Download California 8454 Form

Common Questions

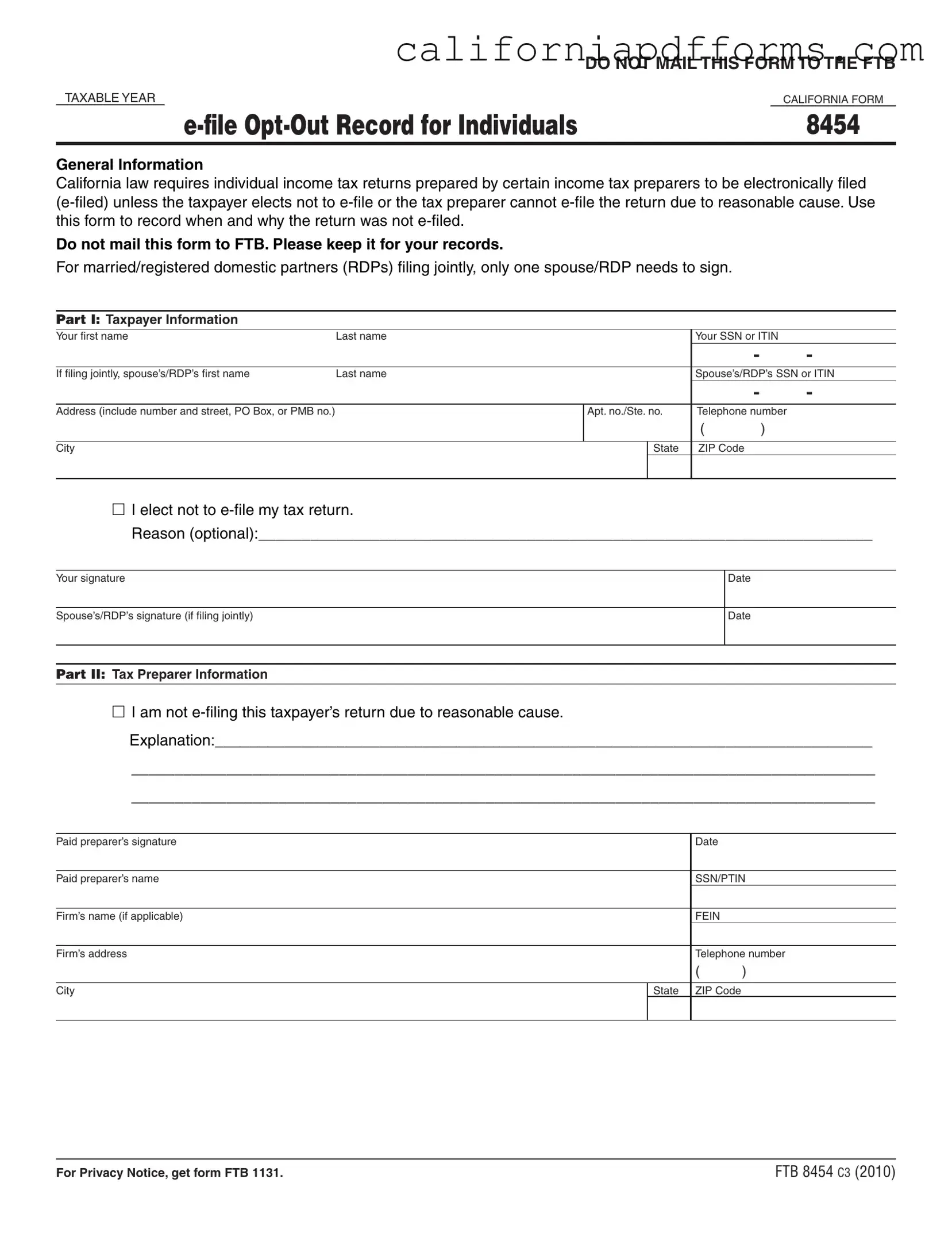

What is the California Form 8454?

The California Form 8454 is an important document for individuals who are opting out of electronically filing their income tax returns. Under California law, certain tax returns prepared by tax preparers must be e-filed. However, if a taxpayer chooses not to e-file or if the tax preparer has a reasonable cause for not e-filing, this form is used to record that decision. Remember, you should keep this form for your records and not send it to the Franchise Tax Board (FTB).

Who needs to fill out Form 8454?

Form 8454 is primarily for individual taxpayers who have their tax returns prepared by a tax professional. If you are filing your taxes and either you or your tax preparer has decided not to e-file, this form is necessary. For couples filing jointly, only one spouse or registered domestic partner (RDP) needs to sign the form, making it a bit simpler for those filing together.

What information do I need to provide on Form 8454?

When completing Form 8454, you will need to provide several key pieces of information:

- Your first and last name, along with your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, your spouse's or RDP's name and SSN or ITIN.

- Your address, including street number, city, state, and ZIP code.

- A checkbox indicating your choice not to e-file, along with an optional reason for this choice.

- Your signature and the date, as well as your spouse's or RDP's signature if filing jointly.

What should I do with Form 8454 once I complete it?

After you have filled out Form 8454, it’s crucial to keep it for your records. Do not mail it to the FTB. This form serves as documentation of your decision to opt out of e-filing and may be important if any questions arise regarding your tax return in the future.

Can my tax preparer fill out Form 8454 on my behalf?

Yes, your tax preparer can assist in filling out Form 8454. They will provide their information, including their signature and the reason for not e-filing, if applicable. However, as the taxpayer, you still need to review and sign the form. This ensures that you are aware of the decision and agree with the reasons for opting out of e-filing.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Form 8454 is used to record the decision not to e-file an individual income tax return. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 18621.1. |

| Filing Requirement | California law mandates that certain individual income tax returns must be e-filed unless an election is made not to do so. |

| Signature Requirement | For married or registered domestic partners filing jointly, only one signature is necessary on the form. |

| Retention | This form should not be mailed to the FTB but should be kept for the taxpayer's records. |

| Tax Preparer Information | The form includes a section for the tax preparer to provide information and a signature if applicable. |

| Optional Reason | Taxpayers can optionally provide a reason for choosing not to e-file their tax return. |

Dos and Don'ts

When filling out the California 8454 form, there are several important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do ensure that all personal information is accurate, including names and Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs).

- Do sign the form where required. If filing jointly, both spouses or registered domestic partners (RDPs) must sign.

- Do keep a copy of the completed form for your records.

- Do provide a reason for opting out of e-filing if you choose to do so.

- Do include your current address and contact information.

- Don't mail the form to the Franchise Tax Board (FTB). It is not required.

- Don't leave any sections blank. Fill in all required fields to avoid delays.

- Don't use this form for any purpose other than to record your decision not to e-file.

- Don't forget to check the box indicating your choice not to e-file if applicable.

- Don't provide false information. Ensure that everything you enter is truthful and accurate.

Misconceptions

Misconceptions about the California 8454 form can lead to confusion for taxpayers and tax preparers alike. Below is a list of ten common misconceptions, along with clarifications to help demystify this important document.

- It must be mailed to the FTB. Many believe that the California 8454 form needs to be sent to the Franchise Tax Board (FTB). In reality, this form is for your records only and should not be mailed.

- All taxpayers must complete this form. Some think that every individual taxpayer is required to fill out the 8454 form. However, it is only necessary for those who choose not to e-file their tax return or when the tax preparer cannot e-file due to reasonable cause.

- Only one signature is required for joint filers. There is a misconception that both spouses or registered domestic partners (RDPs) must sign the form when filing jointly. In fact, only one signature is needed.

- The reason for opting out of e-filing must be provided. While some believe that a reason for not e-filing is mandatory, it is actually optional. Taxpayers can choose to leave this section blank.

- The form is only for tax preparers. A common misunderstanding is that the 8454 form is solely for use by tax preparers. In truth, it serves as a record for both the taxpayer and the preparer regarding the e-filing decision.

- This form is only for specific income levels. Some individuals think that the California 8454 form is only applicable to those with certain income levels. However, it applies to all individual income tax returns prepared by specific tax preparers, regardless of income.

- It is only relevant for the current tax year. There is a belief that this form is only relevant for the current tax year. In reality, it is important to keep this form with your tax records for future reference, especially if questions arise.

- Using this form affects tax refund timing. Some taxpayers worry that opting out of e-filing with this form will delay their tax refunds. The choice to e-file or not does not inherently affect the timing of refunds; it depends more on how the return is processed.

- The form can be submitted electronically. A misconception exists that the California 8454 form can be submitted electronically alongside tax returns. However, it is meant to be retained by the taxpayer and not submitted.

- It is only for individual taxpayers. Some believe that the California 8454 form is exclusively for individual taxpayers. However, it can also be used by married couples or RDPs filing jointly, as well as for individual returns prepared by tax professionals.

Understanding these misconceptions can help taxpayers and tax preparers navigate the requirements associated with the California 8454 form more effectively.

Documents used along the form

The California 8454 form serves as a record for individuals who choose not to e-file their tax returns. This decision may arise from various reasons, and the form is essential for documenting the taxpayer's choice. Alongside this form, several other documents may be necessary or useful in the tax preparation process. Below is a list of related forms and documents commonly used in conjunction with the California 8454 form.

- California Form 540: This is the standard individual income tax return form for California residents. It is used to report income, claim deductions, and calculate the tax owed or refund due.

- California Form 540NR: This form is for non-residents or part-year residents of California. It allows them to report income earned within the state and claim any applicable deductions.

- Form 1040: The federal individual income tax return form. Taxpayers use this form to report their income to the Internal Revenue Service (IRS) and to calculate their federal tax liability.

- Schedule A: This is used to itemize deductions on the federal Form 1040. Taxpayers may choose to use this schedule if their itemized deductions exceed the standard deduction.

- Form W-2: This document is provided by employers and reports an employee's annual wages and the taxes withheld. It is essential for accurately completing tax returns.

- Form 1099: Various types of 1099 forms report different types of income other than wages, such as freelance earnings or interest income. These forms are crucial for reporting all income sources.

- Form FTB 1131: This form provides a privacy notice regarding the collection of personal information by the California Franchise Tax Board (FTB). It is relevant for understanding how taxpayer information is handled.

- California Form 8453: This form is used to authorize an electronic return originator (ERO) to file a tax return electronically on behalf of the taxpayer. It is a necessary component of e-filing.

- Form 8862: This form is used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a previous year. Taxpayers must submit this form to re-establish eligibility for the credit.

These documents collectively assist taxpayers in accurately filing their returns and ensuring compliance with both state and federal tax laws. Proper documentation is essential for maintaining records and supporting any claims made on tax returns.

Different PDF Templates

Pos 010 - It requires the names and addresses of the parties involved in a legal case.

California 3522 - First-time California LLCs may be exempt from the tax during their first taxable year.