Download California 3533 B Form

Common Questions

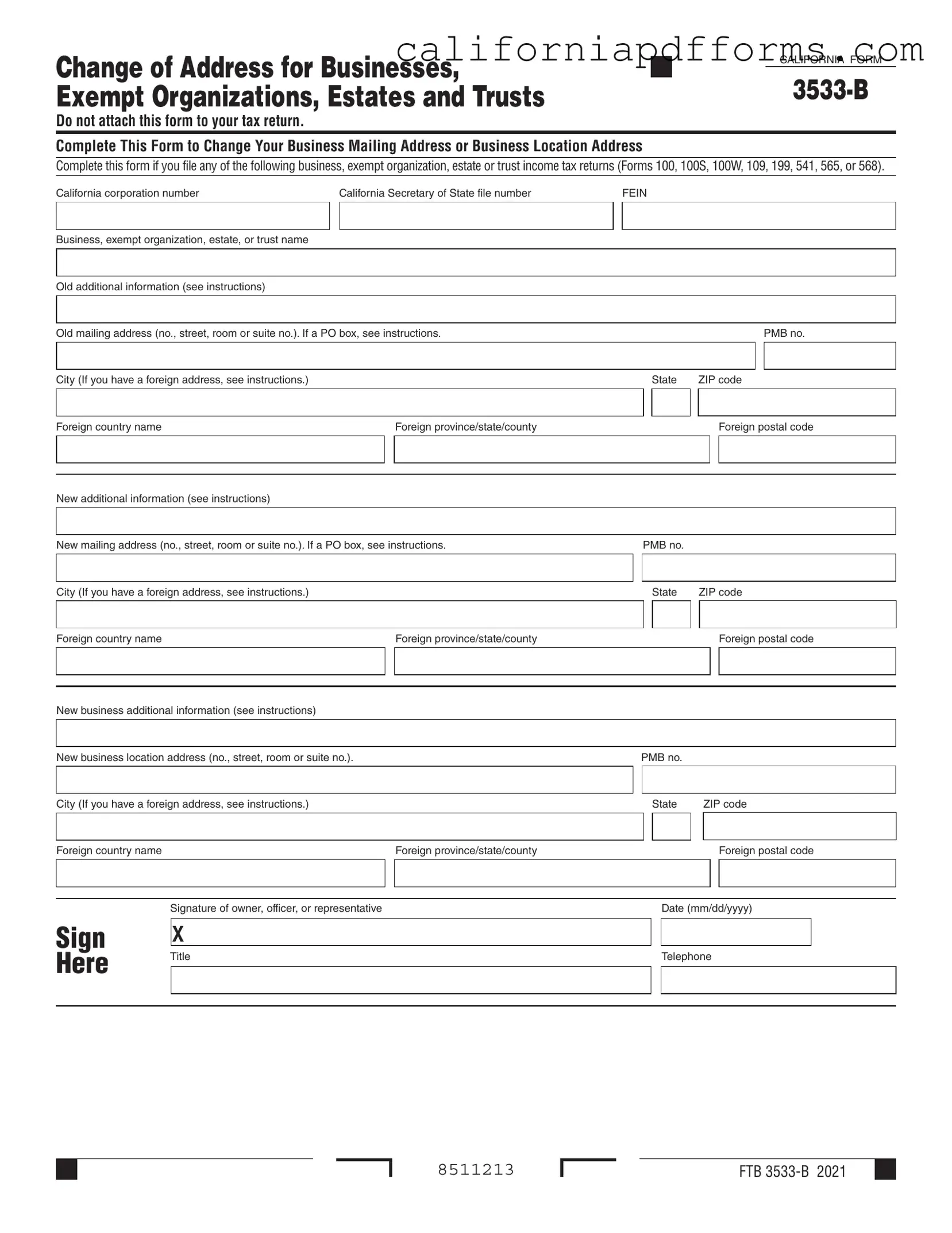

What is the purpose of the California 3533 B form?

The California 3533 B form is used to officially change the mailing address or business location address for various types of entities, including businesses, exempt organizations, estates, and trusts. It is essential for ensuring that the California Franchise Tax Board (FTB) has the correct address on file for important communications and tax-related documents.

Who needs to fill out the California 3533 B form?

This form should be completed by individuals or entities that file any of the following tax returns: Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. If your organization falls into one of these categories and you need to update your address, this form is necessary.

How do I fill out the California 3533 B form?

To fill out the form, you will need to provide several pieces of information:

- Your California corporation number or Secretary of State file number.

- Your Federal Employer Identification Number (FEIN).

- The name of your business, exempt organization, estate, or trust.

- Your old mailing address and the new mailing address.

- If applicable, the old and new business location addresses.

- The signature of the owner, officer, or representative, along with the date and title.

Ensure that all details are accurate and complete before submitting the form.

Do I need to attach this form to my tax return?

No, the California 3533 B form should not be attached to your tax return. It is a standalone form that should be submitted separately to the FTB to ensure your address change is processed correctly.

What should I do if I have a foreign address?

If you have a foreign address, there are specific instructions to follow. Make sure to provide the foreign country name, province/state/county, and postal code. Refer to the instructions included with the form for detailed guidance on how to format this information correctly.

When should I submit the California 3533 B form?

It is advisable to submit the California 3533 B form as soon as you change your address. Timely submission helps avoid any potential issues with receiving important tax documents or communications from the FTB. Keeping your address updated ensures that you remain compliant with California tax regulations.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of the Form | The California Form 3533-B is used to officially change the mailing address or business location address for various types of entities, including businesses, exempt organizations, estates, and trusts. |

| Applicable Tax Returns | This form is required for those filing specific tax returns, including Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. |

| Governing Law | The use of Form 3533-B is governed by California Revenue and Taxation Code sections that pertain to business and income tax reporting. |

| Submission Guidelines | Do not attach this form to your tax return. It should be submitted separately to ensure proper processing. |

| Required Information | When completing the form, entities must provide their California corporation number, Secretary of State file number, FEIN, and both old and new addresses. |

Dos and Don'ts

When filling out the California 3533 B form, there are important guidelines to follow. Here’s a list of things you should and shouldn't do:

- Do ensure that you have the correct form for changing your business mailing or location address.

- Do provide accurate and complete information in all required fields.

- Do double-check your California corporation number and Secretary of State file number for accuracy.

- Do sign and date the form before submitting it.

- Don't attach this form to your tax return; it should be submitted separately.

- Don't use a PO box for your new mailing address unless specified in the instructions.

- Don't leave any sections blank; incomplete forms may delay processing.

Misconceptions

- Misconception 1: The California 3533 B form must be attached to tax returns.

- Misconception 2: Only corporations need to file the 3533 B form.

- Misconception 3: A change of address is only for mailing addresses.

- Misconception 4: The form can be submitted online.

- Misconception 5: The form can be completed by anyone in the organization.

- Misconception 6: You can submit the form at any time without any restrictions.

- Misconception 7: The form is only for physical address changes.

This form is specifically designed for changing business addresses and should not be attached to your tax return. It is a standalone document.

In reality, this form can be used by various entities, including exempt organizations, estates, and trusts. If you file certain tax returns, you may need to use this form.

The form allows you to update both your mailing address and your business location address. It's important to provide accurate information for both to avoid any issues.

Currently, the California 3533 B form must be submitted via mail or in person. There is no online submission option available.

Only authorized individuals, such as the owner, an officer, or a designated representative, should sign the form. This ensures that the information is verified and legitimate.

While there are no strict deadlines, it is advisable to submit the form as soon as possible after a change occurs. This helps prevent any miscommunication with the tax authorities.

In addition to physical address changes, the form can also be used to update information related to your business, such as the name or additional details. Make sure to read the instructions carefully.

Documents used along the form

The California 3533 B form is essential for businesses, exempt organizations, estates, and trusts wishing to update their mailing or business location addresses. However, several other forms and documents may accompany this process to ensure compliance with state regulations. Below are some of the commonly used forms.

- California Form 100: This is the California Corporation Franchise or Income Tax Return. Corporations use this form to report their income, calculate taxes owed, and provide necessary financial information to the state.

- California Form 199: This form is for California Exempt Organizations Annual Information Return. Nonprofits use it to report their activities, finances, and compliance with state regulations, ensuring transparency and accountability.

- California Form 541: This is the California Fiduciary Income Tax Return. Estates and trusts file this form to report income earned and taxes owed, reflecting the financial status of the estate or trust.

- California Form 565: This form is used for Partnership Return of Income. Partnerships must file this to report income, deductions, and other relevant financial details, ensuring that all partners are informed of the partnership's financial standing.

Understanding these forms is crucial for maintaining compliance with California tax laws. Each document plays a significant role in ensuring that businesses and organizations can operate smoothly while fulfilling their legal obligations.

Different PDF Templates

California 592 F - Tax withheld from foreign partners is reported without including backup withholding amounts.

I Lost My Daughter's Birth Certificate - It is crucial to include accurate contact information for any correspondence related to the request.