Download California Balance Sheet Form

Common Questions

What is the California Balance Sheet form?

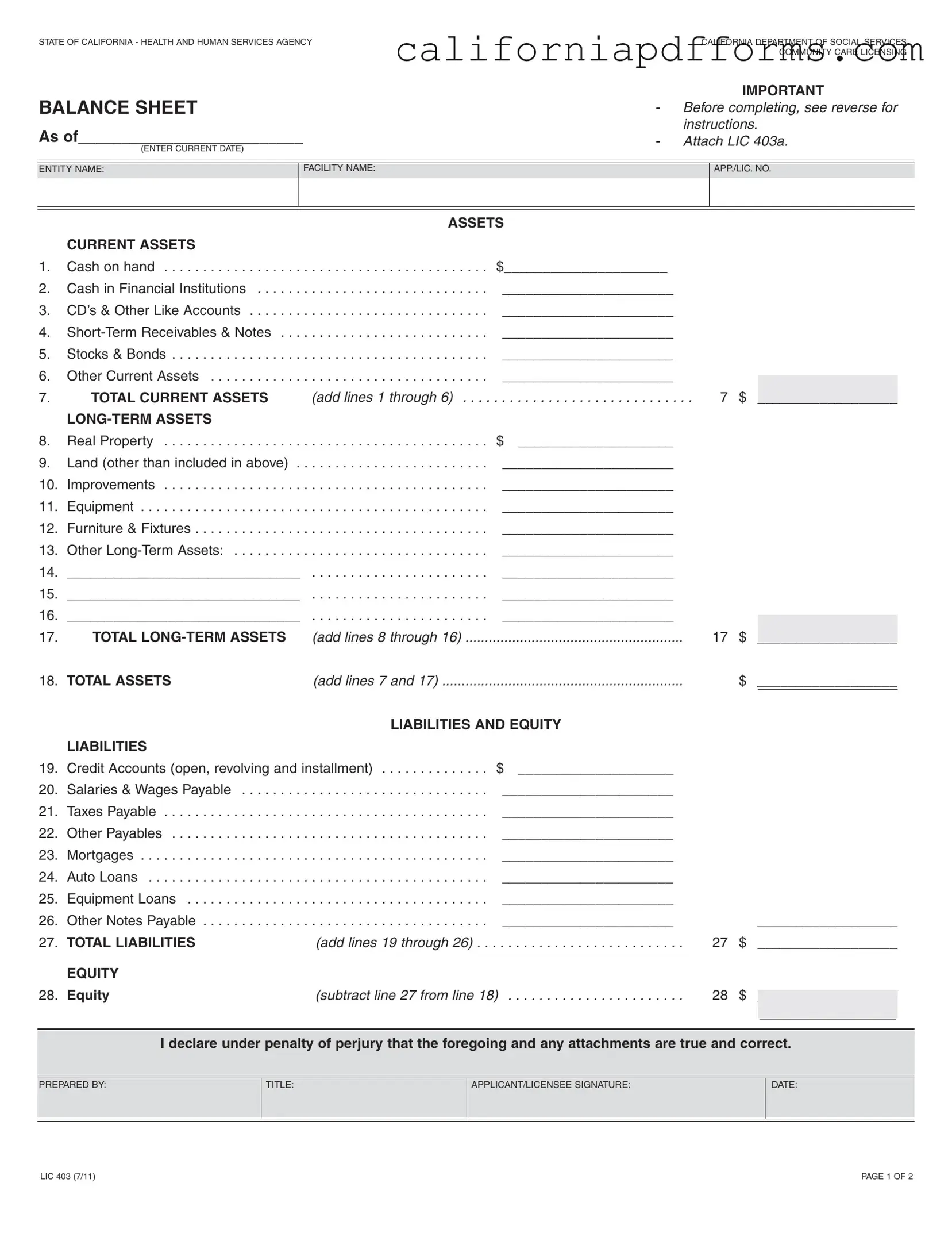

The California Balance Sheet form, also known as LIC 403, is a financial document required by the California Department of Social Services for entities operating community care facilities. It provides a snapshot of an entity's financial position by detailing its assets, liabilities, and equity. This form must be completed alongside the LIC 403a, which serves as a supplemental schedule for compiling detailed financial information.

Who needs to complete the California Balance Sheet form?

Every applicant or licensee operating a community care facility must complete the California Balance Sheet form. This includes sole proprietorships, partnerships, and corporations. Each entity must report all assets and liabilities, not just those related to the facility's operations. Additionally, general partners must submit personal balance sheets to reflect their individual financial positions.

What information is required at the top of the form?

To properly complete the form, you must include the following information:

- Current date for the Balance Sheet

- Entity name (the name of the sole proprietorship, partnership, or corporation)

- Facility name

- Application or license number

This information helps identify the financial report and ensures it is accurately associated with the correct entity.

What types of assets should be reported?

Assets are divided into current and long-term categories. Current assets include:

- Cash on hand

- Cash in financial institutions

- Certificates of deposit and similar accounts

- Short-term receivables

- Stocks and bonds

- Other current assets

Long-term assets encompass real property, land, improvements, equipment, and furniture. You should carefully document all assets to provide a complete financial picture.

What are liabilities, and what should be included?

Liabilities represent the financial obligations of the entity. The form requires reporting various types of liabilities, including:

- Credit accounts

- Salaries and wages payable

- Taxes payable

- Mortgages and loans

- Other payables

Accurate reporting of liabilities is crucial, as it helps in calculating the entity's equity and overall financial health.

How is equity calculated on the Balance Sheet?

Equity is determined by subtracting total liabilities from total assets. Specifically, you take the total assets (line 18) and subtract the total liabilities (line 27). The resulting figure represents the equity of the entity, which is a key indicator of financial stability.

What happens if the form is not signed or dated?

Failure to sign, date, and attest to the accuracy of the information on the Balance Sheet constitutes non-compliance. This may result in the rejection of the report, which can have serious implications for the licensing status of the facility. It is essential to ensure that all sections of the form are completed accurately and that the necessary signatures are provided.

Is additional documentation required?

Yes, the information reported on the Balance Sheet and the supplemental schedule is subject to verification. The California Department of Social Services may request additional documentation to support any amounts reported. Being prepared with comprehensive records can facilitate a smoother review process.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Balance Sheet form is governed by the California Health and Safety Code. |

| Form Number | The official designation of the form is LIC 403. |

| Purpose | This form is used to report the financial position of a community care facility. |

| Current Assets | Current assets include cash, short-term receivables, and other liquid assets. |

| Long-Term Assets | Long-term assets consist of real property, equipment, and other fixed assets. |

| Liabilities | Liabilities encompass all debts, including loans, taxes payable, and credit accounts. |

| Equity Calculation | Equity is determined by subtracting total liabilities from total assets. |

| Signature Requirement | The form must be signed by the applicant or licensee to confirm accuracy and compliance. |

Dos and Don'ts

When filling out the California Balance Sheet form, there are important guidelines to follow. Below is a list of things you should and shouldn't do.

- Do include the current date at the top of the form.

- Do accurately report all assets and liabilities, including those unrelated to the facility.

- Do attach the LIC 403a, which provides detailed information supporting your Balance Sheet.

- Do ensure that the totals from the LIC 403a are transferred correctly to the LIC 403.

- Don't omit any required information, such as entity name and application/license number.

- Don't forget to sign and date the form, as failure to do so may result in non-compliance.

Misconceptions

Here are 10 common misconceptions about the California Balance Sheet form:

- Only financial assets need to be reported. Many believe that only financial assets related to the care facility should be included. In reality, all assets and liabilities of the entity must be disclosed, regardless of their relation to the facility.

- Personal debts do not need to be included. Some think personal debts are irrelevant. However, for sole proprietorships, personal credit card balances and other debts must be reported if they relate to the owners.

- The form is optional for partnerships. It’s a misconception that partnerships can skip the form. Each general partner must file a personal Balance Sheet along with the partnership’s financial statements.

- Only current assets are counted. Many assume that only current assets matter. Both current and long-term assets must be reported to give a complete picture of the entity's financial status.

- Submitting the form is a one-time task. Some believe they only need to submit the form once. In fact, it must be updated and submitted regularly as financial conditions change.

- The Balance Sheet is the same as a profit and loss statement. This is incorrect. The Balance Sheet provides a snapshot of assets and liabilities, while a profit and loss statement shows income and expenses over a specific period.

- All liabilities are equal. There is a misconception that all liabilities are treated the same. They are categorized as current or long-term, which affects how they are reported.

- Only licensed facilities need to file. Some think that only licensed facilities must submit the form. In fact, any applicant, including those in the process of obtaining a license, must complete it.

- The form can be filled out without prior documentation. It’s often assumed that the form can be completed without supporting documents. However, additional documentation may be required to verify the amounts reported.

- Signing the form is a mere formality. Some view the signature as a simple formality. In truth, signing the form attests to the accuracy of the information and is a legal declaration.

Documents used along the form

When completing the California Balance Sheet form, several other documents may be required to provide a comprehensive financial overview. These forms help clarify the financial situation of the entity and ensure compliance with regulations.

- LIC 403a - Balance Sheet Supplemental Schedule: This is a worksheet that gathers detailed financial information. It helps in compiling data that will be transferred to the Balance Sheet (LIC 403). It must be attached to the Balance Sheet when submitted.

- Personal Balance Sheet (for General Partners): Each general partner in a partnership must submit their own Balance Sheet. This document reflects the individual financial position of each partner and must accompany the LIC 403 and LIC 403a.

- Financial Statements: These include income statements and cash flow statements. They provide a broader picture of the financial health of the entity, covering revenue, expenses, and cash management.

- Tax Returns: Recent tax returns may be requested to verify income and financial standing. They provide a clear record of the entity’s earnings and tax obligations.

- Supporting Documentation: Additional documents such as bank statements, loan agreements, and asset valuations may be required. These documents support the figures reported on the Balance Sheet and provide further verification.

Gathering these documents ensures that you have a complete and accurate financial picture. This helps in meeting regulatory requirements and supports the credibility of your financial reporting.

Different PDF Templates

California 5870A - Some lines in the form require historical data, making record-keeping vital for beneficiaries.

California Fj 200 - This application process is vital for upholding a child's rights in legal matters.

California 513 026 - The form outlines the potential for reimbursement of filing fees under specific conditions.