Download California 100X Form

Common Questions

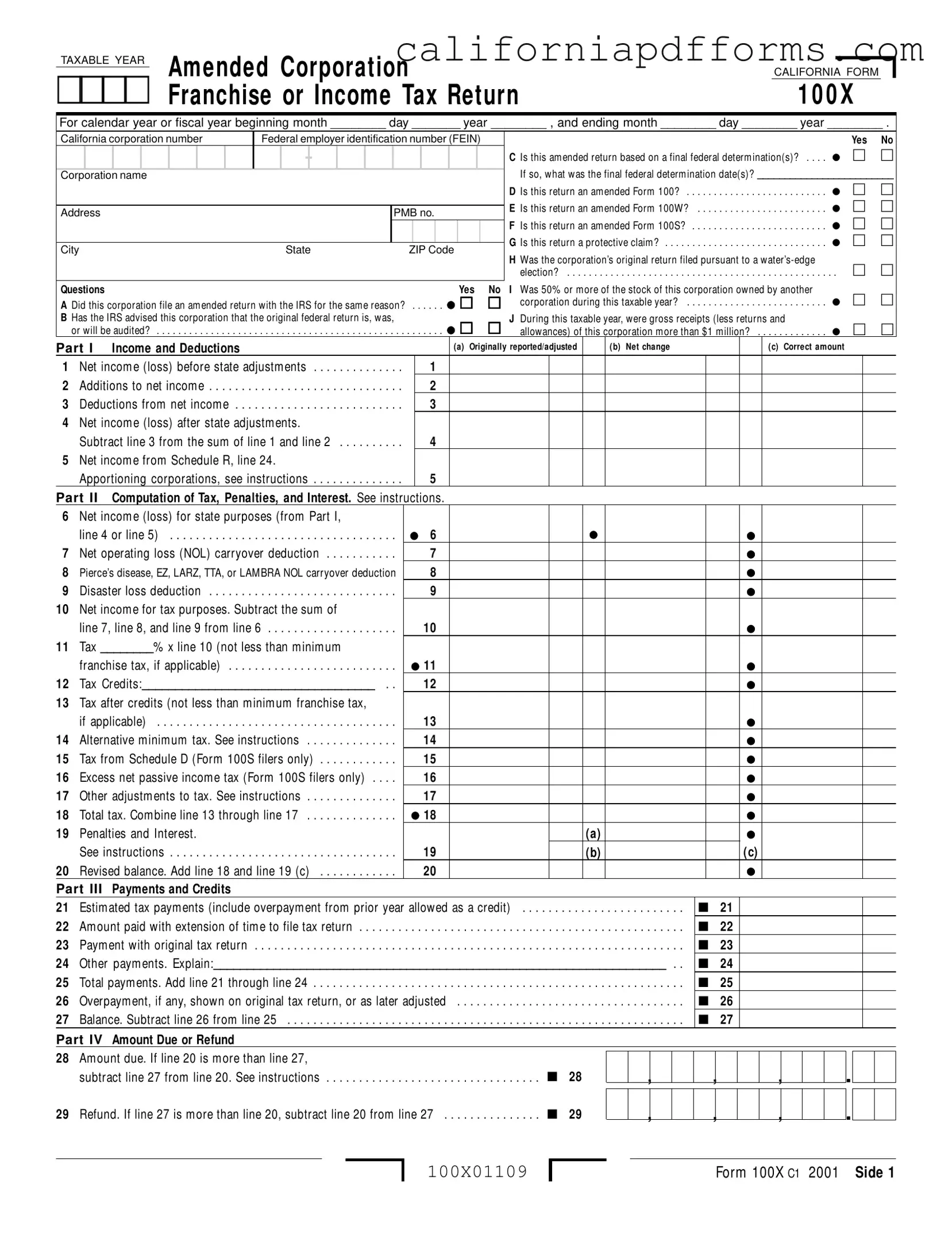

What is the California 100X form?

The California 100X form is used to amend a previously filed California Corporation Franchise or Income Tax Return. Corporations can use this form to correct errors or make changes to their original tax returns, including Forms 100, 100W, or 100S. It is essential for ensuring that all information reported is accurate and up-to-date.

When should I file the California 100X form?

File the California 100X form only after the original tax return has been submitted. The form must be filed within four years from the original due date of the tax return, the date the tax return was filed, or within one year from the date the tax was paid, whichever is later. If changes occur due to a federal audit, these must be reported within six months of the final federal determination.

Where do I send the California 100X form?

Where you send the form depends on whether there is an amount due or a refund. If the amended return results in a refund or no amount due, mail it to:

- FRANCHISE TAX BOARD

- PO BOX 942857

- SACRAMENTO CA 94257-0500

If there is an amount due, send it to:

- FRANCHISE TAX BOARD

- PO BOX 942857

- SACRAMENTO CA 94257-0501

What information is needed to complete the California 100X form?

To complete the California 100X form, you will need the following information:

- California corporation number

- Federal employer identification number (FEIN)

- Details of the original return, including income and deductions

- Explanation of changes being made

- Any supporting documents or schedules

What happens if I do not file the California 100X form?

Failing to file the California 100X form when necessary can lead to unresolved tax issues. This may result in penalties, interest on unpaid taxes, or potential audits. It's crucial to address any discrepancies as soon as possible to avoid further complications.

Can I file the California 100X form electronically?

As of now, the California 100X form must be filed by mail. Electronic filing is not available for this form. Ensure that all necessary documents are printed and mailed to the appropriate address based on whether you owe taxes or are expecting a refund.

What is a protective claim, and how does it relate to the California 100X form?

A protective claim is filed when a corporation seeks a refund but is uncertain about the outcome of related disputes, such as pending audits or litigation. If you are filing the California 100X form as a protective claim, check the appropriate box on the form to indicate this status. This allows you to preserve your right to a refund while awaiting resolution of those issues.

What should I include in the explanation of changes section?

In the explanation of changes section, provide detailed information about each change made to the original return. Include line numbers from both the original and amended returns, reasons for the changes, and any relevant calculations. Attach all supporting documents, including federal schedules if applicable, to substantiate the adjustments.

What are the penalties for filing the California 100X form late?

Filing the California 100X form late can result in penalties and interest on any unpaid taxes. The penalties are generally assessed based on the amount owed and the duration of the delay. It is advisable to file the amended return as soon as possible to minimize these potential costs.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California 100X form is used to amend a previously filed California Corporation Franchise or Income Tax Return, including Forms 100, 100W, and 100S. |

| Filing Deadline | Corporations must file the 100X form within four years from the original due date of the tax return, the date the tax return was filed, or within one year from the date the tax was paid, whichever is later. |

| Governing Law | The California Revenue and Taxation Code Section 19306 governs the statute of limitations for refunds related to the 100X form. |

| Where to File | If a refund is expected, mail the completed form to the Franchise Tax Board at PO Box 942857, Sacramento, CA 94257-0500. If tax is due, send it to PO Box 942857, Sacramento, CA 94257-0501. |

Dos and Don'ts

- Do ensure all information is accurate and complete before submission.

- Do double-check the corporation name and California corporation number against the original return.

- Do attach all necessary supporting documents and explanations for changes made.

- Do file the amended return within the appropriate time frame to avoid missing deadlines.

- Don't leave any questions unanswered; every section must be filled out as applicable.

- Don't forget to sign and date the form; an unsigned return may be rejected.

Misconceptions

- Misconception 1: The California 100X form is only for large corporations.

- Misconception 2: You can only file the 100X form during tax season.

- Misconception 3: Filing a 100X form guarantees a refund.

- Misconception 4: The 100X form can be used to change corporate status.

- Misconception 5: You do not need to include supporting documents with the 100X form.

- Misconception 6: The 100X form can only be filed for federal audit adjustments.

- Misconception 7: You can file the 100X form without addressing the specific changes made.

This form is applicable to any corporation that has previously filed a Form 100, regardless of its size. Small businesses may also need to amend their tax returns for various reasons, such as correcting errors or claiming additional deductions.

While many corporations file during tax season, the 100X form can be submitted any time after the original return has been filed. This flexibility allows corporations to address issues as they arise.

Filing the 100X form does not automatically ensure a refund. The corporation must provide valid reasons for the amendments, and the Franchise Tax Board will review the submission before determining if a refund is warranted.

This form is specifically designed for amending tax returns and cannot be used to change a corporation's status, such as from a C corporation to an S corporation. For such changes, a different form must be filed.

It is essential to attach all relevant supporting documents when submitting the 100X form. This includes any federal schedules that relate to changes made to the original return, as they help substantiate the amendments.

While the 100X form is often used in response to federal audit adjustments, it can also be filed for various reasons, such as correcting mistakes or claiming additional deductions that were not included in the original return.

When filing the 100X form, it is crucial to provide a detailed explanation of the changes being made. This includes referencing specific line numbers from both the original and amended returns, as clarity is necessary for the review process.

Documents used along the form

The California 100X form is used to amend a previously filed corporation franchise or income tax return. Along with the 100X form, several other documents are commonly required or helpful in the amendment process. Below are five such forms and documents.

- Form 100: This is the original California Corporation Franchise or Income Tax Return. It serves as the basis for the amendment and should be referenced to understand the initial filings.

- Form 100W: This form is for corporations filing under the Water's-Edge election. If the original return was filed using this form, it is essential to include it when amending.

- Form 100S: This is the California S Corporation Franchise or Income Tax Return. If the corporation is an S corporation, this form will be relevant for the amendment process.

- Schedule R: This schedule is used for apportioning income for corporations that do business in multiple states. If there are changes in income apportionment, this schedule must be attached to the amendment.

- Federal Form 1120X: This is the U.S. Corporation Income Tax Return Amended. If changes were made to the federal return, including this form helps provide clarity and supports the adjustments made on the California 100X.

These documents collectively support the amendment process, ensuring compliance with both California and federal tax regulations. Properly completing and submitting these forms can facilitate a smoother amendment experience.

Different PDF Templates

Driver License Online - Applicants must provide their Social Security Number when submitting the form.

Notice of Cessation California - It is crucial for owners to be aware of potential risks associated with unpaid labor and materials.

Is Workers Comp Required in California - Last worked and return to work dates are necessary for accurate reporting.