Download California 3885 Form

Common Questions

What is the purpose of the California 3885 form?

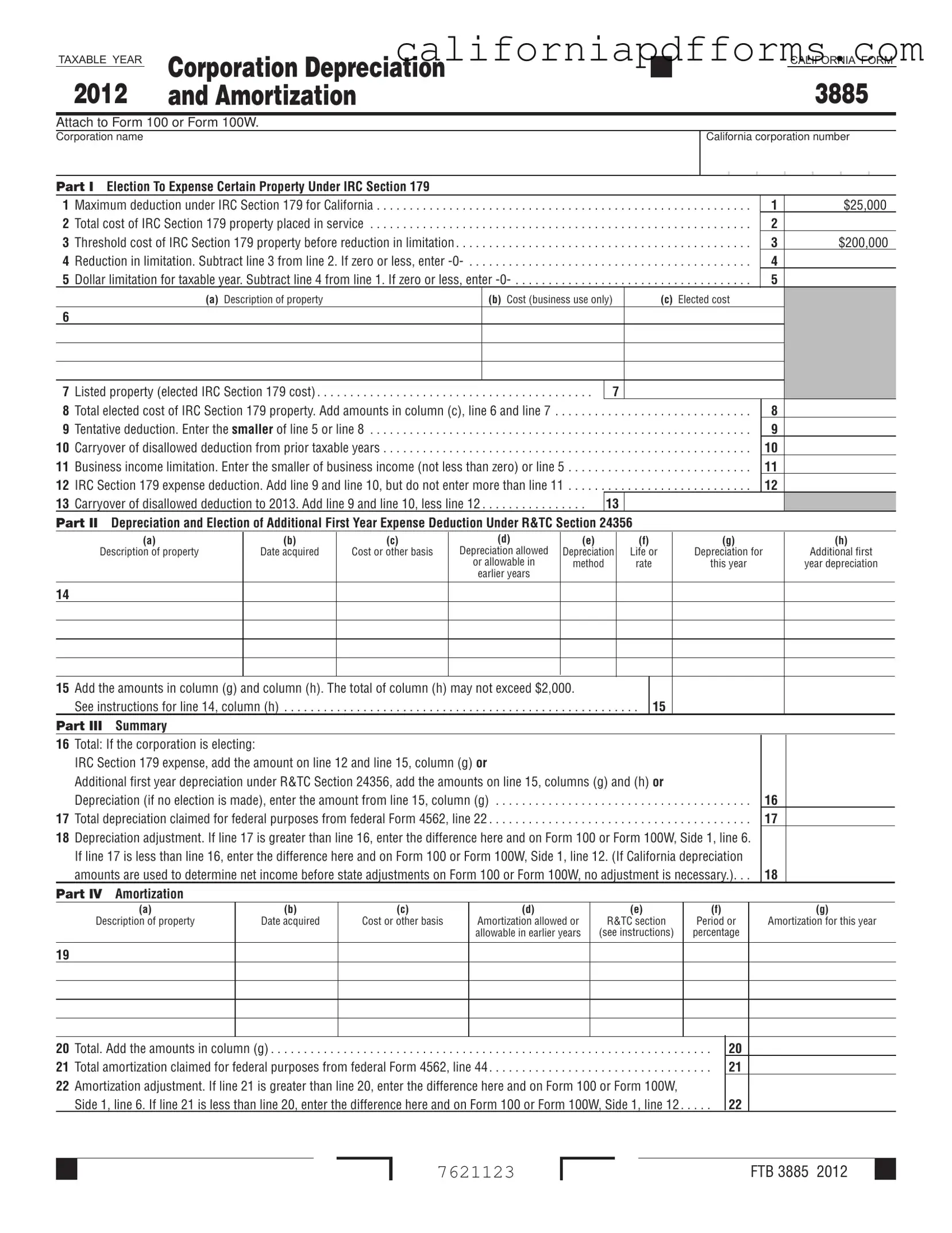

The California 3885 form is used by corporations to calculate depreciation and amortization deductions for state tax purposes. This form is essential for corporations, partnerships, and limited liability companies classified as corporations. It helps in determining how much of the cost of property can be deducted over time, reflecting the wear and tear of business assets.

Who needs to file the California 3885 form?

Any corporation operating in California that has depreciable property or intangible assets must file the California 3885 form. This includes standard corporations, S corporations, partnerships, and LLCs that are taxed as corporations. If your business has purchased property that qualifies for depreciation or amortization, you will need to complete this form.

What types of property can be included on the California 3885 form?

The form covers two main types of property: tangible and intangible. Tangible property includes physical assets like machinery, equipment, and vehicles. Intangible assets may include things like patents or trademarks. Specific rules apply to each type, so it’s important to understand what qualifies under California law.

What are the key differences between California and federal depreciation rules?

There are several important differences between California and federal depreciation rules. For instance, California has a lower maximum deduction limit under IRC Section 179, set at $25,000, compared to federal limits. Additionally, certain types of property may not qualify for deductions in California even if they do federally. It’s crucial to review these differences carefully to ensure compliance and maximize deductions.

How do I calculate the depreciation for my assets?

To calculate depreciation, you will typically use one of several methods: straight-line, declining balance, or sum-of-the-years-digits. Each method has its own formula and is suitable for different types of assets. The straight-line method spreads the cost evenly over the asset's useful life, while the declining balance method allows for larger deductions in the earlier years. You will need to choose the method that best fits your asset type and business needs.

Can I amend my California 3885 form after filing?

Yes, you can amend your California 3885 form if you discover errors or omissions after filing. To do this, you will need to submit an amended return along with the corrected form. Keep in mind that amendments may affect your overall tax liability, so it’s advisable to consult with a tax professional to ensure that all changes are properly documented and submitted.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Form 3885 is used by corporations to calculate depreciation and amortization deductions for tax purposes. |

| Governing Laws | This form is governed by the California Revenue and Taxation Code (R&TC) and conforms to the Internal Revenue Code (IRC) as of January 1, 2009. |

| IRC Section 179 | Corporations can elect to expense certain property under IRC Section 179, with a maximum deduction of $25,000, subject to limitations based on the cost of the property placed in service. |

| Depreciation Methods | Corporations may use various depreciation methods, including straight-line and declining balance, as outlined in R&TC Sections 24349 through 24354. |

| Amortization Rules | California law allows for the amortization of certain intangible assets over a 15-year period, in accordance with IRC Section 197. |

Dos and Don'ts

When filling out the California 3885 form, it is important to follow certain guidelines to ensure accuracy. Here are five things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do ensure all property listed qualifies for the deductions claimed.

- Do double-check calculations for accuracy.

- Do keep records of all property purchases and their costs.

- Do file the form on time to avoid penalties.

- Don't include personal property that does not qualify for business deductions.

- Don't ignore the limits set for deductions under IRC Section 179.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank; provide complete information.

- Don't submit the form without reviewing it for errors.

Misconceptions

- Misconception 1: The California 3885 form is only for corporations.

- Misconception 2: All types of property qualify for IRC Section 179 deductions.

- Misconception 3: California law fully conforms to federal tax law.

- Misconception 4: Depreciation methods are the same for all types of property.

This form is primarily designed for corporations, but it also applies to partnerships and limited liability companies (LLCs) classified as corporations. S corporations have a different requirement and must use Schedule B (100S) for their depreciation and amortization needs.

Not all properties are eligible for the IRC Section 179 expense deduction. For instance, off-the-shelf computer software does not qualify. Additionally, the deduction is limited to tangible personal property used in business, with specific criteria that must be met.

While California does conform to many aspects of federal tax law, there are significant differences. For example, California has its own limits on the maximum IRC Section 179 expense deduction, which is set at $25,000, compared to higher federal limits. Understanding these differences is crucial for accurate tax reporting.

Different types of property require different depreciation methods. For example, real estate and personal property have distinct guidelines for depreciation. Corporations must choose the appropriate method based on the type of asset and its useful life.

Documents used along the form

The California 3885 form is essential for corporations to calculate depreciation and amortization deductions. Several other forms and documents often accompany this form to ensure accurate tax reporting. Below is a list of these documents, each serving a specific purpose in the tax preparation process.

- Form 100: This is the California Corporation Franchise or Income Tax Return. Corporations use it to report income, deductions, and credits, and to calculate the tax owed to the state.

- Form 100W: This form is similar to Form 100 but is specifically for corporations that qualify as "water's edge" filers. It is used to report income and calculate taxes for corporations doing business in California and outside the U.S.

- Form 4562: This federal form is used to claim depreciation and amortization on a corporation's tax return. It provides detailed calculations that can be referenced when completing the California 3885 form.

- Schedule B (100S): S corporations use this schedule to report depreciation and amortization. It ensures that S corporations comply with both federal and state requirements regarding these deductions.

- Form FTB 3809: This form is used for the Targeted Tax Area Deduction and Credit Summary. It helps corporations claim deductions related to property located in designated areas that qualify for tax incentives.

- Form FTB 3805Z: This form summarizes deductions and credits available to corporations operating in Enterprise Zones. It is critical for businesses looking to take advantage of these local incentives.

- Form FTB 3580: This form is for the Application and Election to Amortize Certified Pollution Control Facilities. It allows corporations to recover costs associated with pollution control through amortization.

These forms and documents work together to provide a comprehensive overview of a corporation's financial activities, ensuring compliance with California tax regulations. Properly completing the California 3885 form alongside these additional documents can significantly impact a corporation's tax obligations and benefits.

Different PDF Templates

California Std 830 - This form must be submitted with bids to participate in the preference program.

3832 - While Form 3832 is necessary for LLCs with nonresident members, it does not replace a California income tax return.

Jv570 - The form simplifies the process of notifying the court of an appeal intent.