Download Address Change California Form

Common Questions

What is the Address Change California form?

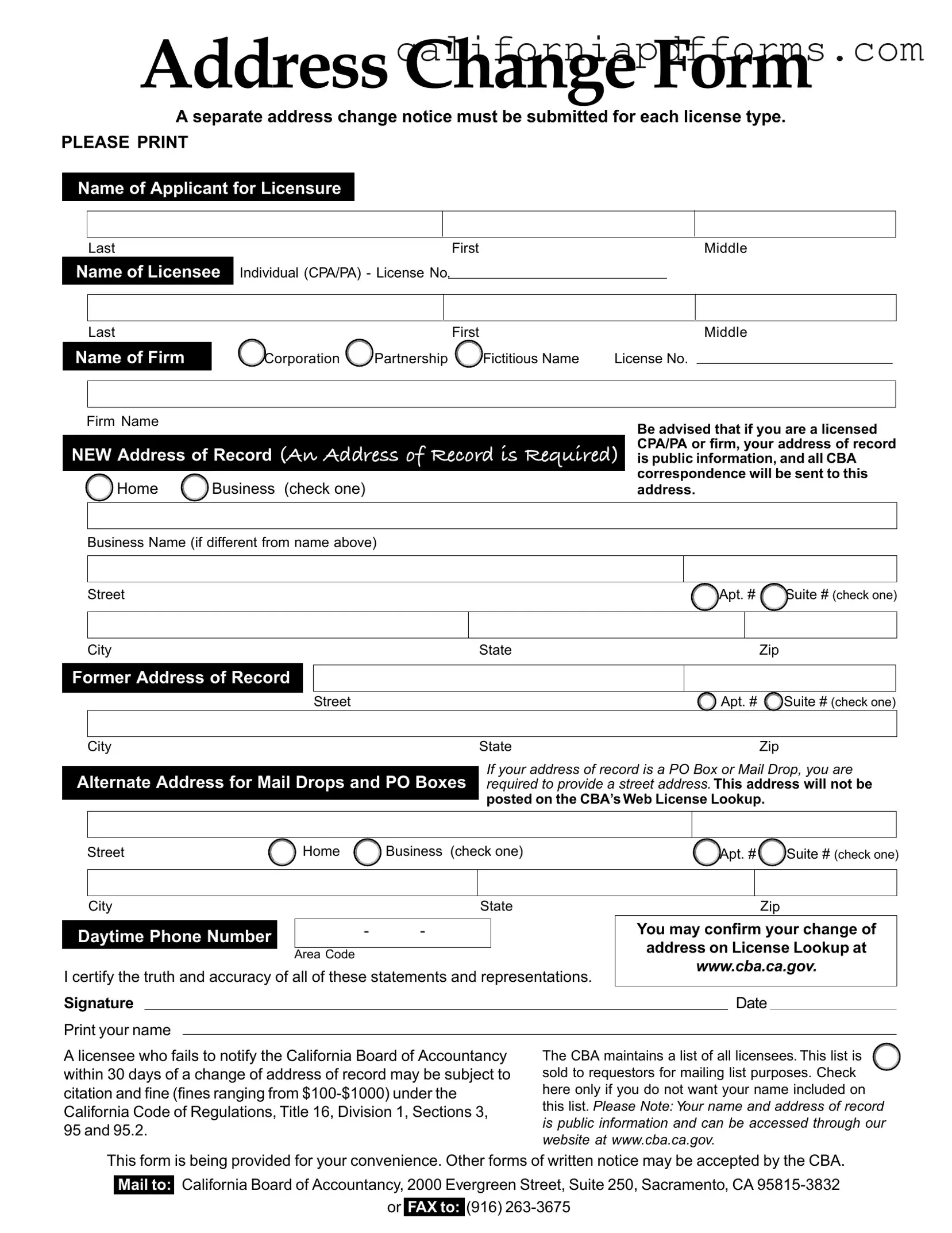

The Address Change California form is a document that individuals and firms must complete to officially notify the California Board of Accountancy (CBA) of a change in their address of record. This form is crucial for maintaining accurate records and ensuring that all correspondence from the CBA reaches the correct location.

Who needs to submit this form?

Any licensed Certified Public Accountant (CPA) or Public Accountant (PA), as well as firms holding a license, must submit this form whenever they change their address. Each license type requires a separate address change notice, ensuring that all records remain up to date.

What information is required on the form?

The form requires several key pieces of information, including:

- Name of the applicant or licensee

- License number

- New address of record

- Former address of record

- Daytime phone number

Additionally, if the new address is a P.O. Box or mail drop, a street address must also be provided. This requirement ensures that the CBA can reach you directly when necessary.

Is the information submitted on the form public?

Yes, the address of record is considered public information. This means that it can be accessed by anyone through the CBA's website. Therefore, it is important to consider the implications of your address being publicly available when filling out the form.

What happens if I do not submit the form on time?

If a licensee fails to notify the CBA of a change of address within 30 days, they may face penalties. The California Code of Regulations stipulates that fines can range from $100 to $1,000 for non-compliance. Timely submission of the form is essential to avoid these consequences.

How can I confirm my address change?

After submitting your address change form, you can confirm that the change has been processed by checking the License Lookup feature on the CBA's website. This tool allows you to verify that your information is accurate and up to date.

Can I submit this form electronically?

Currently, the form must be mailed or faxed to the CBA. You can send it to the following address: California Board of Accountancy, 2000 Evergreen Street, Suite 250, Sacramento, CA 95815-3832, or fax it to (916) 263-3675. While electronic submissions may not be accepted at this time, the CBA does provide this form for your convenience.

What if I do not want my name included in the mailing list?

If you prefer not to have your name included in the CBA's mailing list, there is an option on the form to indicate this preference. By checking the appropriate box, you can ensure that your information is not sold to requestors for mailing list purposes.

Where can I find more information about the form?

For additional details and resources, you can visit the CBA's official website at www.cba.ca.gov. The site provides comprehensive information regarding licensing, regulations, and the address change process, helping you stay informed about your responsibilities as a licensee.

Document Specifications

| Fact Name | Description |

|---|---|

| Separate Submission Required | A separate address change notice must be submitted for each license type. |

| Public Information | The address of record for a licensed CPA/PA or firm is public information. |

| Notification Deadline | Licensees must notify the California Board of Accountancy within 30 days of a change of address. |

| Potential Fines | Failure to notify may result in fines ranging from $100 to $1,000. |

| Governing Laws | California Code of Regulations, Title 16, Division 1, Sections 3, 95, and 95.2 govern the address change process. |

| Mailing List Opt-Out | Licensees can opt-out of having their name included in the CBA's mailing list. |

Dos and Don'ts

When filling out the Address Change California form, it's important to follow certain guidelines to ensure your submission is accurate and accepted. Here’s a list of things you should and shouldn’t do:

- Do print clearly in all sections of the form to avoid any misunderstandings.

- Do submit a separate address change notice for each license type you hold.

- Do provide a street address if your address of record is a PO Box or Mail Drop.

- Do double-check your information for accuracy before sending the form.

- Don't forget to sign and date the form; your signature is required.

- Don't leave any fields blank; if something doesn’t apply, indicate that clearly.

- Don't delay in submitting the form; you must notify the California Board of Accountancy within 30 days of your address change.

Misconceptions

Here are six common misconceptions about the Address Change California form:

- Only one form is needed for multiple licenses. Each license type requires a separate address change notice. Submitting one form for multiple licenses will not suffice.

- Your address is private. In fact, the address of record is public information. Anyone can access it through the California Board of Accountancy's website.

- A PO Box is enough for your address of record. If you use a PO Box or mail drop, you must also provide a street address. The street address will not be displayed publicly, but it is still a requirement.

- You can take your time to submit the form. You must notify the California Board of Accountancy within 30 days of any address change. Failing to do so can lead to fines ranging from $100 to $1,000.

- Changing your address is only a formality. It's essential for all correspondence related to your license. If your address is incorrect, you may miss important communications.

- You cannot opt out of having your name on the public list. You can check a box on the form if you do not want your name included in the mailing list sold to requestors.

Documents used along the form

When changing your address in California, especially if you're a licensed professional, there are several important forms and documents that may accompany the Address Change California form. Understanding these documents can help ensure a smooth transition and compliance with state regulations.

- Application for Licensure: This form is necessary for individuals seeking to obtain a professional license. It collects essential information about the applicant, including educational background and work experience.

- Renewal Application: If your license is up for renewal, this document must be submitted along with any address changes. It ensures that your contact information is current and that you remain in good standing.

- Change of Ownership Form: For businesses, this form is used when there is a change in ownership. It updates the licensing authority about who is now responsible for the firm.

- Inactive Status Request: If you plan to pause your practice, this form allows you to request inactive status for your license. It’s important to update your address even if you are not currently practicing.

- Verification of Licensure: This document can be requested to confirm your license status. It may be needed when applying for jobs or when your license is checked by employers.

- PO Box Notification: If your new address includes a PO Box, this form is required to provide a physical street address for official correspondence, ensuring compliance with regulations.

- Public Information Opt-Out Form: If you prefer that your name and address not be included in public records, this form allows you to opt-out. It’s an important step for those concerned about privacy.

By familiarizing yourself with these documents, you can navigate the process of changing your address more effectively. Keeping your information updated not only helps you avoid fines but also ensures that you receive important communications from the California Board of Accountancy and other relevant parties.

Different PDF Templates

Notice to Consumer California Requirements - There are important instructions on how to file objections to the records request.

Driver License Online - The California Identification Card form is used to apply for or renew a state-issued identification card.