-Related Injuries and Illnesses. Employers use it to record all work-related injuries and illnesses, providing a summary of incidents that occur over the year.

- Form 301: The Injury and Illness Incident Report is used to provide detailed information about a specific incident, including the nature of the injury, how it occurred, and the treatment provided.

- Form DWC 1: This is the Employee's Claim for Workers' Compensation Benefits. Employees complete this form to initiate a claim for benefits after an injury or illness.

- Form 5021: This is the Employer's Report of Occupational Injury or Illness - Amended Report. It is used to update previously submitted reports, particularly in cases where new information comes to light.

- Form 5022: The Notice of Potential Eligibility for Workers' Compensation Benefits informs employees about their rights and the claims process after reporting an injury.

- Form 5023: This is the Employer's Report of Occupational Injury or Illness - Supplemental Report. It provides additional information on the injury or illness after the initial report has been filed.

- Form 5024: The Notice of Employee's Rights provides employees with information regarding their rights under California workers' compensation law, including the right to medical treatment and compensation.

- Form 5025: This is the Medical Provider Network (MPN) Notification, which informs employees about the network of medical providers available for treatment of work-related injuries.

- Form 5026: The Return-to-Work (RTW) form is used to document an employee's ability to return to work after an injury, detailing any restrictions or accommodations needed.

- Form 5027: This is the Claim Closure form, which is submitted when a claim is closed, summarizing the benefits provided and the final status of the claim.

Understanding these documents is essential for employers and employees alike. Each form plays a vital role in ensuring that workplace injuries are reported accurately and that employees receive the necessary support and benefits. Proper use of these forms can facilitate a smoother claims process and help maintain workplace safety standards.

Different PDF Templates

Fl191 - Include the date the support order was filed in the appropriate section.

California Schedule R - Completing any additional required schedules, R-1 through R-7, is essential following the main sections on Side 2.