Download California 8879 Form

Common Questions

-

What is the purpose of Form California 8879?

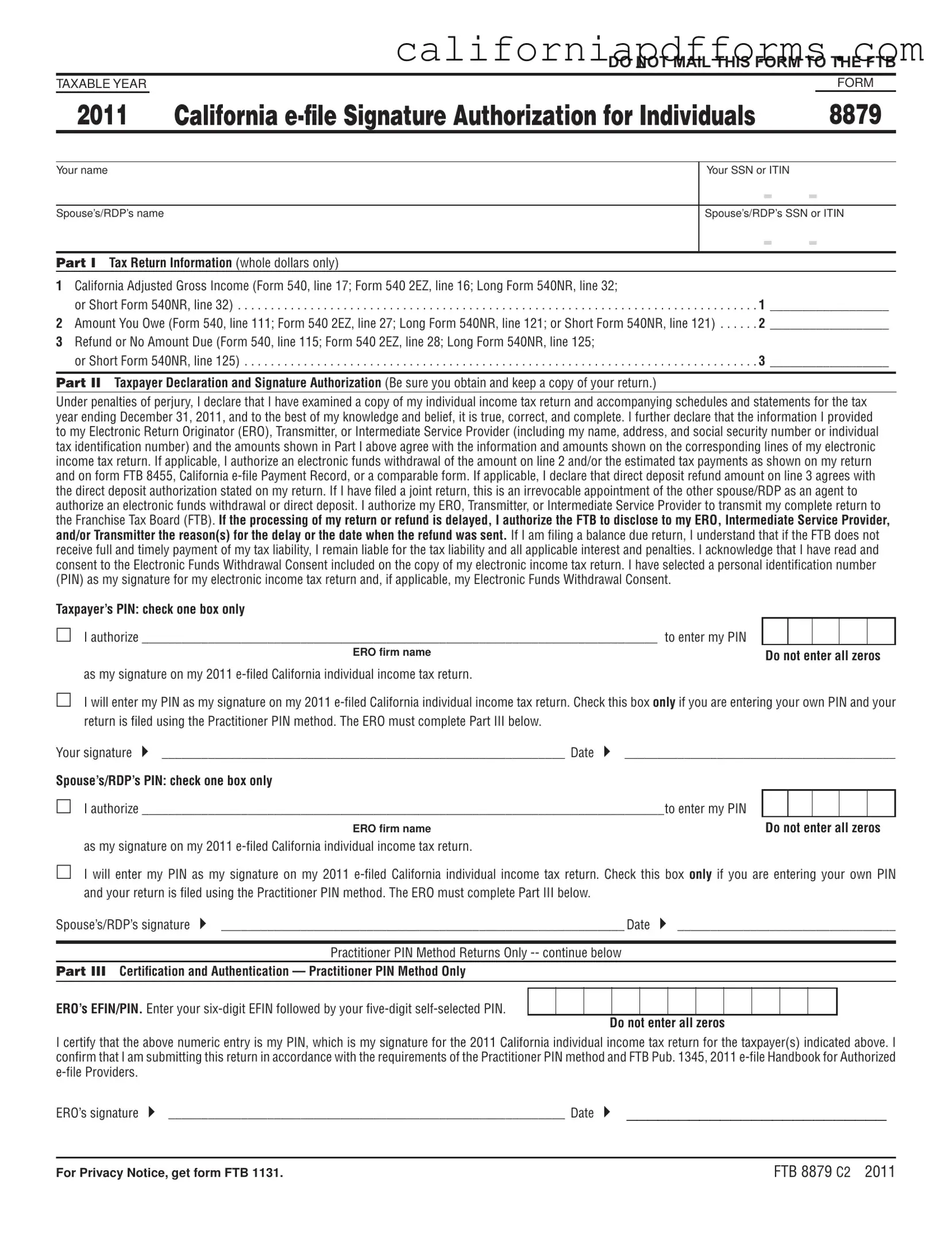

Form California 8879, also known as the California e-file Signature Authorization for Individuals, is used to authorize an Electronic Return Originator (ERO) to enter a taxpayer's personal identification number (PIN) on their e-filed tax return. This form is essential when a taxpayer opts for the Practitioner PIN method, allowing for electronic signatures without the need for a shared secret.

-

Who needs to sign Form 8879?

Both the taxpayer and, if applicable, their spouse or Registered Domestic Partner (RDP) must sign Form 8879. This signature indicates their approval of the tax return and authorizes the ERO to file it electronically. It is crucial that both parties review their tax information before signing.

-

Can I mail Form 8879 to the Franchise Tax Board (FTB)?

No, Form 8879 should not be mailed to the FTB. Instead, it is to be kept by the ERO or the taxpayer for their records. The proof of filing is the acknowledgment from the FTB that confirms acceptance of the tax return.

-

What happens if I do not sign Form 8879?

If Form 8879 is not signed, the ERO cannot e-file your tax return. The return will remain unfiled until the signed authorization is received. Therefore, it is essential to complete and return this form promptly to ensure timely processing of your tax return.

-

What is the Practitioner PIN method?

The Practitioner PIN method allows taxpayers to authorize their ERO to enter their PIN on the tax return. This method simplifies the e-filing process, as it eliminates the need for a shared secret. Taxpayers can choose to authorize their ERO to enter their PIN or enter it themselves, depending on their preferences.

-

What information is required on Form 8879?

Form 8879 requires several pieces of information, including:

- Names of the taxpayer and spouse/RDP

- Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs)

- California Adjusted Gross Income

- Amount owed or refund amount

It is vital that all information is accurate to avoid delays in processing.

-

How long should I keep Form 8879?

Taxpayers should retain Form 8879 for four years from the due date of the tax return or four years from the date the tax return is filed, whichever is later. This retention is important for compliance with California's statute of limitations.

-

What should I do if I need to cancel an electronic funds withdrawal?

If you need to cancel an electronic funds withdrawal or a scheduled estimated tax payment, you must contact the FTB at least two working days before the scheduled withdrawal date. This proactive step can help avoid potential penalties or interest due to errors in account information.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose of Form | Form FTB 8879 is used to authorize an Electronic Return Originator (ERO) to enter a taxpayer’s personal identification number (PIN) on their e-filed California individual income tax return. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 18621.5, which outlines the requirements for electronic filing and signature authorization. |

| Filing Method | The Practitioner PIN method allows taxpayers to e-file their returns through an ERO without needing to enter a shared secret, simplifying the process for those unable to physically enter their PIN. |

| Retention Requirements | Taxpayers must retain Form FTB 8879 and related documents for four years from the due date of the return or four years from the date filed, whichever is later. |

Dos and Don'ts

When filling out the California 8879 form, keep the following tips in mind:

- Do double-check all personal information, including names and Social Security Numbers (SSNs).

- Don't mail the form to the Franchise Tax Board (FTB); it should only be submitted to your Electronic Return Originator (ERO).

- Do ensure that the amounts listed in Part I match those on your tax return.

- Don't enter all zeros as your Personal Identification Number (PIN).

- Do sign and date the form after reviewing all the information carefully.

- Don't forget to keep a copy of your signed form for your records.

- Do authorize your ERO to enter your PIN if you choose not to enter it yourself.

- Don't neglect to confirm your banking information for direct deposit or electronic funds withdrawal.

- Do retain all necessary documents for the required statute of limitations period.

Misconceptions

Misconception 1: The California 8879 form must be mailed to the Franchise Tax Board (FTB).

This is incorrect. The California 8879 form is not meant to be mailed to the FTB. Instead, it serves as an authorization for your Electronic Return Originator (ERO) to submit your e-filed tax return on your behalf. The acknowledgment of acceptance from the FTB is what proves your return has been filed.

Misconception 2: The 8879 form acts as proof of filing.

Many people believe that the 8879 form itself serves as proof that their tax return has been submitted. This is a misunderstanding. The actual proof of filing is the acknowledgment you receive from the FTB, which includes the date of acceptance for your return.

Misconception 3: You can use the 8879 form for any tax year.

Some individuals think that the 8879 form can be used for multiple tax years. However, this form is specific to the tax year it is filed for. Each tax year requires a separate 8879 form, as it is tied to that particular return.

Misconception 4: The 8879 form is only for individual taxpayers.

This is not entirely accurate. While the 8879 form is primarily designed for individual taxpayers, it can also be used by Registered Domestic Partners (RDPs) filing jointly. Both parties need to authorize the ERO to file their return electronically, ensuring compliance with California tax regulations.

Documents used along the form

When filing your California tax return electronically, the California 8879 form is an essential document that authorizes your Electronic Return Originator (ERO) to submit your return on your behalf. However, it is often accompanied by several other forms and documents that play crucial roles in ensuring your tax filing is complete and compliant. Understanding these documents can help you navigate the e-filing process more effectively.

- Form FTB 540: This is the California Resident Income Tax Return. It is used by residents to report their income, claim deductions, and calculate their tax liability. Completing this form accurately is vital for determining your overall tax obligation.

- Form FTB 8455: The California e-file Payment Record for Individuals, this form records the taxpayer's consent for electronic funds withdrawal or direct deposit. It is crucial for ensuring that any payments or refunds are processed correctly.

- Form W-2: This form reports wages paid to employees and the taxes withheld from them. It is necessary for accurately reporting your income and verifying your tax liability, as it provides essential income details.

- Form 1099: This form is used to report various types of income received other than wages, salaries, or tips. If you are self-employed or have received certain payments, you will need to include this form to ensure all income is reported.

- Form FTB 1131: This is the Privacy Notice form that informs taxpayers about how their personal information is handled by the Franchise Tax Board. It is important for understanding your rights regarding privacy and data security.

- Federal Tax Return: A copy of your federal return is often required when filing your California state return. It helps ensure consistency between state and federal filings, and may be necessary for certain deductions or credits.

Being aware of these forms and their purposes can streamline your tax filing process and help prevent potential issues with your return. Each document serves a specific function, contributing to a complete and accurate submission to the Franchise Tax Board. Be diligent in gathering and reviewing these forms before finalizing your e-filing to avoid complications.

Different PDF Templates

Jv570 - Additional contact information for the appellant may be included if necessary.

Soc 839a - The SOC 450 ensures that voluntary services are officially recognized.

Making a Will in California - This will serves as a testament to the individual's final wishes and their commitment to their family’s well-being.