Download California 540 V Form

Common Questions

What is the purpose of the California 540 V form?

The California 540 V form serves as a payment voucher for individuals filing their state income tax returns. It helps the Franchise Tax Board process payments accurately and efficiently. While it is encouraged to use this form when sending a payment, there is no penalty for not using it. If your return indicates a refund or shows no tax due, you do not need to submit this voucher.

How do I complete the California 540 V form?

To complete the California 540 V form, follow these steps:

- Prepare your check or money order: Make it payable to the Franchise Tax Board for the total amount owed. Include your social security number and the type of return on the payment.

- Fill out the payment voucher: Use blue or black ink to enter your name(s), address, and social security number(s). Indicate the payment amount, including any penalties or interest.

- Detach the voucher: Cut off the voucher along the dotted line.

- Attach the voucher and payment: Place your check or money order on top of the voucher and attach them to the front of your return.

Where do I mail my completed California 540 V form?

Mail your completed return, along with the attached California 540 V voucher and your check or money order, to the following address:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001

Is there a deadline for submitting the California 540 V form?

The California 540 V form must be submitted by the tax return filing deadline. This deadline typically aligns with the federal tax return deadline, which is usually April 15. Ensure that your payment and voucher are postmarked by this date to avoid penalties and interest.

What should I do if I made a mistake on my California 540 V form?

If you discover an error after submitting your California 540 V form, you can correct it by filing an amended tax return. Be sure to include the correct payment information. If you have already submitted a payment, contact the Franchise Tax Board for guidance on how to proceed.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Purpose | The California 540-V form is a return payment voucher used for submitting payments with your tax return. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 19011. |

| Eligibility | Use this form if you owe taxes. If your return shows a refund or no tax due, you do not need to use it. |

| Payment Instructions | Make your check or money order payable to the Franchise Tax Board. Include your social security number and the type of return on it. |

| Mailing Address | Send your completed form, voucher, and payment to: Franchise Tax Board, PO Box 942867, Sacramento, CA 94267-0001. |

| Encouragement | The Franchise Tax Board encourages the use of Form 540-V for efficient processing, but no penalties apply if it is not used. |

Dos and Don'ts

When filling out the California 540 V form, there are several important steps to follow and common mistakes to avoid. Below is a list of things you should and shouldn't do.

- Do ensure your check or money order is made out to the Franchise Tax Board for the full amount you owe.

- Do write your social security number and the type of return on your payment method.

- Do use blue or black ink when filling out the Return Payment Voucher.

- Do attach the voucher and your payment to the front of your return where indicated.

- Don't forget to cut off the voucher on the dotted line before attaching it.

- Don't cover your payment and voucher with Form(s) W-2 or any other documents.

Misconceptions

Misconceptions about the California 540 V form can lead to confusion among taxpayers. Below is a list of common misconceptions along with explanations to clarify them.

- Form 540-V is mandatory for all taxpayers. This form is not required if your tax return shows a refund or if no tax is due. It is primarily used for payments owed.

- Using Form 540-V guarantees faster processing. While the form helps the Franchise Tax Board process payments more efficiently, using it does not necessarily speed up the overall processing time of your tax return.

- You can send cash with Form 540-V. Cash payments are not accepted. Payments must be made via check or money order payable to the Franchise Tax Board.

- Form 540-V can be used for any tax year. This form is specific to the tax year indicated on the form. Ensure you are using the correct version for the year you are filing.

- Filing Form 540-V is the same as filing your tax return. The 540-V is a payment voucher and must accompany your tax return. It does not serve as a substitute for the actual return.

- There are penalties for not using Form 540-V. While using the form is encouraged for payment processing, there are no penalties for failing to use it if you are submitting a payment.

- All payments must be sent to the same address. Payments should be mailed to the specific address listed on the form, which is designated for payment submissions.

- It is acceptable to attach the payment and voucher anywhere on the return. The check or money order and the voucher must be attached to the front of the return as specified in the instructions.

- Form 540-V is only for individuals with complex tax situations. This form is applicable to all individuals who owe taxes, regardless of the complexity of their tax situation.

Documents used along the form

The California 540-V form is a return payment voucher that assists taxpayers in submitting their payments accurately and efficiently. When filing your taxes, you may encounter several other forms and documents that complement the 540-V. Understanding these forms can help streamline the filing process and ensure compliance with state tax regulations.

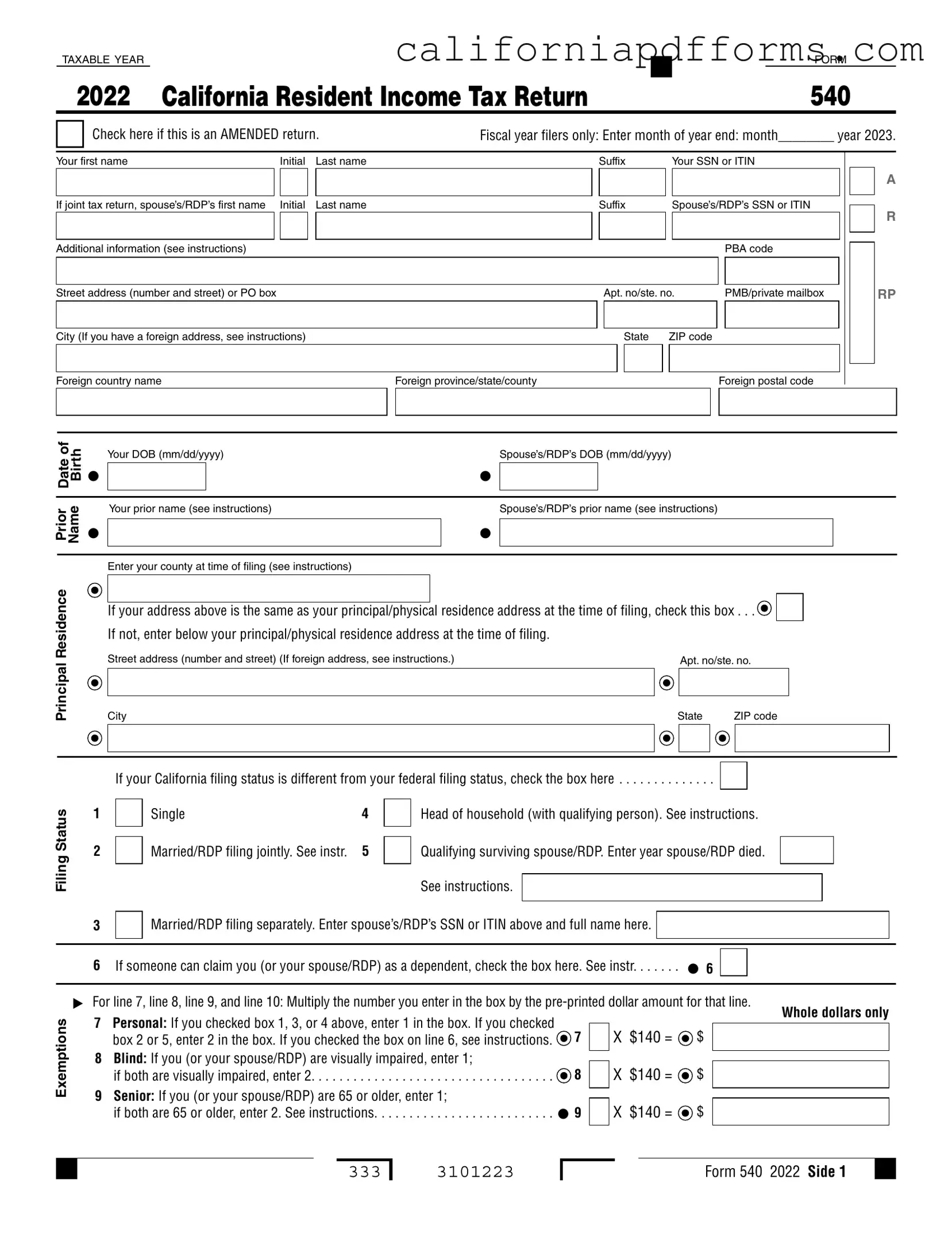

- Form 540: This is the California Resident Income Tax Return form. It is used by residents to report their income, claim deductions, and calculate their tax liability.

- Form 540A: This is a simpler version of Form 540, designed for individuals with less complex tax situations. It allows for standard deductions and is suitable for those who do not itemize their deductions.

- Form 540EZ: This is the easiest form for California residents to use. It is intended for single and joint filers with no dependents and straightforward income sources.

- Form 540NR: This form is for non-residents or part-year residents of California. It allows individuals to report income earned in California while accounting for taxes owed based on their residency status.

- Form W-2: This is the Wage and Tax Statement provided by employers to report an employee's annual wages and the amount of taxes withheld. It is essential for completing your income tax return.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Freelancers and independent contractors often receive this form from clients.

- Schedule CA (540): This schedule is used to adjust your federal adjusted gross income to reflect California-specific tax rules. It helps in calculating state tax liability accurately.

- Form FTB 3519: This is the Payment Voucher for Individual Income Tax. It is similar to the 540-V and is used for making estimated tax payments throughout the year.

- Form FTB 1131: This form provides privacy information related to the collection and use of your personal data by the Franchise Tax Board.

- Form 1040: Although this is a federal form, it is often referenced when preparing state taxes. It reports your total income and calculates your federal tax liability.

By familiarizing yourself with these forms and documents, you can navigate the tax filing process more effectively. Each form plays a crucial role in ensuring that your tax return is complete and accurate, ultimately leading to a smoother experience with the California Franchise Tax Board.

Different PDF Templates

Earthquake Insurance Bay Area - Choose if the property has been inspected for this insurance application.

State of California Franchise Tax Board Letter - The California 3541 form is used to claim the motion picture and television production credit.

California Stop Payment - Claimants must provide specific information about the employer or entity responsible for payment to ensure clarity.