Download California 541 T Form

Common Questions

What is the purpose of the California 541 T form?

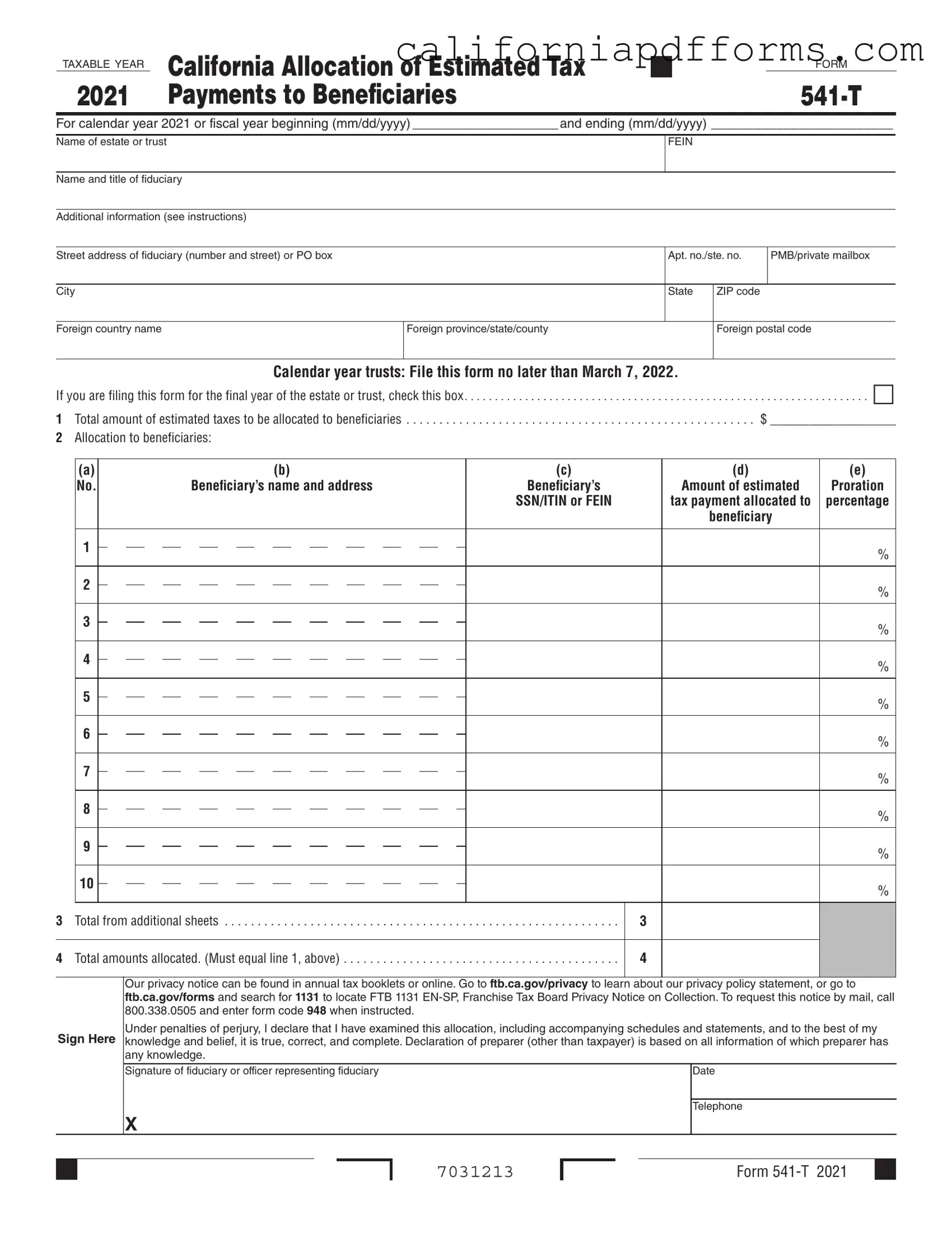

The California 541 T form is used by trusts and decedent’s estates to allocate estimated tax payments to beneficiaries. This form allows a fiduciary to elect to treat some or all of the estate or trust's estimated tax payments as if they were made directly by the beneficiaries. It’s important to note that this election is irrevocable once made. This means that once you decide to allocate these payments to beneficiaries, you cannot change your mind later.

When is the California 541 T form due?

The form must be filed by the 65th day after the close of the tax year. For calendar year trusts, this means you need to submit it by March 6 of the following year. If this date falls on a weekend or a holiday, you can file it on the next business day. Timely filing is crucial to ensure that your election is valid.

How do I file the California 541 T form?

To file the California 541 T form, you should send it separately from the California Fiduciary Income Tax Return (Form 541). Do not attach the 541 T form to the 541 form. Mail the completed 541 T form to the Franchise Tax Board at the address provided in the instructions. This helps ensure that your forms are processed correctly and efficiently.

What information is required on the California 541 T form?

The form requires several pieces of information, including:

- The total amount of estimated taxes to be allocated to beneficiaries.

- The names and addresses of each beneficiary, along with their Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- The amount of estimated tax payment allocated to each beneficiary.

- The proration percentage for each beneficiary, which is calculated by dividing the allocated amount by the total amount of estimated taxes.

Accurate and complete information is essential to avoid processing delays or potential penalties.

What should I do if I have more than ten beneficiaries?

If your trust or estate has more than ten beneficiaries, you can list additional beneficiaries on a separate attached sheet. This sheet should follow the same format as the form itself. Make sure to include the fiduciary’s name and FEIN on this additional sheet to ensure it is processed correctly. This allows for a clear and organized presentation of all beneficiaries and their respective allocations.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California 541 T form allows a trust or decedent's estate to allocate estimated tax payments to beneficiaries. |

| Governing Law | This form is governed by Revenue and Taxation Code Section 17731 and Internal Revenue Code Section 643(g)(1)(B). |

| Filing Requirement | Form 541 T must be filed separately from Form 541, the California Fiduciary Income Tax Return. |

| Filing Deadline | The form must be submitted by the 65th day after the close of the tax year. For calendar year trusts, this is March 6, 2003. |

| Final Year Indicator | There is a box to check if the form is being filed for the final year of the estate or trust. |

| Beneficiary Information | Beneficiary names, addresses, and identifying numbers (SSN or FEIN) must be included on the form. |

| Estimated Tax Amount | Line 1 requires the total amount of estimated taxes to be allocated to beneficiaries. |

| Proration Calculation | Each beneficiary's allocation is based on a proration percentage calculated from the total estimated tax amount. |

| Mailing Address | Form 541 T should be mailed to the Franchise Tax Board at PO Box 942840, Sacramento, CA 94240-0002. |

| Privacy Notice | For privacy information, refer to Form FTB 1131, which is not to be filed with Form 541 T. |

Dos and Don'ts

When filling out the California 541 T form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten important do's and don'ts:

- Do ensure that the form is completed for the correct tax year, which is 2002 for this form.

- Do provide the fiduciary's full name and address, including suite or PMB numbers, if applicable.

- Do enter the total amount of estimated taxes to be allocated to beneficiaries accurately on line 1.

- Do group beneficiaries into two categories: individuals with Social Security Numbers (SSNs) and other entities.

- Do include the correct SSN or FEIN for each beneficiary to avoid processing delays.

- Don't attach Form 541-T to Form 541; file them separately.

- Don't forget to check the box if filing for the final year of the estate or trust.

- Don't underestimate the importance of accurate proration percentages; they must total 100% across beneficiaries.

- Don't omit any beneficiaries if there are more than ten; use an additional sheet to list them.

- Don't file the form late; it must be submitted by the 65th day after the close of the tax year.

Misconceptions

Understanding the California 541 T form can be challenging, and several misconceptions often arise. Here are four common misunderstandings, along with clarifications to help you navigate this important tax document.

- Misconception 1: The California 541 T form is the same as the Form 541.

- Misconception 2: Filing the 541 T form is optional for all trusts and estates.

- Misconception 3: You can distribute withholding amounts to beneficiaries on the 541 T form.

- Misconception 4: The deadline for filing the 541 T form is the same as for Form 541.

This is incorrect. The California 541 T form is specifically used for allocating estimated tax payments to beneficiaries, while Form 541 is the California Fiduciary Income Tax Return. These forms serve different purposes and should be filed separately.

This is not true. Filing the 541 T form is mandatory if a trust or decedent’s estate wants to elect to treat any part of its estimated tax payments as made by its beneficiaries. This election is irrevocable once made, making it crucial to file on time.

This is a misunderstanding. The 541 T form is not intended for distributing withholding amounts. Instead, it focuses solely on the allocation of estimated tax payments among beneficiaries.

This is misleading. The 541 T form must be filed by the 65th day after the close of the tax year, while the deadline for Form 541 may differ. It is important to be aware of these specific deadlines to avoid penalties.

Documents used along the form

The California 541 T form is essential for trusts or estates to allocate estimated tax payments to beneficiaries. When preparing this form, several other documents may be required to ensure compliance and accurate reporting. Below is a list of commonly used forms that accompany the California 541 T.

- Form 541: This is the California Fiduciary Income Tax Return. It reports the income, deductions, and credits of the trust or estate. It must be filed separately from the 541 T form.

- Schedule K-1 (541): This schedule details each beneficiary's share of income, deductions, and credits. It is crucial for beneficiaries to report their income correctly on their personal tax returns.

- Form FTB 1131: This is the Privacy Act Notice. It informs individuals about the collection and use of their personal information by the Franchise Tax Board.

- Form 541-A: This form is used for the California Alternative Minimum Tax. It helps determine if the estate or trust is subject to this tax and calculates the amount owed.

- Form 540: This is the California Resident Income Tax Return. Beneficiaries who are individuals may need to file this form to report their income, including any amounts received from the trust or estate.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It may be used to report distributions made to beneficiaries from the trust or estate.

Each of these documents plays a significant role in the overall tax filing process for trusts and estates in California. Ensure that all necessary forms are completed accurately to avoid any complications with the Franchise Tax Board.

Different PDF Templates

Can an Illegal Immigrant Win the Lottery - Federal tax withholding rates apply based on your citizenship status.

California 513 026 - Labels play a crucial role in how the product is marketed and sold.

Motion to Vacate Judgment California - The SC-223 is a proactive step for creditors to reclaim their funds through the legal system.