Download California 592 F Form

Common Questions

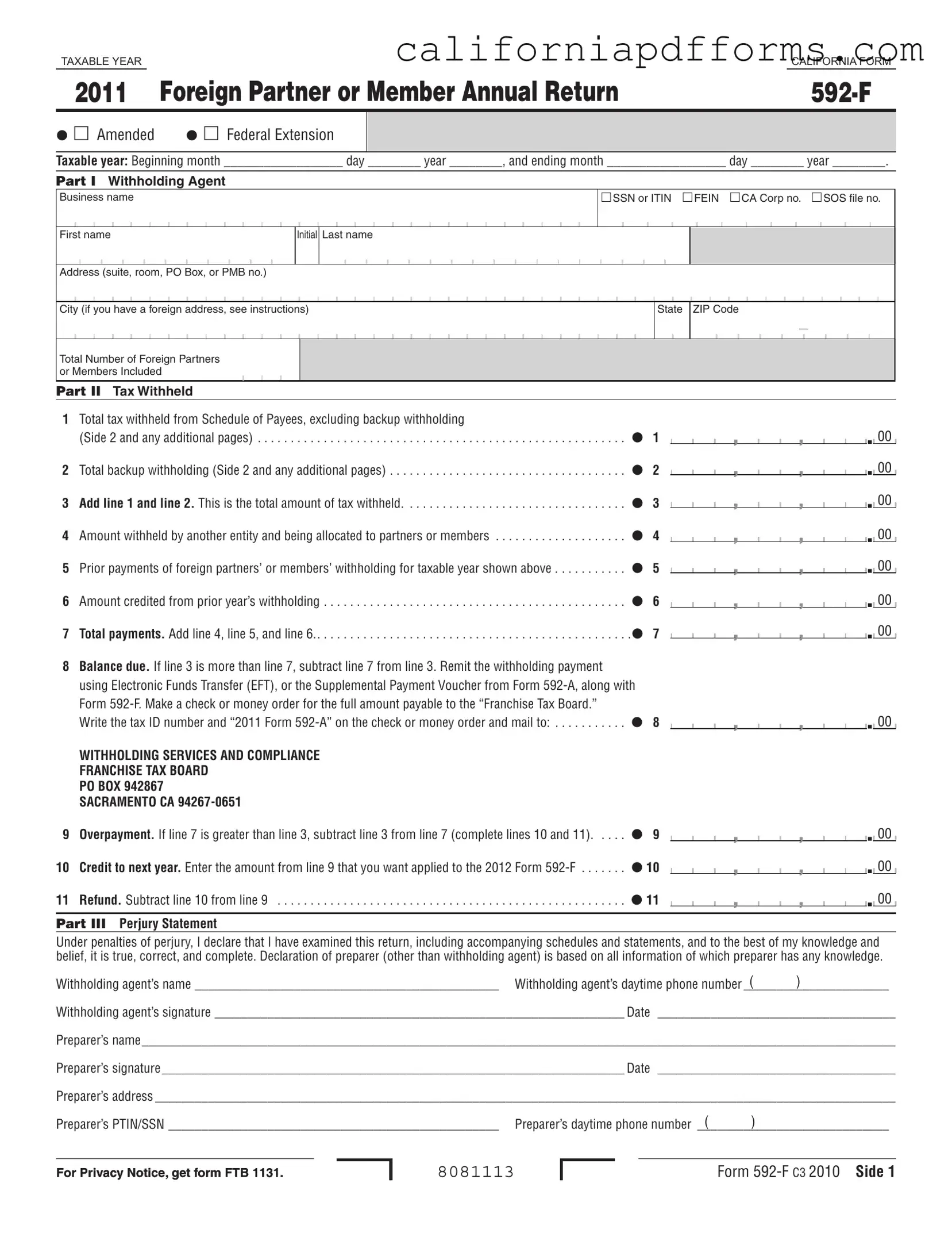

What is the purpose of California Form 592-F?

California Form 592-F is used to report the total withholding for foreign partners or members at the end of the taxable year. It allows partnerships and limited liability companies (LLCs) to allocate income and related withholding to their foreign partners or members. This form simplifies the reporting process by eliminating the need to submit individual withholding statements for each partner or member to the Franchise Tax Board (FTB).

Who needs to file Form 592-F?

Form 592-F must be filed by partnerships and LLCs that have foreign partners or members. If all partners or members are foreign, the form must be filed. If there are domestic nonresident partners or members, use Form 592 instead. It is important to ensure that the correct form is used to avoid penalties.

When is Form 592-F due?

The due date for filing Form 592-F is the 15th day of the 4th month following the close of the partnership’s or LLC’s taxable year. If all partners or members are foreign, the due date extends to the 15th day of the 6th month after the close of the taxable year.

What information is required on Form 592-F?

Form 592-F requires the following information:

- Taxable year dates.

- Withholding agent's name, ID number, and address.

- Total number of foreign partners or members.

- Details of tax withheld, including backup withholding.

- Any prior payments and credits from previous years.

Accurate and complete information is crucial to ensure proper processing and to avoid penalties.

What should I do if I need to amend Form 592-F?

If you need to amend Form 592-F, complete a new form with the correct information. Check the "Amended" box at the top of the form. Include a letter explaining the changes made and why they were necessary. Send the amended form and the letter to the address provided on the form.

What are the penalties for not filing Form 592-F on time?

Failure to file Form 592-F on time can result in penalties. The penalties are calculated per payee:

- $15 if filed 1 to 30 days late.

- $30 if filed 31 days to 6 months late.

- $50 if filed more than 6 months late.

Additionally, interest on late payments may apply, and the withholding agent may be personally liable for the tax that should have been withheld.

How do I remit the payment when filing Form 592-F?

When remitting payment with Form 592-F, use Electronic Funds Transfer (EFT) or the Supplemental Payment Voucher from Form 592-A. Make a check or money order payable to the "Franchise Tax Board." Write the tax ID number and "2011 Form 592-A" on the check or money order. Mail the form, payment, and voucher to the address specified on the form.

What if I have overpaid and want a refund?

If your total payments exceed the tax withheld, you can claim a refund. Complete the necessary lines on Form 592-F to indicate the overpayment and provide instructions for applying the refund to the following year's Form 592-F if desired.

Where can I find additional information about Form 592-F?

For more information, you can contact the FTB's Withholding Services and Compliance department at 888.792.4900 or 916.845.4900. You can also visit the FTB website at ftb.ca.gov to download forms and publications related to withholding and taxation.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | Form 592-F is used to report withholding for foreign partners or members in California. |

| Governing Law | This form is governed by California Revenue and Taxation Code (R&TC) Section 18666. |

| Filing Deadline | Form 592-F must be filed by the 15th day of the 4th month after the taxable year ends. |

| Amendments | To amend, a new Form 592-F must be completed and marked as "Amended." |

| Backup Withholding | The backup withholding rate in California is 7% for certain payments. |

| Electronic Filing | Form 592-F must be filed electronically if there are 250 or more payees. |

| Payment Methods | Payments can be made via Electronic Funds Transfer (EFT) or using Form 592-A. |

| Interest and Penalties | Interest may accrue on late payments, and penalties apply for late filings. |

| Contact Information | For assistance, contact the Franchise Tax Board at 888.792.4900. |

Dos and Don'ts

When filling out the California 592 F form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of important dos and don’ts.

- Do: Enter the correct taxable year at the top of the form, ensuring the beginning and ending dates are accurate.

- Do: Use black or blue ink if completing the form by hand, as this ensures clarity and legibility.

- Do: Include all required information for each payee, as incomplete data can lead to processing delays.

- Do: File the form by the specified deadline to avoid penalties and interest on late payments.

- Don't: Leave any sections blank; all fields must be filled out to avoid complications.

- Don't: Use your own version of the Schedule of Payees; only the official form will be accepted.

- Don't: Forget to check the appropriate boxes for backup withholding if applicable.

- Don't: Attach checks or money orders to the Supplemental Payment Voucher; include them separately as instructed.

Misconceptions

Misconception 1: The California 592 F form is only for U.S. residents.

This form is specifically designed for foreign partners or members. It is used to report withholding for individuals or entities that are not U.S. residents, ensuring compliance with California tax laws.

Misconception 2: Filing the 592 F form eliminates the need for any other tax forms.

While the 592 F form is important, it does not replace other required forms. For example, withholding agents must still provide Form 592-B to partners or members, even after filing the 592 F.

Misconception 3: The 592 F form can be filed at any time during the year.

There are specific deadlines for filing the 592 F form. It must be submitted by the 15th day of the 4th month after the close of the partnership’s or LLC’s taxable year, or by the 15th day of the 6th month if all partners or members are foreign.

Misconception 4: There are no penalties for late filing of the 592 F form.

Failure to file the 592 F form on time can result in penalties. These penalties vary based on how late the form is filed, emphasizing the importance of timely submission.

Documents used along the form

When dealing with the California 592 F form, several other documents may be necessary to ensure compliance with tax regulations. Understanding these forms can help streamline the filing process and avoid potential issues. Below is a list of commonly associated forms and documents.

- Form 592-A: This is the Payment Voucher for Foreign Partner or Member Withholding. It is used to remit withholding payments to the Franchise Tax Board (FTB) for foreign partners or members. This form should be submitted along with Form 592-F to report total withholding for the year.

- Form 592-B: This form is the Resident and Nonresident Withholding Tax Statement. While it is no longer required to be submitted with Form 592-F, withholding agents must still provide copies to partners or members to inform them of the amounts withheld.

- Form 593: This is the Real Estate Withholding Tax Statement. It is specifically used to report withholding on the sale of California real property. It should not be confused with Form 592-F, which is for foreign partners or members.

- Form 8804: This is the Annual Return for Partnership Withholding Tax. If a partnership has filed for a federal extension, the box on Form 592-F should be checked to indicate this status.

- Form 1042-S: This form reports income and withholding for foreign persons. It is important for foreign partners to receive this form to accurately report their income on their tax returns.

- Form W-8BEN: This form certifies foreign status and is typically used by foreign individuals or entities to claim tax treaty benefits. It helps determine the correct withholding tax rate.

- Form W-9: This form is used by U.S. persons to provide their taxpayer identification number (TIN) to withholding agents. It is essential for domestic partners or members to ensure proper reporting.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It may be relevant for reporting payments made to foreign partners or members.

Being aware of these forms can significantly ease the process of compliance when filing the California 592 F form. Ensure that all necessary documentation is completed accurately and submitted on time to avoid penalties and ensure proper reporting of withholding taxes.

Different PDF Templates

App-002 - Before completing the APP-002 form, it's crucial to read the provided information on appeal procedures.

How to File Business Taxes in California - Accurate contact details ensure effective communication with the Surety throughout the process.

State of California Health and Human Services Agency Forms - $25,000 or 5% thresholds for significant business transactions must be carefully calculated and reported.