Download California 5870A Form

Common Questions

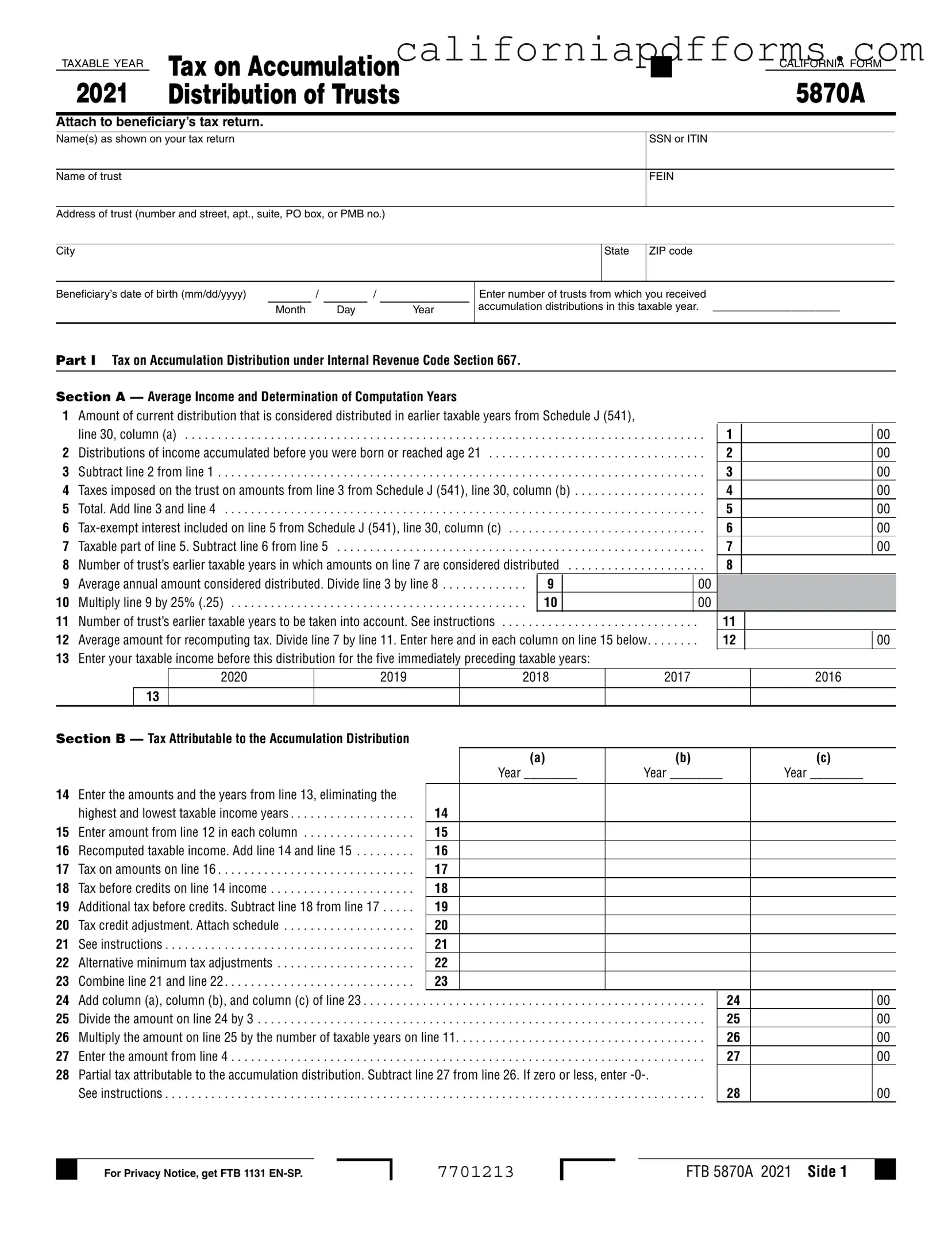

What is the California 5870A form?

The California 5870A form is used to report the tax on accumulation distributions from trusts. It must be attached to the beneficiary's tax return for the taxable year in which the distribution is received. This form helps determine the tax liability associated with distributions that have accumulated over previous years.

Who needs to file the California 5870A form?

Beneficiaries of trusts that receive accumulation distributions are required to file the California 5870A form. If a beneficiary has received distributions that include income accumulated in prior taxable years, they must report this using the form when filing their tax return.

What information is required to complete the California 5870A form?

To complete the California 5870A form, the following information is typically required:

- Name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the beneficiary.

- Name and address of the trust.

- Beneficiary's date of birth.

- Details of the accumulation distributions received from the trust.

What are accumulation distributions?

Accumulation distributions refer to amounts that a trust has retained or accumulated over time rather than distributed to beneficiaries. These distributions may be subject to special tax rules, particularly if they relate to income that was not distributed during the years it was earned.

How is the tax calculated on accumulation distributions?

The tax on accumulation distributions is calculated based on the income accumulated in prior years. The form requires the beneficiary to report the amounts of current distributions, any tax-exempt interest, and other relevant details to compute the taxable portion. The form includes various sections to guide beneficiaries through the calculation process.

What happens if the income was accumulated for less than five taxable years?

If the income was accumulated for less than five taxable years, beneficiaries must complete a specific section of the California 5870A form that addresses this situation. The calculations differ slightly from those used for income accumulated over five years or more, focusing on the shorter accumulation period.

Are there penalties for not filing the California 5870A form?

Failure to file the California 5870A form when required may result in penalties and interest on any unpaid taxes. It is important for beneficiaries to ensure compliance with tax filing requirements to avoid potential financial consequences.

Where can I obtain the California 5870A form?

The California 5870A form can be obtained from the California Franchise Tax Board's website or through various tax preparation software. It is advisable to use the most current version of the form to ensure accuracy in filing.

Can I file the California 5870A form electronically?

Yes, the California 5870A form can be filed electronically if the beneficiary is using tax preparation software that supports this form. Many taxpayers find electronic filing to be a convenient option, as it often allows for faster processing and confirmation of submission.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | The California 5870A form is used to report the tax on accumulation distributions from trusts to beneficiaries. |

| Governing Law | This form is governed by Internal Revenue Code Section 667 and California Revenue and Taxation Code Section 17745. |

| Tax Year | The form is specifically for the taxable year 2020, as indicated in its title. |

| Filing Requirement | Beneficiaries must attach the 5870A form to their tax return when reporting accumulation distributions. |

Dos and Don'ts

When filling out the California 5870A form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are four things you should and shouldn't do.

- Do: Ensure all personal information is accurate, including names, Social Security Numbers (SSN), and the trust's Federal Employer Identification Number (FEIN).

- Do: Double-check the amounts entered in each line to prevent errors that could lead to delays or audits.

- Do: Attach the form to the beneficiary’s tax return as required to ensure proper processing.

- Do: Review the instructions carefully for each section to understand what information is needed.

- Don't: Leave any required fields blank; this can result in processing issues.

- Don't: Use outdated versions of the form; always ensure you are using the most current form available.

- Don't: Ignore the deadlines for submission; late submissions may incur penalties.

- Don't: Forget to keep a copy of the completed form for your records.

Misconceptions

- Misconception 1: The California 5870A form is only for individuals who are beneficiaries of trusts.

- Misconception 2: You only need to file the 5870A if you received a distribution from a trust.

- Misconception 3: The form is only relevant for tax years in which the trust was created.

- Misconception 4: Completing the form is straightforward and does not require any prior knowledge.

- Misconception 5: All income distributions from trusts are taxable.

- Misconception 6: Filing the 5870A will automatically result in higher taxes.

- Misconception 7: The California 5870A form is not required if the trust has already paid taxes.

- Misconception 8: You can ignore the form if you do not understand how to fill it out.

- Misconception 9: The 5870A form is the same as other tax forms for trusts.

- Misconception 10: Once filed, the form cannot be amended.

This form is specifically designed for beneficiaries, but it can also apply to estates and certain trusts. Understanding the broader context of its use is essential.

Even if no distribution was received, the form may still be necessary if there were accumulated distributions in prior years that affect tax calculations.

The California 5870A applies to any taxable year where there are accumulation distributions, regardless of when the trust was established.

While the form may seem simple, it requires a solid understanding of trust income and tax implications. Beneficiaries should seek guidance if unsure.

Some distributions may be tax-exempt, depending on their nature. Beneficiaries should review the specifics of their distributions to determine taxability.

While the form calculates taxes on accumulated distributions, the actual tax owed will depend on various factors, including the beneficiary’s overall income.

Even if the trust has paid taxes, beneficiaries may still need to report and pay taxes on distributions received, necessitating the use of this form.

Ignoring the form can lead to penalties. It is crucial to seek assistance or consult with a tax professional to ensure compliance.

Each tax form has unique requirements and purposes. The 5870A specifically addresses accumulation distributions and their tax implications.

If errors are discovered after submission, beneficiaries can file an amended return. Timely correction is important to avoid potential issues with the tax authorities.

Documents used along the form

The California 5870A form is an essential document for beneficiaries of trusts, specifically for reporting taxable accumulation distributions. When completing this form, several other documents may also be required to ensure accurate tax reporting and compliance. Below is a list of commonly used forms and documents associated with the California 5870A form.

- California Form 541: This is the California Fiduciary Income Tax Return. Trusts must file this form to report their income, deductions, and tax liability. It provides the necessary details about the trust's financial activities for the year.

- Schedule J (Form 541): This schedule is used to report the income distribution to beneficiaries from the trust. It helps in determining how much of the trust's income is taxable to the beneficiaries.

- California Form 540: This is the California Resident Income Tax Return. Beneficiaries use this form to report their personal income, including any distributions received from trusts, to the state of California.

- California Form 540NR: This form is for non-residents or part-year residents of California. It is used to report income earned in California, including trust distributions, during the tax year.

- Tax Credit Adjustment Schedule: This schedule is necessary for reporting any tax credits that may affect the overall tax liability of the trust or the beneficiary. It ensures that beneficiaries receive the appropriate credits for taxes paid.

- Privacy Notice (FTB 1131): This document informs individuals about how their personal information will be used and protected by the Franchise Tax Board. It is important for maintaining privacy when filing tax returns.

These forms and documents collectively support the accurate reporting of trust distributions and ensure compliance with California tax laws. Beneficiaries should gather all necessary paperwork to facilitate a smooth filing process and avoid potential issues with the tax authorities.

Different PDF Templates

Judicial Council Form - Applicants need to include all required documentation to support their claims of citizenship or alien status.

Inactive Real Estate License California - The Bureau of Real Estate uses this information to ensure proper regulatory compliance.

California 513 026 - Confidentiality options are provided for certain information on the application.