Download California Boe 531 Form

Common Questions

What is the California BOE-531 form used for?

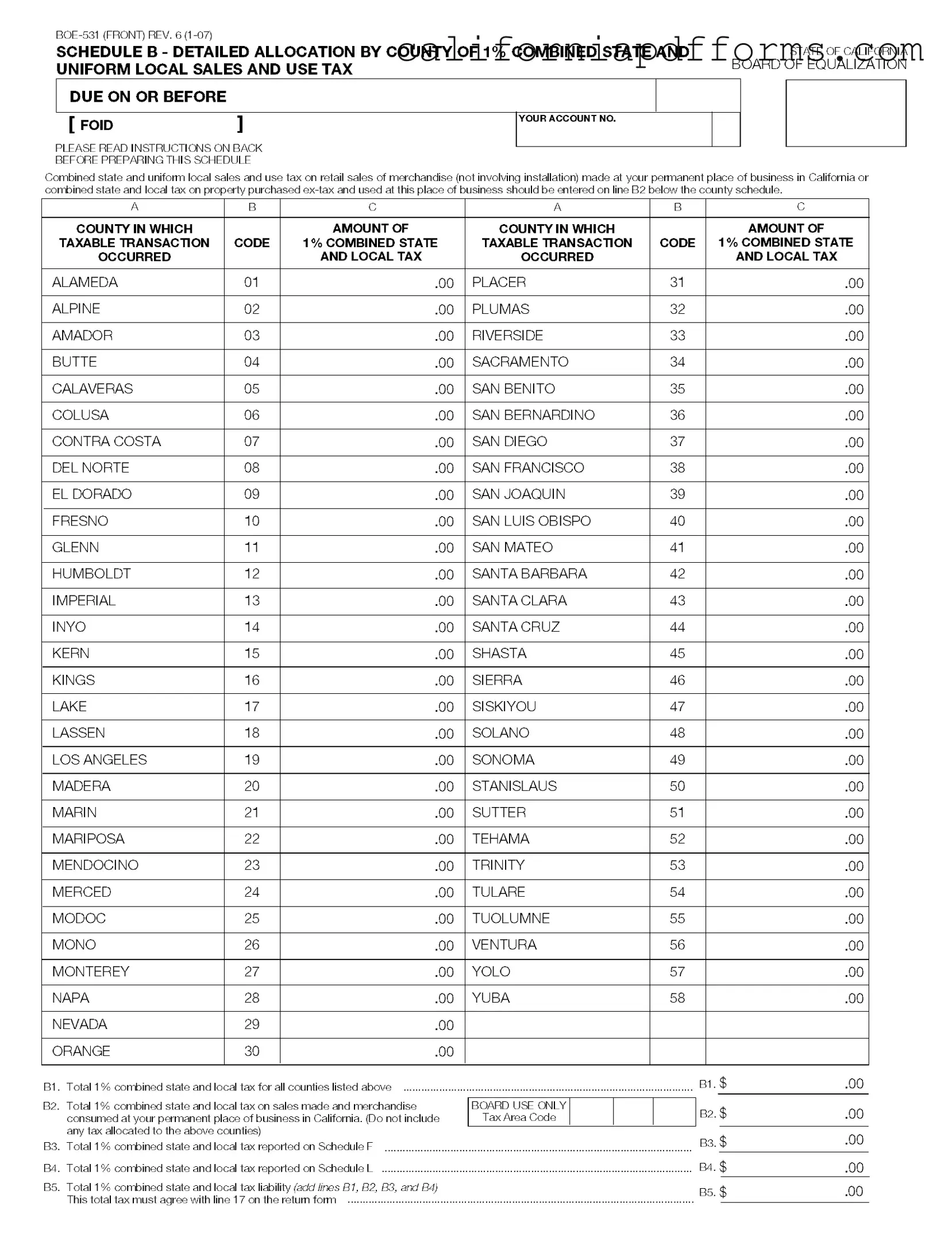

The California BOE-531 form is primarily used for reporting the detailed allocation of the 1% combined state and local sales and use tax by county. Businesses that operate in California must complete this form to report their taxable sales and ensure compliance with state tax regulations. This helps the California Board of Equalization accurately distribute tax revenues to the appropriate local jurisdictions.

Who needs to fill out the BOE-531 form?

Any business that sells taxable merchandise at a permanent location in California is required to fill out the BOE-531 form. This includes retailers, auctioneers, vending machine operators, and out-of-state sellers who have been authorized to operate in California. If your business activities fall into any of these categories, completing this form is essential for proper tax reporting.

How do I complete the BOE-531 form?

To complete the BOE-531 form, follow these steps:

- Enter your account number at the top of the form.

- List the counties where taxable transactions occurred in Column A.

- Assign the appropriate code for each county in Column B.

- In Column C, report the amount of the 1% combined state and local tax for each county.

- Calculate the total tax for all counties and enter it on line B1.

- Complete line B2 with the total tax on sales made at your permanent place of business.

- Ensure all totals are accurate and consistent with your overall tax return.

It’s important to read the instructions on the back of the form carefully to ensure accurate reporting.

What are the consequences of not filing the BOE-531 form?

Failing to file the BOE-531 form can lead to several consequences, including penalties, interest on unpaid taxes, and potential audits. The California Board of Equalization takes compliance seriously, and businesses that do not report their sales tax accurately may face financial repercussions. It is crucial to file on time to avoid these issues.

Can I amend my BOE-531 form after submission?

Yes, you can amend your BOE-531 form if you discover an error after submission. To do this, you will need to file an amended return with the correct information. Be sure to include a clear explanation of the changes made. It’s advisable to do this as soon as possible to minimize any potential penalties or interest.

Where do I send my completed BOE-531 form?

Your completed BOE-531 form should be sent to the California Board of Equalization at the address specified on the form. Make sure to check for any updates regarding mailing addresses or submission methods, as these can change. If you prefer, some forms may also be submitted electronically, depending on your account setup.

Is there a deadline for submitting the BOE-531 form?

Yes, the BOE-531 form must be submitted by the due date specified for your sales tax return. Typically, this is the same deadline as your regular sales tax return, which may be quarterly or annually, depending on your business's reporting schedule. It’s important to mark your calendar and ensure timely submission to avoid penalties.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The BOE-531 form is used for reporting the allocation of the 1% combined state and local sales and use tax due in California. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 6015 and related regulations. |

| Filing Requirement | Businesses must file the BOE-531 form if they engage in retail sales of merchandise or use property purchased ex-tax at their permanent place of business in California. |

| County Allocation | The form requires businesses to detail the allocation of sales and use tax by county where taxable transactions occurred. |

| Tax Calculation | Tax amounts are calculated based on the total sales and use tax for each county, which is then reported in the designated columns. |

| Additional Schedules | Businesses may also need to report totals on Schedule F and Schedule L, depending on their specific tax liabilities. |

| Deadline for Submission | The BOE-531 form must be submitted by the due date specified on the tax return for the reporting period. |

Dos and Don'ts

When filling out the California BOE-531 form, keep these important tips in mind:

- Do read the instructions on the back of the form carefully before you start.

- Do enter the correct county codes for each taxable transaction.

- Do ensure that the total tax reported matches the amount on line 17 of your return.

- Do double-check your calculations for accuracy.

- Don't forget to include all relevant sales made at your permanent place of business.

- Don't leave any sections blank; fill in all required fields.

- Don't mix up amounts for different counties; keep them separate.

- Don't submit the form without reviewing it for any errors.

Misconceptions

Misconception 1: The BOE-531 form is only for large businesses.

This is not true. While larger businesses may have more complex tax situations, the BOE-531 form can be used by any business that makes retail sales in California. Small businesses also need to report their sales and use tax accurately, regardless of their size.

Misconception 2: All sales tax collected in California is allocated to the state.

In reality, the sales tax collected includes both state and local components. The BOE-531 form specifically helps businesses allocate the appropriate amount of tax to the correct counties. This ensures that local governments receive their fair share of tax revenue.

Misconception 3: The BOE-531 form is the same as the BOE-530-B form.

These forms serve different purposes. The BOE-530-B form is specifically for temporary sales locations and certain auctioneers, while the BOE-531 form is designed for detailed allocation by county of the combined state and local sales and use tax. Each form has its own specific instructions and requirements.

Misconception 4: Businesses can ignore the BOE-531 form if they do not have sales in multiple counties.

Even if a business operates in only one county, it may still be required to complete the BOE-531 form. This form is necessary for reporting combined state and local sales and use tax, ensuring compliance with California tax regulations.

Documents used along the form

The California BOE-531 form is an essential document for businesses reporting their sales and use tax obligations. However, it is often accompanied by other forms and documents that provide additional context or information. Understanding these related documents can help streamline the reporting process and ensure compliance with state tax regulations.

- BOE-530-B: This form is used for reporting combined state and local tax allocations for temporary sales locations and certain auctioneers. It is particularly relevant for auction events where taxable gross sales exceed $500,000.

- Schedule F: This document details allocations of the 1% combined state and uniform local sales and use tax. Businesses engaged in significant transactions may need to use this form to report their tax liabilities accurately.

- BOE-401-A: The Sales and Use Tax Return form, or BOE-401-A, is the primary document for reporting sales and use tax. It provides a comprehensive overview of a business's total sales and tax obligations.

- BOE-401-DS: This form is used for reporting sales and use tax for direct sellers. It is tailored for businesses that sell goods directly to consumers without a physical storefront.

- BOE-502: The Seller's Permit Application, or BOE-502, is necessary for businesses that wish to sell tangible personal property in California. This permit allows businesses to collect sales tax from customers.

- BOE-800: This form is the Application for a Seller's Permit. It must be completed by any entity planning to engage in retail sales in California and is crucial for obtaining the necessary tax identification.

These forms and documents work together to create a comprehensive framework for tax reporting in California. Familiarity with them can help businesses navigate their tax obligations more effectively, ensuring compliance and reducing the risk of errors.

Different PDF Templates

List of Alternatives to Incarceration Programs California - The program aims to assist with the transition back into the community.

Attorney Money - FL-346 requests evidence to support claims of financial hardship or capability.

Cr 180 Form - The California Certificate of Rehabilitation form is a legal document used to apply for recognition of rehabilitation.