Download California 3800 Form

Common Questions

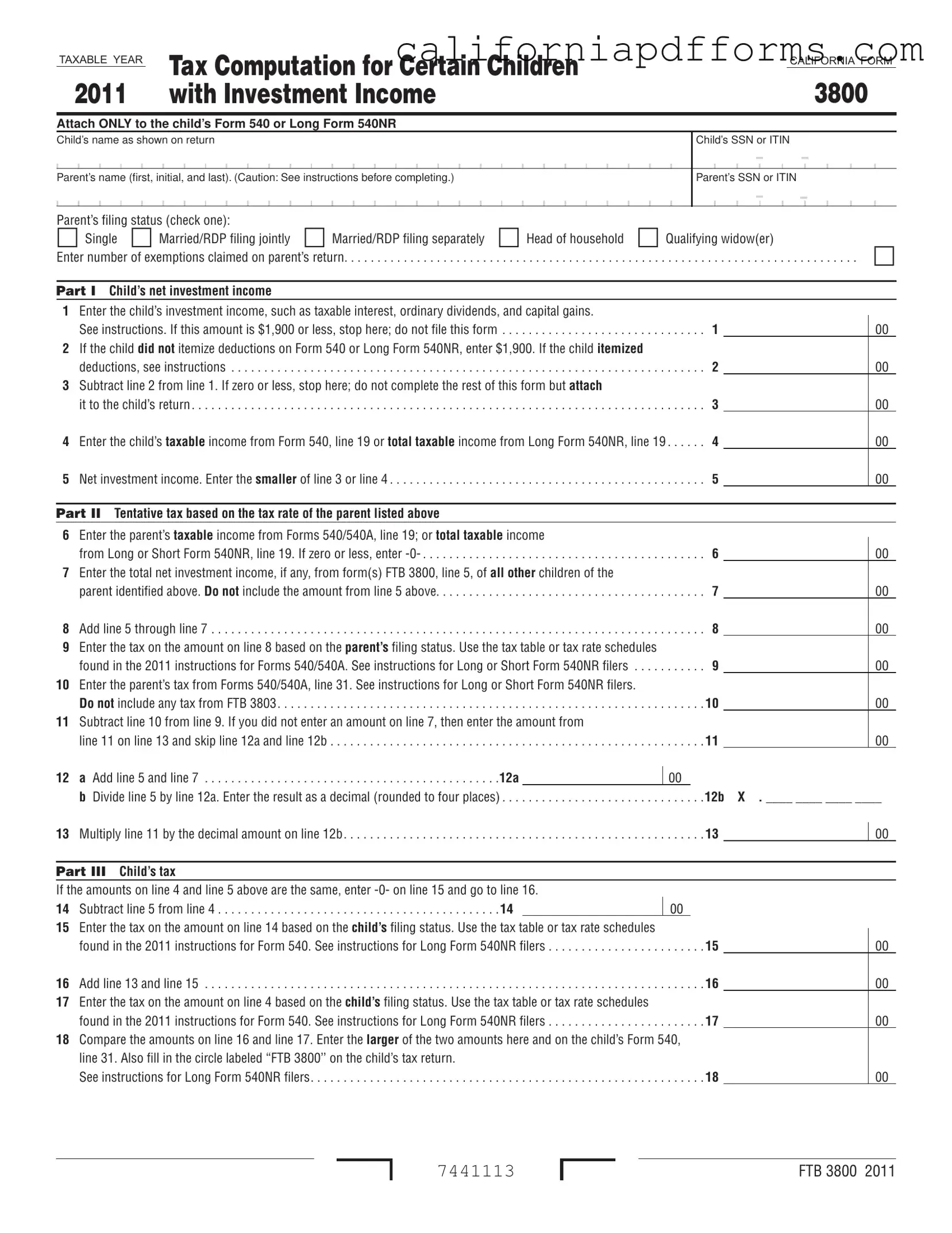

What is the purpose of California Form 3800?

California Form 3800 is used to calculate the tax for certain children with investment income. If a child under 18 or a student under 24 has investment income exceeding $1,900, this form helps determine the tax based on the parent's tax rate. The purpose is to ensure that the child's investment income is taxed appropriately, especially if the parent's tax rate is higher than the child's.

Who needs to file Form 3800?

Form 3800 must be filed if the following conditions are met:

- The child is 18 years old or younger, or a student under 24 at the end of the taxable year.

- The child has investment income taxable by California that exceeds $1,900.

- At least one parent was alive at the end of the taxable year.

If these conditions apply, the form should be attached to the child's Form 540 or Long Form 540NR.

How do I calculate the child's net investment income?

To determine the child's net investment income, start by entering the total investment income on line 1 of Form 3800. This includes taxable interest, dividends, capital gains, and other investment-related income. If the child did not itemize deductions, enter $1,900 on line 2. Then, subtract line 2 from line 1. If the result is zero or less, stop here. If not, proceed to calculate the taxable income and complete the form accordingly.

What happens if the child's investment income is $1,900 or less?

If the child's investment income is $1,900 or less, you do not need to file Form 3800. Simply stop there. The child will not incur any additional tax liability related to their investment income for that year. However, you must still report the income on the child's tax return.

Can parents elect to report their child's investment income on their own tax return?

Yes, parents can elect to report their child's investment income on their own tax return if the child has only interest and dividends as income. This election can simplify the filing process for the child, as they will not need to file a California tax return or Form 3800. However, if estimated tax payments were made in the child's name, this election is not available. Make sure to check the specific instructions and guidelines to ensure compliance.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Form 3800 is used to calculate the tax on investment income for children under 19 or students under 24, ensuring that income over $1,900 is taxed at the parent's rate if higher. |

| Eligibility | To use Form 3800, the child must be 18 or younger, or a student under 24, have taxable investment income exceeding $1,900, and at least one parent must be alive at the end of the tax year. |

| Filing Requirement | This form must be attached to the child's Form 540 or Long Form 540NR when filing taxes in California. |

| Governing Laws | The form adheres to the California Revenue and Taxation Code and conforms to the provisions of the Internal Revenue Code as of January 1, 2009. |

| Investment Income | Investment income includes taxable interest, ordinary dividends, capital gains, and other income types. If the child's income is $1,900 or less, Form 3800 is not required. |

| Tax Calculation | The tentative tax is calculated based on the parent's taxable income and the total net investment income from all children, using tax tables or schedules specific to the parent's filing status. |

Dos and Don'ts

Things to Do:

- Ensure the child’s name and Social Security Number (SSN) are accurate on the form.

- Attach the form only to the child’s Form 540 or Long Form 540NR.

- Enter the child’s investment income correctly, including only taxable amounts by California law.

- Check the parent’s filing status and use the correct tax rate based on that status.

- Complete all relevant sections of the form to avoid delays in processing.

- Review the instructions thoroughly before submitting the form.

Things Not to Do:

- Do not file the form if the child’s investment income is $1,900 or less.

- Avoid using outdated forms or instructions from previous years.

- Do not include any tax amounts from form FTB 3803 on this form.

- Do not leave any required fields blank; this may lead to processing issues.

- Do not submit the form without verifying all calculations for accuracy.

- Do not forget to mark the “FTB 3800” circle on the child’s tax return.

Misconceptions

Misconceptions about the California 3800 Form

- Only wealthy families need to file the form. Many believe that the California 3800 form is only for children from affluent families. In reality, any child with investment income exceeding $1,900 must file this form, regardless of their family's overall financial situation.

- The form is only for children under 18. Some people think that the California 3800 form applies only to minors. However, it also applies to students under the age of 24, provided they meet the other criteria outlined in the instructions.

- Filing the form is optional if the child has investment income. There is a misconception that filing the California 3800 form is a choice. In fact, if a child's investment income exceeds $1,900, filing the form is necessary to ensure proper tax computation based on the parent's tax rate.

- The form is complicated and not worth the effort. Many parents may feel overwhelmed by the form's complexity. While it may seem daunting, the California 3800 form is a straightforward tool designed to ensure that children's investment income is taxed appropriately. Completing it can ultimately save families money.

Documents used along the form

The California Form 3800 is essential for calculating the tax on certain children's investment income. However, it is often accompanied by other forms and documents that help clarify the tax situation for both the child and the parent. Understanding these documents can streamline the filing process and ensure compliance with California tax laws.

- Form 540: This is the California Resident Income Tax Return. Parents must file this form if they are reporting their child's income, especially when using Form 3800. It details the overall income, deductions, and tax liability of the parent.

- Form 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return. If the parent or child does not reside in California for the entire year, this form is necessary. It captures income earned while in California and is crucial for non-residents or part-year residents.

- Form FTB 3803: This form allows parents to elect to report their child's interest and dividends on their own tax return. If parents choose this option, it can simplify their tax filing, as the child will not need to file a return or use Form 3800.

- Schedule CA (540 or 540NR): This schedule is used to adjust income and deductions from federal tax returns to meet California tax requirements. It is important for parents to ensure that the child's income is accurately reported according to California law.

Filing taxes can be complex, especially when it involves children with investment income. By utilizing the appropriate forms and understanding their purposes, parents can navigate the tax landscape more effectively. Each document plays a vital role in ensuring accurate reporting and compliance with California tax regulations.

Different PDF Templates

How to Report an Attorney to the Bar - Describe the nature of your complaint plainly and completely.

Secured Promissory Note - Each installment payment contributes to reducing the principal owed.