Download California 3541 Form

Common Questions

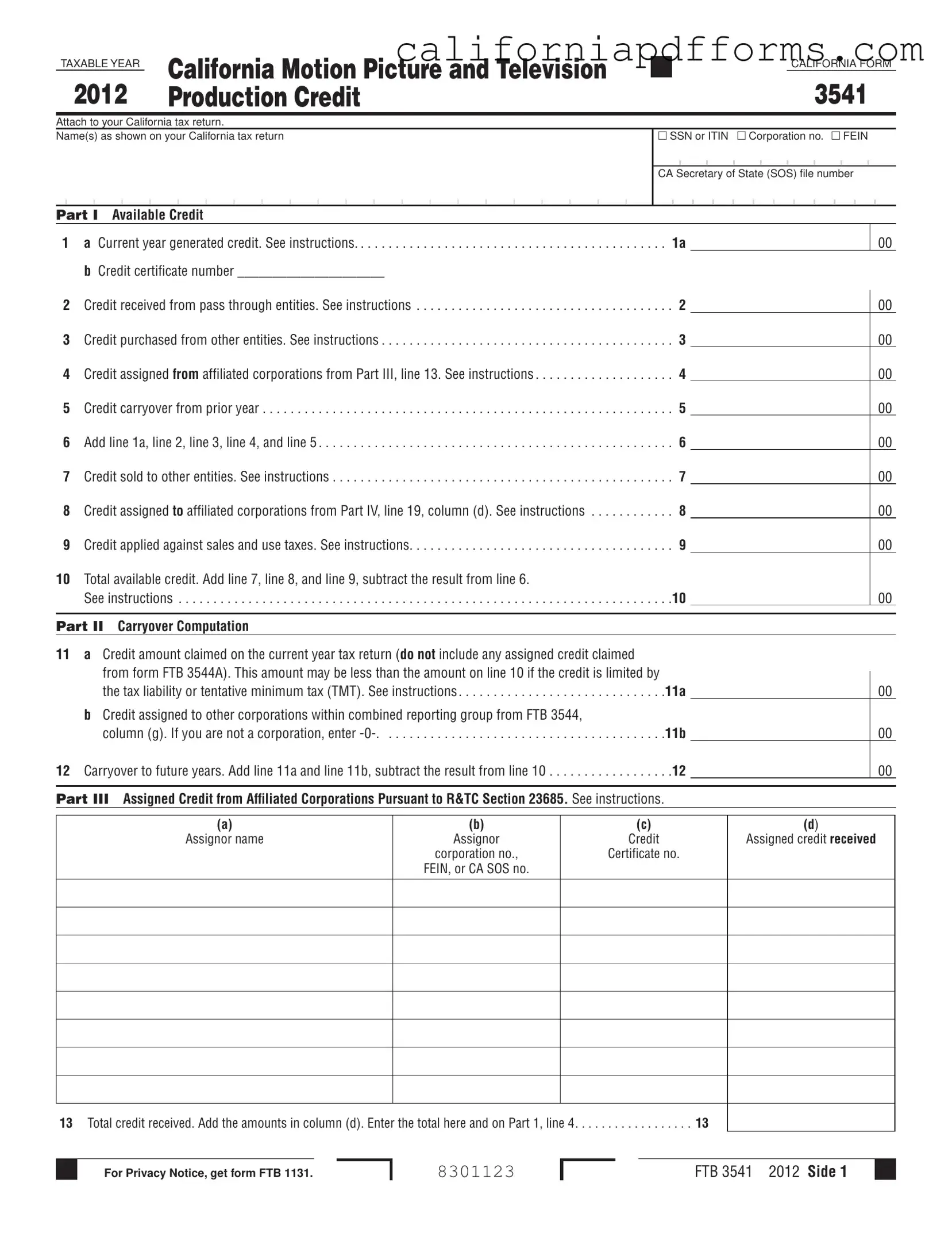

What is the California 3541 form used for?

The California 3541 form is used to report the California Motion Picture and Television Production Credit. This credit is available to qualified taxpayers who have incurred eligible expenditures for the production of motion pictures or television series in California. It helps offset tax liabilities and can be claimed on various California tax returns.

Who qualifies as a "qualified taxpayer"?

A qualified taxpayer is someone who has paid or incurred qualified expenditures and has received a credit certificate from the California Film Commission (CFC). This applies to individuals, corporations, and pass-through entities like partnerships and S corporations, but the credit is not allowed at the pass-through entity level.

How do I apply for the credit?

To apply for the credit, you need to complete the California 3541 form and attach it to your California tax return. Make sure to write “CFC Credit” in red ink at the top margin of your tax return. The form requires details about the credit amount you are claiming, including any credits received from pass-through entities or purchased from other taxpayers.

Can I sell or assign the credit?

Yes, you can sell the credit if it is attributable to an independent film. You must first receive Form M from the CFC. Alternatively, you can assign the credit to an affiliated corporation, but this election is irrevocable. Once assigned, the credit cannot be reassigned.

What if my credit exceeds my tax liability?

If your available credit exceeds your current year tax liability, you can carry over the unused credit for up to six years or until it is exhausted. The carryover should be applied to the earliest taxable years possible. However, you cannot carry the credit back to previous years.

Are there limitations on how the credit can be used?

Yes, the credit cannot reduce certain taxes, including the minimum franchise tax or alternative minimum tax. Additionally, it cannot reduce the S corporation 1.5% entity-level tax. Be sure to review the specific limitations outlined in the form instructions.

What information do I need to provide on the form?

You will need to provide details such as your name, Social Security Number (SSN) or Employer Identification Number (EIN), the credit certificate number, and any credits received from pass-through entities. It's important to follow the instructions carefully to ensure all required information is included.

Where can I find more information about the credit?

For more information, you can visit the California Film Commission's website or the California Franchise Tax Board's website. These resources provide additional details about eligibility, application processes, and the specific instructions for completing the California 3541 form.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California 3541 form is used to claim the Motion Picture and Television Production Credit for qualified productions in California. |

| Governing Law | This form is governed by the Revenue & Taxation Code (R&TC) Sections 17053.85 and 23685. |

| Credit Percentage | The credit is 20% of qualified expenditures for motion pictures and 25% for independent films or television series relocating to California. |

| Eligibility | To qualify, taxpayers must receive a credit certificate from the California Film Commission (CFC) and incur eligible production costs. |

| Application of Credit | Taxpayers can use the credit to offset franchise or income tax liabilities, sell it to unrelated parties, or assign it to affiliated corporations. |

| Non-Refundable | The credit cannot be refunded. If it exceeds tax liability, the excess can be carried over for up to six years. |

| Form Attachment | Form 3541 must be attached to the appropriate California tax return, such as Form 540 for individuals or Form 100 for corporations. |

| Credit Assignment | Credits can be assigned to affiliated corporations but the election is irrevocable and must comply with specific regulations. |

| Sales Tax Application | Qualified taxpayers may apply the credit against sales and use taxes after receiving a certified Form M from the CFC. |

| Record Keeping | Taxpayers must retain all documentation related to the credit and its use, as the Franchise Tax Board may request access to these records. |

Dos and Don'ts

When filling out the California Form 3541, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid while completing this form:

- Do read the instructions carefully before starting the form.

- Do enter your name and identification numbers exactly as they appear on your tax return.

- Do include all relevant credit certificate numbers from Form M.

- Do ensure that the amounts you report are accurate and correspond to the correct lines on the form.

- Do keep copies of all documents related to your credit claims for your records.

- Don't leave any required fields blank; all applicable sections must be completed.

- Don't enter amounts from pass-through entities on the wrong lines; follow the instructions carefully.

- Don't forget to attach the form to your California tax return as required.

- Don't assume that all credits can be carried forward; check the specific limitations on carryovers.

- Don't attempt to assign credits without understanding the eligibility requirements and procedures.

Misconceptions

-

Misconception 1: The California 3541 form is only for large production companies.

This is not true. The form is available to all qualified taxpayers, including independent filmmakers and smaller production entities. Even productions with budgets as low as one million dollars can qualify for the motion picture and television production credit.

-

Misconception 2: The credit is refundable.

Many people mistakenly believe that the California production credit can result in a cash refund. In reality, the credit is non-refundable. It can only be used to offset tax liabilities, which means that if the credit exceeds your tax due, you cannot receive the difference back as cash.

-

Misconception 3: Credits can be transferred freely between any entities.

This is misleading. While the credit can be assigned to affiliated corporations, the assignment is subject to specific rules and cannot be reassigned once completed. Only certain affiliated corporations, as defined by the law, can receive these credits.

-

Misconception 4: The form is only relevant for tax professionals.

In reality, understanding the California 3541 form is crucial for any qualified taxpayer involved in film or television production. Filmmakers and producers should be aware of how to claim these credits effectively to maximize their tax benefits, making it important for them to familiarize themselves with the form.

Documents used along the form

The California 3541 form is essential for taxpayers involved in the motion picture and television industry, allowing them to claim production credits. However, several other forms and documents often accompany this form to ensure proper reporting and compliance with state tax regulations. Below is a list of related forms and documents that may be relevant.

- Form M - Tax Credit Certificate: This certificate is issued by the California Film Commission (CFC) to qualified taxpayers, certifying the amount of credit allocated for production expenditures. It serves as proof of eligibility for claiming credits on tax returns.

- Form FTB 3551 - Sale of Credit Attributable to an Independent Film: This form is used by taxpayers who wish to sell their motion picture credits to unrelated parties. It outlines the necessary details for the sale and reporting of the gain from the transaction.

- Form FTB 3544 - Election to Assign Credit Within Combined Reporting Group: Taxpayers can use this form to elect to assign credits to affiliated corporations within a combined reporting group. It details the assignment process and eligibility criteria.

- Form FTB 3544A - List of Assigned Credit Received and/or Claimed by Assignee: This form tracks the credits assigned to affiliated corporations and must be completed by the assignee to document the credits received.

- Form 100 - California Corporation Franchise or Income Tax Return: Corporations must attach the California 3541 form to their annual tax return, Form 100, to report the production credit and any other relevant income.

- Form 100S - California S Corporation Franchise or Income Tax Return: Similar to Form 100, this form is for S corporations. It requires the attachment of the 3541 form to report any credits claimed.

- Form 540 - California Resident Income Tax Return: Individual taxpayers claiming credits must attach the 3541 form to their personal income tax return, Form 540, to ensure proper credit application.

- Form 540NR - California Nonresident or Part-Year Resident Income Tax Return: Nonresidents or part-year residents must also attach the 3541 form to their tax return to claim any eligible production credits.

These forms and documents play a crucial role in the process of claiming production credits in California. Each serves a specific purpose, ensuring that taxpayers can accurately report their credits while complying with state tax laws. Understanding the requirements and properly completing these forms is vital for maximizing benefits and avoiding potential issues with tax authorities.

Different PDF Templates

California Financial Aid Income Limit - To ensure your form is mailed on time, consider obtaining a U.S. Postal Service Certificate of Mailing.

Ftb Form 3800 - Investment income examples include interest, dividends, and capital gains.

Relative Information - The JV-250 form is specific to the Superior Court of California.