Download California 100 We Form

Common Questions

What is the purpose of the California 100 We form?

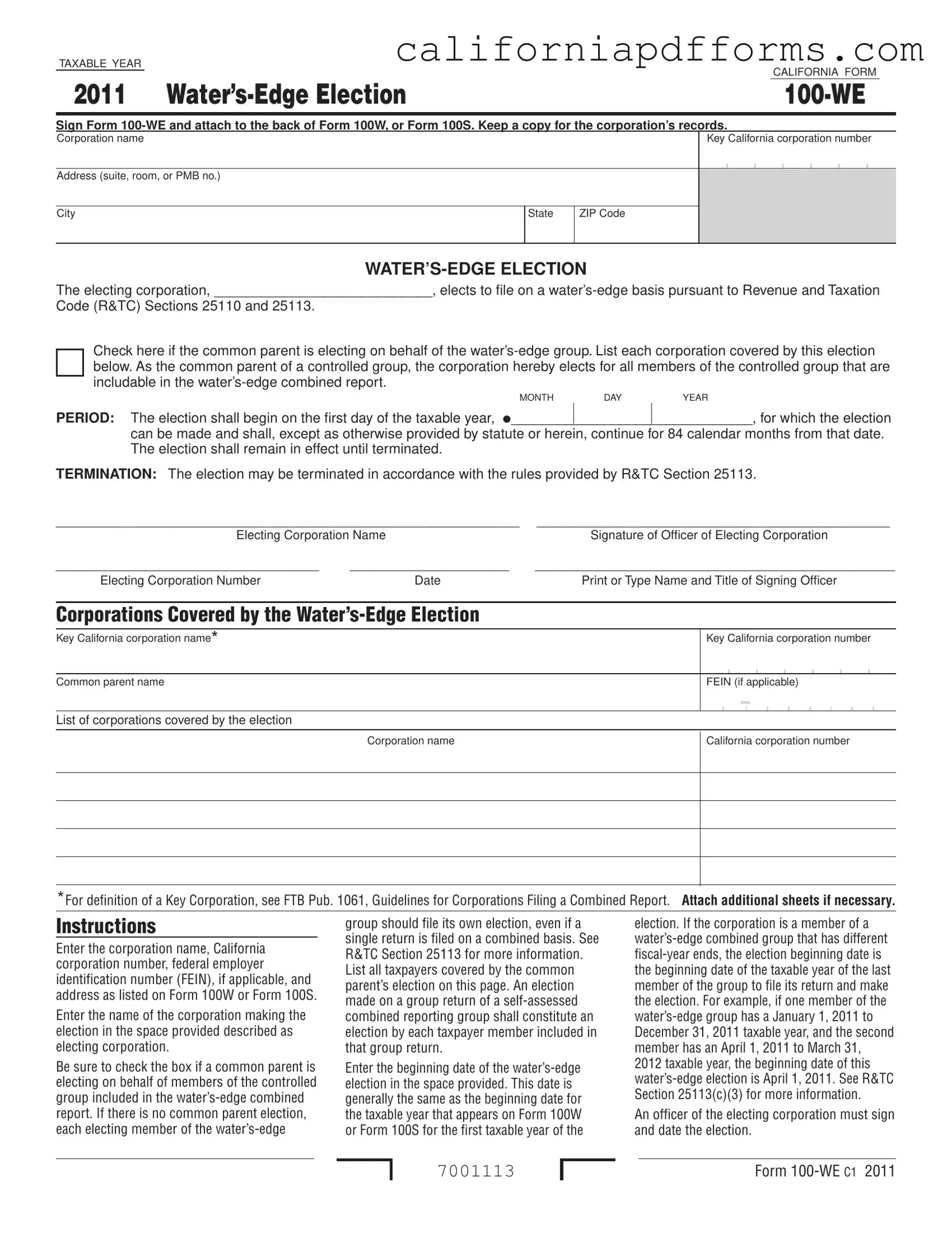

The California 100 We form is used by corporations to elect to file on a water's-edge basis. This election allows corporations to limit their taxable income to only those activities and income sourced from within the United States, thereby excluding certain foreign income. The form must be attached to either Form 100W or Form 100S when filing taxes.

Who needs to file the California 100 We form?

Any corporation that wishes to elect for a water's-edge filing must complete and submit the California 100 We form. This includes the common parent of a controlled group of corporations. If there is no common parent, each corporation within the group must file its own election even if they are submitting a combined return.

What information is required on the form?

The form requires several key pieces of information, including:

- The name of the electing corporation.

- The California corporation number.

- The federal employer identification number (FEIN), if applicable.

- The address of the corporation as listed on Form 100W or Form 100S.

- The beginning date of the water's-edge election.

- A list of all corporations covered by the election.

How long does the water's-edge election last?

The water's-edge election begins on the first day of the taxable year indicated on the form and continues for 84 calendar months. It remains in effect until it is terminated in accordance with the rules set forth in Revenue and Taxation Code Section 25113.

How can a corporation terminate the water's-edge election?

A corporation can terminate the water's-edge election by following the procedures outlined in Revenue and Taxation Code Section 25113. It is essential to review these rules carefully to ensure compliance and proper handling of the termination process.

What happens if a common parent is electing on behalf of the group?

If a common parent is electing on behalf of the controlled group, the election applies to all members of that group that are includable in the water's-edge combined report. It is important to check the appropriate box on the form to indicate this election is being made on behalf of the group.

Is it necessary to keep a copy of the California 100 We form?

Yes, it is crucial for corporations to keep a copy of the California 100 We form for their records. This documentation may be needed for future reference or in the event of an audit by tax authorities.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California Form 100-WE is used for corporations to elect a water’s-edge basis for tax reporting. |

| Governing Laws | This form is governed by the Revenue and Taxation Code Sections 25110 and 25113. |

| Election Duration | The water’s-edge election lasts for 84 calendar months, starting from the first day of the taxable year. |

| Termination Rules | The election can be terminated according to the rules outlined in R&TC Section 25113. |

Dos and Don'ts

When filling out the California 100 We form, consider the following guidelines to ensure accuracy and compliance.

- Do double-check the corporation name and California corporation number for accuracy.

- Do ensure that the address is complete, including suite, room, or PMB number.

- Do read the instructions carefully before completing the form.

- Do check the box if a common parent is electing on behalf of the water’s-edge group.

- Do list all corporations covered by the election clearly and completely.

- Do enter the correct beginning date for the water’s-edge election.

- Do sign and date the form where indicated.

- Don’t leave any required fields blank; fill in all necessary information.

- Don’t forget to keep a copy of the completed form for your records.

- Don’t assume that a single return eliminates the need for each member to file their own election if there is no common parent.

Misconceptions

There are several misconceptions surrounding the California 100 We form that can lead to confusion for corporations. Here are four of the most common misunderstandings:

- The Water’s-Edge Election is Optional for All Corporations: Many believe that the Water’s-Edge Election is optional for every corporation. However, if a corporation is part of a controlled group, it may be required to elect on behalf of the group, especially if a common parent is involved.

- Once Made, the Election Cannot Be Changed: Some think that once a corporation elects to file on a water’s-edge basis, it cannot change its decision. In reality, the election can be terminated according to specific rules outlined in the Revenue and Taxation Code.

- All Corporations Must File a Separate Election: There is a misconception that each corporation in a controlled group must file its own election. In fact, if a common parent makes the election, it covers all members of the controlled group included in the combined report.

- The Election Date is Fixed: Many assume that the election date is fixed and cannot be adjusted. However, the election date is typically the beginning of the taxable year, which can vary depending on the fiscal year ends of the group members.

Documents used along the form

When dealing with the California 100 We form, there are several other important forms and documents that often accompany it. These documents serve various purposes related to tax reporting and compliance for corporations. Understanding each form can help ensure that all necessary information is submitted correctly and on time.

- California Form 100W: This is the Water’s-Edge Corporation Franchise or Income Tax Return. It is used by corporations electing to file on a water’s-edge basis, reporting their income, deductions, and credits for California tax purposes.

- California Form 100S: This form is specifically for S corporations. It allows them to report their income, deductions, and credits while also electing to file on a water’s-edge basis if applicable.

- California Form 100X: This is the Amended Corporation Franchise or Income Tax Return. Corporations use this form to correct errors on previously filed Form 100W or Form 100S.

- California Schedule R: This schedule is used to report the apportionment of income among states. It helps determine how much income is taxable in California versus other states.

- California Form 568: This form is for limited liability companies (LLCs) and is used to report income, deductions, and credits for LLCs that are treated as partnerships or disregarded entities.

- California Form 100-ES: This is the Corporation Estimated Tax Payment form. Corporations use this form to make estimated tax payments throughout the year.

- California Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It is important for corporations that have made payments to contractors or other entities.

- California Form 3885: This form is for claiming depreciation on property. Corporations use it to report the depreciation of tangible assets over time for tax purposes.

Each of these forms plays a critical role in ensuring compliance with California tax laws. By being familiar with them, corporations can navigate the complexities of tax reporting more effectively and avoid potential issues with the tax authorities.

Different PDF Templates

California Fl 685 - It includes a proof of service portion for confirming proper notification.

California Fl 455 - The form outlines conditions under which a stay can be either granted or terminated.