Download California 3528 A Form

Common Questions

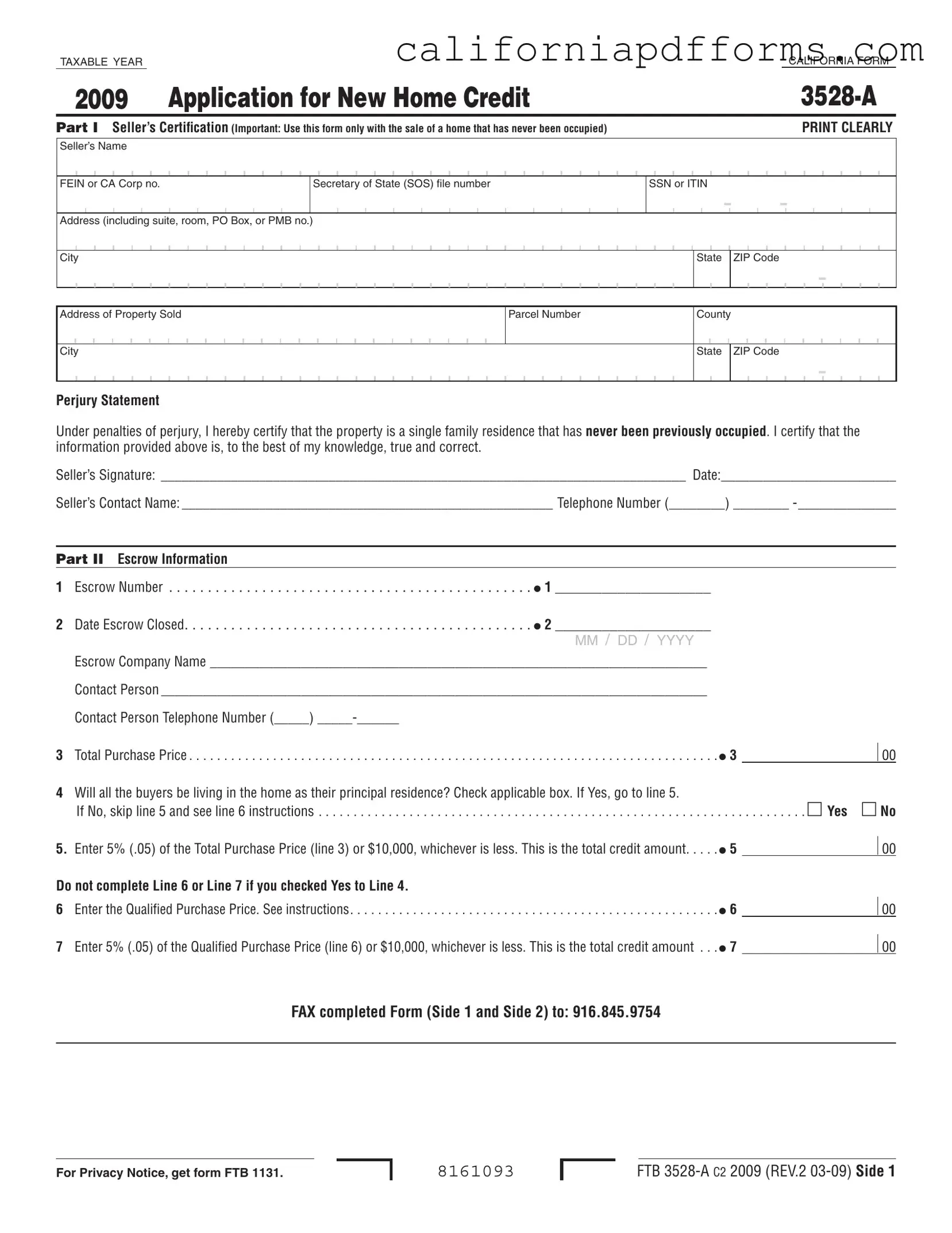

What is the California 3528 A form?

The California 3528 A form, officially known as the Application for New Home Credit, is a document used by sellers of newly constructed homes that have never been occupied. This form allows sellers to certify the eligibility of the property for a tax credit under California's Revenue and Taxation Code. It is specifically for transactions that occur between March 1, 2009, and March 1, 2010.

Who needs to fill out the 3528 A form?

The seller of a new home that has never been occupied must complete Part I of the form. This includes providing their name, identification number, property details, and certifying that the home is eligible for the tax credit. Buyers will also need to complete Part III of the form to confirm their intent to occupy the home as their principal residence.

What information is required on the form?

The form requires various details including:

- Seller’s name and identification numbers (FEIN, CA Corp number, or SSN).

- Address of the property being sold.

- Escrow information such as the escrow number and closing date.

- Total purchase price of the home.

- Confirmation of whether all buyers will occupy the home as their principal residence.

How is the tax credit calculated?

The tax credit is calculated as the lesser of 5% of the total purchase price or $10,000. If all buyers will be living in the home, only line 5 needs to be completed. If not, line 6 and line 7 must also be filled out to determine the qualified purchase price and the corresponding credit amount.

What happens after the form is completed?

Once the form is completed, the escrow company must fax it to the Franchise Tax Board (FTB) at 916.845.9754 within one week of the close of escrow. It is important to note that the form should not be mailed. A copy should also be provided to the buyer.

Are there any limitations to the tax credit?

Yes, there are several limitations to be aware of:

- The credit cannot be claimed if the home has been previously occupied.

- Buyers must intend to occupy the home for at least two years.

- The application must be submitted within one week of the close of escrow.

- The total credit cannot exceed $10,000, and it cannot reduce regular tax below the tentative minimum tax.

How can I get more information about the 3528 A form?

For additional information, you can contact the FTB’s Withholding Services and Compliance at 888.792.4900 or 916.845.4900. They can provide guidance on the application process and any specific questions you may have regarding the credit.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California Form 3528-A is used to apply for the New Home Credit for the sale of a new home that has never been occupied. |

| Governing Law | This form is governed by the Revenue and Taxation Code (R&TC) Section 17059. |

| Eligibility | Only sellers of single-family residences that have never been occupied may use this form. |

| Credit Amount | The credit is equal to 5% of the purchase price or $10,000, whichever is less. |

| Submission Deadline | The completed form must be faxed to the FTB within one week of the close of escrow. |

| Multiple Buyers | If there are multiple buyers, the credit is allocated based on ownership percentages. |

| Non-Refundable Credit | This credit cannot reduce the tax below the tentative minimum tax and is non-refundable. |

| Principal Residence Requirement | Buyers must intend to occupy the home as their principal residence for at least two years. |

Dos and Don'ts

When filling out the California 3528 A form, it's important to follow specific guidelines to ensure a smooth process. Here are seven things you should and shouldn't do:

- Do print clearly to avoid any misunderstandings.

- Do ensure that all information is accurate and complete before submission.

- Do check the applicable boxes carefully, especially regarding residency status.

- Do submit the form via fax within one week of closing escrow.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't mail the form; it must be sent via fax to the designated number.

- Don't include buyers who do not have an ownership interest in the property.

Misconceptions

Understanding the California 3528 A form can be challenging, and several misconceptions can lead to confusion. Here are five common misconceptions explained:

- Misconception 1: The form can be used for any home sale.

- Misconception 2: All buyers must occupy the home to qualify.

- Misconception 3: The credit amount is always $10,000.

- Misconception 4: The form must be mailed to the Franchise Tax Board (FTB).

- Misconception 5: The credit can be carried over to future years.

The California 3528 A form is specifically for new homes that have never been occupied. Using it for homes that have been previously lived in is not allowed.

While it is true that at least one buyer must live in the home as their principal residence, not all buyers need to meet this requirement. Only the buyers who will occupy the home should be included in the credit calculation.

The credit is capped at $10,000, but it can also be 5% of the total purchase price, whichever is less. Therefore, if the purchase price is lower, the credit will be adjusted accordingly.

It is important to note that the completed form should not be mailed. Instead, it must be faxed to the FTB within one week after the close of escrow.

This credit cannot be carried over. It must be claimed in the year the home purchase is made, and if the credit exceeds the current year’s tax, the unused portion is lost.

Documents used along the form

When dealing with the California Form 3528-A, it is essential to understand that several other forms and documents may accompany this application. Each of these documents plays a crucial role in ensuring that the application process is smooth and compliant with state regulations. Below is a brief overview of five important forms that are often used alongside the California 3528-A.

- Form FTB 1131: This form provides the privacy notice required by the Franchise Tax Board (FTB). It informs individuals about how their personal information will be used and protected during the tax credit process.

- Form FTB 3528-B: This is the application for the New Home Credit for buyers. It is necessary for buyers to complete this form to claim their portion of the tax credit after purchasing a new home that has never been occupied.

- Form FTB 540: This is the California Resident Income Tax Return form. Homebuyers must file this form to report their income and claim any credits, including the New Home Credit, on their state tax return.

- Form FTB 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return. Individuals who do not reside in California for the entire year may need this form to report their income and claim applicable credits.

- Escrow Instructions: These are documents provided by the escrow company detailing the terms of the escrow agreement. They ensure that all parties understand their obligations and the timeline for the transaction.

Understanding these additional forms and documents is vital for anyone involved in the home-buying process in California. They help ensure compliance with state regulations and facilitate a smoother transaction. Always consider consulting with a professional if you have questions about these forms or the overall process.

Different PDF Templates

California Participating Physician Application - The proper completion of this form contributes to a safer healthcare environment.

Writ of Execution California - Completing the form accurately helps ensure a smoother legal process in property recovery matters.

Can Parents Agree to No Child Support in California - The FL-615 form is a stipulation for judgment regarding parental obligations in California.