Download California 3588 Form

Common Questions

What is the purpose of the California 3588 form?

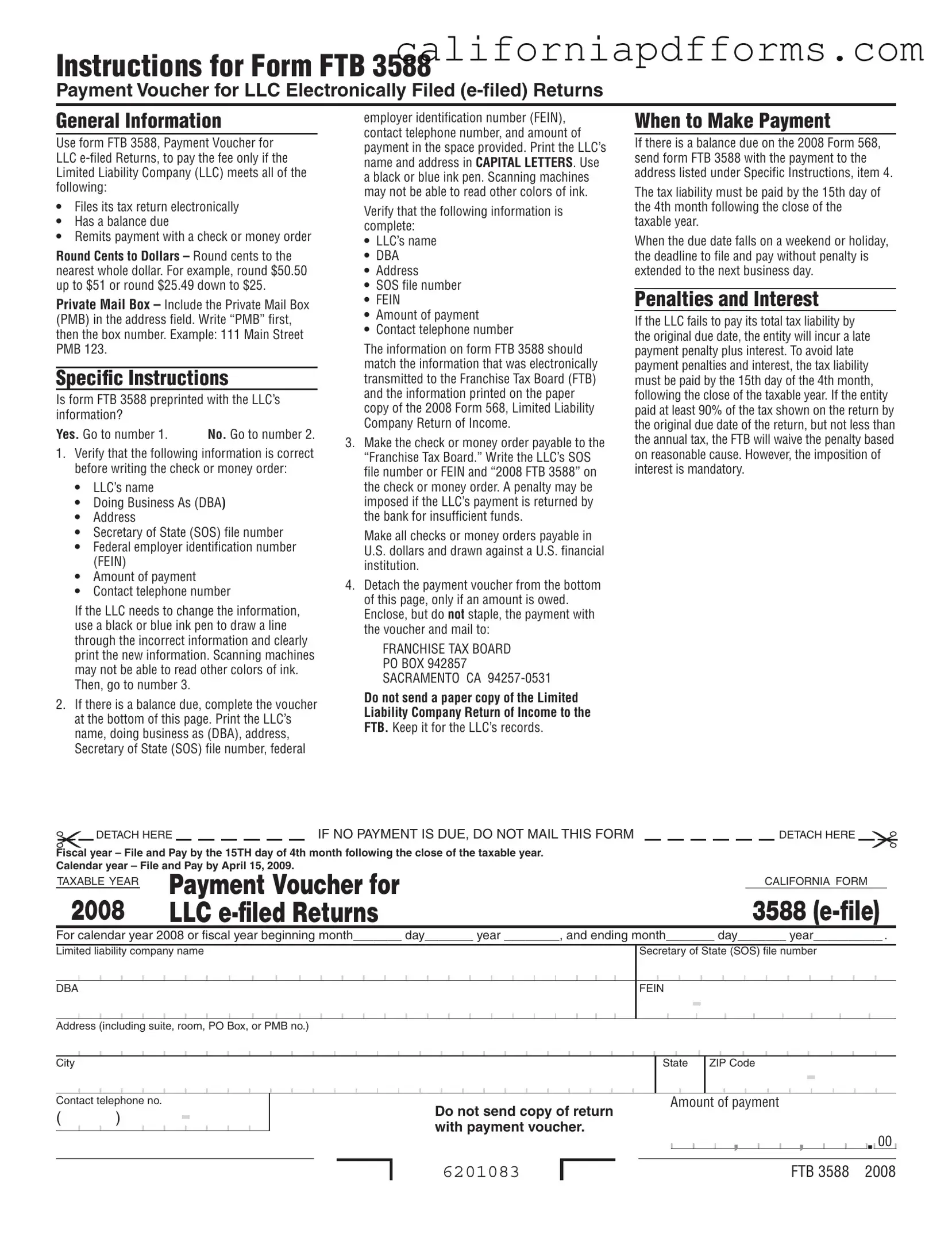

The California 3588 form, known as the Payment Voucher for LLC e-filed Returns, serves a specific purpose. It is designed for Limited Liability Companies (LLCs) that file their tax returns electronically and have a balance due. By using this form, LLCs can make their payments conveniently and ensure they meet their tax obligations. The form helps streamline the payment process and ensures that the Franchise Tax Board (FTB) receives the necessary information for proper processing.

How should I complete the California 3588 form?

Completing the California 3588 form requires attention to detail. First, verify whether the form has preprinted information for your LLC. If it does, check that the following details are correct:

- LLC’s name

- Doing Business As (DBA)

- Address

- Secretary of State (SOS) file number

- Federal Employer Identification Number (FEIN)

- Amount of payment

- Contact telephone number

If any information is incorrect, use a black or blue ink pen to correct it clearly. If the form does not have preprinted information, fill in all required fields in capital letters. Ensure that the information matches what was submitted electronically to the FTB and on the paper copy of the 2008 Form 568.

When is the payment due for the California 3588 form?

Payment for the California 3588 form is due by the 15th day of the 4th month following the close of the taxable year. For calendar year filers, this means the payment is due on April 15. If this date falls on a weekend or holiday, the deadline extends to the next business day. It’s crucial to pay on time to avoid penalties and interest on late payments.

What happens if I do not pay on time?

If an LLC fails to pay its total tax liability by the original due date, it will incur a late payment penalty and interest. To avoid these penalties, ensure that payment is made by the due date. If at least 90% of the tax shown on the return was paid by the original due date, the FTB may waive the penalty for reasonable cause. However, interest will still apply, making timely payment essential.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | The California FTB 3588 is used by Limited Liability Companies (LLCs) to pay their tax liabilities when filing electronically. |

| Eligibility Criteria | An LLC must file its tax return electronically, have a balance due, and remit payment with a check or money order to use this form. |

| Payment Rounding | Payments must be rounded to the nearest whole dollar. For example, $50.50 becomes $51, while $25.49 becomes $25. |

| Preprinted Information | Form FTB 3588 may come preprinted with the LLC's information. If not, the LLC must fill in its details accurately. |

| Payment Instructions | Checks or money orders should be made payable to the “Franchise Tax Board” and must include the LLC's SOS file number or FEIN. |

| Filing Deadline | The payment must be submitted by the 15th day of the 4th month following the close of the taxable year to avoid penalties. |

| Governing Law | The use of Form FTB 3588 is governed by California Revenue and Taxation Code Section 18633. |

Dos and Don'ts

When filling out the California 3588 form, follow these guidelines:

- Do verify all information. Ensure the LLC’s name, DBA, address, SOS file number, FEIN, amount of payment, and contact number are correct.

- Do use black or blue ink. Write all information clearly in a pen that scanning machines can read.

- Do round cents to the nearest dollar. For example, round $50.50 up to $51.

- Do mail the voucher with payment. Detach the voucher and send it along with the payment to the specified address.

- Don’t forget to include the PMB. Write “PMB” first, followed by the box number in the address field.

- Don’t use colors other than black or blue ink. This ensures that your information is legible for processing.

- Don’t staple the payment to the voucher. Enclose them together without staples when mailing.

- Don’t send a paper copy of the LLC Return of Income. Keep it for your records.

Misconceptions

Misconceptions about the California FTB 3588 form can lead to confusion and errors in payment processing. Below are nine common misconceptions, along with clarifications to help ensure compliance.

- Form FTB 3588 is only for paper filings. This form is specifically designed for LLCs that file their tax returns electronically. It is not applicable for paper filings.

- Payments can be made in any currency. All payments must be made in U.S. dollars and drawn against a U.S. financial institution. Other currencies will not be accepted.

- The form is automatically filled out with the LLC's information. While the form may have preprinted information, it is crucial to verify that all details are correct before submitting the payment.

- There is no need to round the payment amount. Payments must be rounded to the nearest whole dollar. For example, $50.50 becomes $51, while $25.49 becomes $25.

- Stapling the payment voucher and check is acceptable. Payments should be enclosed with the voucher but not stapled together. This ensures smooth processing by the Franchise Tax Board.

- Late payments incur only penalties, not interest. Both penalties and interest apply if the total tax liability is not paid by the original due date. Interest accrues regardless of penalties.

- Sending a copy of the tax return with the payment is required. It is explicitly stated that no paper copy of the Limited Liability Company Return of Income should be sent with the payment voucher.

- All LLCs must use the FTB 3588 form regardless of their tax situation. The form should only be used if the LLC has a balance due and is filing electronically. If there is no balance due, the form is unnecessary.

- Payments can be made at any time before the due date. Payments must be made by the 15th day of the 4th month following the close of the taxable year to avoid penalties and interest.

Documents used along the form

The California Form FTB 3588 serves as a payment voucher specifically for Limited Liability Companies (LLCs) that file their tax returns electronically. When submitting this form, several other documents may be necessary to ensure compliance with state tax regulations. Below is a list of forms and documents commonly used in conjunction with the FTB 3588.

- Form 568: This is the Limited Liability Company Return of Income. It must be filed to report the income, deductions, and credits of the LLC. It provides essential details about the financial performance of the business.

- Form 541: This is the California Fiduciary Income Tax Return. If the LLC is a disregarded entity and has a trust or estate as a member, this form may be required to report income generated by the LLC.

- Form 100: The California Corporation Franchise or Income Tax Return is necessary for LLCs taxed as corporations. It reports the corporation's income and calculates the tax owed to the state.

- Form 109: This form is used to report California source income for non-residents and may be relevant for LLCs with members who are not residents of California.

- Form 3536: This is the Estimated Fee for LLCs. If an LLC expects to owe a fee, it must file this form to estimate and pay the fee in advance of the tax return due date.

- Form 8879: This is the IRS e-file Signature Authorization form. It is used to authorize the electronic filing of the LLC's federal tax return, which may be relevant if the LLC is also required to file federal taxes.

- W-9 Form: This form is used to provide taxpayer identification information to other entities. It may be needed when the LLC engages with contractors or vendors.

- Form 941: This is the Employer's Quarterly Federal Tax Return. If the LLC has employees, this form is necessary to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

- Form 3500: This is the Exemption Application for the California Sales and Use Tax. If the LLC is seeking a sales tax exemption, this form must be submitted to the California Department of Tax and Fee Administration.

In summary, the California Form FTB 3588 is just one piece of the puzzle when it comes to tax compliance for LLCs. Understanding the related forms and documents can significantly streamline the filing process and help avoid potential penalties or issues with the Franchise Tax Board. Properly managing these forms ensures that an LLC remains compliant with state tax laws and regulations.

Different PDF Templates

Paperwork When Selling a Car - This form plays a crucial role in ensuring transparency in vehicle ownership transfers.

How to Report an Attorney to the Bar - Attach copies of all correspondence between you and the attorney.