Download California 5805 Form

Common Questions

What is the purpose of California Form 5805?

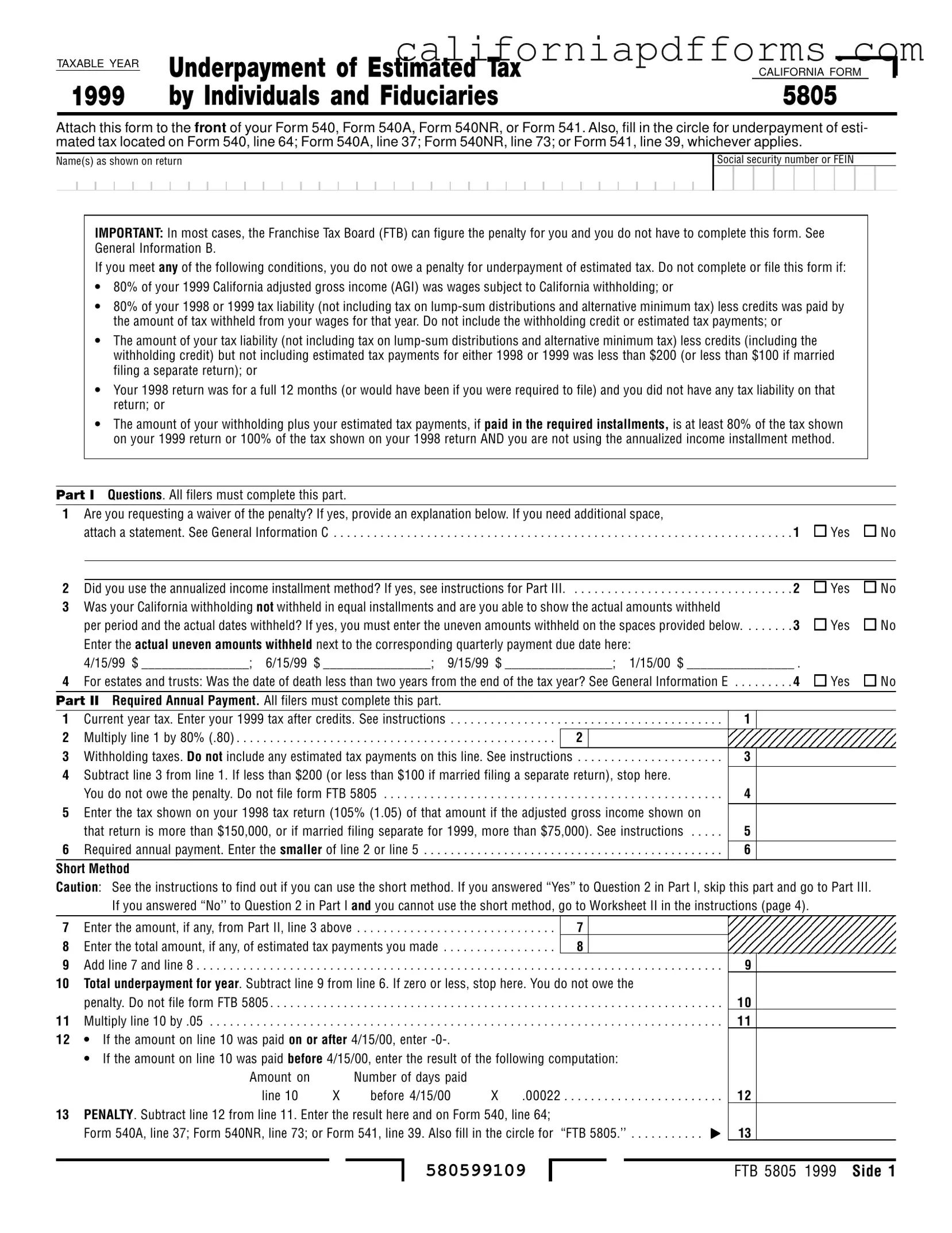

California Form 5805 is used to determine if you owe a penalty for underpaying your estimated tax. If you find that you have underpaid, this form also helps calculate the amount of that penalty. It is important to attach this form to the front of your tax return, such as Form 540, Form 540A, Form 540NR, or Form 541.

Who needs to file Form 5805?

Generally, most taxpayers do not need to complete this form. The Franchise Tax Board (FTB) can calculate any penalties for you after you file your return. However, you must file Form 5805 if you answered "Yes" to any questions in Part I of the form, especially if you are an estate or trust. Additionally, if you are a nonresident or a new resident, you may also need to file this form.

What conditions exempt me from the penalty for underpayment?

You do not owe a penalty for underpayment of estimated tax if you meet any of the following criteria:

- 80% of your California adjusted gross income (AGI) was from wages subject to California withholding.

- 80% of your tax liability for 1998 or 1999 was covered by withholding from your wages.

- Your tax liability for either year was less than $200 (or $100 if married filing separately).

- Your 1998 return showed no tax liability and was for a full 12 months.

- Your total withholding plus estimated tax payments is at least 80% of your 1999 tax or 100% of your 1998 tax.

If you meet any of these conditions, you do not need to complete or file Form 5805.

How do I request a waiver for the penalty?

If you believe you qualify for a waiver of the penalty, you need to indicate this on Form 5805 by checking "Yes" to Question 1 in Part I. You should then provide an explanation for your request. If you need more space, attach a separate statement. Complete the form through Part II, line 12, without regard to the waiver. Write the amount you wish to waive in parentheses next to Part II, line 13. Finally, ensure you fill in the appropriate circle on your tax return to indicate that you are filing Form 5805.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Form 5805 is used to determine if you owe a penalty for underpaying your estimated tax. |

| Who Must File | Generally, you do not need to complete this form. The Franchise Tax Board can calculate the penalty for you. |

| Conditions for No Penalty | You may not owe a penalty if certain conditions are met, such as having 80% of your income subject to withholding. |

| Filing Requirement | Attach Form 5805 to the front of your Form 540, 540A, 540NR, or 541 if you need to file it. |

| Governing Law | The form is governed by California Revenue and Taxation Code Section 18539.5. |

| Waiver Request | You can request a waiver of the penalty if you underpaid due to unusual circumstances, like a disaster. |

Dos and Don'ts

When filling out the California 5805 form, there are essential guidelines to follow to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do ensure that you attach the California 5805 form to the front of your Form 540, 540A, 540NR, or 541.

- Do fill in the circle for underpayment of estimated tax on the appropriate line of your tax return.

- Do provide accurate names and social security numbers or FEIN as required on the form.

- Do check if you qualify for any exceptions to the penalty before completing the form.

- Do request a waiver of the penalty if your underpayment was due to unusual circumstances, such as a disaster.

- Do keep copies of all documents and forms submitted for your records.

- Do review the instructions thoroughly to ensure you understand each part of the form.

- Don't complete or file the form if you meet the criteria for not owing a penalty.

- Don't forget to provide an explanation if you are requesting a waiver of the penalty.

- Don't use the form if your income was consistent throughout the year without fluctuations.

- Don't submit the form without checking for any mistakes or missing information.

- Don't delay in filing your tax return or the 5805 form to avoid additional penalties.

- Don't ignore the specific instructions for estates and trusts if applicable to your situation.

- Don't assume that the Franchise Tax Board will automatically calculate your penalty without submitting the form if required.

Misconceptions

- Misconception 1: Everyone must complete Form 5805.

- Misconception 2: The form is only for individuals.

- Misconception 3: You must always pay a penalty for underpayment.

- Misconception 4: The annualized income installment method is complex and unnecessary.

- Misconception 5: Filing Form 5805 guarantees a penalty waiver.

Many people believe that they are required to fill out Form 5805 regardless of their tax situation. In reality, the Franchise Tax Board (FTB) can often calculate any penalties for underpayment on your behalf. You only need to complete the form if specific conditions apply to your situation.

Some assume that Form 5805 is exclusively for individual taxpayers. However, this form also applies to fiduciaries, such as estates and trusts, which are required to make estimated tax payments. Thus, the form is relevant for a broader range of taxpayers.

Another common misunderstanding is that a penalty is inevitable if you underpay your estimated tax. Under certain circumstances, such as having sufficient withholding or low tax liability, you may not owe any penalty at all. It's important to review the conditions outlined in the form.

Many individuals think that using the annualized income installment method is overly complicated. In fact, this method can actually simplify your tax calculations if your income varies throughout the year. It allows you to potentially lower your required payments based on when you actually earned your income.

Some taxpayers mistakenly believe that simply filing Form 5805 will automatically waive any penalties. While you can request a waiver on the form, the FTB will evaluate your circumstances to determine if the waiver is granted. It’s essential to provide a valid reason for your request.

Documents used along the form

The California Form 5805 is essential for individuals and fiduciaries who need to determine if they owe a penalty for underpaying estimated taxes. Alongside this form, several other documents may be required to ensure compliance with tax regulations. Below is a list of related forms and documents commonly used in conjunction with the California Form 5805.

- Form 540: This is the California Resident Income Tax Return. Individuals use it to report their income and calculate their tax liability for the year.

- Form 540A: This is a simpler version of Form 540 for individuals with straightforward tax situations. It is designed for those who do not need to itemize deductions.

- Form 540NR: Nonresidents and part-year residents use this form to report income earned in California and calculate their tax obligations.

- Form 541: This form is for fiduciaries of estates and trusts to report income and calculate taxes owed on behalf of the estate or trust.

- Form FTB 5806: This form is used by exempt trusts to report underpayment of estimated tax, specifically for those who do not qualify for Form 5805.

- Form FTB 5805F: Farmers and fishermen use this form to calculate underpayment penalties specific to their unique tax situations.

- Form W-2: Employers provide this form to employees to report wages paid and taxes withheld throughout the year, which is crucial for accurate tax filing.

- Form 1099: This form is issued to independent contractors and freelancers to report income received, which must be considered when calculating estimated taxes.

These forms and documents play a vital role in ensuring accurate tax reporting and compliance with California tax laws. Understanding their purposes can help individuals and fiduciaries navigate their tax responsibilities more effectively.

Different PDF Templates

Guardian Ad Litem California Family Law - The judge’s order finalizes the appointment and outlines the legal framework for the guardian’s role.

Does Guardianship Override Parental Rights - The GC 110 form is intended strictly for temporary guardianship situations.