Download California 461 Form

Common Questions

What is the purpose of the California 461 form?

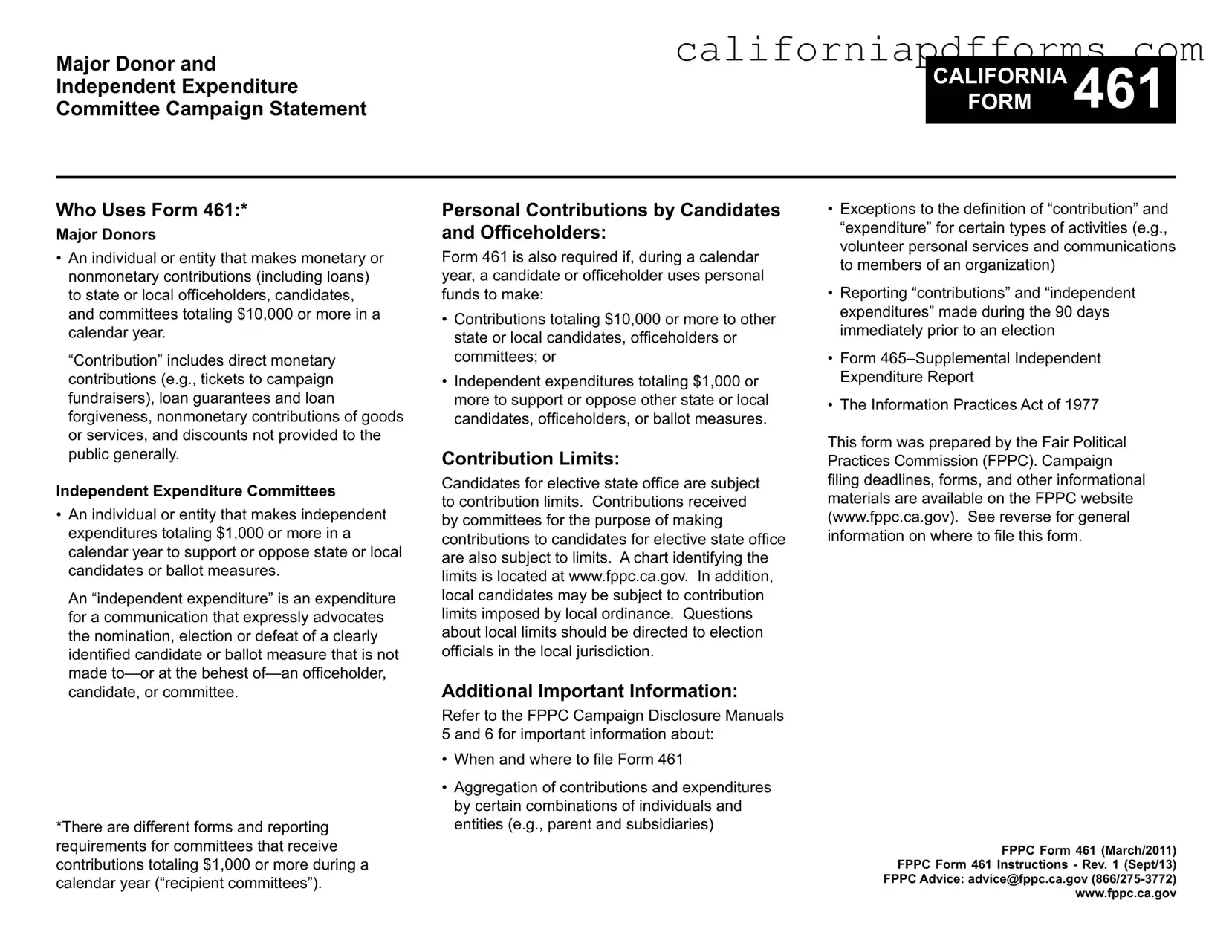

The California 461 form is used by major donors and independent expenditure committees to report their campaign contributions and expenditures. Major donors are individuals or entities that contribute $10,000 or more in a calendar year to state or local officeholders, candidates, or committees. Independent expenditure committees report expenditures of $1,000 or more made to support or oppose candidates or ballot measures. This form ensures transparency in political financing and helps to maintain the integrity of the electoral process.

Who is required to file Form 461?

Individuals or entities that qualify as major donors or independent expenditure committees must file Form 461. Specifically, anyone who makes monetary or nonmonetary contributions totaling $10,000 or more in a calendar year, or who makes independent expenditures of $1,000 or more, must complete this form. Additionally, candidates or officeholders using personal funds for similar contributions or expenditures must also file Form 461.

How do I determine where to file Form 461?

The filing location depends on the nature of your contributions or expenditures. If more than 50% of your activities support state candidates or measures across multiple counties, file with the Secretary of State. For activities concentrated in a single county, submit the form to the county election official. If your contributions or expenditures are focused within a city, file with the city clerk. Always include the original and one copy of the form when filing.

Are there specific deadlines for filing Form 461?

Yes, there are specific deadlines for filing Form 461, which vary depending on the type of statement being filed. Generally, the “period covered” by the statement begins the day after the closing date of your last filed statement. If this is your first statement of the calendar year, start from January 1. It is crucial to check the Fair Political Practices Commission (FPPC) website for detailed deadlines and to ensure compliance.

What should I do if I need to amend a previously filed Form 461?

If you need to amend a previously filed Form 461, check the “Amendment” box on the form. Enter the period covered by the statement you are amending and provide the amended information. Ensure that you complete all relevant sections, including the summary. A responsible officer must sign the amended form, just as with the original. Keep in mind that transparency is key, so disclose all necessary changes accurately.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form 461 | This form is used for reporting contributions and independent expenditures by major donors and independent expenditure committees in California. |

| Who Must File | Major donors and independent expenditure committees must file this form if their contributions or expenditures meet specific thresholds. |

| Contribution Threshold | Individuals or entities making contributions of $10,000 or more in a calendar year must report using Form 461. |

| Independent Expenditure Threshold | Independent expenditure committees must file if they make expenditures of $1,000 or more in a calendar year to support or oppose candidates or measures. |

| Filing Requirements | Form 461 must be filed electronically if total contributions or expenditures reach $25,000 in a calendar year. |

| Where to File | Forms must be filed with the Secretary of State or local election officials, depending on the scope of contributions or expenditures. |

| Contribution Limits | California law imposes limits on contributions to candidates for state office, which can vary by local jurisdiction. |

| Amendments | To amend a previously filed Form 461, check the “Amendment” box and provide the updated information. |

| Governing Laws | The form is governed by California Government Code sections 84200-84216.5, which outline campaign finance regulations. |

| Contact Information | For questions, individuals can contact the Fair Political Practices Commission at 866/275-3772 or visit their website. |

Dos and Don'ts

When filling out the California 461 form, there are several important practices to keep in mind. Here is a list of things to do and avoid:

- Do ensure that all information is accurate and complete. This includes the name of the filer, contributions, and expenditures.

- Do file the form with the appropriate authority based on where the majority of your contributions or expenditures were made.

- Do keep a copy of the completed form for your records after submission.

- Do be aware of the deadlines for filing the form to avoid penalties.

- Do consult the FPPC Campaign Disclosure Manuals for detailed instructions and guidance.

- Don't forget to include all required signatures, especially if the filer is an entity rather than an individual.

- Don't round off amounts inaccurately. Ensure that all figures are reported correctly.

- Don't leave out any entities that should be aggregated under the name of the filer.

- Don't submit the form late. Late submissions can lead to fines or other penalties.

- Don't hesitate to reach out to the FPPC for clarification if any part of the form is unclear.

Misconceptions

- Misconception 1: Only large organizations need to file Form 461.

- Misconception 2: Form 461 is only for monetary contributions.

- Misconception 3: Filing Form 461 is optional for major donors.

- Misconception 4: Independent expenditure committees do not have to report their spending.

- Misconception 5: All contributions are treated the same under the law.

- Misconception 6: Form 461 can only be filed on paper.

This form is required for both individuals and entities that make significant contributions or independent expenditures, regardless of their size.

In addition to monetary contributions, Form 461 also covers non-monetary contributions, such as goods, services, and loan guarantees.

Any major donor who contributes $10,000 or more in a calendar year must file this form. It is not optional.

Independent expenditure committees are required to file Form 461 if their expenditures total $1,000 or more in a calendar year.

There are specific definitions and exceptions for what constitutes a contribution or expenditure. These can vary based on the type of activity.

Many major donor and independent expenditure committees must file Form 461 electronically if they reach a certain threshold in contributions or expenditures.

Documents used along the form

The California Form 461 is essential for major donors and independent expenditure committees. However, it is often accompanied by other important forms and documents that help ensure compliance with campaign finance regulations. Below are four key forms that are frequently used alongside Form 461.

- Form 465 – Supplemental Independent Expenditure Report: This form is used to provide additional details about independent expenditures that exceed $1,000. It helps clarify the nature of these expenditures and ensures transparency in campaign financing.

- Form 497 – 24-Hour Contribution Report: When a contribution of $1,000 or more is received within 90 days of an election, this form must be filed within 24 hours. It allows for timely reporting of significant contributions, promoting transparency in the electoral process.

- Form 410 – Statement of Organization: This form is necessary for registering a committee with the California Secretary of State. It provides essential information about the committee’s structure, purpose, and key officers, ensuring that all committees are properly documented.

- Form 460 – Campaign Statement: This comprehensive form is required for all candidates and committees to report contributions and expenditures. It covers a broader scope than Form 461 and is crucial for tracking overall campaign finances.

Each of these forms plays a vital role in maintaining the integrity of the campaign finance system in California. It is crucial to understand their purposes and ensure timely filing to avoid potential penalties or compliance issues. Staying informed about these requirements will help navigate the complexities of campaign finance effectively.

Different PDF Templates

Jurat California - This document can be used for both personal and business-related attestations.

California Jv 472 - The JV-472 also outlines the steps the court has taken to inform relevant parties about the hearing.

Jv 570 - The JV-100 is structured to streamline information gathering for the court’s assessment.