Download California Affidavit of Death of a Trustee Form

Common Questions

-

What is the California Affidavit of Death of a Trustee?

The California Affidavit of Death of a Trustee is a legal document used to formally declare the death of a trustee in a trust. This affidavit helps to update the trust records and allows the successor trustee to take over the management of the trust assets.

-

Who can file the Affidavit of Death of a Trustee?

The affidavit can be filed by the successor trustee or any interested party. Typically, this includes beneficiaries of the trust or individuals who have been designated to manage the trust after the original trustee's death.

-

What information is required to complete the affidavit?

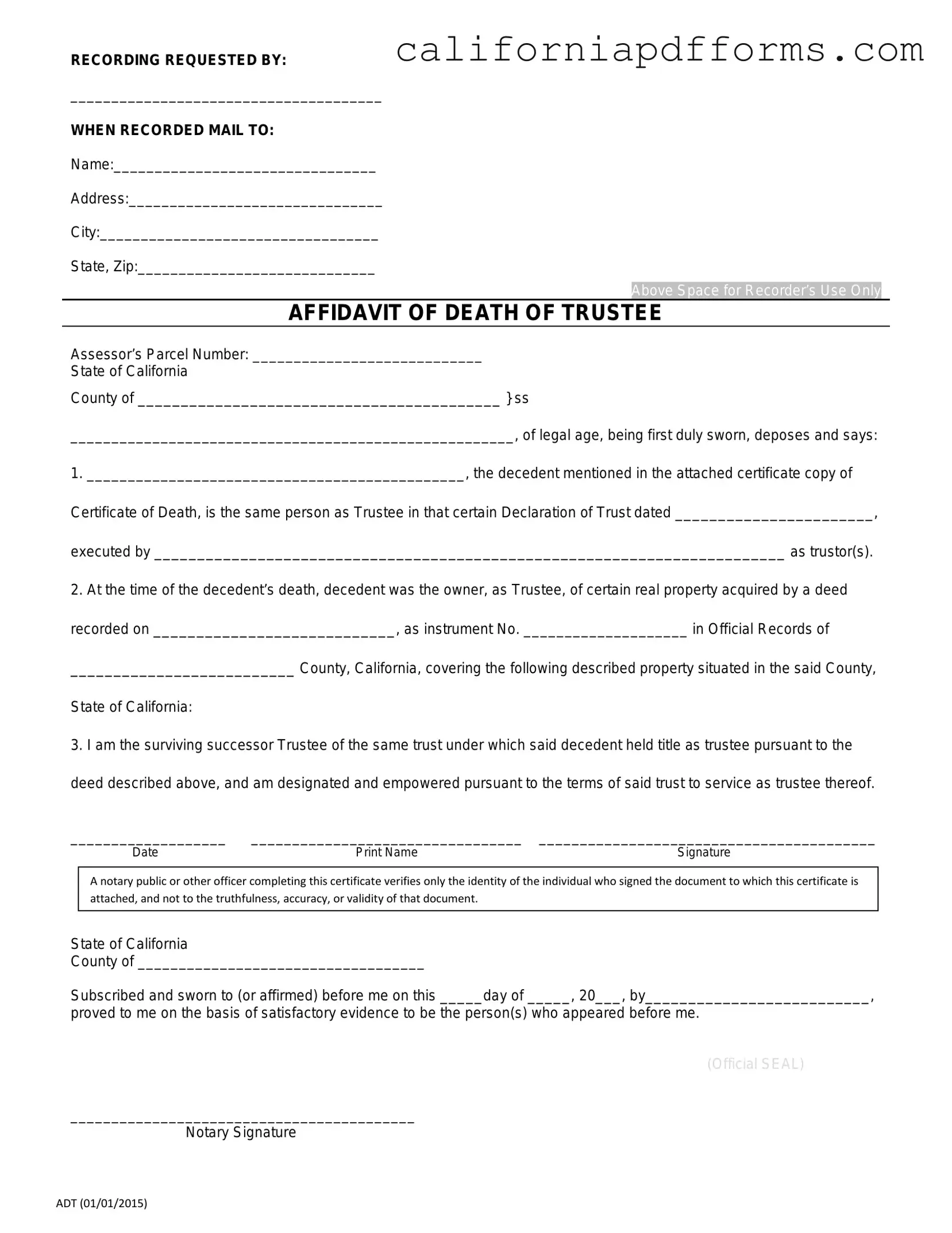

To complete the affidavit, the following information is generally required:

- The name of the deceased trustee.

- The date of death.

- The name of the trust.

- The names of the successor trustees.

- A statement affirming that the affiant is a qualified person to make the affidavit.

-

Do I need to have the affidavit notarized?

Yes, the affidavit must be signed in front of a notary public. This step ensures that the document is legally binding and recognized by courts and financial institutions.

-

Where do I file the Affidavit of Death of a Trustee?

The affidavit should be filed with the county recorder's office in the county where the trust property is located. This action provides public notice of the trustee's death and the appointment of a successor trustee.

-

Is there a filing fee for the affidavit?

Yes, there is typically a filing fee when submitting the affidavit to the county recorder's office. The fee varies by county, so it is advisable to check with the local office for the exact amount.

-

What happens if the Affidavit of Death of a Trustee is not filed?

If the affidavit is not filed, the successor trustee may face difficulties in managing the trust assets. Financial institutions may require proof of the trustee's death and the appointment of a successor before allowing access to trust accounts or assets.

-

Can the Affidavit of Death of a Trustee be contested?

Yes, the affidavit can be contested by interested parties, such as beneficiaries or other trustees. If someone believes that the affidavit is inaccurate or that the successor trustee is not qualified, they may challenge it in court.

-

How long does it take to process the affidavit?

The processing time for the affidavit can vary by county. Generally, it may take a few days to a few weeks. It's advisable to follow up with the county recorder's office if there are any delays.

-

Can I obtain a copy of the affidavit after it has been filed?

Yes, once the affidavit is filed, you can request a copy from the county recorder's office. There may be a small fee for obtaining copies of public records.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to officially document the death of a trustee, allowing for the transfer of trust assets to beneficiaries. |

| Governing Law | This form is governed by California Probate Code Sections 15660-15665, which outline the procedures related to trusts and trustees. |

| Filing Requirements | The completed affidavit must be filed with the county recorder’s office where the trust property is located to provide public notice of the trustee's death. |

| Beneficiaries' Rights | Upon the death of a trustee, beneficiaries have the right to request information about the trust and its assets, ensuring transparency and accountability. |

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it is essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that you have the correct form. Double-check that you are using the California Affidavit of Death of a Trustee form specifically.

- Do provide accurate information. Carefully enter the trustee's name, date of death, and other required details without errors.

- Do sign the affidavit. Make sure to sign the document in the appropriate section, as an unsigned form may be considered invalid.

- Do have the affidavit notarized. A notary public must witness your signature to verify its authenticity.

- Do keep a copy for your records. After completing the form, retain a copy for your personal files for future reference.

- Don't rush through the process. Take your time to read each section thoroughly to avoid mistakes.

- Don't leave any fields blank. Ensure all required information is filled out completely.

- Don't use white-out or correction fluid. If you make a mistake, it is better to cross it out and initial the correction.

- Don't forget to check state-specific requirements. California may have particular regulations regarding the affidavit that you should be aware of.

- Don't submit the form without verifying it. Review the completed affidavit to ensure everything is accurate before submission.

Misconceptions

Understanding the California Affidavit of Death of a Trustee form is essential for those involved in trust administration. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this important document.

- It is only necessary for the death of a trustee. Many believe that this affidavit is only required when a trustee passes away. In reality, it may also be needed if a trustee resigns or is removed, ensuring proper updates to the trust's administration.

- Anyone can file the affidavit. Some people think that any interested party can submit the affidavit. However, typically, it must be filed by a successor trustee or another party authorized to act on behalf of the trust.

- It is a legal document that requires a lawyer's assistance. While legal advice can be beneficial, it is not mandatory to have a lawyer complete the affidavit. Individuals can fill it out themselves, provided they understand the requirements and their responsibilities.

- The affidavit is the same as a death certificate. There is a misconception that the affidavit serves as a substitute for a death certificate. In fact, the affidavit is a separate document that references the death certificate but does not replace it.

- Filing the affidavit is optional. Some may think that submitting the affidavit is merely a formality. However, it is often a necessary step to ensure the trust can be managed and administered properly after the trustee's death.

- It can be filed anytime after the trustee's death. There is a belief that timing is not important. In truth, the affidavit should be filed promptly after the trustee's death to facilitate the transition of responsibilities and avoid potential complications.

- All trusts require this affidavit. Not every trust necessitates an affidavit of death. Certain types of trusts may have different requirements, so it is crucial to determine if this document is needed based on the specific trust in question.

By dispelling these misconceptions, individuals can better navigate the process of trust administration and ensure that all necessary steps are taken following the death of a trustee.

Documents used along the form

The California Affidavit of Death of a Trustee form is an important document used to officially declare the death of a trustee. However, several other forms and documents may accompany it to ensure a smooth transition of trust management. Below is a list of commonly used documents that may be necessary in conjunction with the affidavit.

- Trust Agreement: This document outlines the terms of the trust, including the roles and responsibilities of the trustee and the beneficiaries. It serves as the foundational document for the trust.

- Death Certificate: A certified copy of the deceased trustee's death certificate is often required to validate the claim of death. It provides official proof needed for legal processes.

- Certification of Trust: This document summarizes the essential terms of the trust without revealing all its details. It helps third parties understand the trust's existence and the authority of the remaining trustees.

- Trustee Resignation Letter: If the remaining trustees are resigning or if a new trustee is being appointed, a formal resignation letter may be necessary to document the change in trustee status.

- Notice to Beneficiaries: This document informs all beneficiaries about the trustee's death and any changes to the management of the trust. It ensures that all parties are kept in the loop regarding trust matters.

- Appointment of Successor Trustee: If a successor trustee is named in the trust, this document officially appoints them to take over the responsibilities of the deceased trustee.

- Trustee Bond: In some cases, a bond may be required to protect the trust from potential mismanagement by the new trustee. This document acts as insurance against any misconduct.

Understanding these documents can help streamline the process of managing a trust after a trustee's passing. Each serves a unique purpose and collectively ensures that the trust is administered according to the deceased trustee's wishes and legal requirements.

Different PDF Templates

Filing Under Seal California - Petitioners must lodge sealed documents with the court alongside the application.

Conservatorship California Forms - Petitioners indicate their efforts to contact all relevant parties about the hearing.

Jv462 - The form should be updated regularly to reflect changes in the nonminor's situation and needs.