Download California 109 Form

Common Questions

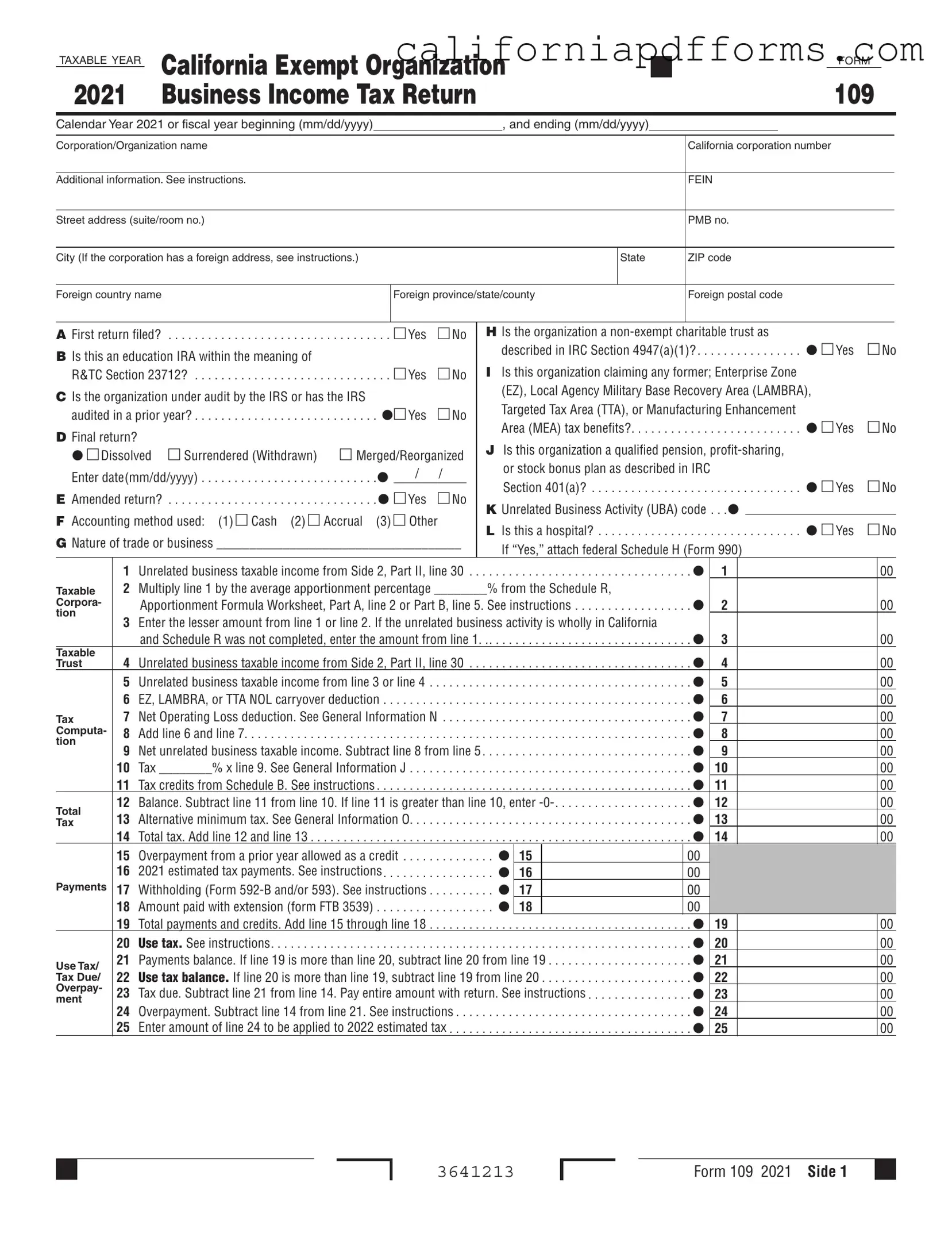

What is the California Form 109?

The California Form 109 is a tax return specifically designed for exempt organizations, including charities and non-profits, to report their unrelated business income. This form is part of the California Exempt Organization Business Income Tax Return, and it helps organizations fulfill their tax obligations while ensuring compliance with state regulations. The form must be completed accurately for the taxable year indicated, whether it's a calendar year or a fiscal year.

Who needs to file Form 109?

Organizations that are recognized as exempt under California law and engage in unrelated business activities must file Form 109. This includes non-profits that earn income from activities not directly related to their exempt purpose. If your organization has generated unrelated business taxable income (UBTI) during the year, you are required to file this form. Additionally, if your organization has undergone changes such as dissolution, merger, or reorganization, it may also need to file this form.

What information is required to complete Form 109?

To complete Form 109, several key pieces of information are needed:

- The name of the organization and its California corporation number.

- The Federal Employer Identification Number (FEIN).

- The organization's address, including city, state, and ZIP code.

- Details about the type of return being filed, such as whether it is the first return, an amended return, or a final return.

- Information about unrelated business taxable income, deductions, and any applicable tax credits.

It is important to gather all necessary documentation and data before starting the form to ensure accurate reporting.

How is unrelated business taxable income calculated on Form 109?

Unrelated business taxable income (UBTI) is calculated by first determining the gross income from unrelated business activities. Then, you subtract any allowable deductions directly connected to those activities. The resulting figure is the UBTI, which is subject to tax. The form includes specific lines for reporting gross receipts, deductions, and calculating the final taxable income. If your organization has income from multiple sources, it may be necessary to complete additional schedules to report that income accurately.

What are the consequences of not filing Form 109?

Failing to file Form 109 when required can lead to various consequences. The California Franchise Tax Board (FTB) may impose penalties and interest on any unpaid taxes. Additionally, not filing can jeopardize the organization’s tax-exempt status. It is crucial for organizations to be aware of their filing requirements and to submit the form on time to avoid potential issues with state tax authorities.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | The California 109 form is used by exempt organizations to report unrelated business taxable income (UBTI) and calculate the corresponding tax owed. |

| Governing Law | The form is governed by California Revenue and Taxation Code (R&TC) Sections 23701 and 23712, along with federal Internal Revenue Code (IRC) regulations. |

| Filing Requirement | Organizations must file Form 109 if they have UBTI of $1,000 or more during the tax year. |

| First Return Indicator | Organizations can indicate if this is their first return by checking the appropriate box on the form. |

| Accounting Methods | Organizations can choose between cash, accrual, or other accounting methods for reporting income and expenses. |

| Tax Calculation | The tax rate applied to UBTI is determined by the California tax laws applicable to corporations. |

| Amended Returns | If an organization needs to correct a previously filed return, it can indicate this by checking the "Amended return" box on the form. |

Dos and Don'ts

When filling out the California 109 form, there are several important guidelines to follow. Here are four things you should do and four things you should avoid:

- Double-check your information: Ensure that all details, including names and identification numbers, are accurate.

- Use the correct accounting method: Choose between cash, accrual, or other methods as appropriate for your organization.

- Keep documentation handy: Have all necessary schedules and supporting documents ready for reference.

- File on time: Submit the form by the deadline to avoid penalties.

- Don't leave fields blank: Fill out all required sections to prevent processing delays.

- Don't guess on deductions: Only claim deductions you can substantiate with documentation.

- Don't ignore instructions: Follow the guidelines provided in the form instructions carefully.

- Don't forget to sign: Ensure that the form is signed by an authorized individual before submission.

Misconceptions

- Misconception 1: The California 109 form is only for profit-making organizations.

- Misconception 2: Only large organizations need to file the California 109 form.

- Misconception 3: The California 109 form is the same as the federal 990 form.

- Misconception 4: Filing the California 109 form is optional if the organization has no taxable income.

- Misconception 5: The California 109 form only applies to charitable organizations.

- Misconception 6: Organizations can ignore deadlines if they file an extension.

- Misconception 7: The California 109 form does not require supporting documentation.

- Misconception 8: All unrelated business income is fully taxable.

- Misconception 9: Once filed, the California 109 form cannot be amended.

This form is designed for exempt organizations, including nonprofits, that may have unrelated business income. It helps these organizations report their taxable income accurately.

Any exempt organization that has unrelated business income must file this form, regardless of size. Small organizations can also have obligations under this tax form.

While both forms serve similar purposes, they are distinct documents with different requirements and instructions. Organizations need to be aware of the specific guidelines for each form.

Organizations must file the form even if they do not have taxable income. This ensures compliance and proper record-keeping with the state tax authorities.

This form can apply to various types of exempt organizations, including educational institutions and religious groups, as long as they have unrelated business income.

Even if an organization files for an extension, it must still adhere to specific deadlines to avoid penalties. Extensions do not eliminate the requirement to file on time.

Organizations must attach relevant schedules and documents as required by the form. Failing to do so can lead to processing delays or penalties.

Some deductions may apply to unrelated business income, which can reduce the overall tax liability. Organizations should consult the instructions for potential deductions.

Organizations can file an amended return if they discover errors after submission. It is important to correct any mistakes to ensure compliance with tax laws.

Documents used along the form

The California 109 form is an essential document for organizations that need to report their business income tax return. However, several other forms and documents often accompany it to provide additional information or to fulfill specific requirements. Below is a list of these commonly used documents, each serving a unique purpose.

- Schedule A: This schedule details the cost of goods sold and/or operations. Organizations use it to outline their inventory valuation methods and to report the costs associated with goods sold during the tax year.

- Schedule B: This document is used to report tax credits. Organizations list the names and codes of the credits they are claiming, which can help reduce their overall tax liability.

- Schedule C: This schedule focuses on rental income from real property. It helps organizations report income and deductions related to property they lease, ensuring accurate tax reporting for rental activities.

- Schedule D: This form is for reporting unrelated debt-financed income. Organizations provide details about income derived from debt-financed property, along with related deductions, to calculate net income.

- Schedule E: This schedule captures investment income for specific tax-exempt organizations. It allows organizations to report gross investment income and any deductions directly related to that income.

- Schedule H: This document is used to report advertising income and excess advertising costs. It helps organizations detail their income from advertising while managing the associated costs.

- Schedule I: This schedule reports the compensation of officers, directors, and trustees. Organizations list the names, titles, and compensation amounts for key personnel, ensuring transparency in financial reporting.

These forms and schedules work together with the California 109 form to provide a comprehensive view of an organization’s financial activities. By accurately completing and submitting these documents, organizations can fulfill their tax obligations while also ensuring compliance with state regulations.

Different PDF Templates

Ftb 3588 - Accuracy in all entries on the form is essential for successful processing.

Form 540 Taxes - Direct deposit requests via Form 8879 require accurate banking information.

Cdph 530 - The HS 402 form includes necessary details about the facility and the bonding agency.