Download California 3506 Form

Common Questions

What is the California Form 3506 used for?

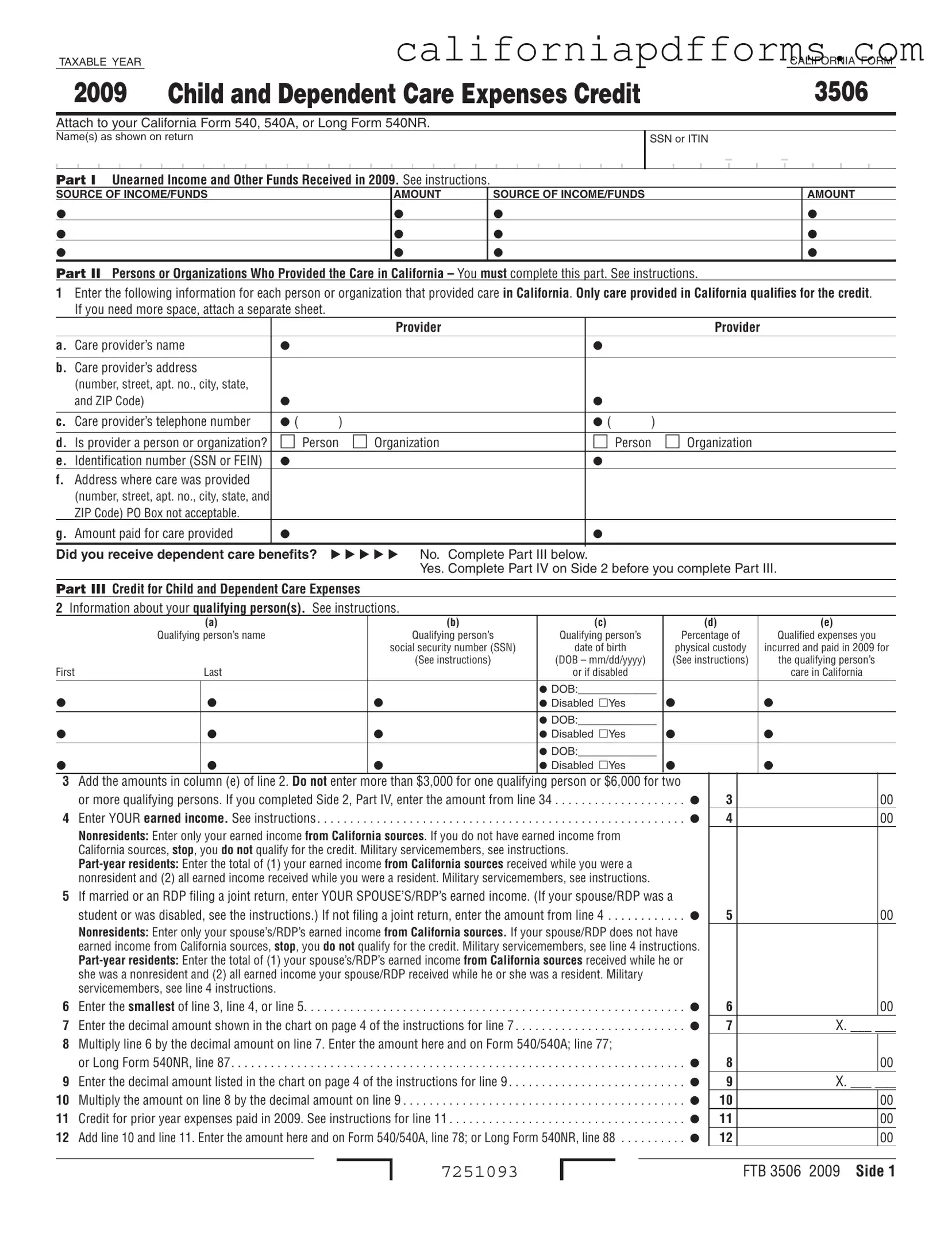

The California Form 3506 is designed to help taxpayers claim the Child and Dependent Care Expenses Credit. This credit is available to individuals who incur expenses for the care of qualifying children or dependents while they work or look for work. To benefit from this credit, you must attach Form 3506 to your California tax return, which can be Form 540, 540A, or Long Form 540NR.

Who qualifies as a care provider for the purposes of this form?

A care provider must be either an individual or an organization that provides care in California. It's important to note that only care provided within the state qualifies for the credit. When filling out Form 3506, you will need to provide detailed information about each care provider, including their name, address, and identification number.

What are the maximum amounts I can claim for child and dependent care expenses?

You can claim up to $3,000 in qualifying expenses for one qualifying person. If you have two or more qualifying persons, the maximum amount you can claim increases to $6,000. However, keep in mind that these amounts are subject to certain income limitations, and you should refer to the instructions on the form for further details.

What if I received dependent care benefits?

If you received dependent care benefits, you must complete Part IV of the form before proceeding to Part III. This section requires you to report the total amount of benefits received and any amounts carried over or forfeited from previous years. It’s crucial to accurately report these amounts to ensure you receive the correct credit.

How do I determine my earned income for the purposes of this form?

Your earned income includes wages, salaries, tips, and other compensation received for work performed. If you are a nonresident, only your earned income from California sources should be reported. For part-year residents, you'll need to combine your earned income from California sources received while a nonresident with all earned income received while a resident.

What if I have no earned income?

If you do not have earned income from California sources, you will not qualify for the Child and Dependent Care Expenses Credit. This applies to both residents and nonresidents. If you are a military servicemember, special instructions may apply, and it is advisable to refer to the form's guidelines for clarification.

Can I claim expenses paid in a previous year?

Yes, if you paid for qualifying expenses in a previous year but did not claim them at that time, you may still be able to claim those expenses on the current year's Form 3506. You will need to complete the appropriate sections regarding prior year expenses, and ensure that you meet all eligibility criteria outlined in the instructions.

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The California Form 3506 is used to claim the Child and Dependent Care Expenses Credit for the 2009 tax year. |

| Eligibility Criteria | Taxpayers must have incurred expenses for the care of qualifying children or dependents while they worked or looked for work. |

| Filing Requirements | This form must be attached to California Form 540, 540A, or Long Form 540NR when filing taxes. |

| Income Reporting | Taxpayers must report unearned income and other funds received during 2009 in Part I of the form. |

| Care Provider Information | Part II requires taxpayers to provide detailed information about the care providers, including names, addresses, and identification numbers. |

| Qualifying Expenses | Taxpayers can claim up to $3,000 for one qualifying person or $6,000 for two or more qualifying persons in Part III. |

| Dependent Care Benefits | Part IV addresses dependent care benefits received, which must be reported and considered in calculating the credit. |

| California Law | The Child and Dependent Care Expenses Credit is governed by California Revenue and Taxation Code Section 17052.8. |

| Submission Deadline | The form must be filed by the tax deadline, which is typically April 15 of the following year. |

Dos and Don'ts

When filling out the California 3506 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid:

- Do provide accurate personal information, including your name and Social Security Number (SSN).

- Do include all qualifying expenses incurred for child and dependent care.

- Do ensure that care was provided in California, as only in-state care qualifies for the credit.

- Do complete all required sections, especially the part detailing care providers.

- Don't leave any fields blank; if a section does not apply, indicate that clearly.

- Don't forget to attach the form to your California Form 540, 540A, or Long Form 540NR.

- Don't include any care expenses that were not paid out-of-pocket or were reimbursed.

- Don't use a P.O. Box for the address where care was provided; a physical address is required.

Misconceptions

- Misconception 1: The California 3506 form is only for parents with children under 13.

- Misconception 2: Only care provided by licensed daycare centers qualifies for the credit.

- Misconception 3: You cannot claim the credit if you are a part-time worker.

- Misconception 4: The credit is automatically applied when filing your tax return.

This form is designed for anyone who incurs child and dependent care expenses, regardless of the age of the child or dependent. Even if your child is older, you may still qualify for the credit if you provide care for a dependent who is disabled or unable to care for themselves.

While licensed daycare centers do qualify, care provided by individuals, such as babysitters or family members, can also be eligible. The key factor is that the care must be provided in California and that you have proper documentation of the expenses.

Your eligibility for the credit is not determined by whether you work full-time or part-time. As long as you have earned income and meet other requirements, you can claim the credit. It’s essential to ensure that your earned income meets the minimum threshold for the credit.

The credit is not automatically applied; you must complete the California 3506 form and attach it to your tax return. Failing to submit the form means you won’t receive the credit, even if you qualify.

Documents used along the form

When filling out the California Form 3506 for Child and Dependent Care Expenses Credit, you may also need to gather additional documents. Here are four forms that are commonly used alongside the 3506 form. Each one plays a role in ensuring you have all the necessary information for your tax return.

- California Form 540: This is the standard income tax return form for California residents. It includes all your income, deductions, and credits, including the Child and Dependent Care Expenses Credit claimed on Form 3506.

- California Form 540A: This is a simplified version of Form 540. If you have a straightforward tax situation, this form may be appropriate for you. Like Form 540, it allows you to report income and claim credits.

- Form W-2: This form reports your annual wages and the taxes withheld from your paycheck. If you received dependent care benefits, this information will be shown in Box 10 of your W-2, which is crucial for completing the 3506 form.

- Form 2441: This is the federal form for Child and Dependent Care Expenses. If you are claiming expenses on your federal tax return, you will need this form to provide details about your care expenses and the qualifying individuals.

Having these documents ready will help you complete the California Form 3506 accurately. Make sure to review each form carefully to ensure all information is correct. This will make the filing process smoother and help you maximize your potential tax benefits.

Different PDF Templates

Fl334 - The document serves as a legal record of orders and agreements reached during hearings.

Fppc - California's FPPC is responsible for enforcement related to the 700-U form and disclosures.

Jv462 - The JV-462 aims to ensure a comprehensive approach to the nonminor’s transition into successful adulthood.