Download California 570 Form

Common Questions

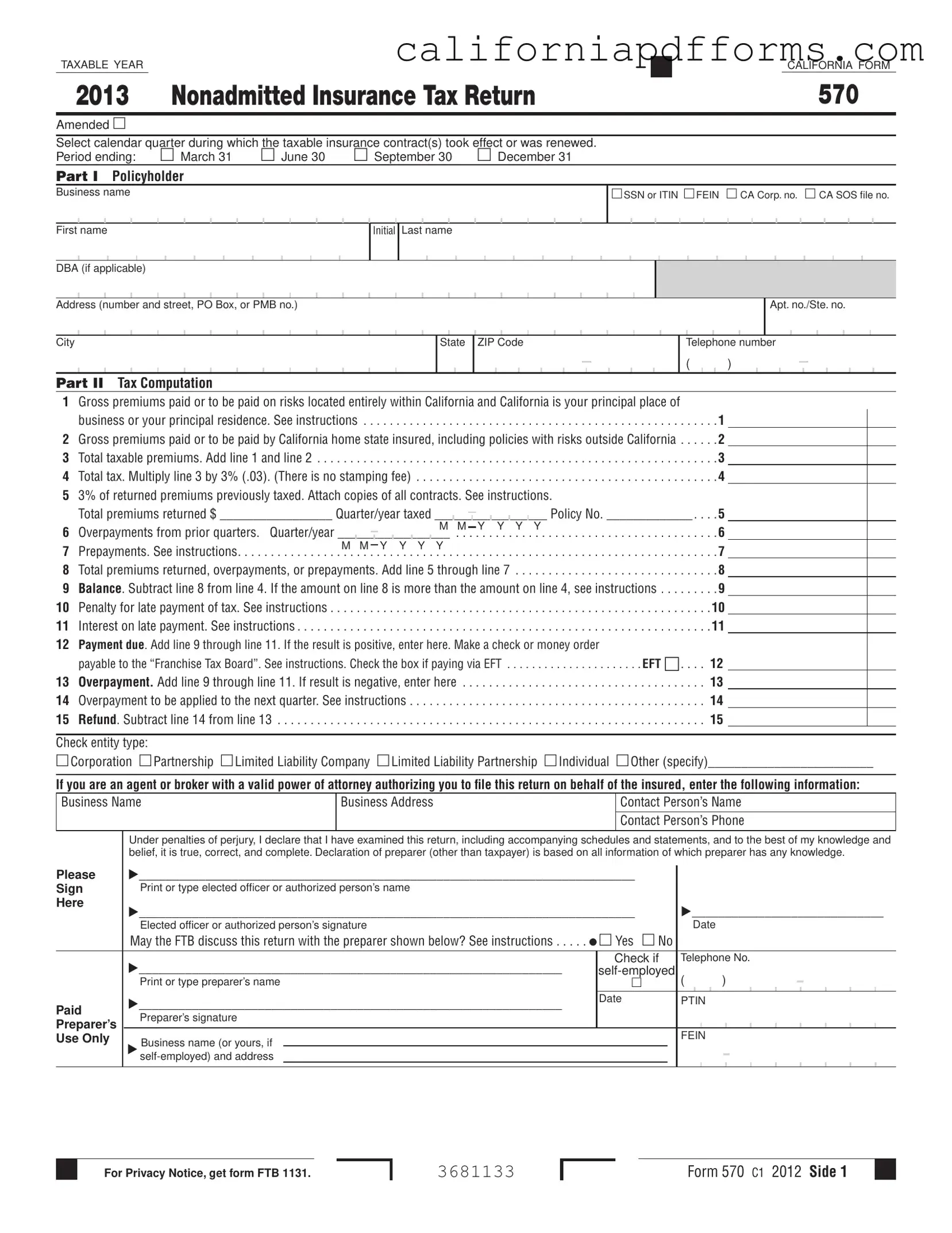

What is the purpose of the California Form 570?

The California Form 570, also known as the Nonadmitted Insurance Tax Return, is used to calculate the tax on premiums paid or to be paid to nonadmitted insurers for contracts that cover risks. This form must be filed by individuals or businesses that purchase or renew nonadmitted insurance contracts during a calendar quarter. Additionally, it can be used to file an amended return if there are corrections or claims for refunds. The tax rate applied is three percent of the gross premiums.

Who is required to file Form 570?

Any individual or business that qualifies as a "home state insured" in California must file Form 570. This includes those who purchase insurance contracts from nonadmitted insurers. A home state insured is defined as someone whose principal place of business or residence is in California. It is important to note that certain types of insurance coverage are exempt from this tax, such as those for which a surplus lines tax has already been paid or those governed by specific provisions of the California Insurance Code.

When is Form 570 due, and where should it be filed?

Form 570 must be filed on or before the first day of the third month following the end of each calendar quarter in which the insurance contract took effect or was renewed. For example, if a contract is effective from January to March, the return is due by June 1. The completed form, along with any payment, should be mailed to the Franchise Tax Board at the specified address: PO Box 942867, Sacramento, CA 94267-0651.

What should be included when filing an amended Form 570?

When filing an amended Form 570, it is essential to check the "Amended" box at the top of the form. Attach a copy of the original return behind the amended return, clearly marked as "copy." Use the amounts that should have been reported on the original return when filling out lines 1 through 15. Amended returns must be submitted within four years of the original due date or within one year from the date of the overpayment. Additionally, include copies of all contracts relevant to the changes being reported.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form 570 | This form is used to determine the tax on premiums paid or to be paid to nonadmitted insurers on contracts covering risks. |

| Governing Law | The form is governed by the California Revenue and Taxation Code and the California Insurance Code. |

| Tax Rate | The tax rate for nonadmitted insurance is set at three percent (3%) of the gross premiums. |

| Filing Frequency | Individuals may need to file up to four Form 570 tax returns in one year, corresponding to each calendar quarter. |

| Amended Returns | Form 570 can be used to file amended returns to correct errors or claim refunds. It must be filed within four years of the original due date. |

| Who Must Pay | The tax is imposed on a home state insured who purchases or renews an insurance contract from a nonadmitted insurer. |

| Payment Deadline | Form 570 must be filed by the first day of the third month following the close of any calendar quarter during which a nonadmitted insurance contract took effect or was renewed. |

| Returned Premiums | Taxpayers can claim returned premiums on line 5 of the form. This includes premiums returned due to cancellation or reduction. |

| Contact Information | For questions, individuals can contact the FTB Nonadmitted Insurance Desk at 916.845.7448. |

Dos and Don'ts

When filling out the California Form 570, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are six do's and don'ts to keep in mind:

- Do print all information clearly using capital letters.

- Do include your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) as required.

- Do double-check all calculations before submitting the form.

- Do file your return by the due date to avoid penalties.

- Don't round cents to the nearest dollar; report amounts with dollars and cents.

- Don't forget to attach copies of all relevant contracts if claiming returned premiums.

Misconceptions

Here are some common misconceptions about the California 570 form:

- Only large businesses need to file Form 570. Many individuals and small businesses also need to file this form if they purchase nonadmitted insurance.

- The tax only applies to insurance purchased in California. The tax applies to all premiums for policies related to risks within the U.S., not just those purchased in California.

- You can ignore late payment penalties. Late payments incur a penalty, and interest will also be charged on the amount due.

- Form 570 is only for the first quarter of the year. You may need to file this form for each calendar quarter if you purchase nonadmitted insurance contracts throughout the year.

- Returned premiums do not need to be reported. You must report returned premiums on the form to receive a proper adjustment.

- Filing an amended return is not necessary. If you made an error on your original return, you should file an amended return to correct it.

- You can round amounts to the nearest dollar. The form requires you to enter amounts with dollars and cents; do not round.

- Only licensed agents can file this form. Individuals can file Form 570 directly if they are the policyholders.

Documents used along the form

The California Form 570 is essential for reporting and paying taxes on nonadmitted insurance contracts. However, several other forms and documents often accompany this tax return to ensure compliance and accuracy. Below are some of the key documents that may be used alongside Form 570.

- Form FTB 1131: This form provides a privacy notice regarding the collection and use of personal information by the Franchise Tax Board (FTB). It informs taxpayers about their rights and how their data will be handled.

- Form FTB 3520: This form is used to designate a third party, such as a tax preparer, to discuss the tax return with the FTB. It allows for more efficient communication regarding any questions or issues that may arise during the processing of the return.

- Side 2 of Form 570: If the taxpayer has more than 24 policies to report, this additional page is required. It allows for detailed reporting of each nonadmitted insurance policy, including information about the insurer, type of coverage, and premium amounts.

- Amended Return Documentation: If corrections are necessary after the initial filing, supporting documents must be attached to any amended return. This includes a copy of the original return and any contracts related to changes in premium amounts.

These accompanying documents play a crucial role in ensuring the accuracy and completeness of the tax reporting process. When filing Form 570, it is important to include all necessary forms and information to avoid delays or issues with the Franchise Tax Board.

Different PDF Templates

California Financial Aid Income Limit - Provide your full name, including last name, first name, and middle initial on the form.

Cdph 530 - The bond must cover the entire state to satisfy legal requirements for health facilities.