Download California 541 A Form

Common Questions

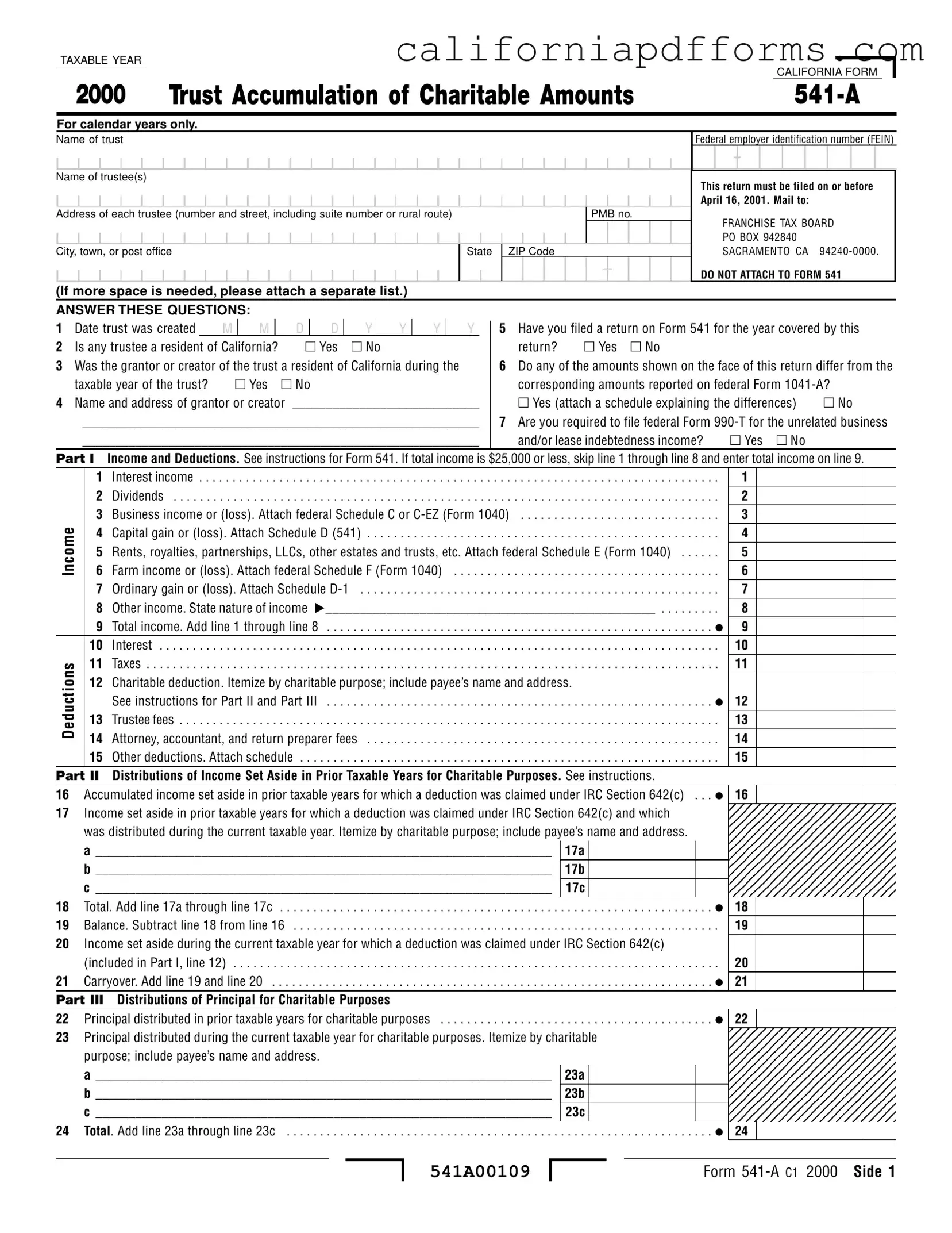

What is the purpose of the California 541-A form?

The California 541-A form is specifically designed for trustees of charitable trusts or split-interest trusts. It helps report the charitable information required under California tax law. This form ensures that any deductions claimed under the Internal Revenue Code (IRC) Section 642(c) are properly documented. By filing this form, trustees can provide necessary details about the trust's income, deductions, and distributions related to charitable purposes.

Who is required to file the California 541-A form?

A trustee must file Form 541-A for a trust that claims a charitable deduction under IRC Section 642(c) or operates as a charitable or split-interest trust. However, if the governing instrument of the trust mandates that all income be distributed currently for the taxable year, then filing this form is not necessary. It's essential to determine if the trust qualifies as a charitable trust or a split-interest trust, as both have specific criteria outlined in the California Revenue and Taxation Code.

When is the California 541-A form due?

The due date for filing the California 541-A form is April 16 of the year following the taxable year being reported. For example, if you are reporting for the taxable year 2000, the form must be filed by April 16, 2001. If more time is needed, California allows for an automatic six-month extension without requiring a request form. This flexibility can be beneficial for trustees needing additional time to gather information.

Where should the California 541-A form be mailed?

Once completed, the California 541-A form should be mailed to the Franchise Tax Board at the following address: PO BOX 942840, Sacramento, CA 94240-0000. Ensuring that the form is sent to the correct address helps avoid any delays in processing and ensures compliance with state requirements.

What should be included in Parts II and III of the California 541-A form?

Parts II and III require detailed descriptions of charitable disbursements made from income set aside in prior taxable years and amounts distributed from principal for charitable purposes. Trustees should include specific information about the nature of the charitable payments, such as nursing services, construction projects, or assistance programs. Clear and detailed descriptions help clarify the purpose of the distributions and support the deductions claimed on the form.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | Form 541-A is used to report charitable amounts for trusts under California law. |

| Governing Law | This form is governed by the Revenue and Taxation Code (R&TC) Section 18635. |

| Filing Deadline | Form 541-A must be filed by April 16, 2001. |

| Who Must File | Trustees of certain charitable trusts must file this form to claim deductions. |

| California Residency | At least one trustee must be a resident of California to file this form. |

| Income Reporting | If total income is $25,000 or less, only the total income needs to be reported. |

| Federal Conformity | California tax law generally conforms to the IRC as of January 1, 1998, with some exceptions. |

| Extension of Time | An automatic six-month extension is available for filing without a request form. |

| Mailing Address | Mail Form 541-A to the Franchise Tax Board at PO Box 942840, Sacramento, CA 94240-0000. |

Dos and Don'ts

When filling out the California 541 A form, keep the following tips in mind:

- Do ensure all information is accurate and complete.

- Do use the correct federal employer identification number (FEIN) for the trust.

- Do file the form by the deadline of April 16, 2001.

- Do attach any necessary schedules or additional information as required.

- Do review the form for any discrepancies before submission.

- Don't leave any required fields blank; provide explanations if necessary.

- Don't forget to sign and date the form before mailing.

- Don't attach the form to Form 541; submit it separately.

- Don't ignore instructions for reporting differences between state and federal amounts.

Misconceptions

- Misconception 1: The California 541 A form is only for charitable trusts.

- Misconception 2: All trusts must file the California 541 A form.

- Misconception 3: The deadline for filing the California 541 A form is strict and cannot be extended.

- Misconception 4: You must attach the California 541 A form to Form 541.

- Misconception 5: The California 541 A form only reports income and not deductions.

- Misconception 6: All income reported on the California 541 A form is taxable.

- Misconception 7: The California 541 A form is the same as the federal Form 1041-A.

- Misconception 8: You can file the California 541 A form electronically.

This form is required for any trust that claims a charitable deduction under IRC Section 642(c) or for a charitable or split-interest trust, regardless of whether it is solely a charitable trust.

Not all trusts are required to file this form. If the governing instrument mandates the distribution of all income for the year, then filing is not necessary.

While the form is due on April 16, 2001, California allows an automatic six-month extension without needing to submit a request form.

The instructions specify that the California 541 A form should not be attached to Form 541, which is a common misunderstanding.

The form includes sections for both income and deductions, allowing trustees to report charitable deductions and other expenses related to the trust.

Income may not be taxable if it is set aside for charitable purposes, as specified under IRC Section 642(c).

While there are similarities, the California 541 A form has specific state requirements and may differ in terms of deductions and reporting obligations.

As of the specified date, the form must be mailed to the Franchise Tax Board and cannot be filed electronically.

Documents used along the form

The California Form 541-A is essential for trustees managing charitable trusts. Alongside this form, several other documents may be necessary to ensure compliance with tax regulations. Below is a list of common forms and documents that often accompany the California 541-A form, each serving a specific purpose in the reporting process.

- California Form 541: This is the primary tax return for fiduciaries in California. It reports the income, deductions, and distributions of the trust, serving as the foundation for the 541-A.

- Federal Form 1041: This federal tax return is required for estates and trusts. It reports income, deductions, gains, and losses, and is often used to reconcile with state filings.

- Federal Form 990-T: If the trust has unrelated business income, this form is needed to report that income and calculate any tax owed.

- California Form 199: This form is used by exempt organizations to report annual information. Charitable trusts that qualify may need to file this to maintain their status.

- Schedule D (Form 541): This schedule is for reporting capital gains and losses. If the trust has investment income, this form is necessary to detail those transactions.

- Schedule E (Form 1040): This is used to report income from rental properties, partnerships, and other pass-through entities. It may be relevant if the trust has such income sources.

- Schedule C (Form 1040): If the trust has business income or losses, this schedule provides the necessary details about that income.

- FTB Form 1131: This form contains the Privacy Act Notice, which is important for understanding how personal information is handled and protected during the filing process.

Understanding these forms can simplify the filing process and help ensure compliance with both state and federal tax laws. Each document plays a crucial role in accurately reporting the financial activities of a charitable trust, ultimately supporting its mission and compliance obligations.

Different PDF Templates

Dcss - Summons / Complaint - Use the FL-600 to formally dispute parentage or child support responsibilities within 30 days of being served.

Ca Court Forms - Filing this form can help individuals collect overdue child and spousal support more effectively.

California Participating Physician Application - Information about the lawsuit's location, including city and state, must be provided.