Download California 590 P Form

Common Questions

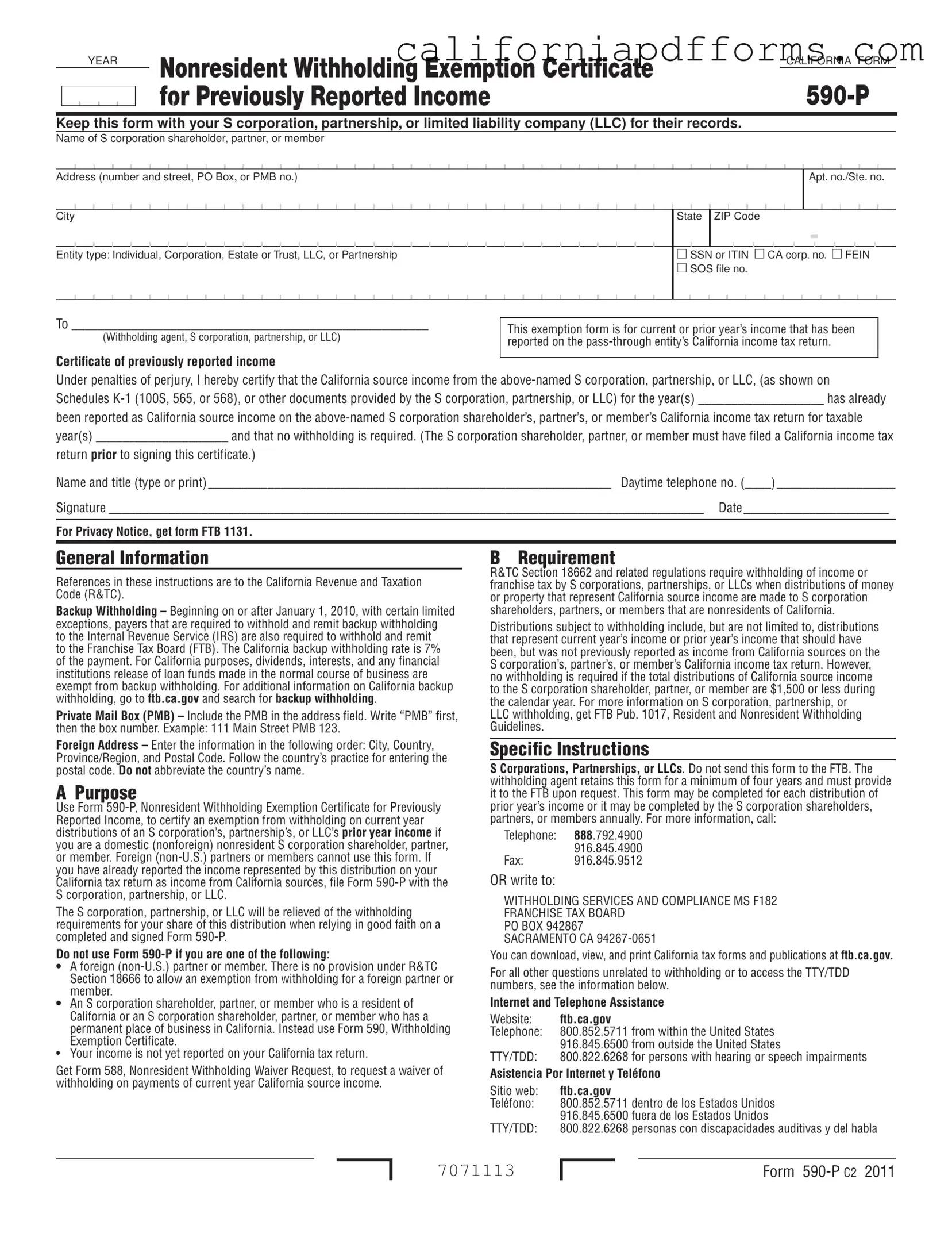

What is the purpose of the California 590 P form?

The California 590 P form, also known as the Nonresident Withholding Exemption Certificate for Previously Reported Income, is used to certify that certain income has already been reported on a California tax return. This form is specifically for nonresident shareholders, partners, or members of an S corporation, partnership, or LLC who are claiming an exemption from withholding on current year distributions of prior year income. By submitting this form, the entity can avoid unnecessary withholding on distributions that have already been accounted for in previous tax filings.

Who should use the California 590 P form?

This form is intended for domestic (nonforeign) nonresident S corporation shareholders, partners, or members. It is important to note that foreign partners or members cannot use this form. Additionally, California residents or those with a permanent place of business in California should not use the 590 P form; they should instead utilize Form 590, which is designed for residents. If the income in question has not yet been reported on a California tax return, individuals should consider filing Form 588 to request a waiver of withholding.

What information is required on the form?

When completing the California 590 P form, you will need to provide several key pieces of information:

- The name and address of the S corporation, partnership, or LLC.

- Your name, address, and identification number (either SSN, ITIN, CA corporation number, FEIN, or SOS file number).

- The year(s) for which the income has been reported.

- Your signature and the date of signing.

Make sure all information is accurate to avoid delays in processing or issues with withholding.

What happens after submitting the form?

Once the California 590 P form is completed and submitted to the S corporation, partnership, or LLC, they will retain it for their records. This form serves as proof that the income has been reported and that no withholding is necessary for the distributions covered by the certificate. The withholding agent must keep this form for a minimum of four years and provide it to the Franchise Tax Board (FTB) if requested.

Are there any exceptions to withholding requirements?

Yes, there are exceptions to the withholding requirements. If the total distributions of California source income to a nonresident shareholder, partner, or member are $1,500 or less during the calendar year, then no withholding is required. Additionally, if the income has already been reported on a California tax return, the 590 P form can be utilized to exempt that income from withholding. However, it’s crucial to ensure that all criteria are met to avoid potential penalties.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | Form 590-P is used to certify an exemption from withholding on distributions of prior year income for nonresident S corporation shareholders, partners, or members who have reported that income on their California tax return. |

| Governing Law | The use of Form 590-P is governed by the California Revenue and Taxation Code (R&TC) Section 18662, which outlines withholding requirements for nonresident income distributions. |

| Eligibility Criteria | This form is not available for foreign partners or members, or for California residents. Only domestic nonresident individuals can use it. |

| Retention Requirement | S corporations, partnerships, or LLCs must keep Form 590-P for a minimum of four years and provide it to the Franchise Tax Board upon request. |

Dos and Don'ts

Things to Do When Filling Out the California 590 P Form:

- Ensure that all personal information, including name and address, is accurate and complete.

- Certify that the income has already been reported on your California tax return.

- Include a daytime telephone number for any necessary follow-up.

- Keep a copy of the form for your records, as it must be retained by the withholding agent for a minimum of four years.

Things Not to Do When Filling Out the California 590 P Form:

- Do not submit the form to the Franchise Tax Board (FTB); it should be retained by the withholding agent.

- Do not use this form if you are a foreign partner or member.

- Avoid leaving any fields blank; incomplete forms may lead to processing delays.

- Do not sign the form if you have not filed your California income tax return.

Misconceptions

Misconceptions about the California 590 P form can lead to confusion and missteps. Let’s clear up some common misunderstandings:

- Only California residents can use the form. This is not true. The 590 P form is specifically for nonresident S corporation shareholders, partners, or members who have already reported income from California sources. Foreign partners or members cannot use this form.

- Form 590 P must be submitted to the Franchise Tax Board (FTB). In reality, this form is retained by the S corporation, partnership, or LLC and is not submitted to the FTB. However, it must be available for review if requested by the FTB.

- Using Form 590 P exempts everyone from withholding. This is a misconception. The form only exempts those who have reported the income on their California tax return. If you haven't reported the income yet, you need to use a different form to request a waiver of withholding.

- There is no minimum threshold for withholding. Actually, if the total distributions of California source income to a nonresident are $1,500 or less during the calendar year, no withholding is required. This is an important detail that can save time and effort.

Understanding these points can help ensure that you navigate the tax landscape more effectively and avoid unnecessary complications.

Documents used along the form

The California 590 P form is an important document used by nonresident shareholders, partners, or members of S corporations, partnerships, or LLCs to certify that they have already reported certain income on their California tax returns. Along with this form, several other documents may be needed to ensure compliance with California tax laws and to facilitate the withholding exemption process. Below is a list of commonly used forms and documents that often accompany the California 590 P form.

- Form 590: This is the Withholding Exemption Certificate for California residents. It is used by California residents to claim an exemption from withholding on income distributions from S corporations, partnerships, or LLCs.

- Form 588: This Nonresident Withholding Waiver Request allows nonresidents to request a waiver of withholding on payments of current year California source income. It is useful when the income has not yet been reported on a tax return.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It is often issued to report income received from S corporations, partnerships, or LLCs, which may be relevant for nonresidents.

- Schedule K-1: This document reports each partner's or shareholder's share of income, deductions, and credits from partnerships or S corporations. It is crucial for completing individual tax returns accurately.

- Form 1040NR: This is the U.S. Nonresident Alien Income Tax Return. Nonresident individuals use this form to report their income and calculate their tax liability.

- Form 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return. It is used by nonresidents to report income earned in California and to determine their California tax obligations.

- Form FTB 1131: This Privacy Notice informs individuals about how their personal information is used and protected by the California Franchise Tax Board, which may be relevant when submitting tax forms.

- Form 941: This is the Employer's Quarterly Federal Tax Return. While primarily for employers, it may be relevant for partnerships or LLCs that have employees and need to report withholding taxes.

- Form 1065: This is the U.S. Return of Partnership Income. Partnerships use this form to report their income, deductions, and credits, which may impact the tax obligations of partners.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation. It is used by S corporations to report income, deductions, and other tax-related information, which is essential for shareholders.

These documents play a vital role in ensuring compliance with California tax regulations and can help clarify the tax obligations of nonresident partners and shareholders. It is important to have these forms ready and accurately completed to avoid any issues with tax withholding or reporting.

Different PDF Templates

How to Make Balance Sheet - After listing all liabilities, calculate the total amount for this section.

California Financial Aid Income Limit - This form helps correct incomplete or inaccurate information provided on the FAFSA or Cal Grant GPA Verification.

Current Inactive Real Estate License - Submitting outdated or incorrect information can delay your licensing process significantly.