Download California 3540 Form

Common Questions

What is the purpose of the California 3540 form?

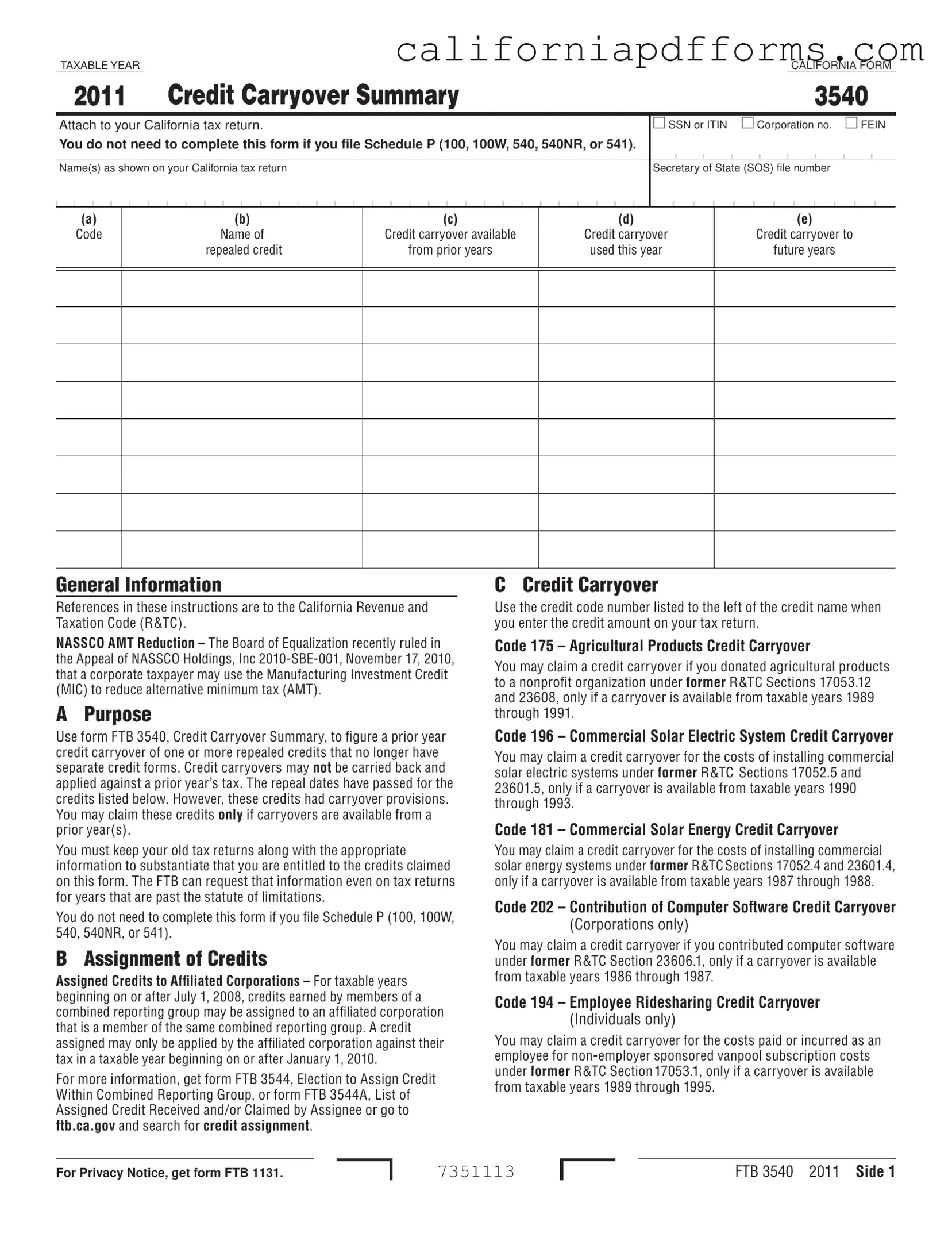

The California 3540 form, known as the Credit Carryover Summary, is used to calculate and report credit carryovers from prior years for certain repealed tax credits. Taxpayers can utilize this form to claim credits that are no longer available on separate forms but still have carryover provisions. It is important to note that these credits cannot be carried back to previous tax years.

Who needs to complete the California 3540 form?

You must complete the California 3540 form if you have credit carryovers from prior years and do not file Schedule P (100, 100W, 540, 540NR, or 541). This form is specifically designed for taxpayers who wish to claim repealed credits that still have available carryovers.

What information is required on the California 3540 form?

The form requires several key pieces of information:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your corporation number or Federal Employer Identification Number (FEIN), if applicable.

- The name(s) as shown on your California tax return.

- The Secretary of State (SOS) file number.

Additionally, you will need to provide details about the specific credits you are claiming, including the credit code, name of the repealed credit, carryover amounts from prior years, and amounts used this year.

What types of credits can be reported on the California 3540 form?

The California 3540 form allows you to report various types of repealed credits. Some examples include:

- Agricultural Products Credit

- Commercial Solar Electric System Credit

- Employee Ridesharing Credit

- Energy Conservation Credit

- Low-Emission Vehicles Credit

Each credit has specific eligibility criteria and carryover provisions, so it is essential to review the details for each one.

Are there limitations on the credits I can claim using the California 3540 form?

Yes, there are limitations. Generally, a credit carryover cannot reduce certain taxes, including the minimum franchise tax and the annual tax for various business entities. Additionally, while some credits can reduce the alternative minimum tax (AMT), others cannot. Each credit may have its own specific limitations, so it is crucial to consult the instructions for detailed information.

How long can I carry over credits reported on the California 3540 form?

In most cases, credit carryovers can be carried forward for up to eight years from the year the credit was incurred. However, some credits may have different carryover periods. For example, certain credits can be carried forward for up to ten years if the taxpayer qualifies as a small business. Always check the specific provisions for each credit to determine the applicable carryover period.

What should I do if I have unused credit carryover amounts?

If your available credit carryover exceeds your current year tax, any unused amount can be carried over to future years. However, this can only occur if the carryover period has not expired. It is advisable to apply the carryover to the earliest taxable years possible.

What happens if I do not keep my old tax returns?

It is essential to retain your old tax returns and any supporting documentation related to the credits you claim. The California Franchise Tax Board (FTB) may request this information, even for years that are past the statute of limitations. Failing to provide this documentation could jeopardize your ability to claim the credits.

Document Specifications

| Fact Name | Detail |

|---|---|

| Form Purpose | The California Form 3540 is used to summarize credit carryovers from prior years for repealed tax credits. |

| Eligibility | Taxpayers do not need to complete this form if they file Schedule P (100, 100W, 540, 540NR, or 541). |

| Governing Law | References in the form relate to the California Revenue and Taxation Code (R&TC). |

| Credit Assignment | Credits earned by members of a combined reporting group can be assigned to affiliated corporations starting from taxable years after July 1, 2008. |

| Carryover Limitations | Credit carryovers cannot reduce minimum franchise taxes or alternative minimum taxes, except for specific credits like the Manufacturing Investment Credit (MIC). |

| Documentation Requirement | Taxpayers must retain prior year tax returns and related information to substantiate claims made on this form. |

| Credit Codes | Each credit has a unique code, such as Code 175 for Agricultural Products Credit Carryover, which must be used when entering amounts on tax returns. |

| Carryover Duration | Generally, credits may be carried forward for up to eight years, or ten years for small businesses in certain cases. |

| Tax Year | This specific form is for the taxable year 2011. |

Dos and Don'ts

When filling out the California 3540 form, it's essential to approach the process carefully to ensure accuracy and compliance. Here are five important dos and don’ts to keep in mind:

- Do double-check your eligibility before completing the form. Make sure you have carryover credits available from prior years.

- Do accurately enter the credit code and name in the respective columns. This ensures that your claim is processed correctly.

- Do keep your prior tax returns and documentation handy. You may need these to substantiate your claims if requested by the tax authorities.

- Do calculate the credit carryover amount carefully. Subtract the claimed amount from the available carryover to determine what can be carried forward.

- Do file the form with your California tax return to ensure that it is considered in your overall tax calculation.

- Don’t forget to check if you need to complete this form. If you file Schedule P, you do not need to fill out the 3540.

- Don’t use outdated credit codes or names. Always refer to the latest instructions to ensure accuracy.

- Don’t neglect to review the limitations on credit carryovers. Some credits cannot reduce certain taxes, so be aware of these rules.

- Don’t carry back any credits to prior years. The rules specify that carryovers can only be applied to future tax years.

- Don’t ignore requests for additional information from the tax authorities. They may ask for documentation even for past years.

Misconceptions

- Misconception 1: The California 3540 form is only for corporations.

- Misconception 2: You can carry back credit carryovers to previous tax years.

- Misconception 3: Completing the California 3540 form is mandatory for all taxpayers.

- Misconception 4: All credit carryovers can be used indefinitely.

- Misconception 5: You do not need to keep records of prior tax returns.

- Misconception 6: All credits listed on the form are currently active and available.

This form can be used by individuals as well as corporations. It is applicable for various tax credits that may be available to both entities.

Credit carryovers cannot be applied to prior years' taxes. They can only be carried forward to future years.

You do not need to complete this form if you file certain schedules, such as Schedule P (100, 100W, 540, 540NR, or 541).

Each credit has specific limitations on how long it can be carried forward, often up to eight or ten years.

It is essential to maintain your old tax returns and supporting documents, as the Franchise Tax Board may request this information even for past years.

Many credits listed on the California 3540 form have been repealed. You can only claim credits that have carryovers available from prior years.

Documents used along the form

The California 3540 form is a Credit Carryover Summary that helps taxpayers report and claim credits that may be carried over from previous years. Several other forms and documents often accompany this form to provide additional information or fulfill specific requirements related to tax credits. Below is a list of these documents, along with a brief description of each.

- FTB 3544: This form is used to elect the assignment of credits within a combined reporting group. Corporations can transfer credits to affiliated corporations, allowing for more flexible tax planning.

- FTB 3544A: This document serves as a list of assigned credits received and/or claimed by an assignee. It helps track how credits are utilized within a combined reporting group.

- FTB 3806: The Los Angeles Revitalization Zone Business Booklet provides guidelines for claiming credits related to the Los Angeles Revitalization Zone, including hiring and sales/use tax credits.

- FTB 1131: This privacy notice informs taxpayers about how their information is used and protected when they submit tax forms, including the 3540.

- Schedule P: This schedule is required for certain taxpayers to report credits, including those related to the alternative minimum tax. It must be filed with various tax returns.

- Form 568: This form is for Limited Liability Companies (LLCs) and addresses income tax obligations. It may be relevant for single-member LLCs claiming credits.

- Form 540, 540NR, 100, and 100W: These are California personal and corporate income tax returns where taxpayers report their income and claim credits, including those detailed on the 3540 form.

These forms and documents collectively support the process of claiming tax credits in California. Understanding their purposes can help ensure compliance and maximize potential tax benefits.

Different PDF Templates

How Long to Get Nclex Results - Application processing typically takes 30 days; applicants will receive notification by mail.

Form Fl-140 - Failure to comply with the FL-140 requirements can delay legal processes.

Proof of Social Security Number Without Card - Invalid or mismatched information may lead to delays in benefit processing.