Download California 3555 Form

Common Questions

What is the California 3555 form?

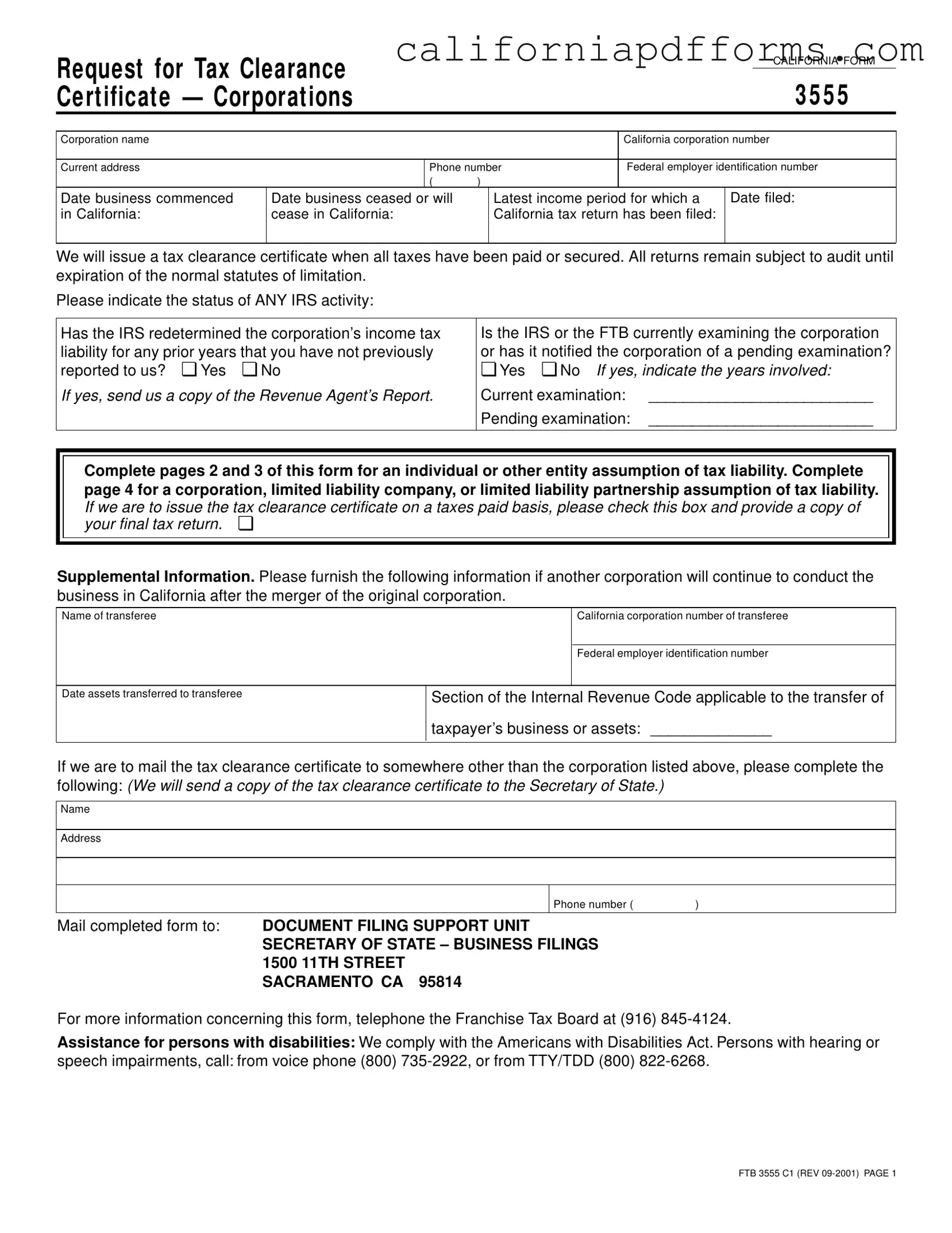

The California 3555 form, also known as the Request for Tax Clearance, is used by corporations to request a tax clearance certificate from the Franchise Tax Board (FTB). This certificate confirms that all taxes owed by the corporation have been paid or secured. It is often required during the dissolution of a corporation or when transferring assets to another entity.

Who needs to file the California 3555 form?

Any corporation that is dissolving or merging with another entity in California must file this form. Additionally, if a corporation is transferring its assets to another corporation, the California 3555 form should be submitted to ensure that all tax liabilities are addressed. The form is necessary to obtain a tax clearance certificate, which is often required by the Secretary of State for business filings.

What information is required to complete the form?

To complete the California 3555 form, the following information is typically required:

- Corporation name and California corporation number

- Current address and phone number

- Federal employer identification number (FEIN)

- Dates related to business commencement and cessation

- Latest income period for which a California tax return has been filed

- Status of any IRS activity concerning the corporation

Additional information may be needed if the business is being transferred or if an individual or trust is assuming tax liabilities.

What happens after submitting the California 3555 form?

Once the California 3555 form is submitted, the FTB will review the information provided. If all taxes have been paid or secured, the FTB will issue a tax clearance certificate. However, all returns remain subject to audit until the expiration of the normal statutes of limitation. If there are any outstanding tax issues, the FTB may require additional information or documentation.

Can the tax clearance certificate be mailed to a different address?

Yes, if you want the tax clearance certificate sent to a different address than the corporation's listed address, you must provide that address on the form. The FTB will send a copy of the certificate to the Secretary of State, as well as to the address specified on the form.

What should I do if there is IRS activity related to the corporation?

If there is any IRS activity concerning the corporation, such as an examination or redetermination of income tax liability, it is crucial to indicate this on the form. You should also provide details about the years involved and submit a copy of any relevant IRS reports, such as the Revenue Agent’s Report. This information is necessary for the FTB to assess the corporation's tax status accurately.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California 3555 form is used to request a tax clearance certificate for corporations. |

| Governing Law | This form is governed by the California Bank and Corporation Tax Law. |

| Eligibility | Only California corporations can file this form to obtain a tax clearance certificate. |

| IRS Activity | The form requires disclosure of any IRS activity related to income tax or examinations. |

| Tax Compliance | A tax clearance certificate will be issued only when all taxes have been paid or secured. |

| Submission Address | Completed forms must be mailed to the Secretary of State’s Business Filings unit in Sacramento. |

| Assumption of Liability | Individuals or trusts can assume tax liability for the corporation using this form. |

Dos and Don'ts

When filling out the California 3555 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do provide complete and accurate information for your corporation, including the corporation name and California corporation number.

- Don't leave any sections blank. Every applicable section must be filled out to avoid delays.

- Do include the correct federal employer identification number (EIN) for your corporation.

- Don't forget to check the box if you want the tax clearance certificate sent to a different address.

- Do attach any required financial statements and documentation, especially if there is an assumption of tax liability.

- Don't submit the form without reviewing it for errors. Double-check all entries for accuracy.

Following these guidelines will help facilitate a smoother process in obtaining your tax clearance certificate.

Misconceptions

Understanding the California 3555 form can be challenging, and several misconceptions often arise. Here are eight common misunderstandings related to this form:

- Tax Clearance Certificates are Automatic: Many believe that submitting the California 3555 form guarantees an immediate tax clearance certificate. In reality, the certificate is issued only after verifying that all taxes have been paid or secured.

- Only Corporations Need to File: Some think that only corporations must complete this form. However, individuals and other entities assuming tax liability also need to fill it out.

- All Taxes Are Cleared Once the Form is Submitted: A common myth is that submitting the form clears all tax liabilities. The form merely initiates the process; the Franchise Tax Board must confirm that all taxes are settled.

- IRS Issues the Tax Clearance: Some individuals mistakenly believe that the IRS provides the tax clearance certificate. The California Franchise Tax Board is responsible for this certificate, not the IRS.

- Only Past Tax Returns Matter: Many assume that only past tax returns are relevant for the 3555 form. However, any pending IRS examinations or audits can impact the issuance of the tax clearance certificate.

- Financial Statements Are Optional: Some think that providing a financial statement is optional. In fact, a detailed financial statement is required for both individual and entity assumptions of tax liability.

- The Form is Only for Dissolving Corporations: It’s a misconception that the 3555 form is solely for corporations that are dissolving. It is also applicable for businesses undergoing mergers or transfers of assets.

- Filing the Form Means No Further Tax Issues: Finally, many believe that once the form is filed, there will be no more tax issues. All returns remain subject to audit until the expiration of the normal statutes of limitation, meaning future tax liabilities could still arise.

Being aware of these misconceptions can help individuals and businesses navigate the complexities of the California 3555 form more effectively.

Documents used along the form

The California 3555 form, known as the Request for Tax Clearance, is an important document for corporations seeking to ensure that all taxes have been settled before dissolution or transfer of assets. Along with this form, several other documents are often required to complete the tax clearance process. Below is a list of related forms and documents that may be needed.

- Form FTB 1131: This form contains the Privacy Act Notice. It informs individuals about how their personal information will be used and protected during the tax clearance process.

- Financial Statement: A detailed financial statement is often required to demonstrate the net worth of the individual or entity assuming tax liability. This includes a list of assets and liabilities.

- IRS Revenue Agent's Report: If the IRS has re-evaluated the corporation's income tax or is currently examining it, a copy of this report must be submitted to the Franchise Tax Board (FTB).

- Form 540 or 1120: These are California personal income tax and corporate tax return forms, respectively. They may be needed to show that all tax returns have been filed and taxes paid.

- Articles of Incorporation: This document outlines the corporation's formation details. It may be required to verify the corporation's legal status and structure.

- Certificate of Good Standing: This certificate from the Secretary of State confirms that the corporation is authorized to conduct business and is in compliance with state regulations.

- Assumption of Tax Liability Agreement: This agreement outlines the responsibilities of the individual or entity assuming the tax liabilities of the corporation. It is crucial for ensuring all obligations are met.

- Transfer Documents: If assets are being transferred to another corporation, documents detailing the asset transfer must be provided to clarify the transaction.

- Notarized Signatures: Many forms require notarization to validate the signatures of those involved in the tax clearance process, ensuring authenticity and compliance.

Gathering these documents can streamline the process of obtaining a tax clearance certificate. It is essential to ensure all forms are completed accurately and submitted on time to avoid delays. If you have questions about any of these documents, reaching out to the Franchise Tax Board or a legal professional can provide clarity.

Different PDF Templates

Ca587 - Payments for goods without services do not require withholding under this form.

How Do You Declare Someone Financially Incompetent - GC-240 details the authority granted to the guardian to manage the ward’s person and estate.

California Schedule R - Total nonbusiness income allocable to California is summarized in line 25.