Download California 3533 Form

Common Questions

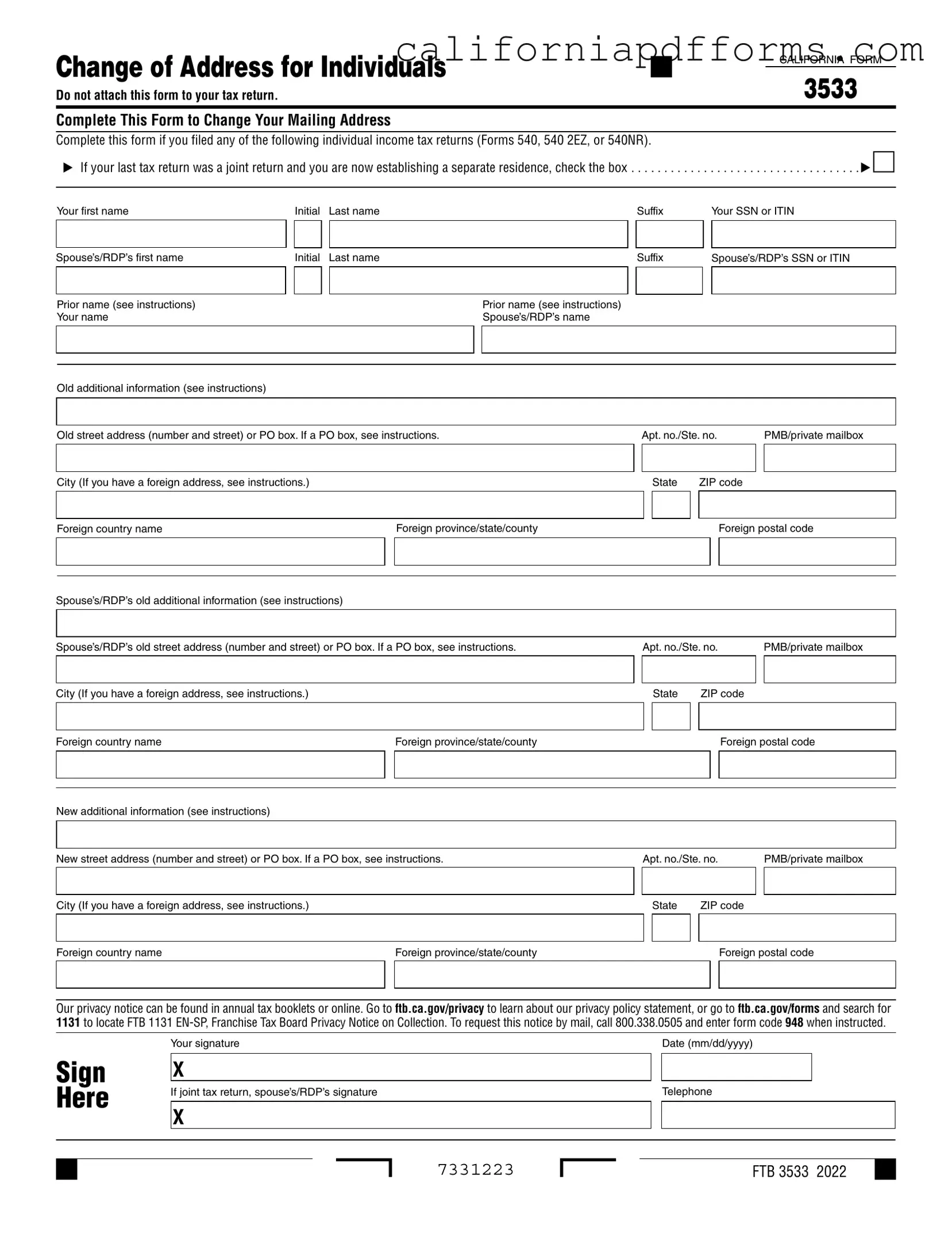

What is the purpose of the California 3533 form?

The California 3533 form is used to change your mailing address with the California Franchise Tax Board (FTB). Individuals who have filed specific income tax returns—namely Forms 540, 540 2EZ, or 540NR—should complete this form if they need to update their address. This ensures that the FTB can send important tax information and correspondence to the correct location.

Who should complete the California 3533 form?

This form is intended for individuals who have previously filed any of the aforementioned tax returns and need to change their mailing address. If you filed a joint tax return with your spouse or registered domestic partner (RDP) and are now establishing a separate residence, you should also complete this form. Remember to check the appropriate box on the form if this applies to you.

What information is required on the California 3533 form?

When filling out the California 3533 form, you will need to provide the following information:

- Your name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and any prior names.

- Your old mailing address, including street address, city, state, ZIP code, and any additional information.

- Your new mailing address, which must include the same details as your old address.

- Your signature and the date of the signature.

- If applicable, your spouse's or RDP's information, including their name, SSN or ITIN, old address, and signature.

Where should I send the California 3533 form?

The California 3533 form should not be attached to your tax return. Instead, it should be mailed directly to the California Franchise Tax Board. The specific mailing address may vary based on your location and whether you are enclosing any payments. It is advisable to check the FTB website or the instructions provided with the form for the correct mailing address.

What happens if I do not submit the California 3533 form?

If you fail to submit the California 3533 form after changing your address, you may miss important tax information and correspondence from the FTB. This could lead to delays in receiving refunds or notices about tax liabilities. It is crucial to keep your mailing address updated to ensure you receive all necessary communications regarding your tax status.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Form 3533 is used to change the mailing address for individuals who have filed specific state income tax returns. |

| Applicable Returns | This form is relevant for individuals who filed Forms 540, 540 2EZ, or 540NR. |

| Joint Returns | If you previously filed a joint return and are now establishing a separate residence, you must check the appropriate box on the form. |

| Privacy Notice | For information regarding privacy rights and the use of personal data, individuals can visit ftb.ca.gov/forms and search for notice 1131. |

| Signature Requirement | Both individuals must sign the form if it pertains to a joint tax return. |

| Governing Law | This form is governed by California Revenue and Taxation Code sections that relate to tax administration. |

Dos and Don'ts

When filling out the California 3533 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are seven key points to consider:

- Do complete the form in its entirety. Missing information can delay the processing of your address change.

- Do ensure that you use your legal name as it appears on your tax return. This helps to avoid any discrepancies.

- Do provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) accurately. This is crucial for identification purposes.

- Do check the appropriate box if you are establishing a separate residence after filing a joint return.

- Don't attach the form to your tax return. It should be submitted separately.

- Don't forget to sign and date the form. An unsigned form may be considered invalid.

- Don't use a PO Box for your new address unless specifically instructed. This may lead to issues with mail delivery.

Misconceptions

Many people have misunderstandings about the California 3533 form, which is used to change your mailing address for tax purposes. Here are seven common misconceptions:

- It must be attached to your tax return. Many believe that the 3533 form needs to be submitted with their tax return. In reality, you do not need to attach this form to your tax return.

- Only individuals can use this form. Some think this form is only for individual taxpayers. However, it can also be used by spouses or registered domestic partners who filed a joint return.

- It’s only for California residents. While it is a California form, anyone who has filed California tax returns can use it, even if they currently live out of state.

- Changing your address means you need to file a new tax return. Many assume that updating their address requires a new tax return. This is not the case; the 3533 form is sufficient for changing your mailing address.

- You can change your address online. Some believe that they can submit this change electronically. Currently, the 3533 form must be filled out and mailed to the appropriate tax authority.

- It’s only necessary if you move out of state. Many think they only need to fill out this form if they are moving out of California. In fact, it’s important to update your address even if you are moving within the state.

- There is a fee for submitting the form. Some people worry about costs associated with filing this form. There is no fee to submit the California 3533 form.

Understanding these points can help ensure that your address change is processed smoothly and efficiently.

Documents used along the form

The California 3533 form is essential for individuals wishing to update their mailing address with the state’s tax authorities. However, it is often accompanied by several other forms and documents that can facilitate various tax-related processes. Below is a list of these forms, each serving a specific purpose.

- Form 540: This is the California Resident Income Tax Return form. Individuals use it to report their income and calculate their tax liability for the year. It is crucial for anyone who meets the residency requirements in California.

- Form 540 2EZ: This simplified version of Form 540 is for residents with straightforward tax situations. It allows for a quicker filing process, ideal for those with basic income sources and no complex deductions.

- Form 540NR: Non-residents or part-year residents use this form to report income earned in California. It helps ensure that individuals who do not reside in the state year-round still fulfill their tax obligations for any income generated within the state.

- Form W-4: Although primarily a federal form, the W-4 is used to determine the amount of federal income tax withheld from an employee’s paycheck. It can be relevant when changing addresses to ensure accurate withholding based on the new location.

- Form 8822: This is the IRS form for changing your address. While it is not specific to California, it is important for individuals to file this form to update their address with the federal government, ensuring that all tax correspondence is sent to the correct location.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Individuals may receive a 1099 for freelance work or interest income, and it is important to ensure that the address on this form is current to avoid issues with tax reporting.

These forms work in tandem with the California 3533 to help individuals manage their tax responsibilities effectively. Keeping all information up to date is vital for compliance and to avoid potential penalties or delays in processing tax returns.

Different PDF Templates

California Std 830 - Transparency in reporting is vital for compliance with TACPA regulations.

Employee Policy Acknowledgement - This certificate serves as legal proof of the signing process taking place.

How to File Contempt of Court in California - This form addresses the citee's rights, ensuring they understand their legal options.