Download California 540 C1 Form

Common Questions

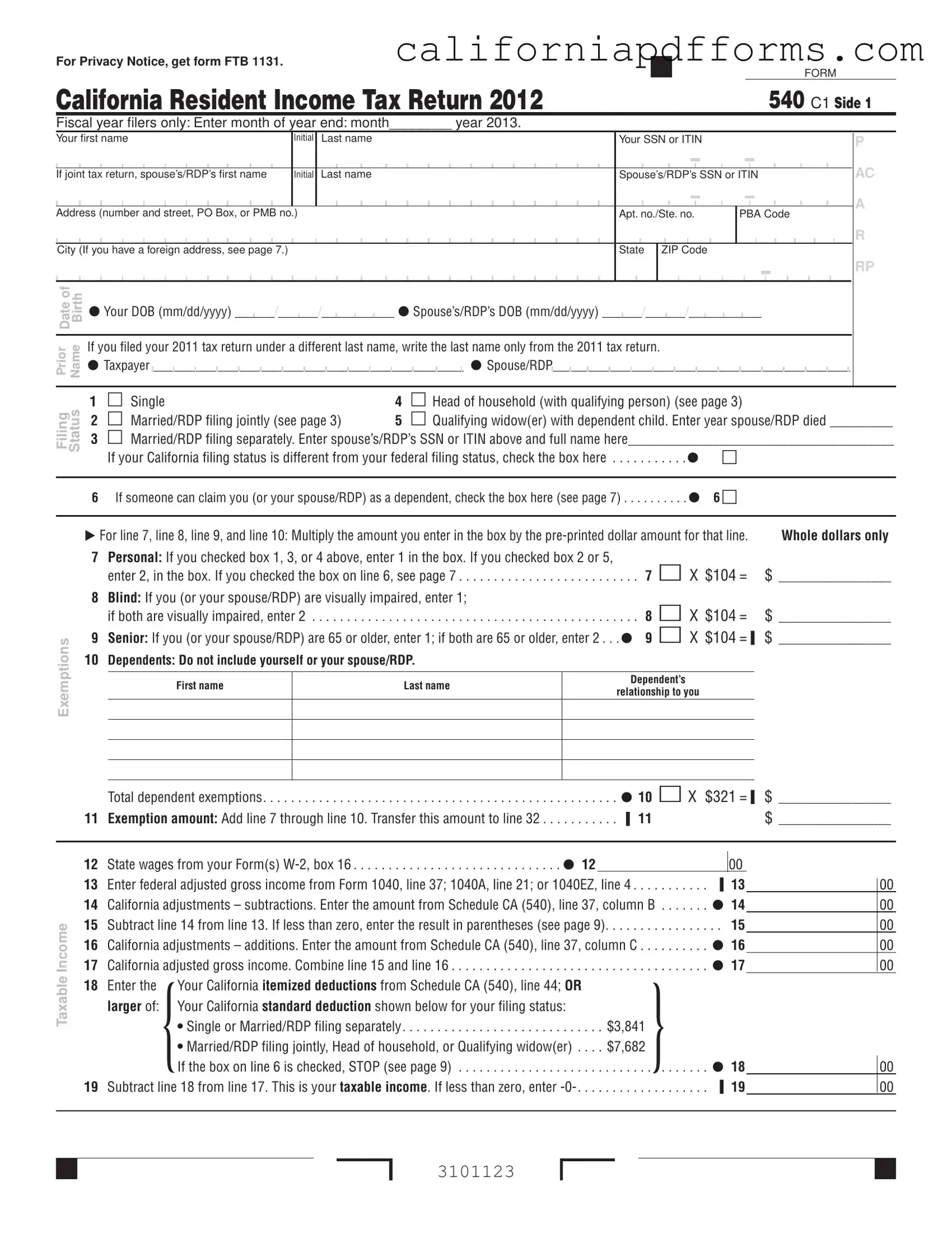

What is the California 540 C1 form?

The California 540 C1 form is a tax return used by residents of California who are filing their state income taxes for a fiscal year. This form is specifically designed for individuals and couples who may have different filing statuses, such as single, married filing jointly, or head of household. It allows taxpayers to report their income, claim deductions, and calculate their tax liability for the year. If you are a resident of California and need to file your state taxes, this form is essential.

Who needs to file the California 540 C1 form?

Individuals who meet certain income thresholds and are considered residents of California must file the California 540 C1 form. This includes:

- Residents who earn income from California sources.

- Individuals who have a filing status of single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Taxpayers whose federal filing status differs from their California status.

If you are unsure whether you need to file, it is advisable to consult with a tax professional or review the guidelines provided by the California Franchise Tax Board.

What information is required to complete the form?

To complete the California 540 C1 form, you will need to gather several pieces of information, including:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your filing status and personal information, such as your name, address, and date of birth.

- Income details, including wages reported on Form W-2 and any other sources of income.

- Information on any dependents you may be claiming.

- Details regarding any deductions or credits you plan to claim.

Having this information readily available will streamline the filing process and help ensure accuracy.

How do I determine my filing status on the form?

Your filing status is determined by your marital status and family situation as of the last day of the tax year. The California 540 C1 form provides several options, including:

- Single

- Married/RDP filing jointly

- Married/RDP filing separately

- Head of household

- Qualifying widow(er) with dependent child

Choose the status that best reflects your situation. If you are unsure, consider seeking guidance from a tax advisor.

What are the common deductions available on the California 540 C1 form?

The California 540 C1 form allows for various deductions that can reduce your taxable income. Common deductions include:

- California standard deduction, which varies based on your filing status.

- Itemized deductions, if you choose to itemize rather than take the standard deduction.

- Exemptions for yourself, your spouse/RDP, and dependents.

- Adjustments for specific expenses, such as contributions to retirement accounts.

It is crucial to review the instructions for the form to ensure you are taking advantage of all eligible deductions.

How do I submit the California 540 C1 form?

Once you have completed the California 540 C1 form, you can submit it in one of two ways:

- Electronically, using the California Franchise Tax Board’s e-file system.

- By mail, sending the completed form to the address specified in the instructions, along with any required payment.

Be mindful of the filing deadline, which typically falls on April 15 of the following year, to avoid any penalties or interest charges.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California 540 C1 form is used by residents to file their state income tax returns for the 2012 tax year. |

| Eligibility | This form is specifically for individuals who are filing as a fiscal year taxpayer, ending in 2013. |

| Governing Laws | The form is governed by the California Revenue and Taxation Code, which outlines the requirements for state income tax filings. |

| Privacy Notice | For information regarding privacy, taxpayers should refer to form FTB 1131. |

Dos and Don'ts

When filling out the California 540 C1 form, there are important dos and don'ts to keep in mind.

- Do double-check your personal information, including names, Social Security Numbers, and addresses, to ensure accuracy.

- Do follow the instructions carefully for each line, especially when calculating exemptions and deductions.

- Do keep a copy of the completed form for your records, as well as any supporting documents.

- Do sign and date the form before submitting it to avoid delays in processing.

- Don't leave any sections blank. If a question does not apply to you, write "N/A" instead.

- Don't forget to check the box if someone can claim you as a dependent.

- Don't ignore the deadline for submission; late filings can result in penalties.

- Don't attempt to submit cash with your form; payments should be made via check or electronic methods.

Misconceptions

- Misconception 1: The California 540 C1 form is only for individuals with complex tax situations.

- Misconception 2: You can only file the California 540 C1 form if you are self-employed.

- Misconception 3: The 540 C1 form is the same as the federal tax return.

- Misconception 4: Filing the 540 C1 form is optional if you owe no taxes.

This form is actually designed for all California residents, regardless of their financial complexity. Whether you have a simple income source or multiple streams, this form applies to you.

This is not true. The California 540 C1 is for all residents who earn income, including those who are employed by others. Self-employment is not a requirement for using this form.

While both forms serve to report income and calculate taxes, they are distinct. The California 540 C1 specifically addresses state tax obligations, while federal returns focus on federal taxes. Different rules and deductions apply.

California residents must file the 540 C1 form even if they do not owe taxes. Failing to file can lead to penalties and complications in future tax filings.

Documents used along the form

When filing your California state income tax return using the 540 C1 form, there are several other documents that you may need to include or reference. Each of these forms serves a specific purpose and helps ensure that your tax return is complete and accurate.

- Form 540: This is the primary California Resident Income Tax Return form. If you're filing as a resident, you'll typically use this form along with the 540 C1 to report your income and calculate your tax liability.

- Schedule CA (540): This schedule is used to make adjustments to your federal adjusted gross income. It helps you report California-specific deductions and additions to your income.

- Form W-2: Employers provide this form to report wages paid and taxes withheld. You'll need it to accurately report your income on your tax return.

- Form 1099: If you received income from sources other than an employer, such as freelance work or interest payments, you'll receive this form. It’s essential for reporting additional income.

- Form FTB 3506: This form is for claiming the Nonrefundable Child and Dependent Care Expenses Credit. If you qualify, it can reduce your tax liability.

- Form FTB 5805: This is used to report any underpayment of estimated tax. If you owe penalties for underpayment, this form will help you calculate those amounts.

- Form FTB 5870A: This form is for reporting the Mental Health Services Tax if applicable. It’s important for those who meet the income threshold.

- Form FTB 1131: This is the Privacy Notice form. It’s required for informing taxpayers about their rights and how their information will be used.

- Schedule P (540): If you are claiming multiple credits, this schedule is necessary to report those credits accurately on your tax return.

- Form 540X: If you need to amend your tax return after filing, this form is used to correct any errors on your original return.

Gathering these forms and understanding their purposes can make your tax filing process smoother. Ensure that you review each document carefully and keep copies for your records. If you have questions about any specific form, consider reaching out for professional assistance to ensure compliance and accuracy.

Different PDF Templates

Notice to Consumer California Requirements - The form is designed to protect personal privacy throughout the subpoena process.

540nr Instructions - Rounding of cents is not permitted on this form; precision in reporting is required.