Download California 597 W Form

Common Questions

What is the purpose of the California 597 W form?

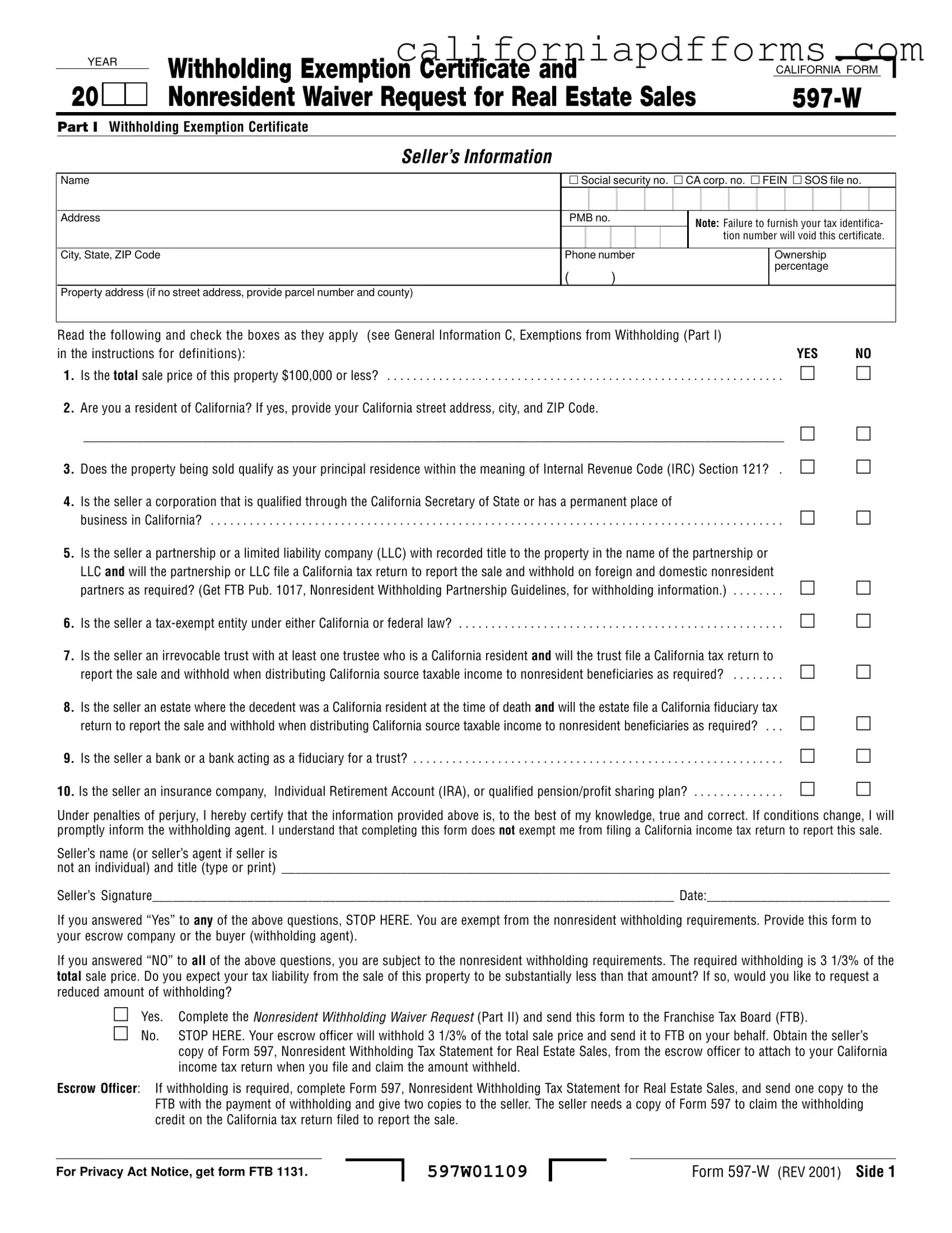

The California 597 W form serves two main purposes: it acts as a Withholding Exemption Certificate and a Nonresident Waiver Request for Real Estate Sales. Sellers use this form to certify whether they qualify for an exemption from nonresident withholding requirements on the sale of real estate in California. If the seller meets certain criteria—such as selling a property for $100,000 or less or being a California resident—they can avoid withholding. If they do not qualify, they can request a reduced withholding amount through the Nonresident Withholding Waiver Request section of the form.

Who needs to fill out the California 597 W form?

Any seller of real estate in California who is a nonresident must consider filling out the California 597 W form. This includes individuals, corporations, partnerships, limited liability companies, and other entities. If the seller does not meet the exemption criteria outlined in the form, they are subject to withholding requirements. Completing this form allows the seller to either claim an exemption or request a waiver for a reduced withholding amount based on their specific tax situation.

What happens if I answer "yes" to any of the exemption questions?

If you answer "yes" to any of the exemption questions on the California 597 W form, you are exempt from the nonresident withholding requirements. In this case, you should stop filling out the form and provide it directly to your escrow company or the buyer, who acts as the withholding agent. This means that no withholding will occur on the sale price of the property, allowing you to receive the full amount without deductions for taxes.

What if I do not qualify for an exemption?

If you answer "no" to all exemption questions, you will be subject to nonresident withholding requirements. In this situation, the withholding amount is set at 3 1/3% of the total sale price. You can, however, request a reduced withholding amount if you believe your tax liability will be significantly less than the withheld amount. To do this, you need to complete the Nonresident Withholding Waiver Request section and submit the form to the Franchise Tax Board (FTB) along with any required documentation. If you choose not to request a waiver, your escrow officer will withhold the necessary amount and send it to the FTB on your behalf.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The California 597-W form serves as a Withholding Exemption Certificate and a Nonresident Waiver Request for Real Estate Sales. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 18662, which outlines the withholding requirements for nonresident sellers. |

| Exemption Criteria | Sellers may be exempt from withholding if the total sale price is $100,000 or less, or if they meet specific residency or entity criteria. |

| Withholding Rate | If withholding is required, the rate is set at 3 1/3% of the total sale price of the property. |

| Submission Process | Sellers must provide the completed form to their escrow company or buyer to ensure compliance with withholding requirements. |

| Tax Return Requirement | Completing the 597-W form does not exempt sellers from filing a California income tax return to report the sale. |

Dos and Don'ts

When filling out the California 597 W form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are ten things you should and shouldn't do:

- Do provide complete and accurate information about the seller, including name and tax identification numbers.

- Do check the appropriate boxes regarding exemptions carefully.

- Do ensure the property address is correct, including parcel numbers if applicable.

- Do sign and date the form to validate it.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to inform the withholding agent if your circumstances change.

- Don't assume that completing this form exempts you from filing a California income tax return.

- Don't provide false information, as this could lead to penalties.

- Don't overlook the need for supporting documentation if requesting a withholding waiver.

Misconceptions

Misconceptions about the California 597 W form can lead to confusion and potential issues during real estate transactions. Here are ten common misconceptions along with clarifications:

- The 597 W form is only for California residents. This form is applicable to both residents and non-residents selling property in California.

- Filling out the 597 W form guarantees no withholding. Completing the form does not automatically exempt you from withholding. You must meet specific criteria outlined in the form.

- All sales under $100,000 are exempt from withholding. While the sale price is a factor, other conditions also determine whether withholding applies.

- The seller does not need to file a California income tax return if they complete the 597 W form. Regardless of the form, all sellers must file a California income tax return to report the sale.

- Only individuals can use the 597 W form. Corporations, partnerships, LLCs, and trusts can also use this form to claim withholding exemptions.

- Once the 597 W form is submitted, it cannot be changed. If conditions change, sellers are required to inform the withholding agent promptly.

- The form is only relevant for residential property sales. The 597 W form applies to all types of real estate transactions, including commercial and vacant land.

- Non-resident sellers cannot request a reduced withholding amount. Non-residents can request a waiver or reduced withholding by completing the appropriate sections of the form.

- Providing incorrect information on the form has no consequences. Providing false information can lead to penalties and complications with tax authorities.

- All escrow companies handle the 597 W form the same way. Different escrow companies may have varying procedures for processing this form, so it’s essential to communicate with your specific escrow officer.

Understanding these misconceptions can help sellers navigate the process more effectively and ensure compliance with California tax laws.

Documents used along the form

The California 597 W form is crucial for nonresident sellers involved in real estate transactions. However, several other documents are often used in conjunction with this form to ensure compliance with state regulations and to facilitate the sale process. Below is a list of these documents, each serving a specific purpose.

- Form 597: This is the Nonresident Withholding Tax Statement for Real Estate Sales. It details the amount withheld from the sale and is essential for the seller to claim a credit on their California income tax return.

- Form 593: This form is used for reporting California real estate withholding for sales involving residents. It's often necessary for escrow companies to complete this form when a resident seller is involved in the transaction.

- Form 593-C: This is the Real Estate Withholding Certificate. It helps sellers certify their residency status and determine if withholding is necessary.

- Form FTB 1131: This Privacy Act Notice informs individuals about how their information will be used. It's important for sellers to understand their rights regarding personal data.

- Escrow Instructions: These are the guidelines provided to the escrow company regarding the transaction. They detail how to handle funds and documents, ensuring a smooth closing process.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes the sale price, contingencies, and other critical details necessary for the transaction.

- Title Report: This document provides information about the property's ownership history and any liens or encumbrances. It is vital for ensuring the buyer receives clear title to the property.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document summarizes all financial transactions involved in the sale, including fees and the distribution of funds.

- Form 1099-S: This is the Proceeds from Real Estate Transactions form. It reports the sale to the IRS and is used to track capital gains and other tax implications for the seller.

Understanding these documents can help sellers navigate the complexities of real estate transactions in California. Each form plays a significant role in ensuring compliance and protecting the interests of all parties involved.

Different PDF Templates

Ds 260 Sample - Completing this form accurately is crucial for the protection of individuals facing domestic violence.

3533 - This form reinforces accountability in maintaining correspondence standards.