Download California 3582 Form

Common Questions

What is the California FTB 3582 form used for?

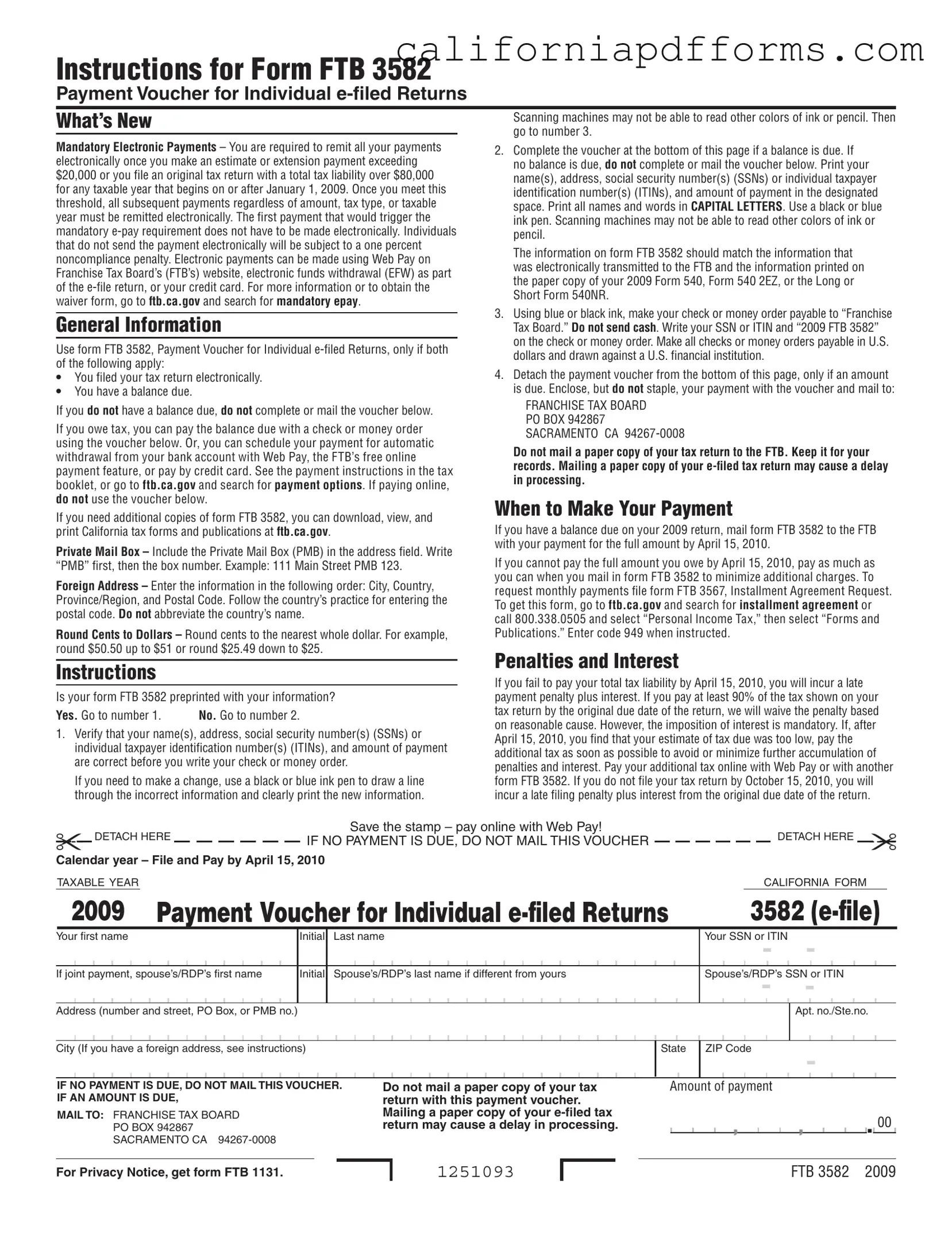

The California FTB 3582 form is a payment voucher specifically designed for individuals who have e-filed their tax returns and have a balance due. If you owe taxes after filing electronically, this form helps you submit your payment properly. It ensures that your payment is processed efficiently by the Franchise Tax Board (FTB).

Who should use the FTB 3582 form?

You should use the FTB 3582 form if you meet two criteria: first, you must have filed your tax return electronically; second, you must have a balance due. If you do not owe any taxes, there is no need to complete or send this voucher.

How do I complete the FTB 3582 form?

Completing the FTB 3582 form involves a few simple steps:

- Check if your information is preprinted on the form. If it is, verify that your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) are correct.

- If the information is incorrect, use a black or blue pen to cross out the incorrect details and write in the correct information.

- If your information is not preprinted, fill in all required fields in capital letters, ensuring accuracy.

- Make your payment by check or money order, payable to "Franchise Tax Board," and include your SSN or ITIN along with "2009 FTB 3582" on it.

- Detach the voucher and mail it along with your payment to the address provided on the form.

What happens if I don't pay my taxes on time?

If you do not pay your total tax liability by the due date, you will incur a late payment penalty and interest charges. However, if you pay at least 90% of your tax by the original due date, you may qualify for a penalty waiver based on reasonable cause. Keep in mind that interest will still accrue on any unpaid balance.

Can I make my payment electronically?

Yes, you can make your payment electronically through various methods. The FTB offers Web Pay, which is a free online payment feature. You can also opt for electronic funds withdrawal (EFW) as part of your e-file return or use a credit card. If you choose to pay online, do not use the FTB 3582 voucher.

What if I can't pay the full amount I owe?

If you are unable to pay the full amount by the due date, it is advisable to pay as much as you can to minimize additional charges. You may also file form FTB 3567, which is an Installment Agreement Request, to set up a payment plan. You can find this form on the FTB website or by calling their helpline.

Document Specifications

| Fact Name | Description |

|---|---|

| Mandatory Electronic Payments | Individuals must remit all payments electronically if they make an estimate or extension payment exceeding $20,000 or file a tax return with a total tax liability over $80,000, starting from taxable years beginning on or after January 1, 2009. |

| Form Usage | Form FTB 3582 should be used only if a taxpayer has filed their tax return electronically and has a balance due. If there is no balance due, the voucher should not be completed or mailed. |

| Payment Instructions | Payments can be made using checks, money orders, or electronically via the Franchise Tax Board's website. It is important to include the correct information and avoid using cash. |

| Penalties for Non-Compliance | If a taxpayer fails to pay their total tax liability by the due date, they will incur a late payment penalty and interest. However, if at least 90% of the tax is paid by the due date, the penalty may be waived based on reasonable cause. |

Dos and Don'ts

When filling out the California 3582 form, follow these guidelines to ensure accuracy and compliance.

- Use black or blue ink. Scanning machines can only read these colors.

- Verify your information. Check that your name, address, and SSN or ITIN are correct before submitting.

- Round cents to the nearest dollar. For example, $50.50 becomes $51.

- Complete the voucher only if you have a balance due. If no balance is due, do not mail the voucher.

- Make payments electronically if required. This applies if your estimated payment exceeds $20,000 or your total tax liability exceeds $80,000.

- Include your Private Mail Box (PMB) in the address. Write "PMB" followed by the box number.

- Detach the voucher only if you owe an amount. Enclose your payment with the voucher.

- Mail your payment to the correct address. Use the address provided for the Franchise Tax Board.

- Keep a copy of your tax return for your records. Do not send a paper copy with the voucher.

- Pay on time to avoid penalties. Submit your payment by April 15, 2010.

Additionally, avoid these common mistakes:

- Do not use colors other than black or blue ink.

- Do not leave any fields blank.

- Do not mail the voucher if you do not owe any payment.

- Do not staple your payment to the voucher.

- Do not send cash as a payment method.

- Do not abbreviate the country name if you have a foreign address.

- Do not forget to write your SSN or ITIN on your payment.

- Do not delay your payment to avoid additional charges.

- Do not assume the information on the voucher is correct without verification.

- Do not ignore the requirement for electronic payments if applicable.

Misconceptions

Many people have misconceptions about the California FTB 3582 form. Here are six common misunderstandings and clarifications to help you navigate this process more easily.

- Misconception 1: You must use the FTB 3582 form for all tax payments.

- Misconception 2: You can pay your tax bill with cash.

- Misconception 3: You can use any color of ink to fill out the form.

- Misconception 4: You can send your tax return along with the FTB 3582 form.

- Misconception 5: You can ignore payment deadlines if you file for an extension.

- Misconception 6: You can pay your balance due anytime without penalties.

This is not true. You only need to use the FTB 3582 form if you filed your tax return electronically and have a balance due. If you don’t owe anything, you should not complete or mail the voucher.

Cash payments are not accepted. You must pay by check, money order, or electronically through options like Web Pay or credit card.

Only blue or black ink should be used. Scanning machines may not read other colors, which can lead to processing delays.

This is incorrect. You should not mail a paper copy of your tax return with the payment voucher. Doing so can cause delays in processing.

Even if you file for an extension, you are still required to pay any taxes owed by the original due date to avoid penalties and interest.

This is misleading. If you do not pay your total tax liability by the due date, you will incur a late payment penalty and interest. Timely payment is crucial to avoid extra charges.

Documents used along the form

When filing taxes in California, several forms and documents may accompany the California FTB 3582 Payment Voucher. Each of these documents serves a specific purpose and can help ensure compliance with tax regulations. Below is a list of commonly used forms that may be relevant.

- Form 540: This is the California Resident Income Tax Return. It is used by residents to report their income, claim deductions, and calculate their tax liability. Completing this form is essential for determining the amount owed, which may lead to the use of the FTB 3582 if a balance is due.

- Form 3567: Known as the Installment Agreement Request, this form allows taxpayers to request a payment plan if they cannot pay their tax liability in full by the due date. Submitting this form can help manage financial obligations and avoid penalties.

- Form 1131: This is the Privacy Notice form. It informs taxpayers about how their personal information is used and protected by the Franchise Tax Board. While not directly related to payments, it is important for understanding privacy rights during the tax process.

- Form 540 2EZ: This simplified version of the California Resident Income Tax Return is available for eligible taxpayers with straightforward tax situations. It allows for easier filing and can lead to quicker refunds or payments.

Understanding these forms can simplify the tax filing process and help ensure that all obligations are met in a timely manner. If you have questions about any of these forms, seeking assistance can provide clarity and support.

Different PDF Templates

Alternative Work Schedule California - The form must include the employee's name and division information.

Inactive Real Estate License California - Written agreements are required for broker-salespersons working under other brokers.