Download California 3521 Form

Common Questions

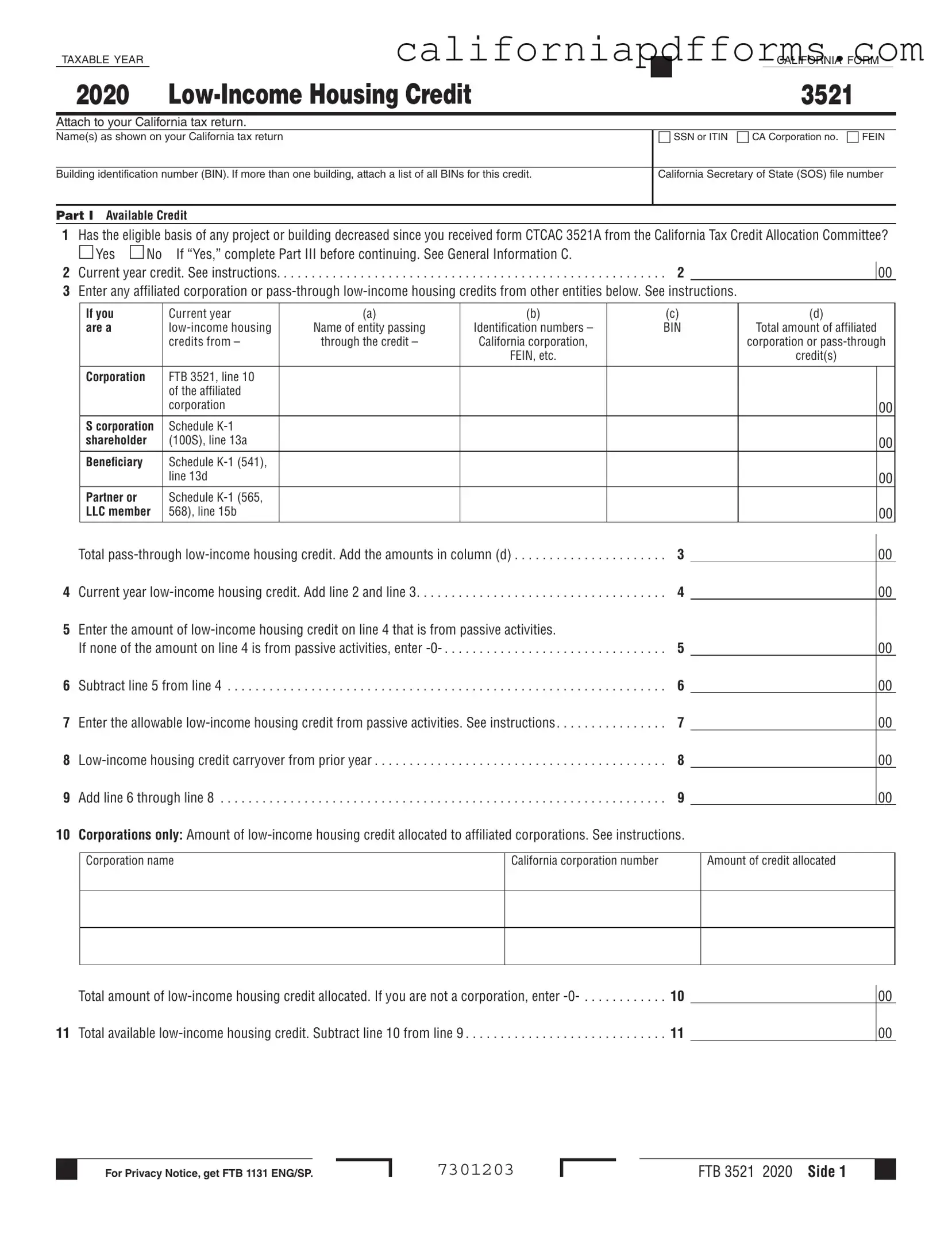

What is the California Form 3521?

The California Form 3521 is used to claim the Low-Income Housing Credit for the tax year. This form must be attached to your California tax return. It helps taxpayers who invest in low-income housing projects to receive tax credits based on their investment.

Who needs to file Form 3521?

Any taxpayer who has invested in low-income housing and wishes to claim the Low-Income Housing Credit must file Form 3521. This includes individuals, corporations, and pass-through entities like partnerships and S corporations.

What information do I need to complete Form 3521?

To complete Form 3521, you will need:

- Your name(s) as shown on your California tax return.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- The Building Identification Number (BIN) for each project.

- Details of any affiliated corporation or pass-through low-income housing credits.

What should I do if the eligible basis of my project has decreased?

If the eligible basis of any project or building has decreased since you received Form CTCAC 3521A, you must complete Part III of the form. This section requires specific information about the decrease and its impact on your credit calculation.

How do I calculate the current year low-income housing credit?

To calculate your current year low-income housing credit, you need to add the amount from line 2 (current year credit) and line 3 (pass-through credits). This total will give you the amount of credit you can claim for the current tax year.

What happens to unused credits?

If you have unused low-income housing credits, they can be carried over to future tax years. You will need to complete Part II of the form to determine the amount of credit carryover available for future use.

Is there a deadline for filing Form 3521?

Form 3521 must be filed along with your California tax return by the due date of that return. For most taxpayers, this is typically April 15th of the following year. Be sure to check for any updates or extensions that may apply.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | The California Form 3521 is used to claim the Low-Income Housing Credit for the taxable year. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 17058, which outlines the Low-Income Housing Credit program. |

| Filing Requirement | Taxpayers must attach Form 3521 to their California tax return when claiming the credit. |

| Eligibility Criteria | To qualify, the taxpayer must have an eligible basis in a low-income housing project and must not have a decrease in that basis since the last form CTCAC 3521A was received. |

| Credit Calculation | The credit amount is calculated by adding the current year credit and any pass-through credits from affiliated entities. |

Dos and Don'ts

When filling out the California 3521 form, it’s important to be careful and precise. Here are some key dos and don’ts to keep in mind:

- Do ensure that all names and identification numbers are accurate as shown on your California tax return.

- Do check if the eligible basis of any project has decreased since receiving form CTCAC 3521A.

- Do include all affiliated corporation or pass-through low-income housing credits from other entities.

- Do add the amounts in column (d) to calculate the total pass-through low-income housing credit.

- Don’t leave any fields blank if they are applicable to your situation; provide all necessary information.

- Don’t forget to sign and date the form before submitting it with your California tax return.

Misconceptions

Here are five common misconceptions about the California Form 3521, which pertains to the Low-Income Housing Credit:

- Misconception 1: The form is only for large corporations.

- Misconception 2: You can file the form anytime during the year.

- Misconception 3: You do not need to report affiliated credits.

- Misconception 4: The credit is automatically granted without any calculations.

- Misconception 5: Once you claim the credit, you don’t need to keep records.

This is not true. While corporations can use the form, it is also applicable to individuals and smaller entities involved in low-income housing projects.

The form must be attached to your California tax return. Timely filing is crucial to ensure you receive the credit.

Affiliated credits must be reported on the form. Failing to do so can lead to discrepancies and potential issues with your tax return.

Calculating the credit involves multiple steps, including determining eligible basis and current year credits. Proper calculations are essential for accurate reporting.

Documents used along the form

The California Form 3521 is essential for claiming the Low-Income Housing Credit. However, it is often accompanied by several other forms and documents that help clarify and support the information provided. Below is a list of additional forms that may be used in conjunction with the California 3521 form, along with brief descriptions of each.

- California Form 3544: This form is used to report the assignment of low-income housing credits. Taxpayers must complete this form if they are transferring credits to another entity.

- California Form 540: This is the standard individual income tax return form for California residents. It is where taxpayers report their overall income and tax liability, including any credits claimed.

- California Schedule K-1 (100S): This form is issued to shareholders of S corporations. It reports the shareholder's share of income, deductions, and credits, including any low-income housing credits.

- California Schedule K-1 (541): Beneficiaries of estates or trusts receive this form. It details the beneficiary's share of income and deductions, which may include low-income housing credits.

- California Schedule K-1 (565): This form is provided to partners in partnerships or LLC members. It outlines their share of the partnership’s income, deductions, and credits.

- California Form FTB 1131: This document contains the privacy notice related to the collection and use of personal information by the Franchise Tax Board. It is often included with various tax forms.

- California Form 3885A: This form is used for reporting depreciation on property. If the low-income housing project includes depreciable assets, this form may be necessary.

- California Form 100: This is the California Corporation Franchise or Income Tax Return form. Corporations claiming low-income housing credits must file this form to report their income and calculate their tax liability.

Understanding these forms and their purposes can help ensure that taxpayers properly claim the Low-Income Housing Credit and comply with California tax regulations. It is advisable to review each form's instructions carefully to provide accurate and complete information.

Different PDF Templates

Tro California - It's a straightforward method to communicate your need for a new hearing date.

How to Collect a Judgement From a Person - The SC-130 provides guidance on requesting a vacate of the judgment if necessary.