Download California 540 Schedule P Form

Common Questions

What is the purpose of the California 540 Schedule P form?

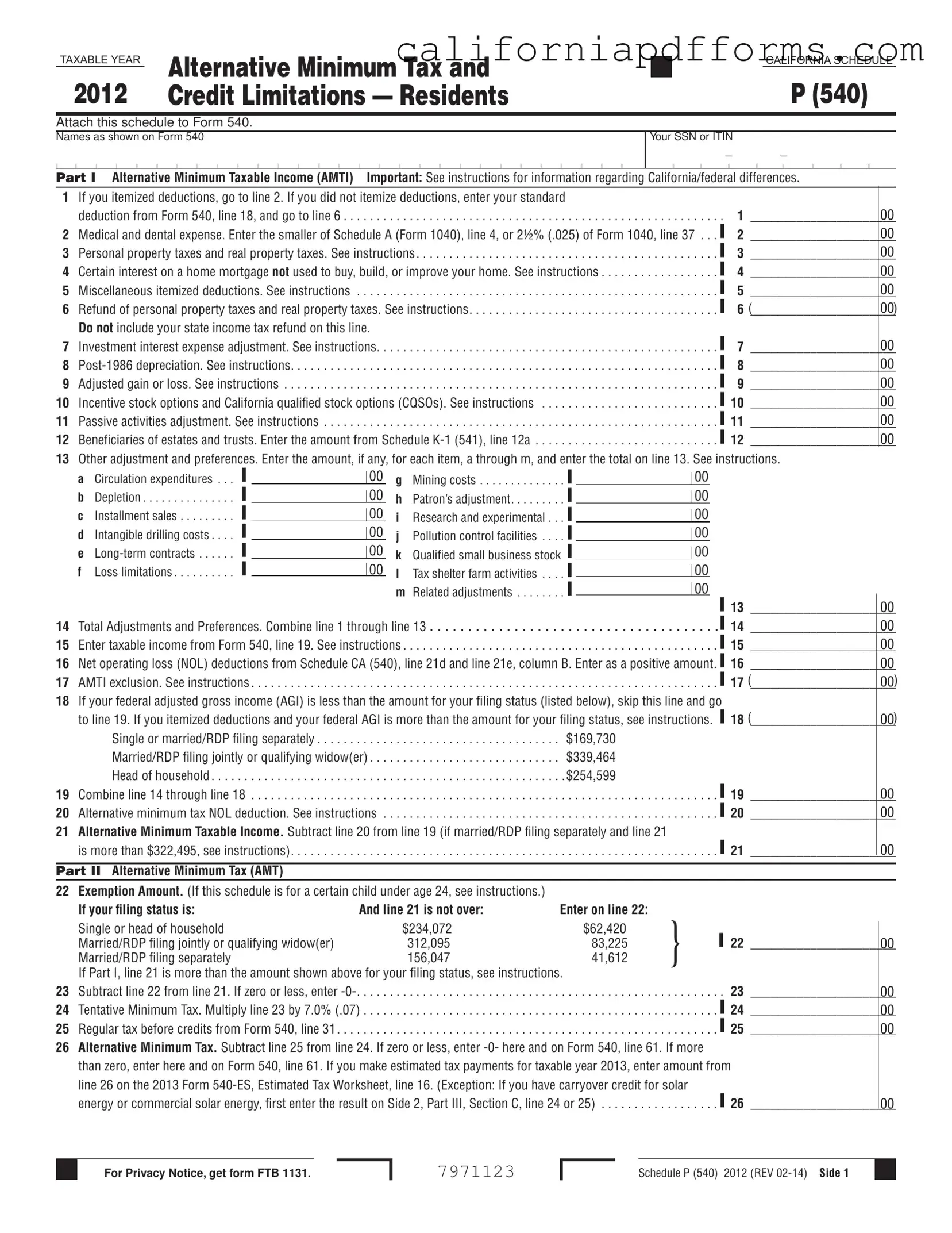

The California 540 Schedule P form is used to calculate the Alternative Minimum Tax (AMT) for residents of California. It helps taxpayers determine their Alternative Minimum Taxable Income (AMTI) and any credits that may reduce their tax liability. By filing this form, taxpayers ensure compliance with California tax laws and accurately assess their tax obligations.

Who needs to file the California 540 Schedule P?

Taxpayers who are required to file a California state income tax return and who have a taxable income that exceeds certain thresholds may need to file Schedule P. This includes individuals who have itemized deductions or who have income from certain sources that could trigger the AMT. Specific guidelines are provided in the form instructions to help determine if filing is necessary based on income levels and filing status.

How do I calculate my Alternative Minimum Taxable Income (AMTI)?

To calculate your AMTI, start by entering your taxable income from Form 540. Then, make adjustments based on various factors, such as deductions and credits. Follow these steps:

- Complete Part I of the Schedule P, listing your adjustments and preferences.

- Subtract any allowable deductions from your total income.

- Combine the results to arrive at your AMTI.

Consult the instructions for specific calculations related to itemized deductions and other adjustments to ensure accuracy.

What types of credits can I claim on Schedule P?

Schedule P allows taxpayers to claim various credits that may reduce their tax liability. These include:

- Credits that reduce excess tax without carryover provisions.

- Credits that have carryover provisions, which can be used in future tax years.

- Credits specifically designed to reduce alternative minimum tax.

It is important to attach the relevant credit forms to your Form 540 when filing.

What should I do if my income is below the filing threshold?

If your federal adjusted gross income (AGI) is below the specified threshold for your filing status, you can skip certain lines on Schedule P and proceed to complete the form. This exemption helps streamline the filing process for those who may not be subject to the AMT. Always refer to the latest instructions to confirm the thresholds and any updates that may affect your filing.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Purpose | The California 540 Schedule P form is used to calculate the Alternative Minimum Tax (AMT) for residents, ensuring that taxpayers pay a minimum amount of tax regardless of deductions and credits. |

| Filing Requirement | This schedule must be attached to the California Form 540 when filing state income taxes if the taxpayer's income exceeds certain thresholds. |

| Taxable Year | The form is specific to the taxable year indicated at the top, which in this case is 2012. |

| AMTI Calculation | Taxpayers must calculate their Alternative Minimum Taxable Income (AMTI) by adjusting their regular taxable income with specific preferences and adjustments outlined in the form. |

| Exemption Amounts | Different exemption amounts apply based on filing status, such as single, married filing jointly, or head of household, which can significantly affect the AMT calculation. |

| Governing Laws | The form is governed by California Revenue and Taxation Code Sections 17062 and 17062.5, which outline the provisions for the Alternative Minimum Tax. |

| Credits | Taxpayers can utilize various credits that may reduce their tax liability, including those for solar energy and dependent care, which are detailed in the latter sections of the form. |

| Important Instructions | Instructions are provided within the form to guide taxpayers through the process of calculating their AMTI and determining applicable credits, emphasizing the differences between California and federal tax laws. |

Dos and Don'ts

When filling out the California 540 Schedule P form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are eight important dos and don’ts to keep in mind:

- Do read the instructions carefully before starting the form. Understanding the requirements will help you avoid mistakes.

- Do use the correct year’s form. Tax laws can change, so ensure you have the most current version for the year you are filing.

- Do double-check your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for accuracy. Errors can delay processing.

- Do include all necessary supporting documents. Attach any required forms, such as credit forms, to your main tax form.

- Don't skip any lines without understanding their purpose. Each line on the form serves a specific function in calculating your tax.

- Don't forget to calculate your Alternative Minimum Taxable Income (AMTI) correctly. This calculation is crucial for determining your tax liability.

- Don't assume that information from previous years is still valid. Review your current financial situation and update any relevant figures.

- Don't ignore the deadlines. Ensure that you submit your form on time to avoid penalties and interest on late payments.

Misconceptions

Misconception 1: The California 540 Schedule P form is only for high-income earners.

This is not true. While the form is associated with the Alternative Minimum Tax (AMT), it applies to various income levels. Anyone who has to calculate AMTI may need to use this form, regardless of their income bracket.

Misconception 2: You can skip the Schedule P if you do not owe AMT.

Many people believe they can avoid filling out Schedule P if they think they won’t owe AMT. However, it’s essential to complete the form to determine your AMTI accurately. This ensures compliance and helps you understand your tax situation better.

Misconception 3: The form is the same as the federal AMT form.

While both forms deal with AMT, they are not identical. California has its own rules and adjustments that differ from federal guidelines. It’s crucial to follow the specific instructions for the California 540 Schedule P form to avoid errors.

Misconception 4: You don’t need to file Schedule P if you take the standard deduction.

Even if you take the standard deduction, you may still need to complete Schedule P. If your income level requires it, you must report your AMTI, which can include various adjustments and preferences, regardless of your deduction choice.

Documents used along the form

The California 540 Schedule P form is an essential document for taxpayers who need to calculate their Alternative Minimum Tax (AMT) and any applicable credit limitations. However, it is often accompanied by several other forms and documents that provide necessary information and context for accurate tax filing. Below is a list of some of these related documents, each serving a specific purpose in the overall tax preparation process.

- Form 540: This is the primary California state income tax return form for residents. Taxpayers use it to report their income, claim deductions, and calculate their tax liability. The Schedule P form must be attached to this main form if AMT calculations are necessary.

- Schedule CA (540): This form is used to make adjustments to income and deductions that differ between federal and California tax laws. It helps taxpayers reconcile their federal adjusted gross income with California's requirements, which is crucial for accurate AMT calculations.

- Schedule K-1 (541): Beneficiaries of estates or trusts receive this form to report their share of income, deductions, and credits. It is particularly relevant for those who have income from pass-through entities, as it may affect the calculations on the Schedule P form.

- Form FTB 3506: This form is used to claim the Child and Dependent Care Expenses Credit. Taxpayers who qualify for this credit must attach it to their primary tax return, as it may help reduce their overall tax liability, including any AMT owed.

- Form FTB 3553: This is the Enterprise Zone Employee Credit form. Taxpayers who hire employees from designated enterprise zones can claim this credit, which can significantly reduce their tax burden. It is important for those who wish to offset their AMT with available credits.

Understanding these forms and their interconnections is vital for taxpayers navigating the complexities of California tax law. Each document plays a role in ensuring compliance and optimizing tax liabilities, particularly for those subject to alternative minimum tax calculations.

Different PDF Templates

Fw 002 - Additional facts supporting the fee waiver request can be described on the form.

California Jv 445 - The form also outlines necessary services, assessments, and evaluations for the child.