Download California 1296 32 Form

Common Questions

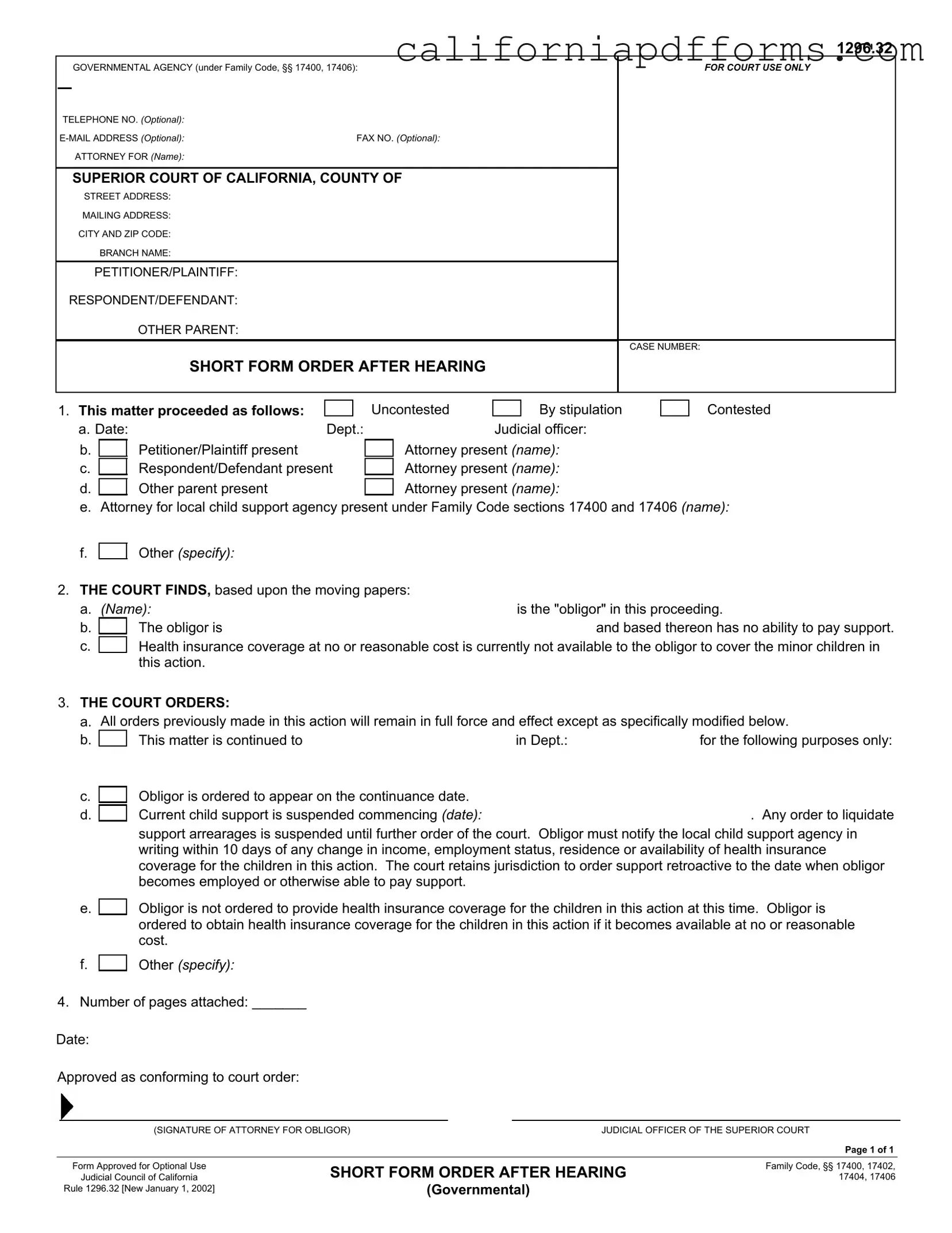

What is the purpose of the California 1296.32 form?

The California 1296.32 form, also known as the Short Form Order After Hearing, is primarily used in family law cases. It documents the court's findings and orders after a hearing related to child support. This form is essential for establishing or modifying child support obligations and ensuring that all parties involved are aware of the court's decisions. It helps maintain clarity and accountability regarding support payments and related issues.

Who is considered the "obligor" in the context of this form?

In the context of the California 1296.32 form, the "obligor" refers to the person who is responsible for paying child support. This individual may be a parent or guardian who has been ordered by the court to provide financial support for their minor children. The form outlines the obligor's financial obligations and any findings related to their ability to pay support, including their employment status and access to health insurance for the children.

What are the obligations of the obligor after the court hearing?

After the court hearing, the obligor has several important obligations, including:

- Notifying the local child support agency in writing within 10 days of any changes in income, employment status, residence, or health insurance availability for the children.

- Appearing at any scheduled court dates as ordered.

- Obtaining health insurance coverage for the children if it becomes available at no or reasonable cost.

- Understanding that current child support payments may be suspended until further notice, but that the court retains the right to order support retroactively once the obligor becomes able to pay.

These obligations are crucial for ensuring that the needs of the children are met and that the court can effectively monitor compliance with its orders.

What happens if the obligor's financial situation changes?

If the obligor's financial situation changes, they are required to inform the local child support agency in writing within 10 days. This includes any changes in income, employment status, or availability of health insurance for the children. The court retains jurisdiction, meaning it can revisit the support order and make adjustments based on the obligor's new circumstances. This ensures that child support remains fair and reflective of the obligor's current ability to pay.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California 1296.32 form is governed by Family Code sections 17400, 17402, 17404, and 17406. |

| Purpose | This form serves as a Short Form Order After Hearing for child support matters, specifically in governmental agency cases. |

| Obligor Definition | The term "obligor" refers to the individual responsible for paying child support in the proceedings outlined in this form. |

| Notification Requirement | The obligor must notify the local child support agency in writing within 10 days of any changes in income, employment, residence, or health insurance availability. |

Dos and Don'ts

When filling out the California 1296.32 form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things to do and avoid:

- Do read the entire form carefully before starting.

- Do provide accurate information for all required fields.

- Do include the case number at the top of the form.

- Do ensure that the names of all parties involved are spelled correctly.

- Do keep a copy of the completed form for your records.

- Don’t leave any mandatory fields blank.

- Don’t use abbreviations or slang in the form.

- Don’t forget to sign the form before submitting it.

- Don’t submit the form without reviewing it for errors.

- Don’t ignore the deadlines for submitting the form.

Following these tips can help ensure that your form is filled out correctly and submitted on time.

Misconceptions

Understanding the California 1296 32 form can be challenging. Several misconceptions often arise regarding its purpose and requirements. Below are five common misconceptions, along with clarifications to enhance understanding.

- The form is only for child support cases. This form is utilized in various family law matters, not exclusively for child support. It addresses obligations related to health insurance and other financial responsibilities concerning minor children.

- Only attorneys can file this form. While attorneys often assist in the process, individuals may also file the form on their own. It is essential, however, to understand the legal implications and requirements involved.

- The obligor is always required to pay support immediately. The court may suspend child support payments if the obligor demonstrates an inability to pay. This suspension can occur until the obligor's financial situation improves.

- The form guarantees that health insurance will be provided. The form does not automatically mandate health insurance coverage for children. It only requires the obligor to obtain coverage if it becomes available at no or reasonable cost.

- Once the form is filed, the case is resolved. Filing the form is just one step in the legal process. The court may schedule further hearings or require additional actions from the parties involved.

By clarifying these misconceptions, individuals can approach the California 1296 32 form with a better understanding of its implications and requirements.

Documents used along the form

The California 1296.32 form is primarily used in family law cases related to child support. However, several other documents often accompany this form to ensure that all legal requirements are met and that the proceedings are comprehensive. Below is a list of these documents, each described briefly to provide clarity on their purpose and importance.

- California Child Support Guideline Calculator: This tool helps determine the appropriate amount of child support based on both parents' incomes, expenses, and other relevant factors. It provides a standardized calculation to ensure fairness in support obligations.

- Income and Expense Declaration (Form FL-150): This form allows parties to disclose their financial situation, including income, expenses, assets, and debts. It is crucial for the court to assess each parent's ability to pay child support.

- Request for Order (Form FL-300): This document is used to request a court hearing on various family law matters, including child support modifications. It outlines the specific requests being made and the reasons for them.

- Proof of Service (Form FL-335): This form confirms that all parties involved have been properly notified of court filings and hearings. It is essential for ensuring that the legal process is transparent and that everyone has the opportunity to respond.

- Judgment (Form FL-180): This document finalizes the court's decisions regarding child support and other family law issues. It serves as an official record of the court's orders and is enforceable by law.

- Notice of Motion (Form FL-301): This form is used to inform the other party and the court about a motion being filed. It provides details about the motion and the time and place of the hearing.

- Child Support Agency Referral (Form FL-395): This form is used to refer a case to the local child support agency for assistance in establishing or modifying child support orders. It helps streamline the process and ensures that the agency can provide necessary support.

Each of these documents plays a vital role in the family law process, particularly in cases involving child support. By understanding their functions, individuals can better navigate the complexities of the legal system and ensure that their rights and responsibilities are upheld.

Different PDF Templates

Fw 002 - This form is part of a procedural requirement for those facing court fees.

Dcss - Summons / Complaint - The FL-600 highlights the potential consequences of not adhering to child support provisions.