Download California 3581 Form

Common Questions

-

What is the purpose of California Form 3581?

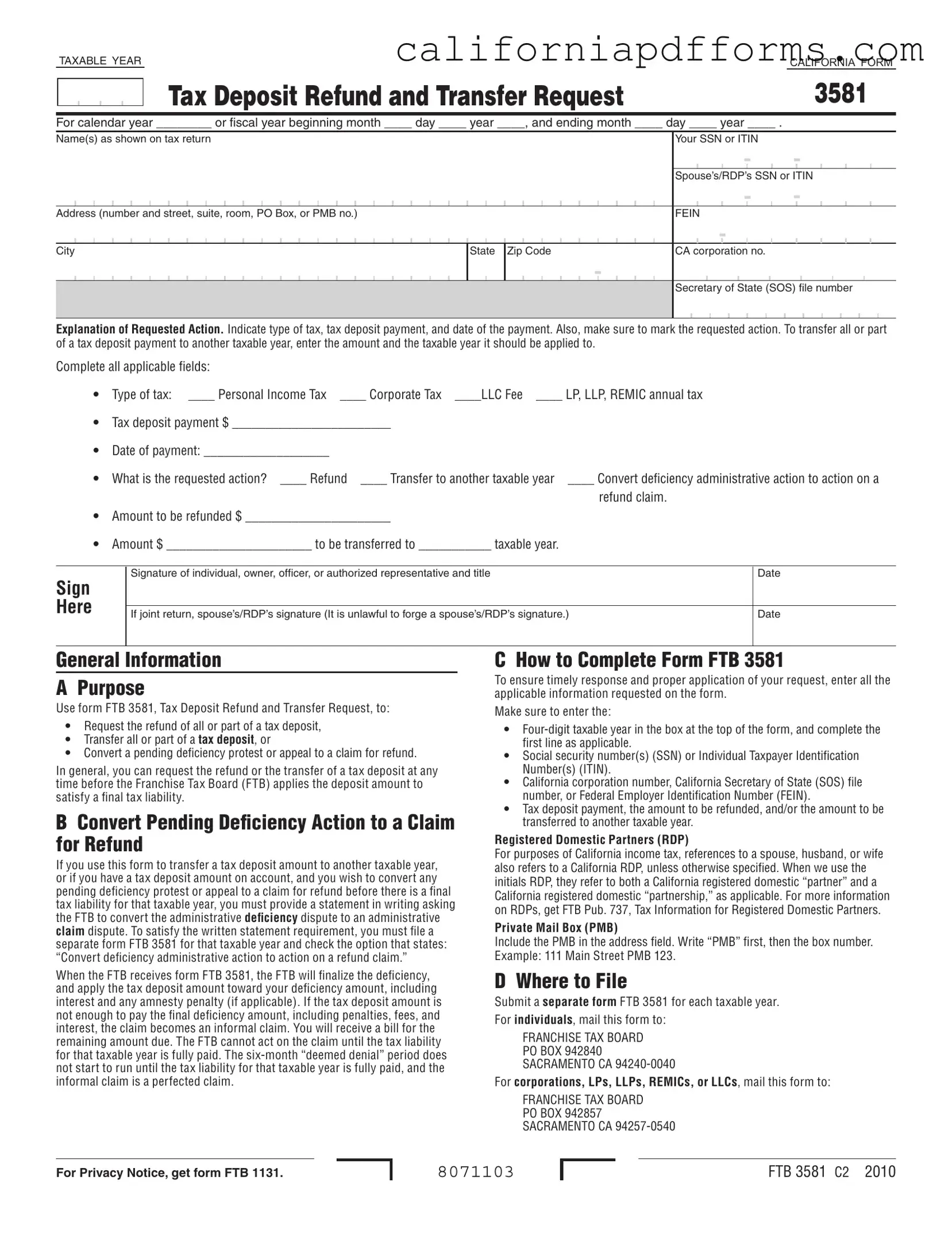

Form FTB 3581, Tax Deposit Refund and Transfer Request, is used to request a refund of all or part of a tax deposit, transfer a tax deposit to another taxable year, or convert a pending deficiency protest or appeal into a claim for refund. This form allows taxpayers to manage their tax deposits effectively before the Franchise Tax Board (FTB) applies them to any final tax liability.

-

Who should use Form 3581?

Any individual or entity that has made a tax deposit with the FTB and wishes to request a refund, transfer, or conversion of that deposit should use Form 3581. This includes individuals, corporations, limited liability companies (LLCs), and registered domestic partners (RDPs).

-

How do I complete Form 3581?

To complete Form 3581, follow these steps:

- Enter the four-digit taxable year at the top of the form.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Include your California corporation number, Secretary of State file number, or Federal Employer Identification Number (FEIN).

- Fill in the tax deposit payment amount, the amount to be refunded, and/or the amount to be transferred.

Ensure all applicable fields are completed to avoid delays.

-

What actions can I request using Form 3581?

You can request one of the following actions:

- A refund of all or part of a tax deposit.

- A transfer of all or part of a tax deposit to another taxable year.

- A conversion of a pending deficiency protest or appeal into a claim for refund.

-

What should I include if I want to convert a deficiency action to a claim for refund?

If you wish to convert a pending deficiency protest or appeal to a claim for refund, you must provide a written statement requesting this conversion. Additionally, you should complete Form 3581 for the applicable taxable year and check the option indicating your desire to convert the deficiency action.

-

Where do I file Form 3581?

File Form 3581 at the following addresses based on your entity type:

-

For individuals:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0040 -

For corporations, LPs, LLPs, REMICs, or LLCs:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA 94257-0540

-

For individuals:

-

What happens if my tax deposit amount is insufficient to cover my final deficiency?

If the tax deposit amount is not enough to satisfy the final deficiency amount, including penalties, fees, and interest, your claim will become an informal claim. You will receive a bill for the remaining balance due. The FTB cannot process the claim until the tax liability for that taxable year is fully paid.

-

Can I request a refund for a tax deposit at any time?

You can request a refund or transfer of a tax deposit at any time before the FTB applies that deposit to satisfy a final tax liability. It is crucial to act promptly to ensure your request is processed correctly.

-

What should I do if I have a Private Mail Box (PMB)?

If you have a PMB, include it in the address field of Form 3581. Write "PMB" first, followed by the box number. For example: 111 Main Street PMB 123.

-

What if I am a registered domestic partner?

For California income tax purposes, references to a spouse also include registered domestic partners (RDPs). When completing Form 3581, RDPs should follow the same instructions as spouses unless otherwise specified.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The California Form 3581 is used to request a refund of all or part of a tax deposit, transfer a tax deposit to another taxable year, or convert a pending deficiency protest to a claim for refund. |

| Applicable Tax Types | This form can be used for various tax types, including Personal Income Tax, Corporate Tax, LLC Fee, and LP, LLP, or REMIC annual tax. |

| Filing Requirements | Individuals and entities must submit a separate Form 3581 for each taxable year. Specific mailing addresses are designated for individuals and corporations. |

| Governing Law | California Revenue and Taxation Code governs the use of Form 3581 and the procedures for tax deposit refunds and transfers. |

| Signature Requirement | The form must be signed by the individual, owner, officer, or authorized representative. If filing a joint return, both parties must sign. |

| Conversion of Deficiency | To convert a pending deficiency action to a claim for refund, a written statement must be provided, and the option to convert must be checked on Form 3581. |

Dos and Don'ts

When filling out the California 3581 form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do to ensure your request is processed smoothly.

- Do enter the correct taxable year at the top of the form.

- Do provide accurate Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs).

- Do clearly indicate the type of tax you are addressing.

- Do specify the amount you wish to refund or transfer.

- Don’t forget to sign the form; an unsigned form may delay processing.

- Don’t leave any applicable fields blank; incomplete forms can be rejected.

- Don’t forge a spouse’s or registered domestic partner’s signature; it is illegal.

- Don’t submit multiple forms for the same taxable year; each year requires a separate submission.

Following these guidelines will help ensure that your request is handled efficiently and correctly. Be thorough and attentive to detail to avoid any potential issues.

Misconceptions

Misconceptions about the California 3581 form can lead to confusion and delays in processing requests. Here are five common misconceptions explained:

- It can be submitted at any time. Many believe they can submit the form whenever they want. However, the form must be submitted before the Franchise Tax Board (FTB) applies the deposit to a final tax liability.

- Only individuals can use this form. Some think this form is exclusive to individuals. In reality, corporations, LLCs, and other entities can also utilize it for tax deposit refunds and transfers.

- A refund request guarantees approval. Just because a refund request is made does not mean it will be granted. The FTB will review the request and determine eligibility based on the provided information and applicable laws.

- All fields are optional. It’s a common belief that not all fields need to be completed. In fact, all applicable fields must be filled out to ensure the request is processed efficiently.

- Submitting the form once is enough. Some think that one submission suffices for all tax years. Each taxable year requires a separate form to be filed, so multiple submissions may be necessary.

Documents used along the form

The California 3581 form is an essential document for taxpayers seeking to manage their tax deposits effectively. It allows individuals and businesses to request refunds, transfer deposits, or convert deficiency actions into claims for refunds. To navigate the tax landscape smoothly, several other forms and documents often accompany the California 3581 form. Below is a list of these related documents, along with a brief description of each.

- California Form 540: This is the California Resident Income Tax Return form. It is used by residents to report their income, calculate their tax liability, and claim any applicable credits and deductions.

- California Form 100: This form is the California Corporation Franchise or Income Tax Return. Corporations use it to report their income, calculate taxes owed, and provide necessary financial information to the Franchise Tax Board.

- California Form 568: This is the Limited Liability Company Return of Income form. LLCs use it to report their income and pay the annual LLC fee, along with any applicable taxes.

- California Form 941: This form is used for reporting California Employer's Quarterly Wage Reports. Employers file it to report wages paid to employees and the taxes withheld from those wages.

- California Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It is often issued to independent contractors and freelancers.

- California Form 3519: This is the Payment for Automatic Extension for Individuals form. It allows individuals to request an automatic extension of time to file their California income tax return, while also providing a way to pay any taxes owed.

- California Form 1131: This form contains the Privacy Notice for taxpayers. It outlines how the Franchise Tax Board collects, uses, and protects personal information.

- California Form 3500: This is the Exemption Application for Nonprofit Organizations. Nonprofits use it to apply for tax-exempt status under California law.

- California Form 3520: This form is the Annual Information Return of Foreign Trust with a U.S. Owner. It is used to report information about foreign trusts and their U.S. beneficiaries.

Understanding these forms can significantly enhance your ability to manage tax obligations and ensure compliance with California tax laws. Each document serves a specific purpose and can be crucial in various tax-related situations.

Different PDF Templates

Inactive Real Estate License California - It is crucial to submit the correct application form according to the situation.

Death Certificate Affidavit - The affidavit eliminates the need for lengthy probate proceedings for the property involved.