Download California 3832 Form

Common Questions

-

What is the purpose of the California 3832 form?

The California 3832 form is used by limited liability companies (LLCs) that have one or more nonresident members. This form allows nonresident members to consent to California's jurisdiction for taxing their share of the LLC's income that is sourced from California. It must be attached to Form 568 when filing and a copy should be provided to each nonresident member.

-

Who needs to sign the California 3832 form?

All nonresident members of the LLC must sign the form. If a nonresident member has a spouse or registered domestic partner (RDP), that individual must also sign the form. This ensures that the state can tax the distributive share of income attributable to California sources for all relevant parties.

-

When should the California 3832 form be filed?

The form should be filed during the first taxable period for which the LLC has nonresident members. Additionally, it should be filed for any taxable period in which the LLC had a nonresident member who did not sign the form. This ensures compliance with California tax regulations for all applicable periods.

-

What information is required on the California 3832 form?

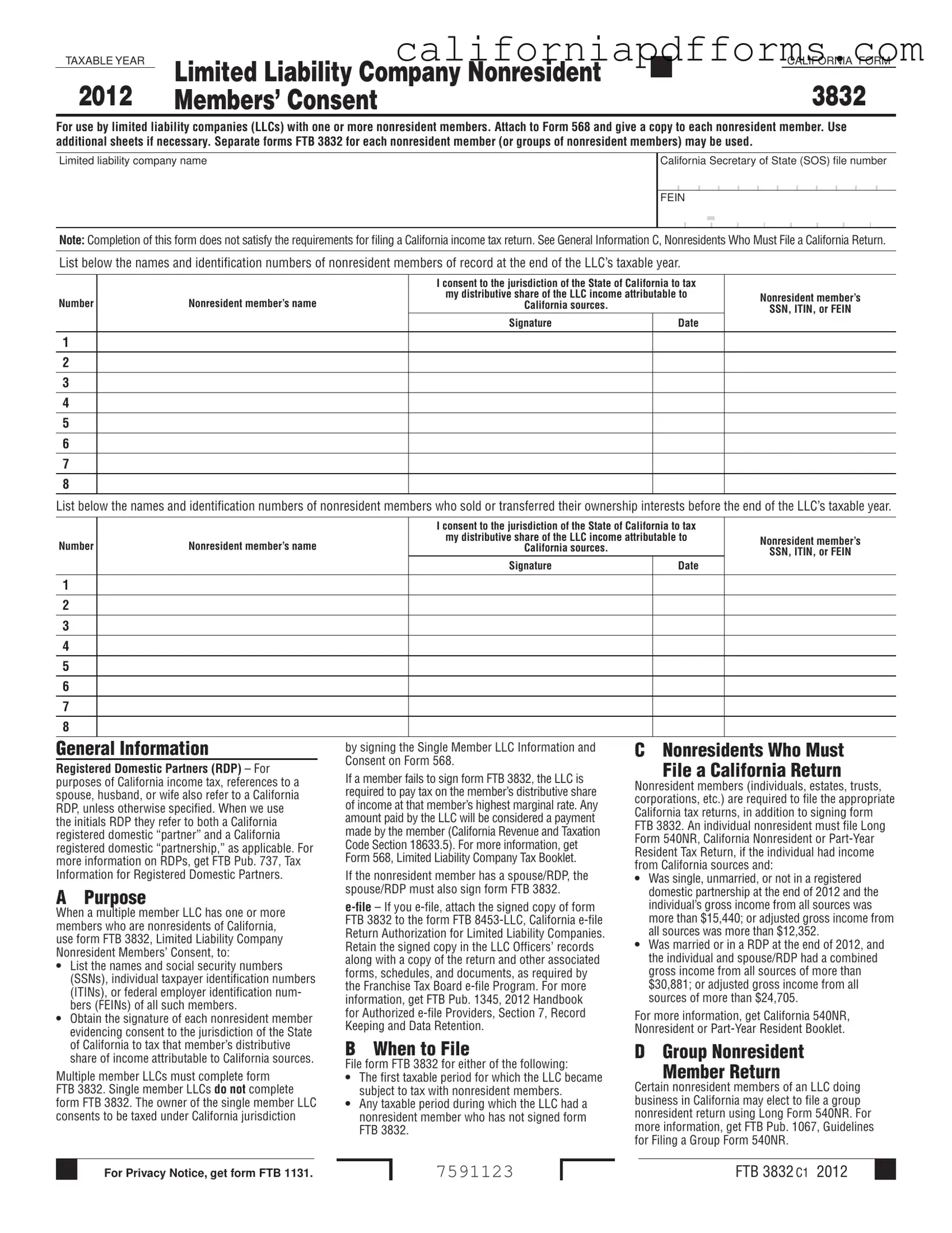

The form requires the following information:

- The name of the limited liability company

- The California Secretary of State (SOS) file number

- The Federal Employer Identification Number (FEIN)

- The names and identification numbers (SSNs, ITINs, or FEINs) of all nonresident members

- Signatures and dates from each nonresident member consenting to California's jurisdiction

-

What happens if a nonresident member does not sign the California 3832 form?

If a nonresident member fails to sign the form, the LLC will be required to pay tax on that member's distributive share of income at the member's highest marginal rate. This may result in additional tax liabilities for the LLC.

-

Is the California 3832 form sufficient for filing taxes?

No, completing the California 3832 form does not fulfill the requirements for filing a California income tax return. Nonresident members must still file the appropriate California tax returns, such as Form 540NR, if they have income from California sources.

-

Where can I find more information about the California 3832 form?

Additional information can be found in the California Limited Liability Company Tax Booklet and the Franchise Tax Board's publications, such as FTB Pub. 737 for registered domestic partners and FTB Pub. 1067 for group nonresident returns. These resources provide further guidance on filing and compliance requirements.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Purpose | The California 3832 form is used by limited liability companies (LLCs) with nonresident members to obtain consent for California to tax their distributive share of income. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 18633.5, which outlines the tax obligations of nonresident members. |

| Attachment Requirement | LLCs must attach the FTB 3832 form to Form 568, California Limited Liability Company Return of Income. |

| Signature Requirement | Each nonresident member must sign the form to consent to California's jurisdiction over their distributive share of income. |

| Filing Timeline | The form must be filed for the first taxable period when the LLC had nonresident members or during any period when a nonresident member has not signed the form. |

| Nonresident Member Identification | The form requires the names and identification numbers (SSNs, ITINs, or FEINs) of all nonresident members at the end of the LLC's taxable year. |

| Single Member LLCs | Single member LLCs do not need to complete form FTB 3832, as the owner consents to tax jurisdiction by default. |

| Group Filing Option | Nonresident members of an LLC can elect to file a group nonresident return using Long Form 540NR if they choose. |

Dos and Don'ts

When filling out the California 3832 form, it is essential to approach the task with care. Below is a list of things you should and shouldn't do to ensure the process is smooth and compliant.

- Do ensure that you have the correct form for the specific taxable year.

- Do list all nonresident members accurately, including their identification numbers.

- Do obtain signatures from all nonresident members to confirm their consent.

- Do attach the completed form to Form 568 and provide copies to each nonresident member.

- Don't forget to retain a signed copy of the form for the LLC's records.

- Don't leave any required fields blank, as this may delay processing.

- Don't assume that signing this form fulfills all California tax filing obligations.

Misconceptions

Misconceptions about the California 3832 form can lead to confusion for limited liability companies (LLCs) and their nonresident members. Here are five common misconceptions, clarified for better understanding:

- Completion of Form 3832 eliminates the need for filing a California income tax return. This is incorrect. Completing Form 3832 does not replace the requirement for nonresidents to file a California income tax return.

- Only single-member LLCs need to use Form 3832. This is misleading. Form 3832 is required for any multiple-member LLC that has nonresident members, while single-member LLCs do not complete this form.

- All nonresident members must sign Form 3832. This is not entirely true. Only nonresident members who have not signed the form are required to do so. If a member has already signed, they do not need to sign again.

- Form 3832 is only for individuals. This misconception overlooks that estates, trusts, and certain corporations can also be nonresident members and must adhere to the same requirements regarding the form.

- Filing Form 3832 guarantees tax benefits. This is a misunderstanding. Filing the form does not guarantee any specific tax benefits; it simply provides consent for California to tax the member's distributive share of income.

Documents used along the form

The California 3832 form is essential for limited liability companies (LLCs) with nonresident members. It helps ensure that the LLC complies with California tax laws by obtaining consent from nonresident members regarding the taxation of their distributive share of income. Alongside this form, several other documents are often required to complete the tax filing process effectively. Below are four key forms and documents that are commonly used in conjunction with the California 3832 form.

- Form 568: This is the Limited Liability Company Return of Income form. LLCs must file it annually to report income, deductions, and other tax-related information. It serves as the primary return for LLCs in California and must be filed regardless of whether the LLC has income or not.

- Form 540NR: The California Nonresident or Part-Year Resident Tax Return is necessary for individual nonresident members who have income from California sources. This form is used to report income and determine tax liability, ensuring compliance with California tax obligations.

- Form FTB 8453-LLC: This is the California e-file Return Authorization for Limited Liability Companies. When e-filing, this form must be attached to the e-filed return, confirming that the signatures of the nonresident members have been obtained and are valid.

- FTB Pub. 1067: This publication provides guidelines for filing a group nonresident return using Long Form 540NR. It outlines the eligibility criteria and procedures for nonresident members of an LLC who choose to file collectively, streamlining the tax process for multiple nonresidents.

Understanding these forms and documents is crucial for LLCs with nonresident members. Properly completing and submitting them helps avoid penalties and ensures compliance with California tax laws. Always consider consulting with a tax professional for personalized advice and guidance tailored to your specific situation.

Different PDF Templates

Ftb Form 3800 - If parents filed jointly, use the income of the parent listed first.

Simple Sales Contract - Information about the property must be precise and inclusive of legal descriptions.