Download California 540X Form

Common Questions

-

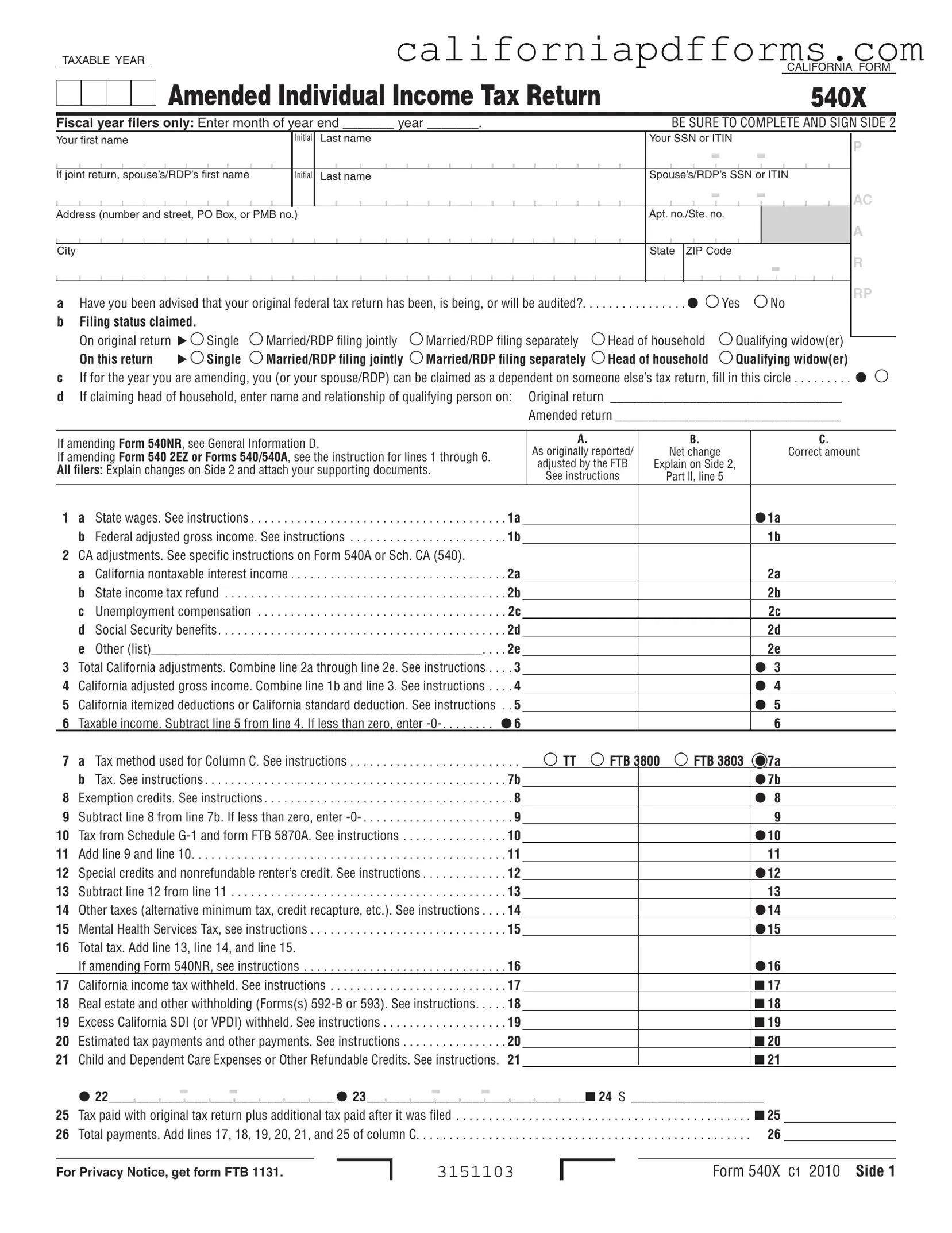

What is the California 540X form?

The California 540X form is an Amended Individual Income Tax Return. It is used by taxpayers to correct errors or make changes to their previously filed California tax returns. This form allows individuals to report changes in income, deductions, credits, or filing status.

-

Who needs to file the 540X form?

Any individual who has already filed a California tax return and needs to amend it should file the 540X form. This includes those who have received new information that affects their tax liability or who have made errors in their original returns.

-

How do I fill out the 540X form?

To complete the 540X form, follow these steps:

- Provide your personal information, including your name, Social Security Number (SSN), and address.

- Indicate your original filing status and the status you are claiming on the amended return.

- List the amounts as originally reported and the corrected amounts for each relevant line item.

- Explain the changes made on Side 2 of the form and attach any necessary supporting documents.

-

When should I file the 540X form?

The 540X form should be filed as soon as you discover an error or need to make changes to your tax return. There is no specific deadline, but it is advisable to file the amendment within four years of the original filing date to ensure you can claim any potential refunds.

-

What supporting documents do I need to include?

When filing the 540X form, include any supporting documents that substantiate the changes being made. This may include corrected W-2s, 1099s, K-1s, or any other relevant financial documents. It is essential to provide a detailed explanation of each change and to attach a list of all supporting documents.

-

What happens after I file the 540X form?

After filing the 540X form, the Franchise Tax Board (FTB) will review your amended return. If you are due a refund, it will be processed and issued accordingly. If you owe additional taxes, the FTB will notify you of the amount due and any penalties or interest that may apply.

-

Where do I send the completed 540X form?

The mailing address for the completed 540X form depends on whether you owe taxes or are expecting a refund. If you are due a refund or have no amount due, send it to:

Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0002

If you owe taxes, mail your return and payment to:

Franchise Tax Board, PO Box 942867, Sacramento, CA 94267-0001

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Form 540X is used to amend an individual income tax return. |

| Eligibility | This form is applicable for individuals who need to correct errors on their original Form 540, 540A, or 540EZ returns. |

| Filing Requirement | Taxpayers must file Form 540X if they have made changes to their federal tax return that affect their California taxes. |

| Governing Law | California Revenue and Taxation Code Sections 18522 and 18523 govern the use of Form 540X. |

| Submission Deadline | Form 540X must be submitted within four years from the original due date of the return. |

| Signature Requirement | Both spouses or registered domestic partners must sign the form if filing jointly. |

| Supporting Documents | Taxpayers must attach any necessary supporting documents that justify the changes made. |

| Refund Claims | If a refund is due, it will be processed after the amended return is reviewed. |

| Where to File | Mail the completed form to the Franchise Tax Board at the specified addresses based on whether you owe taxes or are due a refund. |

| Privacy Notice | Taxpayers can find the privacy notice by referring to Form FTB 1131. |

Dos and Don'ts

When filling out the California 540X form, there are important guidelines to follow. Here’s a list of what to do and what to avoid:

- Do read the instructions carefully before starting.

- Do provide accurate personal information, including your Social Security Number or ITIN.

- Do explain all changes clearly on Side 2 of the form.

- Do attach all necessary supporting documents, such as corrected W-2s or 1099s.

- Do sign and date the form to validate your submission.

- Don't leave any required fields blank; fill in all necessary information.

- Don't submit duplicate copies of the amended return unless specifically requested.

- Don't forget to check for any penalties or interest that may apply.

- Don't use a previous year’s form; ensure you have the current version.

- Don't ignore deadlines for filing the amended return; timely submission is crucial.

Misconceptions

The California 540X form is an important document for taxpayers who need to amend their individual income tax returns. However, several misconceptions surround its use. Understanding these can help ensure that you complete the form correctly and avoid potential issues.

- Misconception 1: The 540X form is only for residents.

- Misconception 2: You can only amend your return if you owe more taxes.

- Misconception 3: The 540X form is the same as the original tax return.

- Misconception 4: You do not need to provide documentation with the 540X.

- Misconception 5: You can amend your return at any time.

- Misconception 6: Filing a 540X will automatically trigger an audit.

- Misconception 7: You cannot amend a return if the IRS has audited it.

- Misconception 8: You must amend your federal return before amending your California return.

- Misconception 9: You can submit the 540X electronically.

Many believe that only California residents can file the 540X form. In reality, both residents and nonresidents who have filed a California tax return can amend their returns using this form.

Some think that amendments are only necessary if additional taxes are owed. This is not true. You can also amend your return to claim a refund or correct errors that may have resulted in overpayment.

While the 540X form is related to your original return, it is specifically designed for amendments. It requires different information and explanations for the changes made.

Many taxpayers think they can submit the form without any supporting documents. However, it is essential to attach any relevant documents that justify the changes, such as corrected W-2s or 1099s.

There is a time limit for filing an amendment. Generally, you must submit the 540X form within four years from the original due date of the return or within one year from the date you paid the tax, whichever is later.

Some individuals fear that filing an amended return will lead to an audit. While any return can be subject to review, filing a 540X does not inherently increase the likelihood of an audit.

People often believe that once the IRS audits a return, it cannot be amended. However, you can still file a 540X to correct errors, even after an audit, as long as you provide the necessary information.

Although it is advisable to amend your federal return first if it affects your California taxes, you can file the 540X independently. Just be sure to address any discrepancies between the two returns.

Currently, the 540X form must be filed by mail. It cannot be submitted electronically, which is a common misconception among taxpayers.

Documents used along the form

The California 540X form is used for amending an individual income tax return. When filing this form, several other documents may be required to support the changes being made. Below is a list of commonly used forms and documents that often accompany the California 540X form.

- California Form 540: This is the standard individual income tax return form for California residents. If you are amending your return, you will need to include a copy of the original Form 540.

- California Schedule CA (540): This schedule is used to report adjustments to income and deductions for California tax purposes. It is essential to provide this document when amending your return.

- Federal Form 1040: If changes to your California tax return are based on modifications to your federal return, you must include a copy of the amended federal Form 1040.

- Federal Schedule A: This schedule is used to report itemized deductions on your federal tax return. If your itemized deductions have changed, include this document.

- W-2 Forms: These forms report wages and tax withheld from your employer. If there are corrections to your income, attach the revised W-2s.

- 1099 Forms: Similar to W-2s, 1099 forms report various types of income. If there are adjustments related to income reported on these forms, include them with your amendment.

- Supporting Documentation: Any other documents that substantiate the changes made, such as corrected K-1s, court documents, or contracts, should be attached as well.

- California Form FTB 5870A: If applicable, this form is used to report additional taxes owed. It may be necessary if your amended return results in a tax liability.

When submitting the California 540X form, ensure that all necessary documents are included to avoid delays in processing. Accurate and complete submissions help facilitate a smoother amendment process and can assist in obtaining any refunds or adjustments owed.

Different PDF Templates

How to Check Gun Registration Online - The form also inquires about mental health history relevant to firearm ownership eligibility.

California 565 - The LP-7 form is essential for managing the status of limited partnerships in California.

Fl-341(b) - Judicial discretion is reinforced through mandated assessments for all parties involved.