Download California 3500 Form

Common Questions

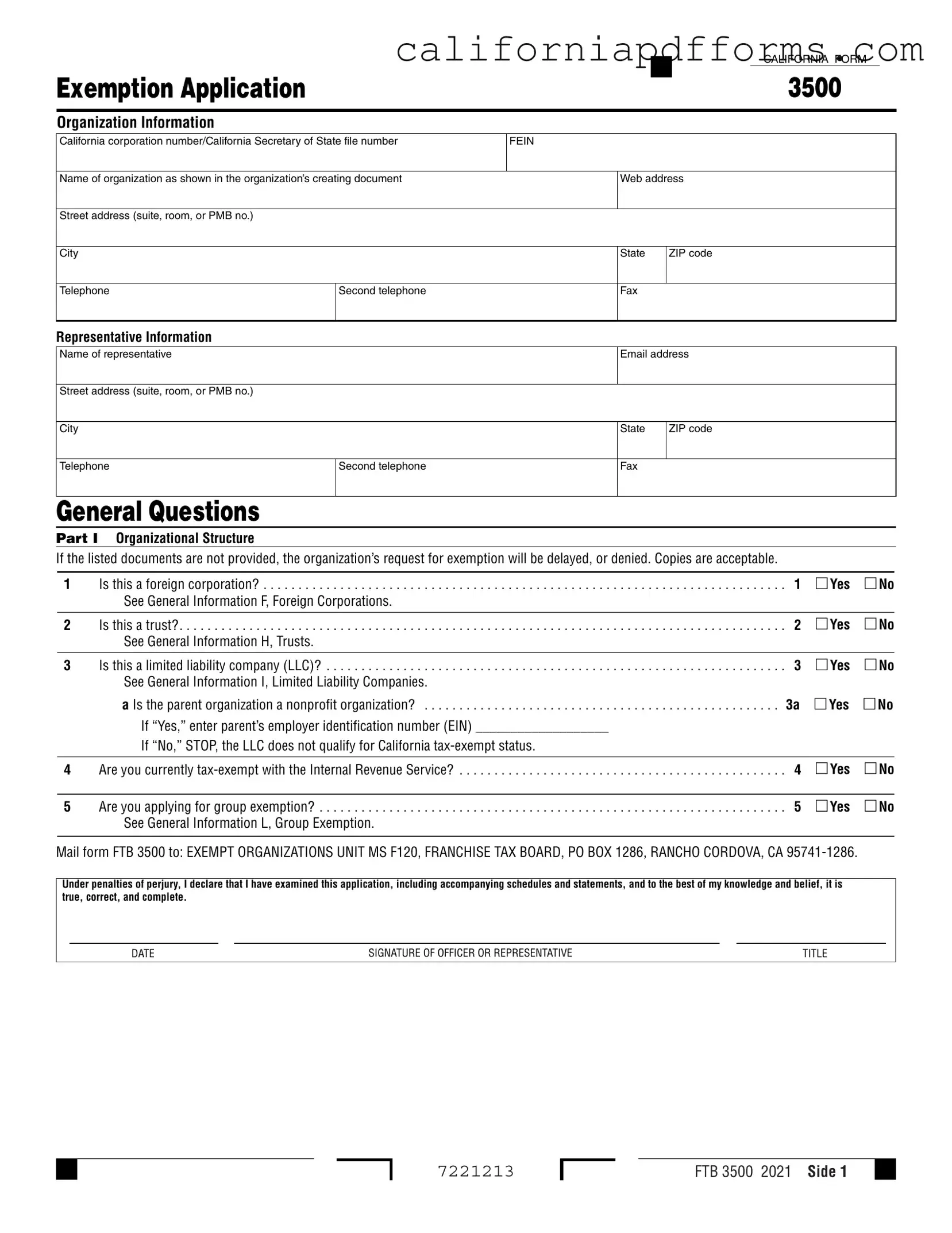

What is the California 3500 form?

The California 3500 form is an application used by organizations seeking tax-exempt status in California. It collects information about the organization’s structure, activities, and financial data. Completing this form is essential for organizations that wish to qualify for exemption from certain state taxes.

Who needs to file the California 3500 form?

Organizations that are applying for tax-exempt status in California must file the California 3500 form. This includes foreign corporations, trusts, limited liability companies (LLCs), and other types of organizations that meet specific criteria under California law.

What information is required on the California 3500 form?

The form requires various details, including:

- Organization information, such as name, address, and contact details.

- Representative information, including the name and contact details of the person submitting the form.

- Details about the organizational structure, such as whether it is a foreign corporation, trust, or LLC.

- A narrative of the organization's activities, including past, present, and planned activities.

- Financial data, including income and expenses.

- Information about officers, directors, and trustees.

How does an organization demonstrate its activities on the form?

Organizations must provide a detailed description of their activities. This includes:

- The purpose of each activity and how it furthers the organization's exempt purpose.

- The timeline of when activities were or will be initiated.

- The location and individuals involved in conducting the activities.

What happens if the California 3500 form is incomplete?

If the form is incomplete or missing required documents, the request for exemption may be delayed or denied. It is important to ensure that all necessary information is included and accurate to avoid these issues.

Can an organization apply for group exemption using the California 3500 form?

Yes, organizations can apply for group exemption using the California 3500 form. However, they must indicate this on the form and provide the necessary details about the group and its members. Additional guidelines may apply, so it is advisable to review the relevant sections of the form carefully.

Is there a filing fee associated with the California 3500 form?

No, there is no filing fee for submitting the California 3500 form. Organizations can file the form without incurring any costs. However, they should ensure that all required information is included to avoid delays in processing.

How long does it take to process the California 3500 form?

The processing time for the California 3500 form can vary. Typically, it may take several weeks to a few months, depending on the volume of applications and the completeness of the submission. Organizations should plan accordingly and follow up if they do not receive confirmation within a reasonable time frame.

Where should the California 3500 form be mailed?

The completed California 3500 form should be mailed to the Exempt Organizations Unit at the Franchise Tax Board. The address is:

EXEMPT ORGANIZATIONS UNIT MS F120

FRANCHISE TAX BOARD

PO BOX 1286

RANCHO CORDOVA, CA 95741-1286

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The California Form 3500 is an application for organizations seeking tax-exempt status under California law. |

| Governing Law | This form is governed by the California Revenue and Taxation Code, specifically sections related to tax exemptions. |

| Organizational Information | Organizations must provide essential details such as their California corporation number, FEIN, and address to complete the form. |

| General Questions | Applicants are required to answer questions regarding their organizational structure, such as whether they are a foreign corporation or a trust. |

| Submission Process | Completed forms must be mailed to the Exempt Organizations Unit of the California Franchise Tax Board for processing. |

| Financial Data | Organizations must provide financial information, including previous filings and a detailed income and expense statement if applicable. |

Dos and Don'ts

When filling out the California 3500 form, it is essential to ensure accuracy and completeness. Here are seven important dos and don'ts to consider:

- Do provide all required information clearly and accurately.

- Do double-check your organization’s details, including the name and address.

- Do include copies of any necessary documents to support your application.

- Do ensure that all signatures are provided where required.

- Don't leave any sections blank; every question must be answered.

- Don't submit the form without reviewing it for errors or omissions.

- Don't forget to keep a copy of the completed form for your records.

Misconceptions

Here are five common misconceptions about the California Form 3500:

- Misconception 1: The 3500 form is only for new organizations.

- Misconception 2: Only nonprofit organizations need to file this form.

- Misconception 3: Filing the 3500 guarantees tax-exempt status.

- Misconception 4: All required documents must be original.

- Misconception 5: Once tax-exempt status is granted, it lasts forever.

This form can also be used by existing organizations seeking to obtain or maintain tax-exempt status. It is essential for both new and established entities.

While primarily for nonprofits, certain types of organizations, like trusts and limited liability companies (LLCs), may also need to file for tax exemption.

Submitting the form does not automatically grant tax-exempt status. The California Franchise Tax Board reviews each application, and approval is based on compliance with specific criteria.

Copies of the necessary documents are acceptable. This can help expedite the application process.

Tax-exempt status can be revoked if the organization fails to comply with ongoing requirements, such as filing annual returns or maintaining proper records.

Documents used along the form

The California Form 3500 is used by organizations seeking tax-exempt status in the state. When submitting this form, several other documents may also be required to support the application. Below is a list of additional forms and documents that are often used in conjunction with the California 3500 form.

- FTB 3500A: This form is a submission of exemption request for organizations that have not previously been granted tax-exempt status. It is used to provide additional information when applying for exemption.

- Form 199: The California Exempt Organization Annual Information Return must be filed annually by tax-exempt organizations. It provides the Franchise Tax Board with financial information about the organization.

- FTB 199N: This is the California e-Postcard, a simplified annual filing for smaller tax-exempt organizations with gross receipts under a certain threshold. It serves as a notification of continued tax-exempt status.

- IRS Form 1023: This is the application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. Many organizations submit this form to the IRS to obtain federal tax-exempt status.

- IRS Form 990: This is the annual information return that most tax-exempt organizations must file with the IRS. It provides detailed information on the organization’s financial activities and governance.

- Articles of Incorporation: This document outlines the organization’s purpose, structure, and governance. It is essential for establishing the legal existence of the organization in California.

- Bylaws: Bylaws govern the internal management of the organization. They outline how decisions are made, how meetings are conducted, and the roles of officers and directors.

- Employer Identification Number (EIN): This is a federal tax identification number required for tax-exempt organizations. It is used for reporting purposes to the IRS and other agencies.

- Financial Statements: These documents provide a summary of the organization’s financial position, including income, expenses, and assets. They are often required to demonstrate financial viability.

Understanding these forms and documents can help ensure a smoother application process for tax-exempt status in California. Each document serves a specific purpose and provides necessary information to the relevant authorities.

Different PDF Templates

California Wic - The referral also considers historical medical conditions that may impact the woman or her pregnancy.

California Ud 105 - Defendants should review the completed form for all required fields before submission.