Download California 3539 Form

Common Questions

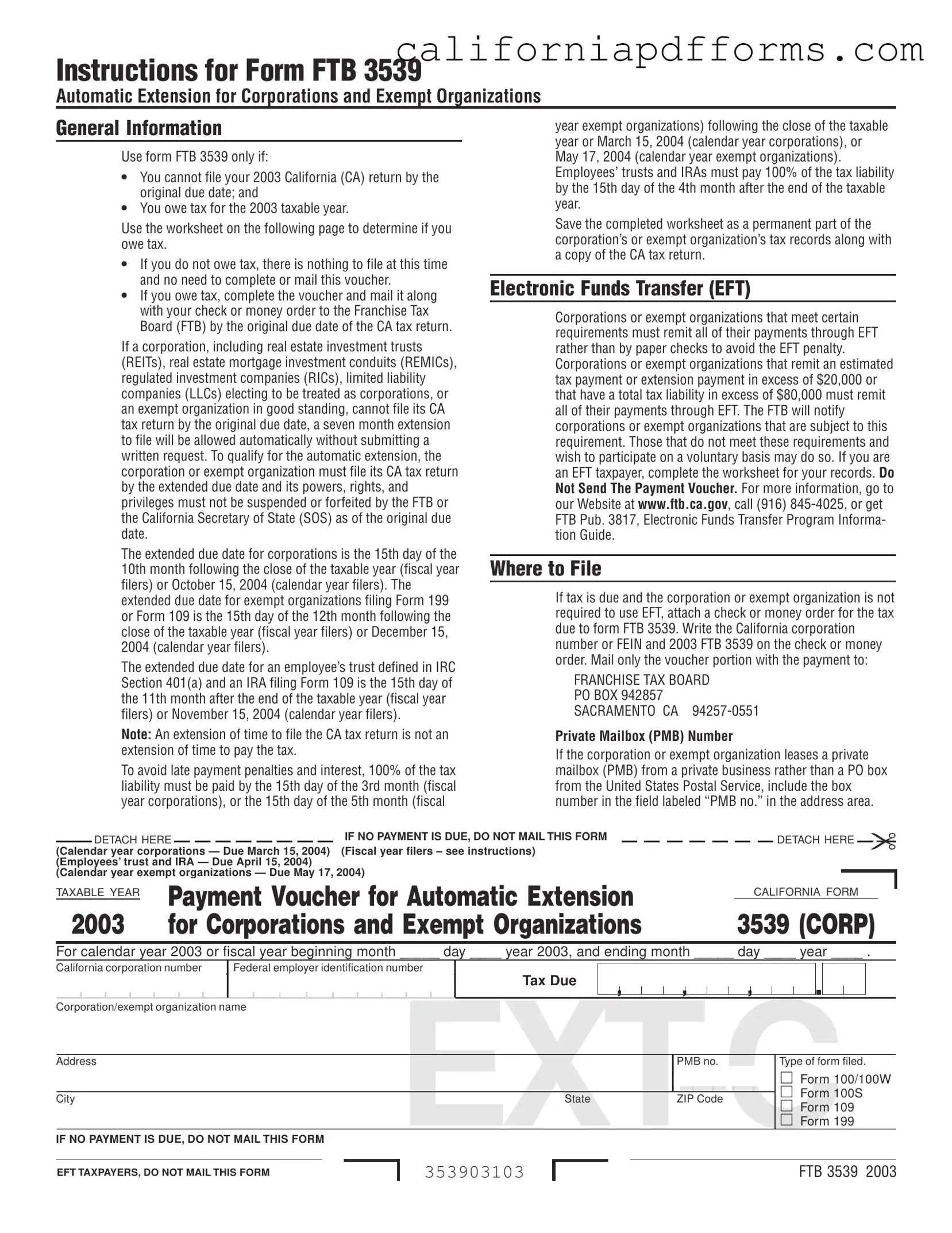

What is the purpose of the California Form 3539?

The California Form 3539 is designed for corporations and exempt organizations to request an automatic extension of time to file their tax returns. If a corporation cannot file its California tax return by the original due date and owes tax, this form allows them to extend the filing deadline without needing to submit a written request. It is important to note that this extension is only for filing and does not extend the time to pay any taxes owed.

Who needs to file Form 3539?

Corporations and exempt organizations that meet specific criteria must file Form 3539. You should use this form if:

- You cannot file your California tax return by the original due date.

- You owe tax for the taxable year.

- Your organization is in good standing with the Franchise Tax Board (FTB) and the California Secretary of State.

If you do not owe any tax, there is no need to file this form. Simply ensure that your tax return is filed by the extended due date.

What are the deadlines for filing Form 3539?

The deadlines for filing Form 3539 vary depending on the type of organization and its fiscal year. For calendar year filers, the deadlines are as follows:

- Corporations: October 15, 2004

- Exempt Organizations filing Form 199: December 15, 2004

- Exempt Organizations filing Form 109: November 15, 2004

For fiscal year filers, the extended due date is the 15th day of the 10th month following the close of the taxable year. It is crucial to remember that while you may receive an extension to file, you must still pay any taxes owed by the original due date to avoid penalties.

What happens if I do not file Form 3539 on time?

If you fail to file Form 3539 by the original due date and owe taxes, you may incur penalties and interest. A late payment penalty will be added to your tax due, and if your tax return is not filed by the extended due date, a delinquency penalty will apply. Additionally, if your organization’s powers or privileges have been suspended or forfeited, the automatic extension will not apply, and further penalties may be assessed.

How do I complete the Tax Payment Worksheet associated with Form 3539?

To complete the Tax Payment Worksheet, follow these steps:

- On Line 1, enter your total tentative tax, including any alternative minimum tax if applicable.

- On Line 2, input your estimated tax payments, which may include prior year overpayments applied as a credit.

- On Line 3, calculate your tax due by subtracting Line 2 from Line 1. If Line 1 is greater than Line 2, you have tax due; if not, you have no tax due.

Make sure to keep this worksheet as part of your tax records. If you owe tax, you must send the payment along with the voucher portion of Form 3539 to the FTB by the original due date.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Form FTB 3539 is used for requesting an automatic extension for corporations and exempt organizations that cannot file their tax return by the original due date. |

| Filing Deadline | The extended due date for calendar year corporations is October 15, 2004, while for fiscal year filers, it is the 15th day of the 10th month after the close of the taxable year. |

| Payment Requirement | Corporations and exempt organizations must pay 100% of their tax liability by the original due date to avoid penalties. An extension to file does not extend the time to pay taxes. |

| EFT Requirement | Entities with a tax liability over $80,000 or estimated payments exceeding $20,000 must remit payments electronically through EFT to avoid a penalty. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 18566, which outlines the requirements for extensions and payment of taxes. |

Dos and Don'ts

When filling out the California 3539 form, there are specific actions to take and avoid to ensure compliance and accuracy. Below is a list of recommended practices and pitfalls to steer clear of.

- Do complete the voucher accurately, including the corporation number and FEIN.

- Do ensure that the payment is submitted by the original due date if taxes are owed.

- Do keep a copy of the completed worksheet and the CA tax return for your records.

- Do verify that your organization is in good standing with the FTB before submitting the form.

- Don't send the payment voucher if no tax is due; simply keep it for your records.

- Don't submit the form without checking for accuracy in all entries.

- Don't ignore the EFT requirements if your organization qualifies; failure to comply may result in penalties.

- Don't assume that an extension to file is an extension to pay; ensure all tax liabilities are settled on time.

Misconceptions

- Misconception 1: The California 3539 form is only for corporations.

- Misconception 2: Filing the 3539 form extends the time to pay taxes.

- Misconception 3: If I don’t owe any taxes, I still need to file the form.

- Misconception 4: All corporations automatically qualify for an extension.

- Misconception 5: I can file the form anytime before the due date.

- Misconception 6: The 3539 form can be filed electronically.

- Misconception 7: Corporations can ignore the EFT requirement.

- Misconception 8: I can submit the payment voucher without the tax payment.

- Misconception 9: The 3539 form is only for calendar year filers.

- Misconception 10: I don’t need to keep records of the 3539 form.

This form is also applicable to exempt organizations. Both types can use it to request an automatic extension for filing their tax returns.

An extension to file does not mean an extension to pay. Tax liabilities must still be settled by the original due date to avoid penalties.

If no taxes are owed, there is no need to file the 3539 form. It is only necessary if you owe tax for the taxable year.

Only corporations that meet specific criteria, such as being in good standing and having not suspended rights, automatically qualify for an extension.

The form must be submitted by the original due date of the tax return to qualify for the extension.

Currently, the form must be mailed in, especially if there is a tax payment due.

Corporations with certain tax liabilities must remit payments through Electronic Funds Transfer (EFT) to avoid penalties.

The payment voucher should only be submitted if there is a tax payment due. Otherwise, it should not be mailed.

This form applies to both calendar year and fiscal year filers, with different due dates based on the type of organization.

It is essential to save the completed form and any associated worksheets as part of your tax records for future reference.

Documents used along the form

The California Form FTB 3539 is used by corporations and exempt organizations to request an automatic extension for filing their tax returns. However, several other forms and documents are commonly used alongside this form. Each of these documents serves a specific purpose in the tax filing process.

- Form 100: This is the California Corporation Franchise or Income Tax Return. Corporations use this form to report their income, calculate their tax liability, and pay any taxes owed to the state of California.

- Form 100S: This form is specifically for S corporations, which are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. It allows them to report their income and calculate their tax obligations.

- Form 199: This is the California Exempt Organization Annual Information Return. Exempt organizations use this form to report their financial activities and ensure compliance with state regulations. A filing fee is typically required with this return.

- Form 109: This form is used by certain exempt organizations to report business income. The due date for filing this form varies depending on the type of organization, and it is essential for maintaining compliance with California tax laws.

- Tax Payment Worksheet: This worksheet is included with Form FTB 3539 to help organizations calculate their tentative tax liability. It assists in determining the amount of tax due and is a crucial tool for accurate reporting.

Understanding these forms and their purposes is vital for compliance with California tax regulations. Properly completing and submitting the necessary documents can help avoid penalties and ensure timely filing.

Different PDF Templates

Form 100w - Corporations with diverse fiscal years must take special care to note their dates.

Schedule Ca (540) Instructions 2022 - Taxpayers should ensure their personal information is correctly filled in at the beginning of the form.