Download California 3803 Form

Common Questions

-

What is the purpose of California Form 3803?

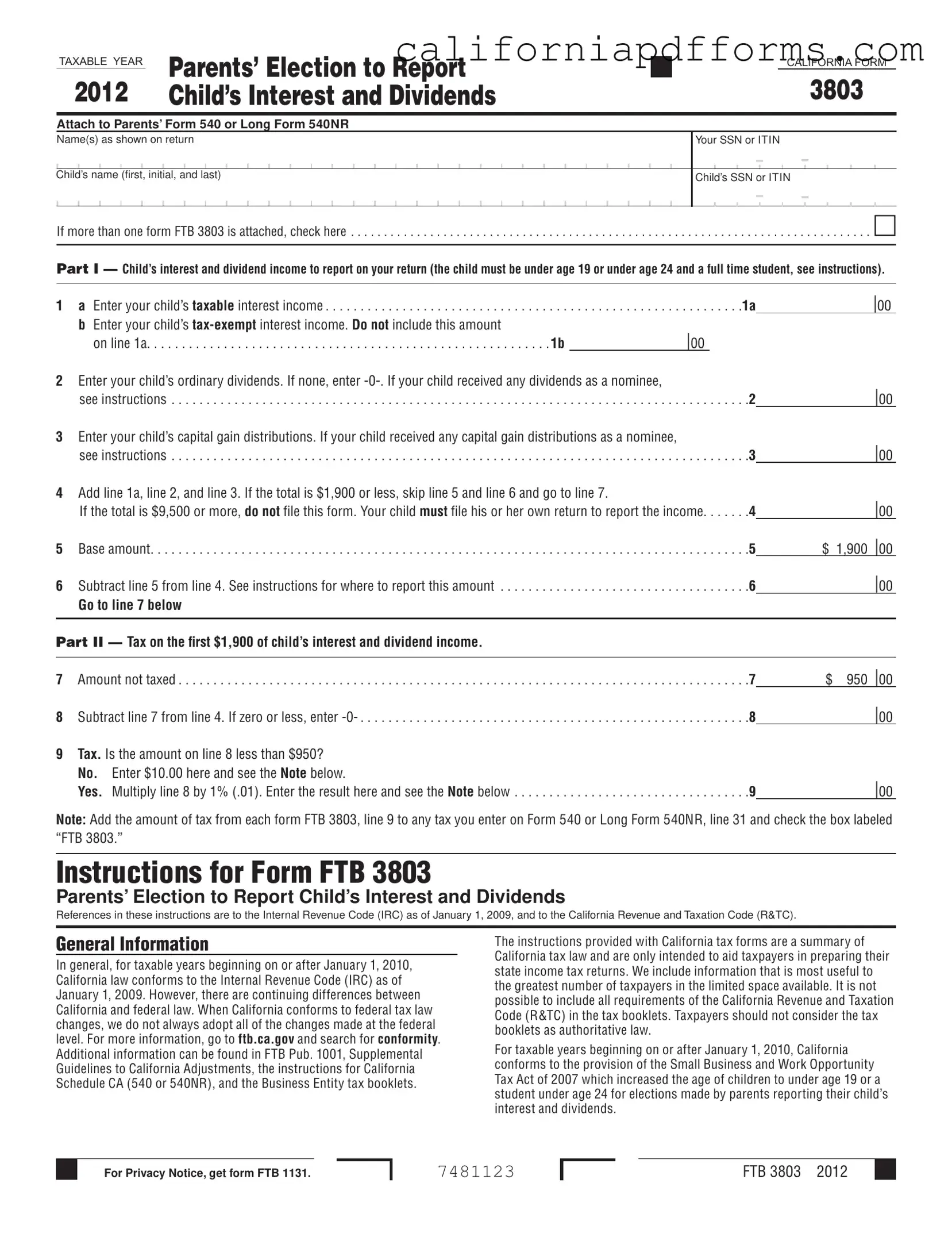

California Form 3803, also known as the Parents’ Election to Report Child’s Interest and Dividends, allows parents to report their child’s interest and dividend income on their own tax return. This election can simplify the tax filing process for families, as it enables the child to avoid filing a separate tax return if certain criteria are met. The child must be under age 19 or under age 24 and a full-time student, and the income must come solely from interest and dividends.

-

Who qualifies to make the election on Form 3803?

Parents can qualify to make this election if they file Form 540 or Long Form 540NR. Additionally, at least one of the following conditions must apply:

- The parents are married or in a registered domestic partnership and file a joint return.

- The parents are married or in a registered domestic partnership but file separate returns, with one parent having the higher taxable income.

- One parent is unmarried or treated as unmarried for tax purposes, has custody of the child, and has the higher taxable income.

These qualifications ensure that the election is made by the appropriate parent based on custody and income considerations.

-

What are the income limits for a child to be eligible for this election?

For a child to be eligible for the election on Form 3803, their gross income from interest and dividends must be less than $9,500 for the tax year. If the total income exceeds this amount, the child is required to file their own tax return. Additionally, the child must not have made any estimated tax payments or had state income tax withheld from their income.

-

How do parents complete Form 3803?

To complete Form 3803, parents must fill out the relevant sections that detail the child's interest and dividend income. This includes reporting taxable interest income, tax-exempt interest income, ordinary dividends, and capital gain distributions. After completing the form, it must be attached to the parents' Form 540 or Long Form 540NR when filing their tax return. Each child for whom the election is made requires a separate Form 3803.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | Form 3803 allows parents to report their child's interest and dividends on their California income tax return, avoiding the need for the child to file a separate return. |

| Eligibility Criteria | To use this form, the child must be under 19 or under 24 and a full-time student, have income only from interest and dividends, and meet specific income thresholds. |

| Income Limits | The child’s total income must be less than $9,500 for the year. If it exceeds this amount, the child must file their own tax return. |

| Tax Calculation | For the first $1,900 of the child's interest and dividend income, there is a specific tax calculation. If the amount is less than $950, a flat tax of $10 applies; otherwise, a 1% tax rate is used. |

| Filing Requirements | Parents must attach Form 3803 to their Form 540 or Long Form 540NR when filing their tax return. Each child requires a separate form. |

| Governing Laws | This form is governed by the California Revenue and Taxation Code (R&TC) and conforms to the Internal Revenue Code (IRC) as of January 1, 2009. |

| Registered Domestic Partners | For California tax purposes, references to spouses also include registered domestic partners, allowing them to report their child's income similarly. |

Dos and Don'ts

When filling out the California 3803 form, here are five things you should do:

- Ensure your child qualifies: Confirm that your child is under age 19 or a full-time student under age 24.

- Accurately report income: Include all taxable interest, tax-exempt interest, ordinary dividends, and capital gain distributions your child received.

- Use the correct form: Attach the completed FTB 3803 to your Form 540 or Long Form 540NR.

- Check for nominee distributions: If your child received income as a nominee, note this clearly on the form.

- File on time: Submit your return by the due date, including any extensions, to avoid penalties.

Conversely, here are five things you shouldn't do:

- Do not include deductions: You cannot reduce your child's income by any deductions they may claim on their own return.

- Avoid incorrect information: Do not provide inaccurate Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs).

- Don't forget to check eligibility: Ensure that you meet the qualifications as a parent to make this election.

- Refrain from filing multiple forms for one child: File a separate FTB 3803 for each child whose income you report.

- Do not ignore instructions: Follow all instructions provided with the form to ensure proper completion.

Misconceptions

Misconceptions about the California 3803 form can lead to confusion for parents trying to report their child's interest and dividends. Here are five common misconceptions:

- Only parents can report child income. While parents typically report their child's income, guardians or custodians can also file the form if they meet the requirements.

- Children must file their own tax returns if they have income. If parents elect to report the child's income using Form 3803, the child does not need to file a separate return, provided all conditions are met.

- All types of income can be reported. Only interest and dividend income can be reported on this form. Other types of income, like wages or business income, must be reported on the child's own tax return.

- The form is only for children under 18. The eligibility extends to children under age 19 or full-time students under age 24. This provides flexibility for families with older students.

- Filing this form guarantees a tax benefit. There is no guarantee of a tax benefit. Parents should assess their overall tax situation, as the child’s income may impact the parents' tax liability.

Documents used along the form

The California Form 3803 is essential for parents who wish to report their child's interest and dividend income on their own tax returns. However, several other forms and documents may accompany this form to ensure proper reporting and compliance with tax laws. Below are some commonly used forms and documents related to Form 3803.

- Form 540: This is the California Resident Income Tax Return. Parents use it to report their income, including any income reported from their child's Form 3803. It serves as the primary tax return for California residents.

- Form 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return. If parents are nonresidents or only lived in California for part of the year, they will use this form to report their income and any income from their child's Form 3803.

- Form 8814: This is the Parents' Election to Report Child's Interest and Dividends for federal tax purposes. While it is not required for California tax, it provides guidance on how to report a child's income on the federal return and may help clarify the process for parents.

- Schedule CA (540 or 540NR): This schedule is used to make adjustments to federal income when filing California taxes. Parents may need to include adjustments related to the income reported from their child's Form 3803.

Using these forms together helps ensure accurate reporting of income and compliance with tax obligations. It's important to understand how each document fits into the overall tax filing process to avoid any issues with the California Franchise Tax Board.

Different PDF Templates

Does California Allow Section 179 Depreciation - Utilizing this form accurately can enhance a corporation's financial management strategies.

Who Fills Out California Form 593 - Understanding this form can save sellers substantial amounts in withholding taxes.