Download California 3725 Form

Common Questions

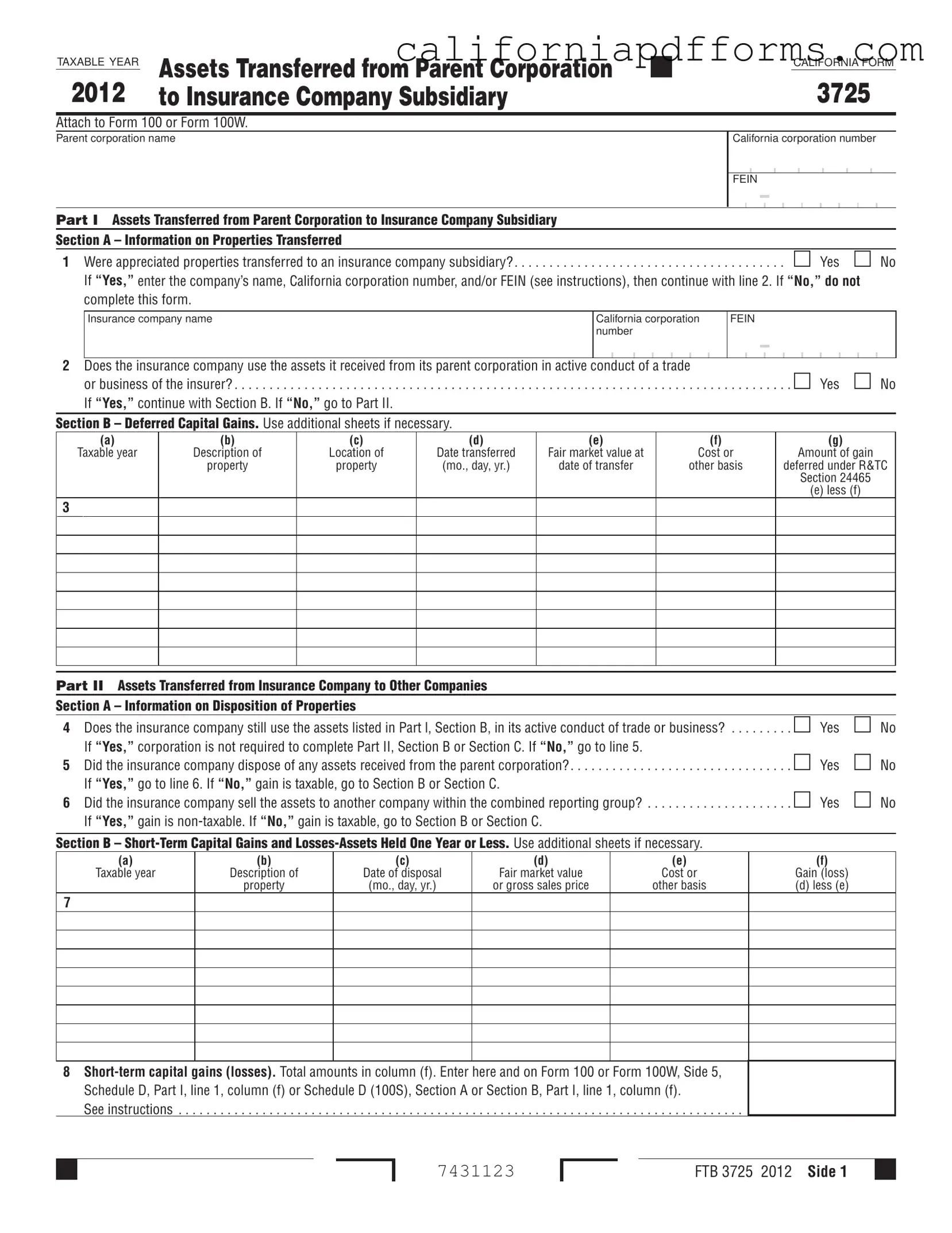

What is the purpose of the California 3725 form?

The California 3725 form is used to report assets transferred from a parent corporation to its insurance company subsidiary. It helps track these transfers and calculate any capital gains or losses associated with the transaction. This form is particularly important for transactions involving appreciated property, as it determines whether gains can be deferred under California Revenue and Taxation Code Section 24465.

When should I use the California 3725 form?

You should use the California 3725 form if your corporation transferred appreciated properties to an insurance company subsidiary on or after June 23, 2004. If no appreciated properties were transferred, you do not need to complete this form. Additionally, the form must be attached to either Form 100 or Form 100W when filing your taxes.

What information is required on the form?

The form requires several pieces of information, including:

- The name and identification numbers (California corporation number and FEIN) of both the parent corporation and the insurance company subsidiary.

- A description of the properties transferred, their fair market value at the time of transfer, and the cost or adjusted basis of those properties.

- Details regarding whether the insurance company is actively using the transferred assets in its business.

What happens if the insurance company no longer uses the transferred assets?

If the insurance company stops using the transferred assets in its active trade or business, the gain on those assets becomes taxable. The form requires you to report this gain, as it can affect your overall tax liability. It is crucial to keep accurate records of how and when the assets are used or disposed of to ensure compliance.

How do I report capital gains or losses on the form?

Capital gains or losses are reported in two sections of the form, depending on how long the assets were held:

- Short-term capital gains and losses apply to assets held for one year or less.

- Long-term capital gains and losses apply to assets held for more than one year.

For each section, you will need to provide details such as the description of the property, date of disposal, fair market value, and cost or other basis. The final gain or loss is calculated by subtracting the cost from the fair market value or gross sales price.

What if the insurance company sells the assets to another company?

If the insurance company sells the assets to another company within the combined reporting group, the gain from that sale is considered non-taxable. However, if the sale occurs outside the group, the gain may be taxable. It is essential to accurately document these transactions to determine the tax implications correctly.

Are there any special instructions for filling out the form?

Yes, there are specific line instructions that must be followed. For instance, when describing the properties transferred, you should provide detailed information about each asset. Additionally, ensure that you enter the fair market value accurately and calculate the adjusted basis correctly. Failure to follow these instructions can lead to issues with your tax filings.

Where can I find additional resources or help regarding the California 3725 form?

Additional resources can be found on the California Franchise Tax Board's website. They provide detailed instructions, FAQs, and contact information for assistance. Consulting with a tax professional is also advisable if you have specific questions or complex situations regarding the form.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | This form tracks assets transferred from a parent corporation to an insurance company subsidiary and calculates capital gains or losses. |

| Governing Law | California Revenue and Taxation Code (R&TC) Section 24465 governs the deferral of capital gains when appreciated property is transferred. |

| Eligibility | Only corporations transferring appreciated properties to insurance subsidiaries after June 23, 2004, must use this form. |

| Sections | The form consists of two main parts: assets transferred from the parent corporation and assets transferred from the insurance company. |

| Deferred Gains | If the insurance company uses the transferred assets in its business, gains may be deferred. If not, gains become taxable. |

| Reporting Requirements | Short-term and long-term capital gains must be reported on Form 100 or Form 100W, with specific lines designated for this purpose. |

Dos and Don'ts

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the parent corporation and the insurance company.

- Do ensure that you indicate whether appreciated properties were transferred.

- Do complete all relevant sections if the answer to the initial questions is "Yes."

- Do use additional sheets if necessary to provide complete information.

- Don't leave any required fields blank; all sections must be filled out as applicable.

- Don't submit the form without double-checking the figures and descriptions provided.

- Don't forget to attach the form to Form 100 or Form 100W as required.

- Don't assume that previous years' information is still valid; verify all data.

- Don't ignore deadlines for submission to avoid penalties or complications.

Misconceptions

Misconceptions about the California 3725 form can lead to confusion for those involved in asset transfers between parent corporations and insurance company subsidiaries. Here are ten common misconceptions:

- Only large corporations need to file this form. This form is required for any parent corporation transferring assets to an insurance company subsidiary, regardless of size.

- All asset transfers are taxable. If the assets are used in the active conduct of the insurer's trade or business, the gain may be deferred.

- Filing the form is optional. Completing the California 3725 form is mandatory if assets are transferred and specific conditions are met.

- Only appreciated properties need to be reported. The form must be completed for all assets transferred, regardless of whether they are appreciated or depreciated.

- The form is only for transfers made after 2004. While the rules apply to transfers after June 23, 2004, earlier transfers may still need to be reported based on specific circumstances.

- All information can be estimated. Accurate descriptions, fair market values, and costs must be provided; estimates are not acceptable.

- Only gains need to be reported. Both gains and losses from asset transfers must be documented on the form.

- Once filed, the form cannot be amended. If errors are found, the form can be amended by following the proper procedures set by the California Franchise Tax Board.

- The form is the same for all types of assets. Different types of assets may require specific information or additional documentation.

- Completing the form guarantees no tax liability. While the form may defer gains, it does not eliminate potential tax liabilities upon future asset dispositions.

Documents used along the form

The California 3725 form is essential for tracking assets transferred from a parent corporation to its insurance company subsidiary. It helps determine capital gains or losses arising from these transactions. When filing this form, there are several other documents that may be required to ensure compliance with California tax regulations. Below is a list of these documents, each serving a specific purpose in the reporting process.

- Form 100: This is the California Corporation Franchise or Income Tax Return. Corporations use it to report their income, calculate their tax liability, and claim any applicable credits or deductions.

- Form 100W: This form is specifically for corporations that qualify as a water's-edge filer. It is similar to Form 100 but includes different provisions for income earned outside the United States.

- Schedule D: Attached to Form 100 or 100W, this schedule is used to report capital gains and losses from the sale of assets, including those reported on the California 3725 form.

- Form 565: This is the Partnership Return of Income. It is used by partnerships to report their income, deductions, and credits, and may be relevant if the parent corporation is part of a partnership structure.

- Form 568: This form is the Limited Liability Company Return of Income. It is used by LLCs to report their income and calculate their tax liability, which may be pertinent if the insurance company subsidiary is structured as an LLC.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It may be necessary if the parent corporation or subsidiary has engaged in transactions requiring reporting of payments to independent contractors or other entities.

- Form 8832: This is the Entity Classification Election form. If the insurance company subsidiary has elected to be treated as a corporation for tax purposes, this form is required to formalize that election.

- FTB Publication 1060: This publication provides guidance on California corporate tax issues, including asset transfers and capital gains. It is a helpful resource for understanding the implications of transactions reported on the California 3725 form.

- FTB Form 541: This is the California Fiduciary Income Tax Return. If the parent corporation or the insurance company subsidiary is part of a trust or estate, this form may be required for reporting income and gains.

In summary, the California 3725 form plays a critical role in the reporting of asset transfers between corporations and their insurance subsidiaries. To ensure a comprehensive understanding of tax obligations, it is essential to be aware of the various forms and documents that may accompany it. Each of these documents serves a unique function in the broader context of corporate tax compliance in California.

Different PDF Templates

How to Collect a Judgement From a Person - Information regarding asset disclosure from judgment debtors is provided.

Ihss Autism - Ensuring all applicable sections are filled out can expedite the review process.

California Tax Forms - It is important to keep copies of all parts of the form throughout the legal process.