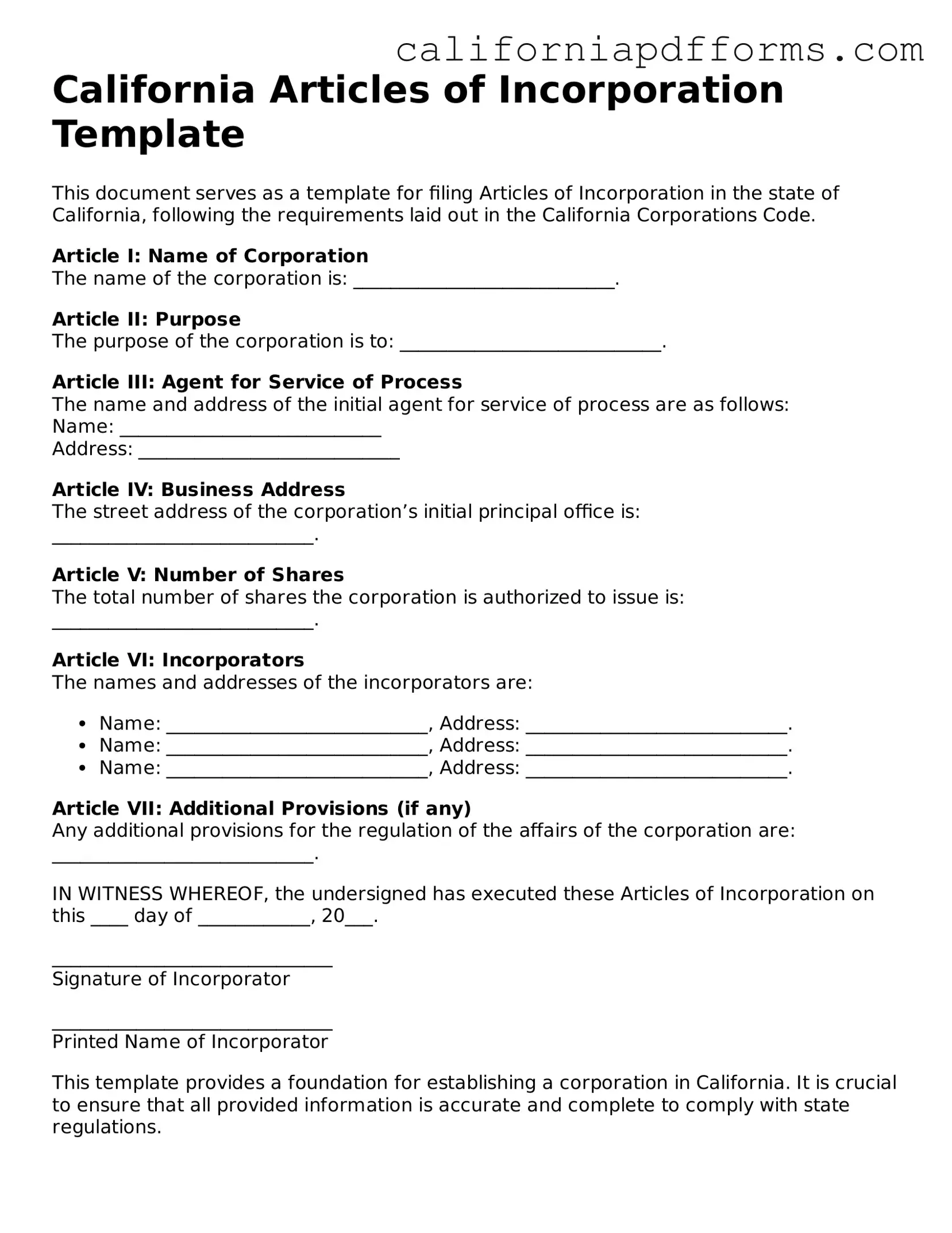

Official Articles of Incorporation Template for the State of California

Common Questions

What are the Articles of Incorporation in California?

The Articles of Incorporation is a legal document that establishes a corporation in California. This form is filed with the Secretary of State and serves as the foundation for the corporation's existence. It outlines essential information about the corporation, such as its name, purpose, and structure. By filing this document, you officially create a separate legal entity that can own property, enter contracts, and conduct business in its own name.

What information is required in the Articles of Incorporation?

When completing the Articles of Incorporation form, several key pieces of information must be included:

- Name of the Corporation: The name must be unique and not already in use by another entity in California.

- Purpose: A brief statement describing the purpose of the corporation, which can be general or specific.

- Agent for Service of Process: This is an individual or business designated to receive legal documents on behalf of the corporation.

- Incorporator Information: The name and address of the person or entity filing the Articles of Incorporation.

- Stock Information: If the corporation will issue stock, details about the classes of stock and the number of shares must be provided.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done in a few simple steps:

- Complete the Articles of Incorporation form, ensuring all required information is accurate and complete.

- Submit the form to the California Secretary of State, either online or by mail. If filing by mail, include a check for the filing fee.

- Once processed, the Secretary of State will return a stamped copy of the Articles, confirming the corporation's formation.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in California varies depending on the type of corporation being formed. As of the latest updates, the fee typically starts around $100 for a standard corporation. Additional fees may apply for expedited processing or for specific types of corporations, such as non-profits. It is advisable to check the California Secretary of State's website for the most current fee schedule before submitting your application.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If there are changes to the corporation’s name, purpose, or other key details, an amendment must be filed with the Secretary of State. This process typically involves submitting a specific form and paying a fee. It is crucial to keep the Articles of Incorporation updated to reflect the current status and structure of the corporation, ensuring compliance with state regulations.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to establish a corporation in the state of California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Sections 200-220. |

| Filing Requirements | To file, a completed form must be submitted to the California Secretary of State along with the required filing fee. |

| Information Needed | Key details such as the corporation's name, purpose, and registered agent must be included in the form. |

| Processing Time | Typically, the processing time for the Articles of Incorporation can range from a few days to several weeks, depending on the volume of submissions. |

Dos and Don'ts

When filling out the California Articles of Incorporation form, it’s important to be mindful of certain best practices. Here’s a helpful list of things you should and shouldn’t do:

- Do ensure that the name of your corporation is unique and not already in use by another entity in California.

- Do provide a clear and concise business purpose that reflects the nature of your corporation.

- Do include the correct number of shares your corporation is authorized to issue.

- Do designate a registered agent who has a physical address in California.

- Don’t leave any sections blank; if a section does not apply, write "N/A" or "None."

- Don’t forget to sign and date the form; an unsigned form will be rejected.

- Don’t submit the form without double-checking for any spelling or grammatical errors.

Following these guidelines can help ensure a smoother incorporation process. Taking the time to carefully complete the form will save you from potential delays or complications down the line.

Misconceptions

Understanding the California Articles of Incorporation is essential for anyone looking to establish a corporation in the state. However, several misconceptions often cloud this important process. Below is a list of ten common misunderstandings regarding the Articles of Incorporation form.

- All corporations must use the same Articles of Incorporation form. Many believe that there is a one-size-fits-all form. In reality, the form can vary based on the type of corporation, such as nonprofit or for-profit.

- Filing Articles of Incorporation guarantees the corporation will be approved. While submitting the form is a crucial step, approval is contingent upon meeting all legal requirements, including compliance with state laws.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles of Incorporation, allowing for adjustments as the corporation evolves.

- The Articles of Incorporation are the only documents needed to start a corporation. This is misleading. Other documents, such as bylaws and organizational minutes, are also necessary for a fully functioning corporation.

- Anyone can file Articles of Incorporation on behalf of a corporation. While technically possible, it is advisable that the person filing has a good understanding of corporate law to avoid mistakes that could lead to complications.

- There is no fee associated with filing Articles of Incorporation. Contrary to this belief, there is typically a filing fee that must be paid to the state, which varies depending on the type of corporation.

- Articles of Incorporation do not need to include the corporation's purpose. This is a misconception. The purpose of the corporation must be clearly stated in the Articles, as it defines the scope of its activities.

- Filing Articles of Incorporation is a quick process. While the submission can be done relatively quickly, the review and approval process by the state can take longer than expected.

- All states have the same requirements for Articles of Incorporation. This is false. Each state, including California, has its own specific requirements and forms that must be followed.

- Once the Articles are filed, the corporation is automatically in good standing. This is not accurate. Ongoing compliance with state regulations and timely filing of necessary documents is essential to maintain good standing.

By dispelling these misconceptions, individuals can better navigate the process of incorporating a business in California, ensuring a smoother and more informed experience.

Documents used along the form

When forming a corporation in California, several other documents and forms are often required alongside the Articles of Incorporation. Each of these plays a crucial role in establishing and maintaining the legal status of the corporation. Below is a list of commonly used forms and documents.

- Bylaws: These are the internal rules that govern how the corporation operates. Bylaws outline the responsibilities of directors and officers, meeting procedures, and other operational guidelines.

- Initial Statement of Information: This document must be filed within 90 days of incorporation. It provides essential information about the corporation, including its address, officers, and agent for service of process.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes. It is required for opening a bank account and hiring employees.

- Statement of Domestic Partnership (if applicable): If the corporation is formed by partners, this document may be needed to establish the partnership legally.

- Business License: Depending on the type of business and location, a city or county business license may be required to operate legally.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders, including how shares can be bought or sold and how disputes will be resolved.

- Meeting Minutes: Keeping accurate records of meetings is essential. Minutes document decisions made during meetings and can be important for legal compliance and transparency.

Each of these documents serves a specific purpose in the incorporation process and ongoing operations of the business. It is important to ensure that all necessary forms are completed accurately and filed on time to avoid potential legal issues in the future.

Other Popular California Forms

Home Purchase Agreement - Details the earnest money deposit requirements.

California Dmv Bill of Sale - The Bill of Sale may also include the sale date, which is important for record-keeping purposes.

Simple Promissory Note Template California - The Promissory Note typically includes details such as payment due dates and any applicable late fees.