Download California 3805Z Form

Common Questions

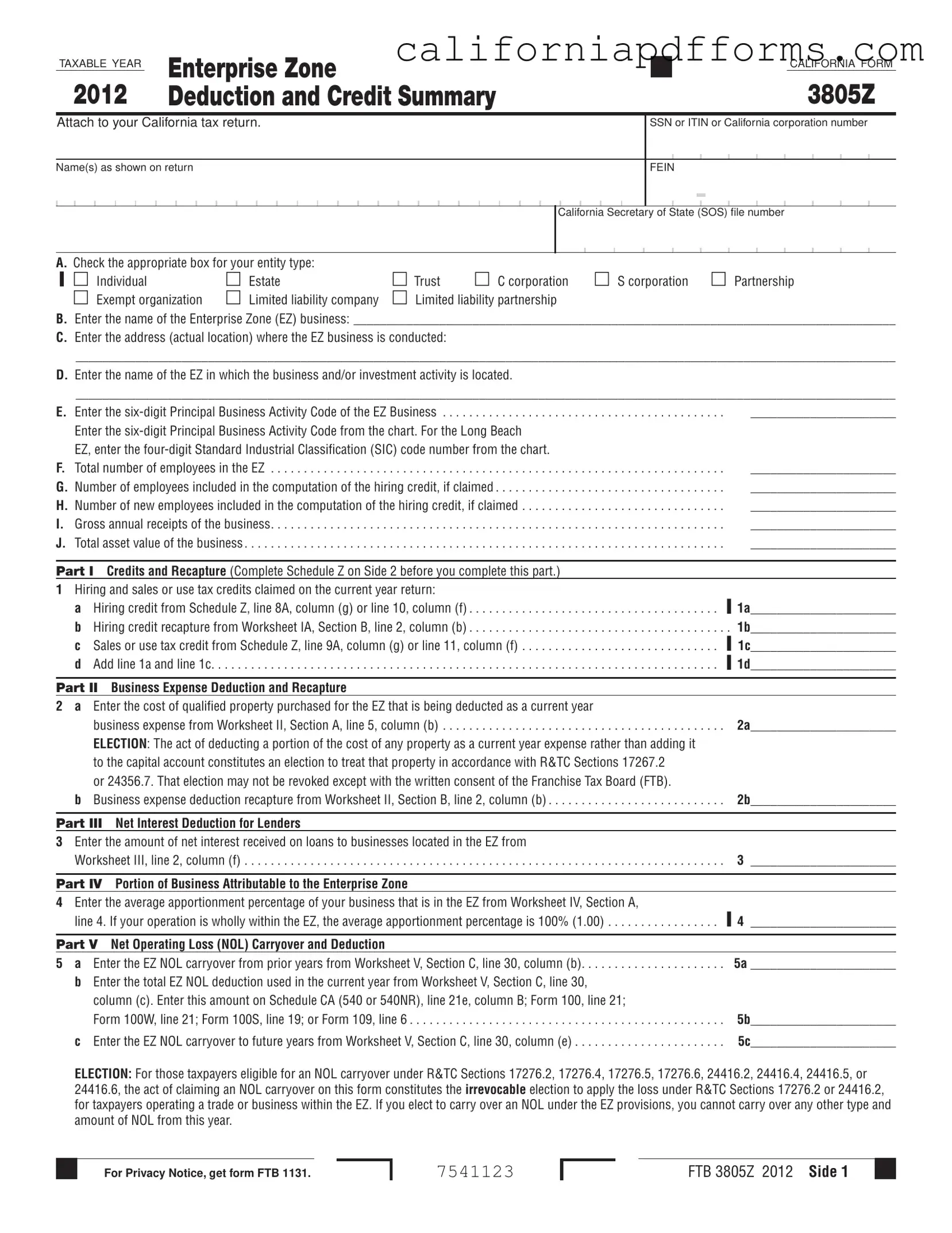

What is the California 3805Z form?

The California 3805Z form is a tax document used by businesses operating in designated Enterprise Zones within California. It allows eligible businesses to claim various deductions and credits related to their operations, such as hiring credits and sales or use tax credits. This form must be attached to the California tax return for the taxable year in which the deductions or credits are claimed.

Who needs to file the 3805Z form?

Any business entity that operates in an Enterprise Zone and wishes to claim related tax benefits must file the 3805Z form. This includes individuals, corporations (both C and S), partnerships, estates, trusts, limited liability companies, and exempt organizations. Each entity type has specific requirements for completing the form, so it is important to check the instructions based on the entity type.

What information is required on the 3805Z form?

The form requires various pieces of information, including:

- The name and address of the Enterprise Zone business.

- The Principal Business Activity Code, which classifies the type of business.

- The total number of employees and those included in the hiring credit computation.

- Gross annual receipts and total asset value of the business.

Additionally, businesses must complete several sections related to credits, deductions, and net operating loss carryovers.

How do businesses calculate the hiring credit?

To calculate the hiring credit, businesses must determine the number of new employees hired within the Enterprise Zone and the associated wages. This information is then entered into the appropriate sections of the 3805Z form. The hiring credit is based on the total wages paid to these new employees, and specific calculations must be completed as outlined in the form’s instructions.

What happens if a business does not file the 3805Z form?

If a business fails to file the 3805Z form when eligible, it will not be able to claim the deductions and credits associated with operating in an Enterprise Zone. This could result in a higher tax liability than necessary. It is important for businesses to be aware of their eligibility and to file the form in a timely manner to take full advantage of the available tax benefits.

Where can businesses find additional information or assistance with the 3805Z form?

Businesses can find additional information about the 3805Z form by visiting the California Franchise Tax Board's website. The website provides detailed instructions, FAQs, and resources to help businesses understand the form and its requirements. For personalized assistance, consulting with a tax professional or accountant who is familiar with California tax laws and Enterprise Zone benefits is also advisable.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California Form 3805Z is used to summarize deductions and credits for businesses operating in designated Enterprise Zones. |

| Eligibility | Businesses must be located in an Enterprise Zone to qualify for the deductions and credits outlined in this form. |

| Entity Types | The form accommodates various entity types, including individuals, corporations, partnerships, and limited liability companies. |

| Filing Requirement | Form 3805Z must be attached to the California tax return when claiming Enterprise Zone credits and deductions. |

| Principal Business Activity Code | Businesses must provide a six-digit Principal Business Activity Code, which identifies their primary business operations. |

| Governing Law | The form is governed by the California Revenue and Taxation Code, specifically Sections 17267.2 and 24416.2, among others. |

| Net Operating Loss (NOL) Provisions | Taxpayers can elect to carry over Net Operating Losses under specific provisions, impacting future tax liabilities. |

Dos and Don'ts

When filling out the California 3805Z form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do: Carefully read the instructions provided with the form to understand each section and requirement.

- Do: Ensure that all information entered, such as your name, address, and entity type, is accurate and matches your tax return.

- Do: Double-check the Principal Business Activity Code to ensure it aligns with the business activities you are reporting.

- Do: Include all necessary attachments, such as supporting documents for credits and deductions claimed.

- Do: Keep a copy of the completed form for your records after submission.

- Don’t: Leave any required fields blank; incomplete forms may delay processing or result in rejection.

- Don’t: Use outdated information; always refer to the most current version of the form and instructions.

- Don’t: Attempt to claim deductions or credits that you do not qualify for, as this can lead to penalties.

- Don’t: Forget to sign and date the form before submitting it, as an unsigned form is considered invalid.

- Don’t: Ignore deadlines for submission; timely filing is crucial to avoid late fees or loss of credits.

Misconceptions

Misconception 1: The 3805Z form is only for large corporations.

This form is applicable to various entity types, including individuals, estates, trusts, partnerships, and exempt organizations. Small businesses can also benefit from the deductions and credits available through this form.

Misconception 2: You must be located in an Enterprise Zone to use the 3805Z form.

While the form is designed for businesses operating within designated Enterprise Zones, it is not limited to those locations. Businesses can claim certain credits and deductions even if they have investments or activities in multiple areas.

Misconception 3: The 3805Z form is optional for all businesses.

Filing the 3805Z form is necessary if you want to claim specific tax credits or deductions related to your business activities in an Enterprise Zone. Not filing could mean missing out on significant tax benefits.

Misconception 4: You can change your election after filing the 3805Z form.

Once you elect to treat certain property as a current year expense, this decision cannot be revoked without written consent from the Franchise Tax Board. It’s important to understand the implications before making this election.

Misconception 5: The 3805Z form is only relevant for tax credits.

While many focus on the credits, the form also addresses business expense deductions and net operating loss carryovers. Understanding all sections can maximize your potential tax benefits.

Documents used along the form

The California 3805Z form is an essential document for businesses operating in designated Enterprise Zones. This form helps businesses claim various tax credits and deductions, aimed at encouraging economic growth in these areas. Alongside the 3805Z, several other forms and documents may be necessary to ensure compliance and maximize benefits. Below is a list of common forms that are often used in conjunction with the California 3805Z form.

- Form 540: This is the California Resident Income Tax Return. Individuals use it to report their income, claim deductions, and calculate their state tax liability.

- Form 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return. It is designed for individuals who do not reside in California for the entire year but have income sourced from the state.

- Form 100: Corporations use this form to report their California corporate income tax. It includes details about the corporation's income, deductions, and credits.

- Form 100S: This form is specifically for S corporations to report income, deductions, and credits. It allows S corporations to pass income directly to shareholders for tax purposes.

- Form 541: This is the California Fiduciary Income Tax Return. Trusts and estates use this form to report income and calculate taxes owed on behalf of beneficiaries.

- Form 100W: This is the California Corporation Franchise or Income Tax Return for Water's Edge corporations. It is used by corporations that elect to file under the Water's Edge method.

- Form FTB 3544: This form is used to report and claim the Enterprise Zone hiring credit. It provides detailed information on eligible employees and wages paid.

- Form FTB 1131: This is the Privacy Notice form. It informs taxpayers about the collection and use of their personal information by the Franchise Tax Board.

- Worksheets (I, II, III, IV, V): These worksheets assist in calculating various deductions and credits related to the Enterprise Zone. They provide detailed guidance on how to report specific financial information.

Understanding these forms and documents is crucial for businesses seeking to leverage the benefits of the Enterprise Zone program in California. Each form plays a significant role in ensuring compliance and maximizing potential tax savings. Properly completing and submitting these forms can lead to substantial financial advantages for eligible businesses.

Different PDF Templates

California 1296 32 - Judicial officers use the form to confirm decisions made during hearings related to child support cases.

Proof of Social Security Number Without Card - It ensures clients have the required Social Security number for benefits.

Conservatorship California Forms - Each section aims to be comprehensive for the court's understanding of the situation.