Download California 51 055A Form

Common Questions

What is the California 51 055A form?

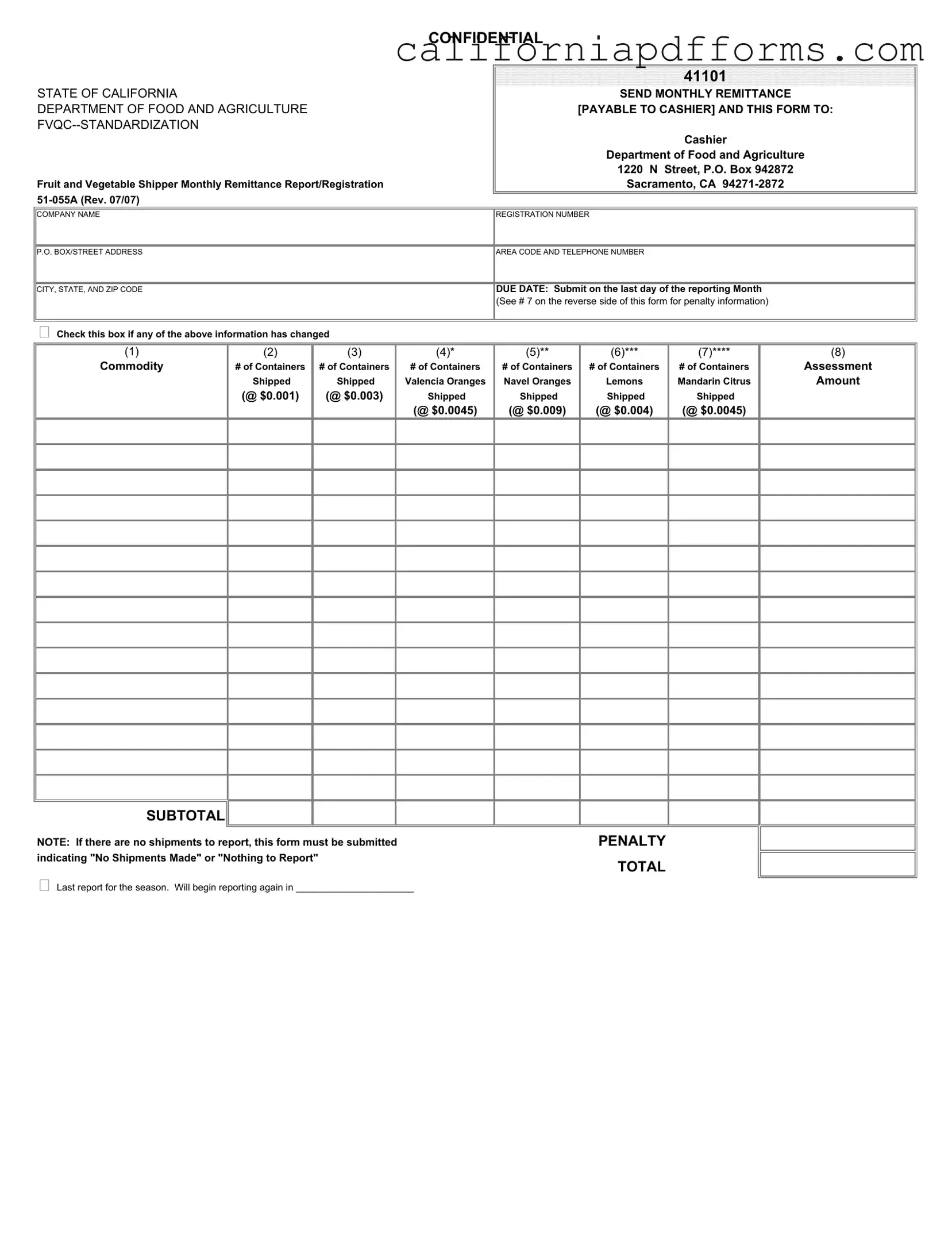

The California 51 055A form is a monthly remittance report used by fruit and vegetable shippers in California. It is required by the Department of Food and Agriculture to report shipments and calculate assessments based on the number of containers shipped.

Who needs to fill out the California 51 055A form?

Any company engaged in shipping fruits and vegetables within California must complete this form. This includes businesses that handle Valencia oranges, Navel oranges, lemons, and mandarin citrus.

When is the California 51 055A form due?

The form is due on the last day of the reporting month. Timely submission is crucial to avoid penalties. It is important to keep track of these deadlines to ensure compliance.

What information is required on the form?

The form requires several key pieces of information:

- Company name and contact information

- Registration number

- Details of shipments, including the number of containers for each type of fruit

- Assessment amounts based on the type of fruit shipped

What should I do if there are no shipments to report?

If there are no shipments to report, you must still submit the form. Indicate “No Shipments Made” or “Nothing to Report” on the form to comply with reporting requirements.

What happens if I miss the submission deadline?

Missing the submission deadline may result in penalties. It is essential to familiarize yourself with the penalty information provided on the form to understand the potential consequences of late submission.

Where do I send the completed California 51 055A form?

The completed form, along with the monthly remittance, should be sent to:

- Cashier

- Department of Food and Agriculture

- 1220 N Street, P.O. Box 942872

- Sacramento, CA 94271-2872

Can I make changes to the information on the form?

If any of the information provided on the form changes, you should check the designated box indicating that changes have occurred. This helps ensure that the Department of Food and Agriculture has the most accurate information on file.

What are the assessment amounts for different types of fruit?

The assessment amounts vary by type of fruit. For example:

- Valencia Oranges: $0.001 per container

- Navel Oranges: $0.003 per container

- Lemons: $0.004 per container

- Mandarin Citrus: $0.0045 per container

What if I need to stop reporting for the season?

If you are at the end of your shipping season, you can indicate this on the form. Specify the date when you plan to resume reporting. This ensures clarity for both your business and the Department of Food and Agriculture.

Document Specifications

| Fact Name | Description |

|---|---|

| Form Title | Fruit and Vegetable Shipper Monthly Remittance Report/Registration |

| Form Number | 51-055A |

| Governing Law | California Food and Agricultural Code, Section 22781 |

| Submission Frequency | Monthly, due on the last day of the reporting month |

| Address for Submission | Cashier, Department of Food and Agriculture, 1220 N Street, P.O. Box 942872, Sacramento, CA 94271-2872 |

| Penalty for Late Submission | Penalties apply if the form is not submitted on time, as noted in the instructions |

| No Shipments Reporting | If there are no shipments, the form must still be submitted indicating "No Shipments Made" |

Dos and Don'ts

When filling out the California 51 055A form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and avoid:

- Do double-check all your information before submission to avoid errors.

- Do submit the form by the last day of the reporting month to prevent penalties.

- Do indicate any changes in your information by checking the appropriate box.

- Do include all necessary details, such as the number of containers shipped for each commodity.

- Do submit the form even if there are no shipments, indicating "No Shipments Made."

- Don't forget to sign the form if required, as it may lead to processing delays.

- Don't leave any sections blank; fill out all applicable areas to ensure completeness.

- Don't submit the form without the required remittance, as it may result in penalties.

- Don't ignore the instructions on the reverse side of the form; they provide important information.

- Don't wait until the last minute to submit; plan ahead to avoid potential issues.

Misconceptions

Here are four common misconceptions about the California 51 055A form:

- It’s only for large businesses. Many people think that only large companies need to fill out this form. In reality, any business that ships fruits and vegetables in California must submit the form, regardless of size.

- You can submit the form at any time. Some believe that there is flexibility in the submission timeline. However, the form is due on the last day of the reporting month. Late submissions can incur penalties.

- It’s optional if there are no shipments. A common misunderstanding is that if there are no shipments, the form doesn’t need to be submitted. This is not true. Even if there are no shipments, you must still submit the form indicating “No Shipments Made” or “Nothing to Report.”

- The assessment amounts are fixed. Some think that the assessment amounts listed on the form are set in stone. In fact, these amounts can vary based on the type of fruit and market conditions, so it’s important to check the current rates.

Documents used along the form

The California 51 055A form is essential for fruit and vegetable shippers to report their monthly shipments and remit assessments. Along with this form, several other documents may be necessary to ensure compliance with state regulations. Here’s a list of some commonly used forms and documents that accompany the California 51 055A form.

- California 51 055B Form: This form is used for reporting any changes in registration information. It helps keep the state updated on your business details.

- Shipping Manifests: These documents list all items being shipped, including quantities and descriptions. They provide proof of what has been sent out.

- Invoices: Invoices detail the sale of goods and services. They are important for record-keeping and financial tracking.

- Sales Receipts: These are proof of purchase for the buyer. They help in tracking sales and can be used for accounting purposes.

- Compliance Certificates: These certificates confirm that the products meet state and federal regulations. They assure customers of quality and safety.

- Tax Forms: Various tax forms may be required for reporting income from sales. These help ensure proper tax compliance.

- Business Licenses: A valid business license is necessary for operating legally in California. It shows that the business is authorized to conduct operations.

- Inspection Reports: These documents are issued after inspections by state officials. They confirm that the facilities and products meet health and safety standards.

Having these documents ready can help streamline the reporting process and ensure compliance with state regulations. Proper documentation is crucial for smooth operations in the fruit and vegetable shipping industry.

Different PDF Templates

California Courts - Legal clarity can greatly enhance the court's understanding.

California G 6 - Provide accurate information to avoid issues with your Cal Grant eligibility.