Download California 587 Form

Common Questions

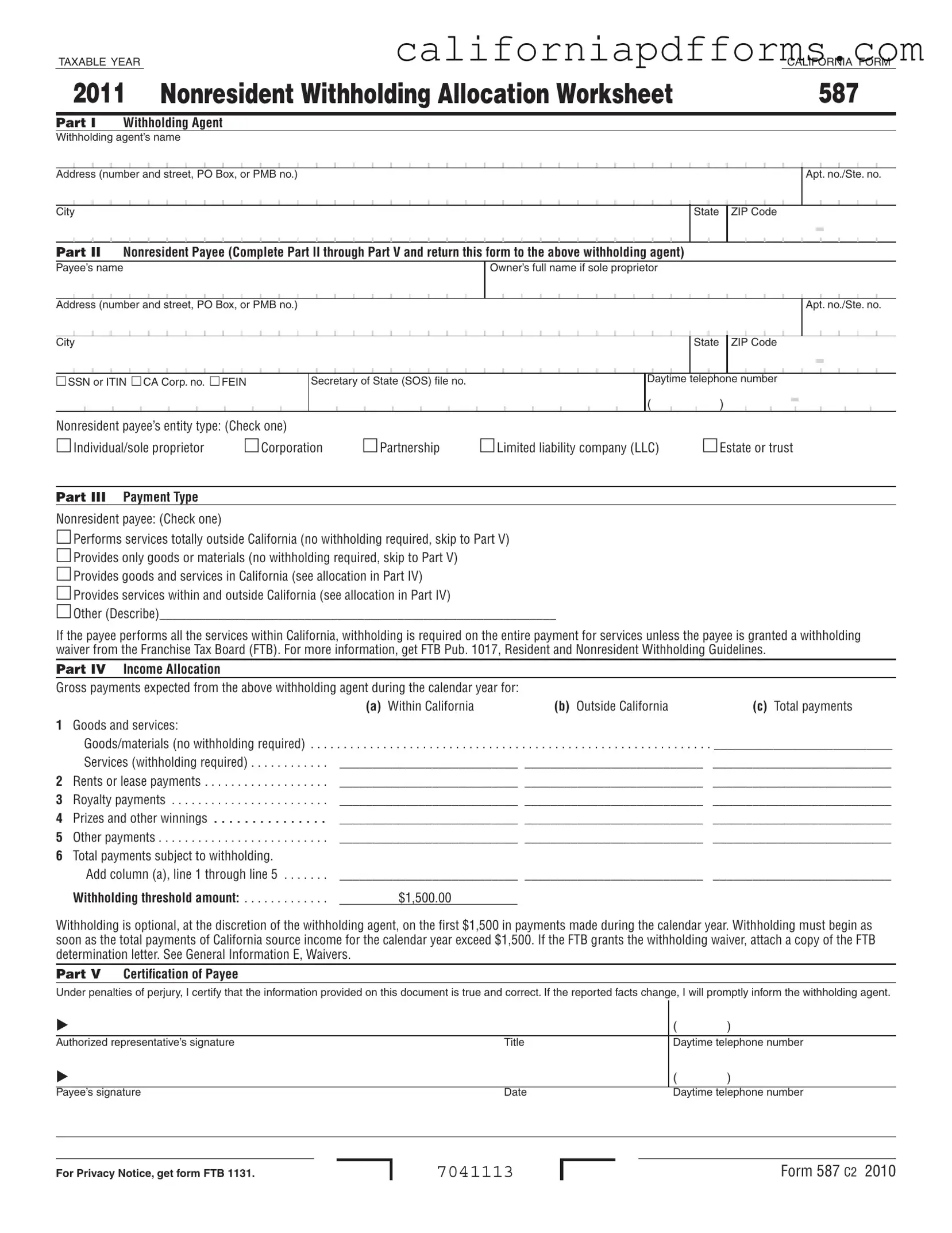

What is California Form 587?

California Form 587, also known as the Nonresident Withholding Allocation Worksheet, is used to determine the amount of withholding required on payments made to nonresidents. This form is essential for withholding agents to ensure compliance with California tax laws when making payments to nonresident individuals or entities.

Who needs to complete Form 587?

Form 587 must be completed by nonresident payees who receive payments from a withholding agent for services performed in California. This includes individuals, corporations, partnerships, limited liability companies (LLCs), estates, and trusts. The withholding agent must also fill out Part I of the form before providing it to the payee.

When is withholding required?

Withholding is required when total payments of California source income to a nonresident exceed $1,500 during the calendar year. If the total payments are $1,500 or less, no withholding is necessary. Payments subject to withholding include:

- Services performed in California

- Rents for property located in California

- Royalties from activities in California

- Prizes for contests entered in California

What types of payments are exempt from withholding?

Payments not subject to withholding include those made to California residents or entities with a permanent place of business in California. Additionally, payments for goods purchased, services performed outside California, or to tax-exempt organizations are also exempt.

How does a nonresident payee request a withholding waiver?

A nonresident payee can request a withholding waiver by using Form 588, Nonresident Withholding Waiver Request. If the Franchise Tax Board (FTB) grants a waiver, the payee must attach a copy of the determination letter to Form 587.

What should be included in Part IV of Form 587?

Part IV is used to allocate income between payments made for services performed within California and those performed outside California. The payee must provide the expected gross payments in three columns: payments within California, payments outside California, and total payments. This section helps determine the correct amount subject to withholding.

How long should Form 587 be retained?

Withholding agents must retain completed Form 587 for a minimum of four years. This form should be available for review by the FTB upon request. It remains valid for the duration of the contract or term of payments unless there are material changes in the facts.

What happens if the information on Form 587 changes?

If any reported facts change, the payee must promptly inform the withholding agent and may need to submit a new Form 587. This ensures that the withholding agent has the most accurate information for compliance purposes.

Where can I find additional information about Form 587?

For more information, you can visit the California Franchise Tax Board's website at ftb.ca.gov. You can also contact their Withholding Services and Compliance department at 888.792.4900 or 916.845.4900 for assistance.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form 587 | Form 587 is used to determine the amount of withholding required on payments made to nonresidents for services performed in California. |

| Governing Law | This form is governed by the California Revenue and Taxation Code (R&TC) Section 18662, which mandates withholding on certain payments to nonresidents. |

| Withholding Threshold | No withholding is required if total payments to a nonresident do not exceed $1,500 during the calendar year, making it essential to track payments accurately. |

| Filing Requirements | The withholding agent must request Form 587 from the payee before payment is made, and it must be retained for a minimum of four years for record-keeping purposes. |

Dos and Don'ts

When filling out the California Form 587, there are several important practices to keep in mind. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do provide complete and accurate information in all required fields, including your taxpayer identification number.

- Do check the appropriate payment type box to indicate the nature of your services or goods.

- Do retain a copy of the completed form for your records for at least four years.

- Do notify the withholding agent promptly if any of the information changes after submission.

- Don't forget to sign and date the form before submitting it to the withholding agent.

- Don't use this form if you are a California resident or if your payment is solely for goods without services.

Misconceptions

- Misconception 1: The California 587 form is only for individuals.

- Misconception 2: Withholding is always required on all payments made to nonresidents.

- Misconception 3: The form must be submitted with every payment.

- Misconception 4: Nonresidents do not need to file a California tax return if they submit Form 587.

- Misconception 5: All payments made to nonresidents are subject to a 7% withholding rate.

- Misconception 6: The withholding agent is solely responsible for determining withholding amounts.

This form is applicable not just to individuals, but also to various entities, including corporations, partnerships, and limited liability companies (LLCs). All these entities may have withholding obligations when making payments to nonresidents for services performed in California.

This is not true. Withholding is only required if the total payments to a nonresident exceed $1,500 during the calendar year. If payments are below this threshold, withholding is optional and at the discretion of the withholding agent.

The California 587 form does not need to be submitted with each payment. Instead, it should be completed and returned to the withholding agent when a contract is entered into or before the first payment is made. The form remains valid for the duration of the contract unless there are changes in the facts.

Submitting Form 587 does not exempt nonresidents from filing a California tax return. Regardless of whether withholding is applied or a waiver is granted, nonresidents are still required to file a tax return and pay any taxes due.

While the standard withholding rate is 7%, certain payments may be exempt. For example, payments made for goods or services performed entirely outside of California do not require withholding. It is essential to evaluate the nature of the payment to determine if withholding applies.

Although the withholding agent plays a crucial role, the nonresident payee also has responsibilities. The payee must accurately complete the California 587 form and provide truthful information. If the payee’s circumstances change, they are obligated to inform the withholding agent promptly.

Documents used along the form

The California 587 form is an important document used to determine withholding requirements for payments made to nonresidents. In conjunction with this form, several other documents may also be necessary to ensure compliance with California tax regulations. Below is a list of related forms that are often used alongside the California 587 form.

- Form 588 - Nonresident Withholding Waiver Request: This form allows nonresidents to request a waiver of the standard withholding amount. If approved, it must be attached to the California 587 form when submitting it to the withholding agent.

- Form 590 - Withholding Exemption Certificate: Used by payees to certify their exemption from withholding. This form is applicable when the payee is a California resident or a non-grantor trust with at least one California resident trustee.

- Form 593-C - Real Estate Withholding Certificate: This document is required when payments are made for the sale of California real estate. It certifies the amount of withholding required on such transactions.

- Form 540NR - California Nonresident or Part-Year Resident Income Tax Return: Nonresidents must file this tax return to report their California source income and pay any taxes owed. It is crucial for ensuring compliance with state tax laws.

- Form 541 - California Fiduciary Income Tax Return: This form is used by estates and trusts to report income generated from California sources. It is essential for fiduciaries managing these entities.

- Form 100 - California Corporation Franchise or Income Tax Return: Corporations that operate in California must file this return to report their income and pay taxes. It is relevant for corporate payees subject to withholding.

Understanding these forms and their purposes is essential for compliance with California tax regulations. Each document plays a specific role in the withholding process and helps ensure that all parties meet their tax obligations accurately.

Different PDF Templates

Form 540 Taxes - The Practitioner PIN method allows taxpayers to avoid using a shared secret for the submission.

Ca Court Forms - Inaccuracies in the form could delay the court's response to the modification request.

How to Sever Joint Tenancy in California - Timely filing of the Notice of Severance is important to secure one's rights before any potential issues arise.