Download California 3522 Form

Common Questions

What is the purpose of Form FTB 3522?

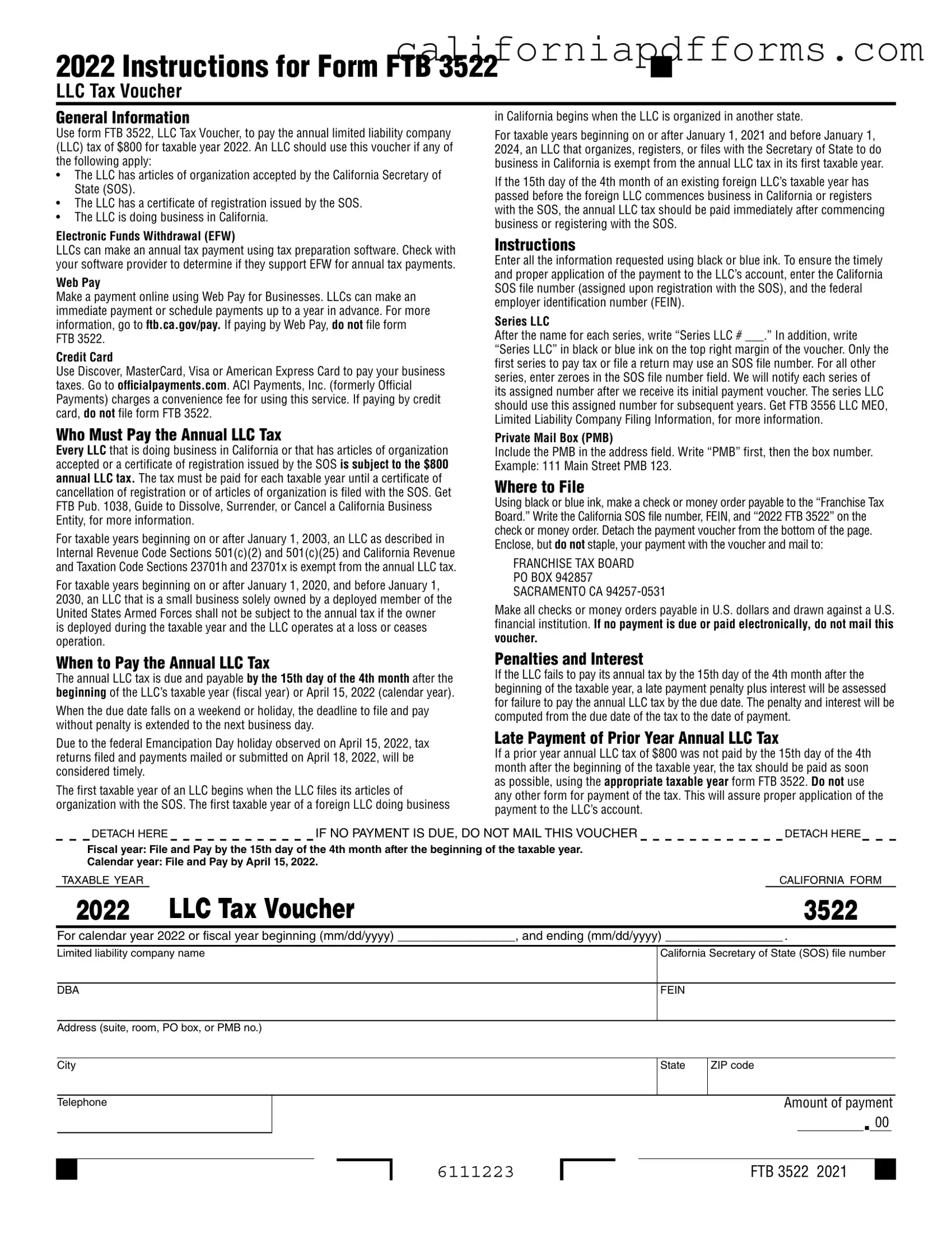

Form FTB 3522, also known as the LLC Tax Voucher, is used to pay the annual limited liability company (LLC) tax of $800 for the taxable year. This form is applicable to any LLC that has articles of organization accepted by the California Secretary of State, has a certificate of registration issued by the Secretary of State, or is actively doing business in California. The form ensures that the tax payment is properly recorded and applied to the LLC’s account.

Who is required to pay the annual LLC tax?

Every LLC that operates in California or has filed articles of organization or a certificate of registration with the Secretary of State is required to pay the annual LLC tax. This obligation remains until the LLC files a certificate of cancellation of registration or articles of organization. Certain exemptions apply, including LLCs organized under specific sections of the Internal Revenue Code and California Revenue and Taxation Code, as well as small businesses solely owned by deployed members of the U.S. Armed Forces under certain conditions.

When is the annual LLC tax due?

The annual LLC tax is due on the 15th day of the 4th month after the beginning of the LLC's taxable year. For LLCs following a calendar year, this means the payment is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. For the 2022 tax year, payments made by April 18, 2022, will be considered timely due to the Emancipation Day holiday.

How can the annual LLC tax be paid?

LLCs have several options for making their annual tax payment:

- Electronic Funds Withdrawal (EFW): Use tax preparation software that supports EFW.

- Web Pay: Make an online payment through the Franchise Tax Board's Web Pay for Businesses. Payments can be made immediately or scheduled in advance.

- Credit Card: Pay using Discover, MasterCard, Visa, or American Express via officialpayments.com. Note that a convenience fee may apply.

If using Web Pay or a credit card, do not file Form FTB 3522.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California FTB 3522 form is used by limited liability companies (LLCs) to pay the annual tax of $800 for the taxable year 2022. |

| Eligibility | An LLC must file this form if it has articles of organization accepted by the California Secretary of State or is doing business in California. |

| Payment Methods | Payments can be made through Electronic Funds Withdrawal, Web Pay for Businesses, or by credit card. If using Web Pay or credit card, do not file the form. |

| Due Date | The annual LLC tax is due by the 15th day of the 4th month after the beginning of the LLC’s taxable year, or April 15, 2022, for calendar year filers. |

| Exemptions | LLCs organized in California for the first time are exempt from the annual tax in their first taxable year. Additionally, certain small businesses owned by deployed military members may also be exempt. |

| Governing Law | The California Revenue and Taxation Code governs the annual LLC tax requirements, specifically Sections 17941 and 23701h. |

Dos and Don'ts

When filling out the California 3522 form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do use black or blue ink when completing the form.

- Do include the California Secretary of State (SOS) file number and the federal employer identification number (FEIN).

- Do make sure to write “Series LLC” if applicable, along with the series number.

- Do ensure your payment is enclosed with the voucher, but do not staple them together.

- Don't mail the voucher if no payment is due or if you paid electronically.

- Don't forget to make your payment by the due date to avoid penalties and interest.

Misconceptions

Misconceptions about the California 3522 form can lead to confusion for LLC owners. Here are five common misunderstandings:

- Only large LLCs need to pay the annual tax. This is false. Every LLC doing business in California, regardless of size, must pay the $800 annual tax.

- Filing the 3522 form is mandatory for all payments. Not true. If you pay your tax online or by credit card, you do not need to file the 3522 form.

- The LLC tax is a one-time payment. Incorrect. The annual tax must be paid each year until the LLC is formally canceled or dissolved.

- LLCs can ignore the tax if they operate at a loss. This is misleading. Even if an LLC operates at a loss, the annual tax still applies unless specific exemptions are met.

- There are no penalties for late payments. This is not accurate. Late payments incur penalties and interest, which can add up quickly.

Understanding these points can help ensure compliance and avoid unnecessary penalties.

Documents used along the form

The California 3522 form, also known as the LLC Tax Voucher, is essential for limited liability companies (LLCs) to pay their annual tax obligations. However, there are several other forms and documents that may be necessary or helpful for LLCs operating in California. Understanding these documents can assist in ensuring compliance with state regulations and facilitate smoother business operations.

- Form FTB 3556: This form provides information regarding the filing requirements for LLCs in California. It outlines the specific information that must be submitted when registering or doing business in the state.

- Form FTB 3522-LLC: This is a variation of the standard LLC Tax Voucher that may be used by series LLCs. It includes specific instructions for reporting taxes for each series within the LLC.

- Articles of Organization: This document is filed with the California Secretary of State to officially create an LLC. It includes essential details such as the LLC's name, address, and management structure.

- Certificate of Registration: If an LLC is formed in another state but wishes to operate in California, it must obtain this certificate. It allows the LLC to legally conduct business in California.

- Form 568: This is the Limited Liability Company Return of Income form. It is required for LLCs to report their income, deductions, and credits to the Franchise Tax Board.

- Form 1099: If an LLC pays independent contractors or freelancers, it must issue a 1099 form to report those payments to the IRS. This is important for tax compliance for both the LLC and the contractors.

- Operating Agreement: While not required by law, this internal document outlines the management structure and operating procedures of the LLC. It can help prevent disputes among members and clarify roles and responsibilities.

- Form 8832: This form allows an LLC to elect how it will be taxed, either as a corporation or as a partnership. This choice can have significant tax implications for the business.

In summary, while the California 3522 form is critical for LLCs to fulfill their tax obligations, several other forms and documents play important roles in the establishment and operation of an LLC in California. Being aware of these documents can help ensure compliance and support effective business management.

Different PDF Templates

Employee Policy Acknowledgement - Clear, reproducible impressions of the notary seal are essential for validity.

Filing Under Seal California - Petitioners can choose to include an optional fax number and email for court communication.

Probate Court Sacramento - The form is structured in sections for ease of reading and completion.