Download California 592 B Form

Common Questions

-

What is the purpose of California Form 592-B?

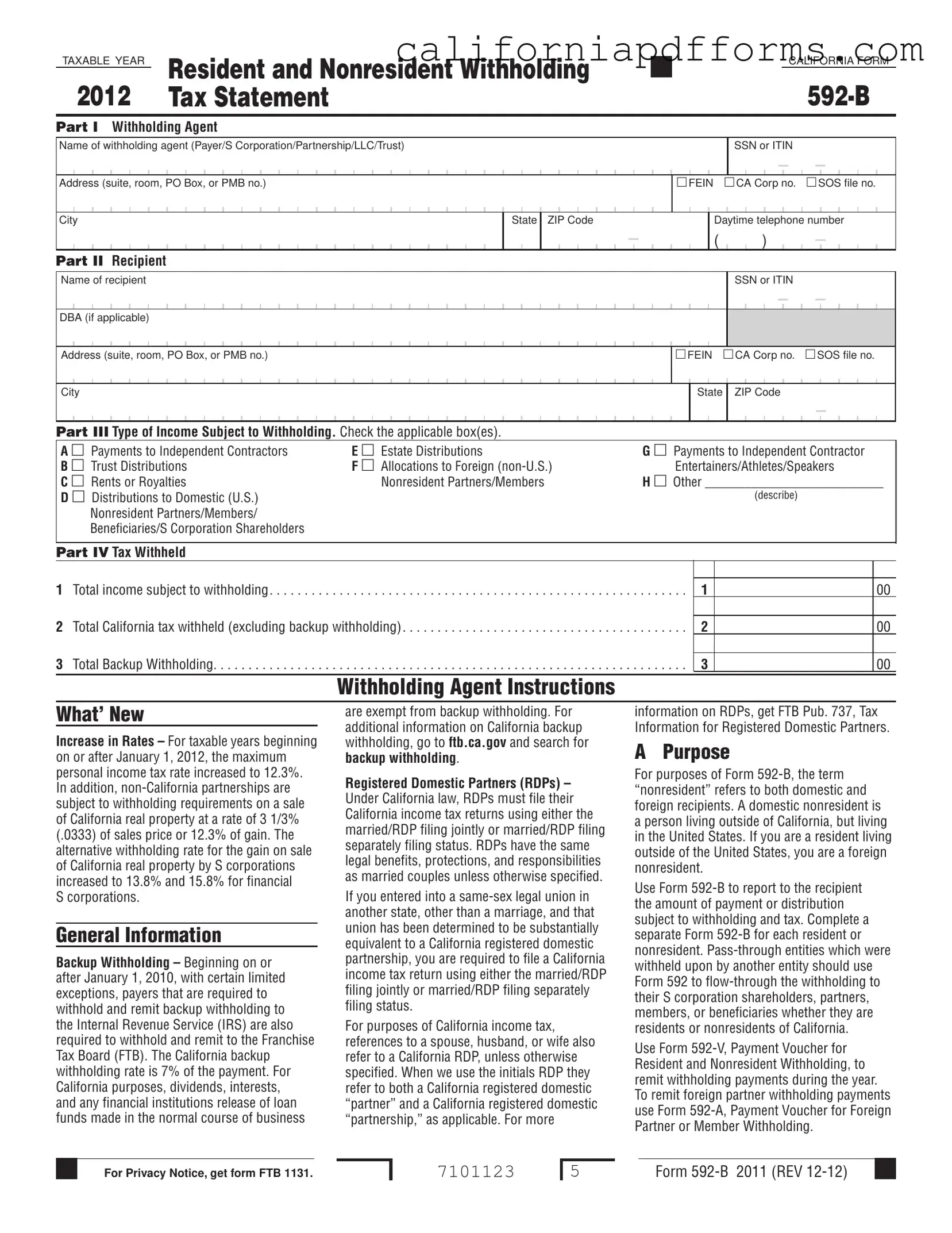

California Form 592-B is used to report the amount of payments or distributions subject to withholding tax. It provides recipients with a record of the withholding, which they will need when filing their California tax returns. This form is essential for both residents and nonresidents who receive income from California sources.

-

Who is required to complete Form 592-B?

Any individual or entity that has withheld taxes on payments to residents or nonresidents must complete Form 592-B. This includes withholding agents, such as partnerships, corporations, and trusts. Additionally, pass-through entities that have had withholding applied must also use this form to flow-through the withholding credit to their shareholders or partners.

-

When is Form 592-B due?

Form 592-B must be provided to recipients by January 31 of the year following the close of the calendar year. For brokers, the due date is February 15. If the recipients are foreign partners in a partnership, the form must be provided by the 15th day of the fourth month following the close of the taxable year. If all partners are foreign, the deadline extends to the 15th day of the sixth month after the close of the taxable year.

-

What are the penalties for not providing Form 592-B on time?

If a withholding agent fails to provide complete and correct copies of Form 592-B by the due date, they may face penalties. The penalty is $50 for each payee statement not provided on time. If the failure is due to intentional disregard of the requirement, the penalty increases to $100 or 10% of the amount required to be reported, whichever is greater.

-

How do I report the amount withheld on my tax return?

When filing your California tax return, report the income as required and enter the amount from Form 592-B, Part IV, line 2 as real estate and other withholding. Attach a copy of Form 592-B to your tax return. If you received a composite statement from a broker, only the information from Form 592-B needs to be attached.

-

What types of income are subject to withholding reported on Form 592-B?

Various types of income are subject to withholding and should be reported on Form 592-B. These include payments to independent contractors, rents or royalties, estate distributions, trust distributions, and allocations to foreign entertainers or athletes. It's important to check the appropriate boxes on the form to indicate the type of income.

-

Can Form 592-B be provided electronically?

Yes, Form 592-B can be provided to recipients electronically. This method is acceptable and may simplify the process for both the withholding agent and the recipient. Ensure that all required information is included and that the form is accessible for the recipient's records.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | Form 592-B is used to report payments made to residents and nonresidents that are subject to withholding tax in California. |

| Who Must Complete | Any individual or entity that withholds tax on payments to residents or nonresidents must complete this form. |

| Filing Deadline | Form 592-B must be provided to recipients by January 31 of the following year, ensuring timely reporting. |

| Tax Withholding Rates | The standard withholding rate is 7%, while different rates apply for foreign partners and certain entities. |

| Backup Withholding | Starting January 1, 2010, California requires backup withholding at a rate of 7% on certain payments. |

| Record Keeping | Withholding agents must retain proof of withholding for at least four years and provide it upon request from the Franchise Tax Board. |

| Governing Law | California Revenue and Taxation Code Sections 18662 and 18668 govern the use and requirements of Form 592-B. |

Dos and Don'ts

When filling out the California 592 B form, here are ten important do's and don'ts to keep in mind:

- Do ensure that you enter the correct taxable year in the upper left corner of the form.

- Do provide complete and accurate taxpayer identification numbers (TINs) for all payees.

- Do check the appropriate boxes for the type of income subject to withholding.

- Do submit the form by the due date to avoid penalties.

- Do retain proof of withholding for at least four years.

- Don't leave any fields blank; complete all sections of the form.

- Don't forget to include the PMB in the address field if applicable.

- Don't enter the name of a trust or trustee if the recipient is a grantor trust.

- Don't submit the form late; timely submission is crucial.

- Don't ignore the requirement to provide a copy of the form to the recipient.

Misconceptions

Misconception 1: The California 592 B form is only for California residents.

This form is actually used for both residents and nonresidents. It helps report income subject to withholding for anyone receiving payments in California, regardless of their residency status.

Misconception 2: Only individuals need to complete the 592 B form.

In reality, any withholding agent, including businesses and partnerships, must complete this form if they withhold taxes on payments. This includes payments to independent contractors and distributions to partners or beneficiaries.

Misconception 3: The form is only needed for certain types of income.

The 592 B form covers a wide range of income types, including rents, royalties, and payments to independent contractors. If there’s withholding involved, this form is necessary.

Misconception 4: You can submit the 592 B form at any time during the year.

The form must be provided to recipients by January 31 of the following year. Timeliness is crucial to avoid penalties, so make sure to meet this deadline.

Misconception 5: Once the 592 B form is filed, there are no further obligations.

Filing the form doesn’t eliminate the need for the recipient to file their California tax return. Recipients still need to report their income and may face penalties if they fail to do so.

Misconception 6: The information on the form is not important for tax purposes.

The details on the 592 B form are essential for both the withholding agent and the recipient. It helps ensure that the correct amount of tax is reported and withheld, impacting the recipient's tax liability.

Documents used along the form

The California 592 B form is an important document for reporting withholding on payments to both residents and nonresidents. Along with this form, several other documents are often used to ensure compliance with California tax regulations. Below is a list of six common forms and documents that accompany the 592 B form.

- Form 592: This form is used to report withholding amounts to be allocated among partners, shareholders, or members of pass-through entities. It ensures that the withholding credits flow through to the appropriate individuals.

- Form 592-V: This payment voucher is utilized to remit withholding payments throughout the year. It simplifies the process of making timely payments to the Franchise Tax Board.

- Form 592-A: This form serves as a payment voucher specifically for foreign partner or member withholding. It is used to report and remit amounts withheld from foreign partners or members of an LLC.

- Form 541: This is the California Fiduciary Income Tax Return. Estates and trusts use this form to report income and claim any withholding amounts that were withheld on their behalf.

- Form 1099: This form is issued to report various types of income other than wages, salaries, and tips. Independent contractors often receive this form, which helps determine their California source income.

- FTB Publication 737: This publication provides tax information for Registered Domestic Partners (RDPs). It clarifies how RDPs should file their California tax returns and understand their tax obligations.

Understanding these documents can help ensure compliance with California tax laws and streamline the reporting process. Each form plays a specific role in the overall tax reporting landscape, making it essential to use them correctly in conjunction with the California 592 B form.