Download California 3523 Form

Common Questions

What is the California Form 3523?

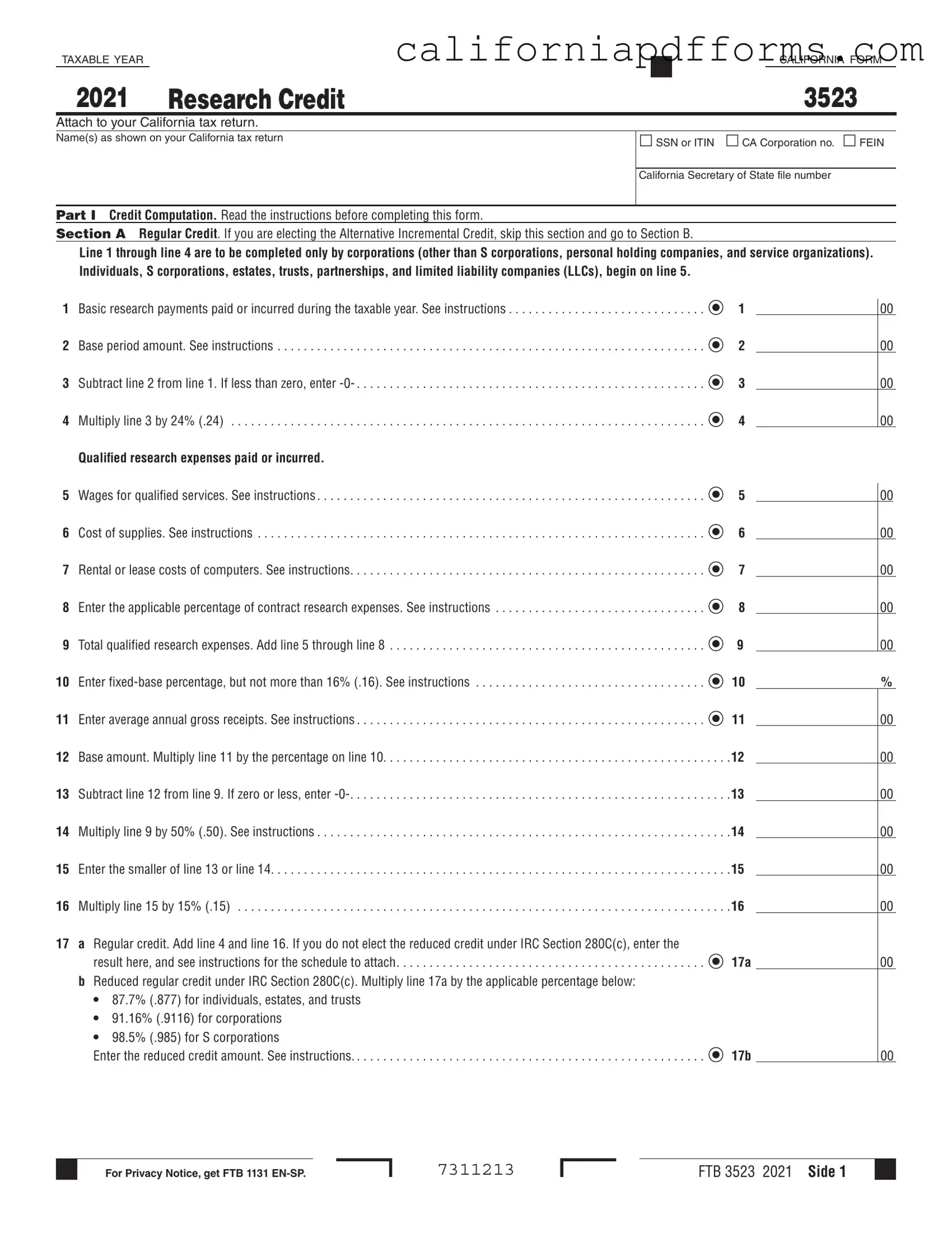

The California Form 3523 is a tax form used to claim the Research Credit for businesses engaged in qualified research activities. It is specifically designed for California taxpayers, including corporations, individuals, and various business entities, to report their research expenses and calculate the credit they may be eligible for on their state tax returns.

Who should file Form 3523?

Form 3523 should be filed by any taxpayer who has incurred qualified research expenses in California during the taxable year. This includes corporations (excluding S corporations, personal holding companies, and service organizations), individuals, estates, trusts, partnerships, and limited liability companies (LLCs). Each entity must follow the appropriate section of the form based on its classification.

What are qualified research expenses?

Qualified research expenses (QREs) include costs directly related to research activities. These expenses can encompass:

- Wages for employees engaged in qualified research services

- Costs of supplies used in research

- Rental or lease costs for computers used in research

- Contract research expenses

Taxpayers must carefully track and document these expenses to substantiate their claims for the credit.

What are the two sections of Form 3523?

Form 3523 consists of two primary sections for credit computation:

- Regular Credit: This section is for taxpayers who are not electing the Alternative Incremental Credit. Corporations complete lines 1-4, while individuals and other entities start from line 5.

- Alternative Incremental Credit: This section is for those who choose the Alternative Incremental Credit option. It begins at line 18 for corporations and line 22 for individuals and other entities.

How is the credit amount calculated?

The credit amount is calculated based on the qualified research expenses incurred during the taxable year. For the Regular Credit, taxpayers multiply the difference between their QREs and a base amount by a specified percentage (24% for basic research payments). In the Alternative Incremental Credit section, the calculation follows a different method that involves various multipliers based on the taxpayer's gross receipts and other factors.

What is the significance of IRC Section 280C(c)?

IRC Section 280C(c) allows taxpayers to elect a reduced credit amount if they have received federal grants or other assistance for their research activities. This section provides specific percentages for reducing the credit based on the type of entity, which can affect the overall amount claimed on the tax return.

Can credits be carried over to future years?

Yes, any unused research credits can be carried over to future tax years. Taxpayers should keep track of their credit carryovers, as they can use these amounts to offset future tax liabilities. Form 3523 includes a section for calculating the available carryover amount for future use.

Where can I find instructions for completing Form 3523?

Instructions for completing Form 3523 are typically included with the form itself or can be found on the California Franchise Tax Board's website. It is essential to read the instructions thoroughly to ensure accurate completion and to maximize the potential credit claimed.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Form 3523 is used to claim the Research Credit for taxable year 2020, allowing eligible businesses to receive a tax credit for qualified research expenses. |

| Eligibility | Corporations, S corporations, partnerships, LLCs, estates, and trusts can claim the credit, provided they have incurred qualified research expenses during the taxable year. |

| Sections | The form includes two main sections: Section A for Regular Credit and Section B for Alternative Incremental Credit. Each section has specific lines for different types of expenses. |

| Governing Law | The credit is governed by California Revenue and Taxation Code Section 23609, which outlines the requirements and limitations for claiming the Research Credit. |

| Filing Requirement | Form 3523 must be attached to the California tax return when filing, ensuring that all relevant information regarding the research credit is submitted for review. |

Dos and Don'ts

When filling out the California 3523 form, consider the following guidelines to ensure accuracy and compliance.

- Do read the instructions carefully before starting the form.

- Do provide accurate information regarding your name, SSN or ITIN, and corporation details.

- Do complete the correct section based on your entity type (corporation or individual).

- Do double-check calculations for qualified research expenses and credits.

- Don't skip any required lines; each line serves a purpose in the credit computation.

- Don't forget to attach any necessary schedules or additional forms as instructed.

- Don't provide false information, as this can lead to penalties.

- Don't wait until the last minute to file; allow time for corrections if needed.

Misconceptions

- Misconception 1: The California 3523 form is only for large corporations.

- Misconception 2: You must complete Section A to qualify for any credit.

- Misconception 3: All research expenses qualify for the credit.

- Misconception 4: The form is not necessary if you have already claimed credits in previous years.

This form is applicable to various entities, not just large corporations. Individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs) can also utilize this form to claim research credits.

Section A is specifically for those electing the Regular Credit. If you are opting for the Alternative Incremental Credit, you should skip Section A and complete Section B instead. This flexibility allows taxpayers to choose the section that best fits their situation.

Not all expenses related to research qualify. Only specific qualified research expenses, such as wages for qualified services, costs of supplies, and rental costs for computers, can be claimed. It’s essential to review the instructions carefully to determine what qualifies.

Documents used along the form

The California Form 3523 is essential for claiming research credits on your tax return. However, there are several other forms and documents that often accompany it, helping to clarify and support your claims. Below is a brief overview of these documents.

- California Form 540: This is the standard individual income tax return form for California residents. It provides a comprehensive overview of your income, deductions, and credits, including any research credits claimed on Form 3523.

- California Form 100: This form is used by corporations to report their income, deductions, and credits. If you are a corporation claiming research credits, this form will provide the necessary context for your overall tax situation.

- California Form 3544: This document is specifically for the assignment of credits. If you plan to assign your research credits to another entity, this form is crucial for detailing how the credits are allocated.

- California Form 3805Z: This form is used for claiming the California Enterprise Zone credits. If your research activities are conducted within an enterprise zone, this form may also be relevant to your tax filings.

- Federal Form 6765: This federal form is used to claim the federal research credit. If you are claiming both state and federal research credits, this form will complement your California Form 3523.

- California Schedule C: This schedule is for reporting profit or loss from a business. If your research activities are part of a business venture, this schedule will provide additional details that support your research credit claims.

Using these forms in conjunction with the California Form 3523 can help ensure that your claims for research credits are well-supported and accurately reported. Always consider consulting with a tax professional to navigate these documents effectively.

Different PDF Templates

California Form 565 - This is a mandatory form, implying that it's essential for certain legal operations.

Cdph 530 - This form helps encourage proper financial conduct and accountability in health facilities.

California Sr 10 - Providers must check relevant forms associated with their audits, such as SR 3 or SR 4.