Download California De 305 Form

Common Questions

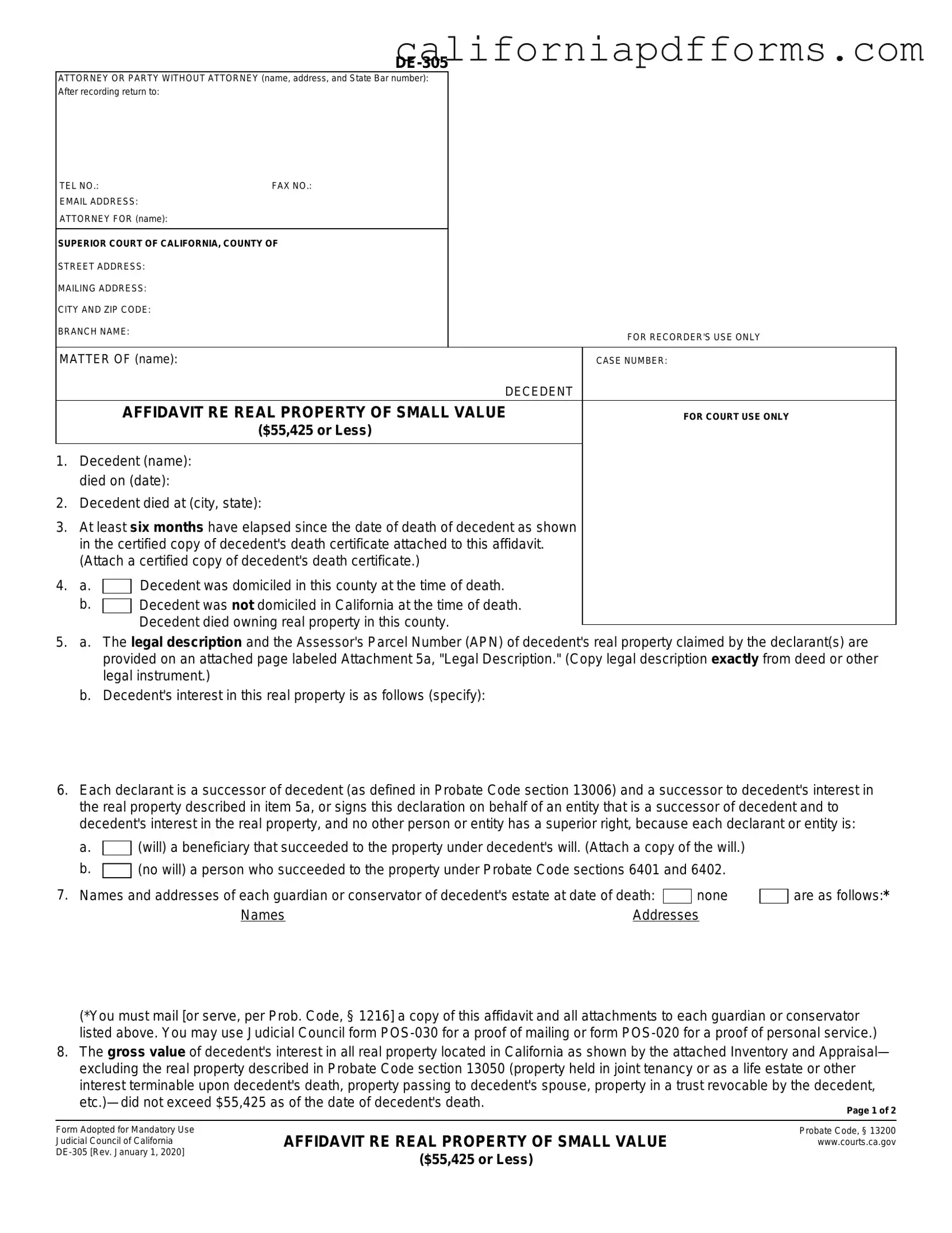

What is the California DE-305 form?

The California DE-305 form, also known as the Affidavit Regarding Real Property of Small Value, is a legal document used to claim real property owned by a deceased person when the total value of the property is $55,425 or less. This form is particularly useful for individuals who need to transfer property without going through the lengthy probate process.

Who can use the DE-305 form?

The DE-305 form can be used by successors of the deceased person, which may include beneficiaries named in a will or individuals who inherit property under state law if there is no will. The form is designed for those who are claiming an interest in the real property that belonged to the decedent.

What information is required on the DE-305 form?

When completing the DE-305 form, you will need to provide several key pieces of information, including:

- The name of the deceased person and the date of their death.

- The city and state where the deceased person died.

- A certified copy of the death certificate.

- A legal description of the real property, including the Assessor's Parcel Number (APN).

- Details about the decedent's estate, such as any guardians or conservators and the gross value of the real property.

Is a death certificate required?

Yes, a certified copy of the death certificate must be attached to the DE-305 form. This document serves as proof of the decedent's death and is a crucial part of the filing process.

What if the decedent had debts?

The DE-305 form requires that all known unsecured debts, funeral expenses, and expenses related to the last illness of the decedent have been paid. It is important to note that the person filing the form may be personally liable for these debts up to the fair market value of the property they are claiming.

How is the value of the property determined?

The value of the decedent's interest in the real property must not exceed $55,425 as of the date of death. An Inventory and Appraisal must be prepared by a probate referee to establish this value. This document should be attached to the DE-305 form when it is submitted.

What happens after the DE-305 form is filed?

Once the DE-305 form is completed and submitted, it allows the successor to claim the property without going through probate. This can facilitate a quicker transfer of ownership. However, it is essential to ensure that all required documents are included and that the form is filled out accurately to avoid delays.

Do I need a lawyer to file the DE-305 form?

While it is not mandatory to have a lawyer to file the DE-305 form, consulting with one may be beneficial, especially if there are complexities involved, such as disputes over the estate or concerns about debts. A legal professional can provide guidance and ensure that the form is completed correctly.

Where can I obtain the DE-305 form?

The DE-305 form can be obtained from the California Courts website or at local Superior Court offices. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The DE-305 form is used to declare the real property of a decedent whose estate is valued at $55,425 or less. |

| Governing Law | This form is governed by California Probate Code, specifically sections 13200 and 13050. |

| Eligibility | It is intended for individuals who are successors to the decedent's interest in the real property. |

| Time Requirement | At least six months must pass since the decedent's death before filing this affidavit. |

| Property Description | The form requires a legal description and Assessor's Parcel Number (APN) of the decedent's real property. |

| Inventory Requirement | An Inventory and Appraisal of the decedent's real property interests must be attached to the form. |

| Debts | All known unsecured debts of the decedent must be paid before filing this affidavit. |

| Notary Requirement | A notary public must acknowledge the signatures on the form to validate the declaration. |

| Filing Instructions | After completion, the form must be filed with the Superior Court of California in the appropriate county. |

Dos and Don'ts

When filling out the California DE-305 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are nine essential do's and don'ts to keep in mind:

- Do provide accurate and complete information about the decedent, including their full name and date of death.

- Do attach a certified copy of the decedent's death certificate as required.

- Do ensure that all declarants are identified correctly and have the right to claim the property.

- Do include a detailed legal description of the real property, copying it exactly from the deed.

- Do verify that the gross value of the decedent's real property does not exceed $55,425.

- Don't forget to mail or serve copies of the affidavit to any guardians or conservators listed.

- Don't leave out any required attachments, such as the Inventory and Appraisal or copies of the will.

- Don't submit the form without ensuring that all signatures are present and correctly dated.

- Don't attempt to notarize the document without ensuring compliance with the specific notary requirements outlined.

By following these guidelines, you can help ensure that the DE-305 form is completed accurately and efficiently, facilitating a smoother process in handling the decedent's estate.

Misconceptions

- Misconception 1: The DE 305 form is only for large estates.

- Misconception 2: You don’t need to attach a death certificate.

- Misconception 3: All heirs must sign the DE 305 form.

- Misconception 4: You can use the DE 305 form without any legal advice.

- Misconception 5: The form does not require an appraisal.

This is incorrect. The DE 305 form is specifically designed for estates with a gross value of $55,425 or less. It allows for a simplified process in handling small estates, making it accessible for those who do not have extensive assets.

This is false. A certified copy of the decedent's death certificate must be attached to the DE 305 form. This document is essential to validate the claim and confirm the decedent's passing.

This is not true. Only the successors or individuals who are claiming an interest in the property need to sign the form. If you are acting on behalf of an entity, you must specify your capacity to sign.

This is incorrect. An Inventory and Appraisal must be attached to the DE 305 form. This appraisal, conducted by a probate referee, establishes the value of the decedent's real property, which is crucial for the affidavit.

Documents used along the form

The California DE-305 form, also known as the Affidavit Re Real Property of Small Value, is an essential document used in probate cases involving the transfer of real property valued at $55,425 or less. When completing this process, several other forms and documents may also be necessary to ensure everything is handled correctly. Below is a list of commonly used documents that accompany the DE-305 form.

- Death Certificate: This official document confirms the decedent's death and is required to prove that at least six months have passed since the date of death. It must be attached to the DE-305 form.

- Will: If the decedent left a will, a copy must be included to show who the beneficiaries are. This document is crucial for establishing the rights of the heirs to the property.

- Inventory and Appraisal (Forms DE-160 and DE-161): These forms provide a detailed account of the decedent's real property and its value. An appraisal from a probate referee is also necessary to support the claim.

- Proof of Mailing (Form POS-030) or Proof of Personal Service (Form POS-020): These forms serve as evidence that all required parties, such as guardians or conservators, have been notified about the affidavit and its attachments.

- Notary Acknowledgment: A notary public must acknowledge the signatures on the DE-305 form. This verification ensures that the signatories are who they claim to be and that they signed the document willingly.

Using these documents in conjunction with the DE-305 form helps streamline the probate process and ensures that all legal requirements are met. Proper preparation can make a significant difference in how smoothly the transfer of property occurs during this challenging time.

Different PDF Templates

Does Guardianship Override Parental Rights - The form requires a detailed account of the minor's financial situation if estate guardianship is requested.

Motion to Seal California - The server is responsible for ensuring that all documents are mailed correctly.

How to Collect Money After Winning a Judgement in California - This form is crucial to ensure that all parties are correctly identified in the case.